Back in February during the 10 day S&P 500 correction I introduced an analogy about speeding (click here to read it.) Back then the “car in the median” was inflation. My conclusion then was it was not a cop, but enough people were racing along at speeds they knew were too fast, their (over)reaction turned into a minor crash. Thus far the data has told us inflation scare seems to have been just that.

Last week the S&P 500 retested the closing lows, losing nearly 6% for the week and nearly 8% over the past 9 days. This time, the cause of the crash may have been an actual cop (or two or three). Market participants are concerned the tariffs implemented by the Trump Administration could turn into an all-out trade war. (click here to read why I think this may be a necessary war). Over the short-term trade wars could spark inflation and slow the economy significantly. Sentiment declines both for consumers and market participants. This late into a bull market with valuations at levels only experienced during the late 1920s and late 1990s, this could cause a massive pile-up on the bull market highway.

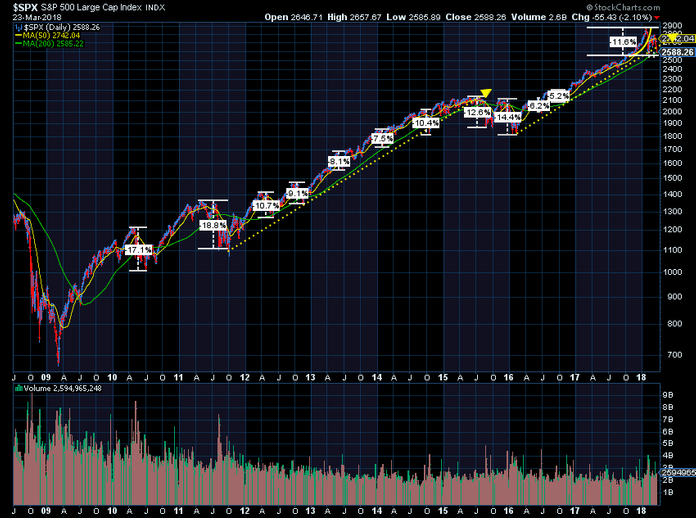

While the markets are looking to start the week with a rally, this does not mean the worst is over. After such a rapid drop it would be a huge concern if the week started with another sell-off. Markets do not go straight up (unless you’re in a bubble) and they do not go straight down (even in a bear market). The market should rally from here — it re-tested the closing low from February & is sitting right on the 200-day moving average. On the negative side, it did break the uptrend line formed off the lows in 2015, meaning additional downward moves are certainly possible.

As I said back in February, whether or not this was a sign of much tougher enforcement on speeding by the market “cops” or just a one-off false-alarm, whether you are an advisor or investor if you found yourself wanting to hit the brakes at all this year as the market fell, you were probably going to fast. SEM’s number one purpose is helping advisors and their clients find the right level of speed (risk) in their portfolio to get everyone to their destination as safely as possible.