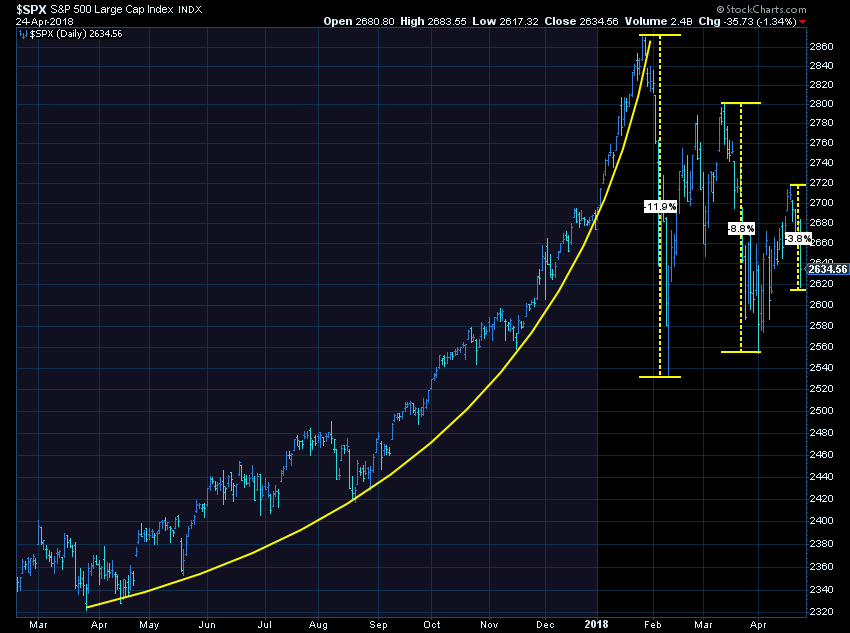

Just when I commented how the market had seemed to settle down (by not making 1%+ daily/hourly moves) volatility returned once again on Tuesday. Following the parabolic move that began last September, these sort of swings should be expected. That doesn’t make them any more comfortable.

From a technical standpoint, the last bounce-back came on decreasing volume (enthusiasm), which is why our Price Divergence System sold a week ago inside our Tactical models. The fact it wasn’t able to reach the recent highs is certainly not a good sign, but merely points to the need for market participants to regroup and make another run at keeping the bull market alive. For now we’ve had higher lows and could be forming a consolidation pattern. For longer-term investors so long as the lows from February hold it’s too early to call an end the bull market.

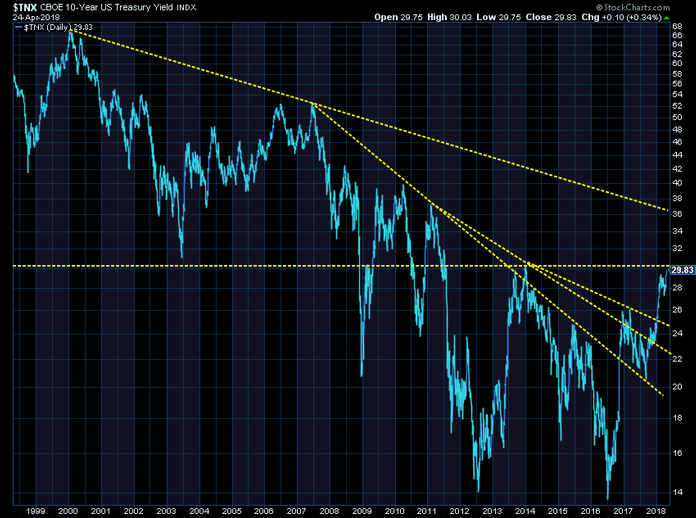

A bigger story, but still a whole lot of noise is the push up in Treasury rates. The 10 year crossed the 3% threshold for the first time since 2014. We keep hearing experts saying the long-term downtrend in interest rates is over. My question is how in the world are they drawing their trend-lines. This chart shows all the possible downtrend lines on the 10 Year Treasury Yield (this is the CBOE index — move the decimal one spot to the left for the corresponding yield).

I drew a line at 3%. Note rates are still lower than BEFORE S&P stripped the US of our AAA credit rating. Keep in mind, the changes in rates do matter. I discussed this in our Chart of the Week last Friday.

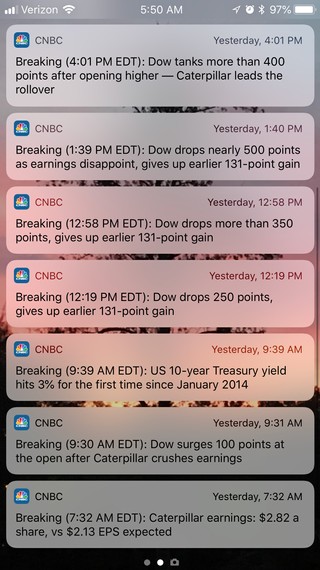

If the moves in the market this year do not convince you how inefficient the market is I do not know what will. The proponents of passive investing want you to believe the market is perfectly efficient, which means all of the future projected changes are immediately priced into the market. Just watching yesterday’s CNBC push alerts it is almost comical how they have no idea what is moving the market.

Here’s the problem with the efficient market theory passive proponents have pushed on everyone the last 3-4 years — NOBODY knows what the future may hold. This means the valuation models used by the “market” have inputs that are unreliable. The key variables in all market valuation models are expected earnings, future growth rates (both near-term and perpetuity), the market risk premium (how much you need to be paid for taking on stock market risk), and interest rates.

Besides interest rates (which by moving higher makes stocks less valuable) all of the other valuation components are SUBJECTIVE. This means the “efficiency” of the market is based on the consensus viewpoints of the market participants. In other words, the “value” of the market is going to swing back and forth on the EMOTIONS of the market participants. At some point yesterday the opinions changed from Caterpillar earnings “crushing it” to some concerns about future economic growth. Higher interest rates likely caused some of this concern, but was it enough to take the down from up 131 points to down 500 points in a few hours?

I know it’s been a while since we have had a bear market, but the only way to overcome these emotional swings is to use DATA. The data tells us what the overall consensus view of the market is and can highlight times where the market is seemingly schizophrenic. When that happens, our Scientifically Engineered Models are designed to systematically reduce exposure and wait for better opportunities. We are currently in one of those situations.

What is likely frustrating and also what could lead to many investors enduring losses they are not prepared for — our economic models are still saying things are ok in the economy even with rates moving higher. Unfortunately following the move in 2017 the “efficient” market was pricing in 3 1/2 – 4% GDP growth that was not possible, so even though economic growth is still decent, the market may need to re-price those expectations.

If you find yourself having too much exposure to passive investments or investments that have done well over the past 3-5 years that have lost more than you were comfortable with this year, I’d like to have a conversation about how SEM can help.