“Stocks are more attractive than bonds.”

The S&P 500 dividend yield is 2.03% compared to the 10-Year Treasury Yield of 1.51%.

This type of comparison drives me crazy. Stocks & bonds are completely different investments with completely different characteristics and roles in the portfolio.

First off, a dividend is not a contract, but simply a planned payment that could evaporate in a heartbeat. For example, the S&P 500 dividend peaked at $28.80 per share in September 2008. It did not bottom until April 2010 at $21.90 per share (a 24% cut in the dividend payment).

Bonds, however, are contracts to pay a certain amount at a certain point in time. Missing a bond payment has devastating consequences to an issuer and is something management will do everything possible to avoid.

If we want a more fair comparison of stocks versus bonds, then we shouldn’t use the basically risk free US Treasury Bond yield, but rather a more risky bond. The AAA-rated corporate bond yield is 3.4%. The still “investment grade” bond yield for Baa-rated corporate bonds is 4.2%. It is highly unlikely any of these bonds will cut their coupon payment even in the depths of a recession, unlike stocks and their dividend payments.

To be fair, stocks have upside while bonds held to maturity do not, so it is fair to include the “earnings yield” in the analysis. As an “investor”, owners of a stock have a claim on the earnings. Those earnings can either be re-invested into future growth of the company or paid out in dividends. We simply cannot add the earnings yield to the dividend yield since the dividends must come from earnings. Earnings yield is simply the inverse of the P/E ratio.

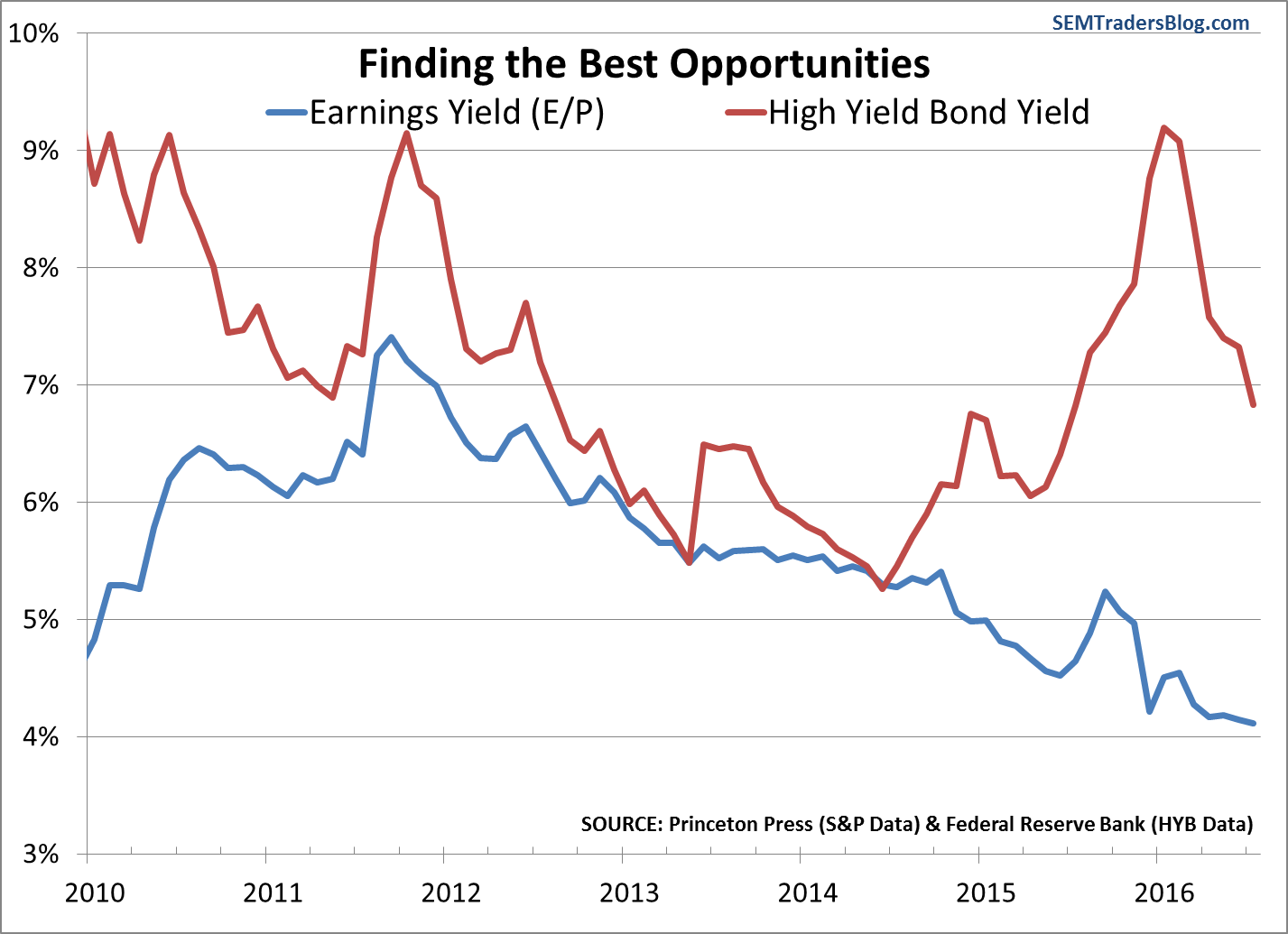

Using actual earnings (not pro-forma or ‘adjusted’ earnings since dividends must be paid from all earnings), the current earnings yield is 4.1%, which is below the Baa-rated corporate bonds. Given the limited upside of held-to-maturity bonds, a better comparison for stocks should be the high yield bond index yield. Those more risky bonds (which still have a historical default rate less than 5%) appear far more attractive than stocks at the current yield levels.

Despite this we continue to hear far too many people say “get out of bonds” because rates have to go higher. We’ve seen far too many of our clients leaving this year due to this belief (along with the “your fees are too high” argument we always hear during the late stages of a bull market). For the most part, investors in bonds should not be comparing their returns to the stock market. The risk characteristics are not even close to the same. Those that have fallen for this trap have missed out on one of the best starts to the year we’ve had since 2009.