There are a lot of adages thrown around the investing world. One of the most common is "buy low, sell high." It makes sense. If you want to get the best return on anything, you want to buy it at the lowest price possible. As humans, it is not so

Tag: Behavioral Finance

Did you miss our SEM University today? This presentation is near and dear to my heart because when I was in school, I struggled with economics classes. Our hope with this presentation is that we can help our advisors and clients understand how the economy works.

Long story short, humans

One of the things we strive for in our more-connected-than-ever world is, well, finding connections. We are all different in so many ways, but despite all of our differences there will always be things that we find similar that we can relate to people with. These connections allow us to

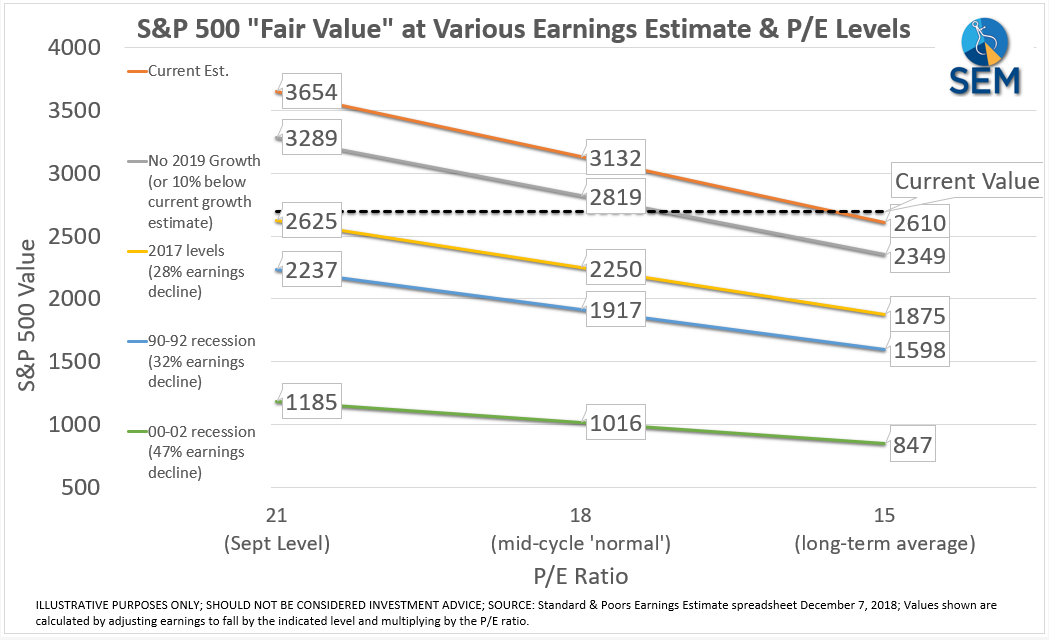

Volatility has returned to the markets with full force this year. The financial media continues to point to various culprits every time the stock market makes a major move up or down. This has left investors wondering how one small piece of information can cause the stock market to fall

In college, my peers voted me “most likely to appear on CNBC”. Even back then I enjoyed talking about the markets and attempting to educate anyone who would listen about how the markets work (or don’t work). Some of my fondest memories occurred after class or