After 20 years with SEM I should not be surprised to see how many people get sucked into the late stages of a bull market. We all have heard the key to investing – “buy low, sell high.” Unfortunately, our brains typically trick us into forgetting this wisdom. Whether it’s confirmation, representative, availability, hindsight, or conservatism bias (or usually a combination of them) we often believe this environment is “different” than the last market bubble. The reason technical analysis works (SEM’s primary way of managing risk in our portfolios) is because human emotions drive the market. Our country has changed dramatically over the past 120 years, but yet the market continues to go through the same fear/greed cycles.

The best way to overcome our personal behavioral biases is to use DATA to frame our decisions. The question of whether or not the market prices are “high” or “low” is not always easy to answer as earnings estimates can vary greatly based on the current mood of the market analysts. In addition, earnings also tend to peak just before the recession, which very few people anticipate until it’s too late. This is the primary reason Robert Shiller developed the Cyclically Adjusted Price/Earnings Ratio (CAPE). He won the Nobel Prize in Economics for this work along with his study of human behavior and how it impacts the markets. The “Shiller P/E” ratio essentially smooths the earnings results of the S&P 500 companies to eliminate the market cycle and any variations in analysts’ estimates. In other words, it takes the emotions out of the valuation equation.

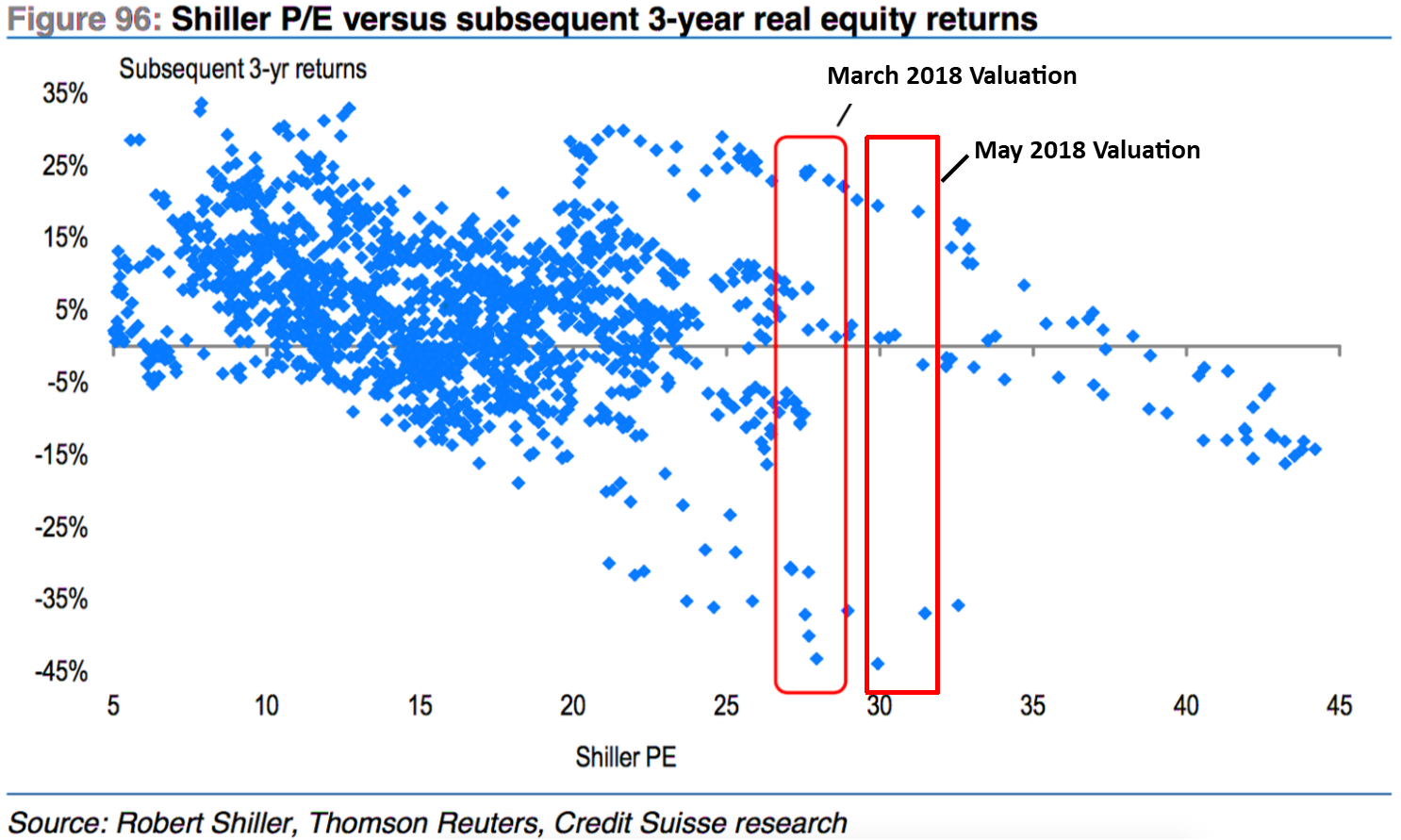

The Shiller P/E ratio is currently at 32. It was at 30 just before the market peaked in 1929 and 28 before it peaked in 2007. The only time it has been higher was at the end of the tech bubble. This does not mean the market will automatically fall. A study by Credit Suisse showed based on the historical relationship between the Shiller P/E and investor return, the next 3 years could either have gains of 20% or losses of 45%. Essentially buy & hold investors are betting the valuation of the markets will push towards the 1999 tech bubble rather than revert back to more normal valuations.

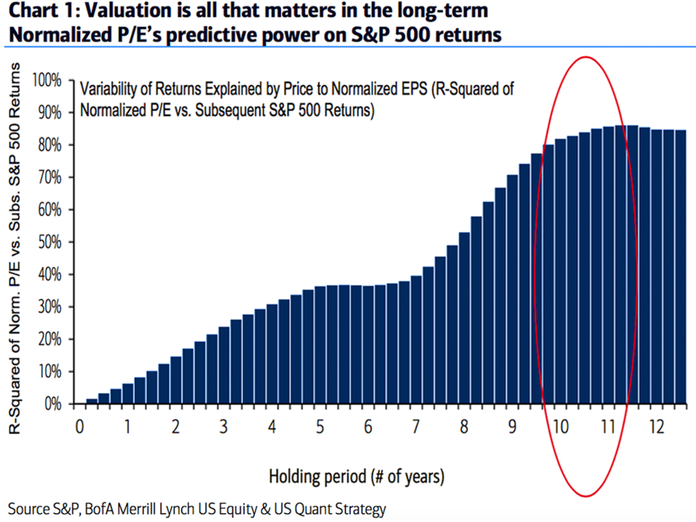

Notice on the chart, the lower the starting valuation the lower the chances of losses & the higher the returns. This is the DATA behind the “buy low, sell high” philosophy. If you are a longer-term investor (as you should be if you are following a buy & hold investor), valuation is about the only thing that matters. This chart shows how over the short-term returns have low correlation to valuations, but as your holding period lengthens, valuation becomes the driver of your returns. In other words, high valuations will lead to low returns and low valuations will lead to high returns — over the long-term.

Are you willing to gamble your hard-earned money? We aren’t, which is why we utilize a Behavioral Approach to Investing using our Scientifically Engineered Models. This means we will not always participate fully when the market hits extremes like it is right now, but it also means we aren’t betting on high valuations going even higher.