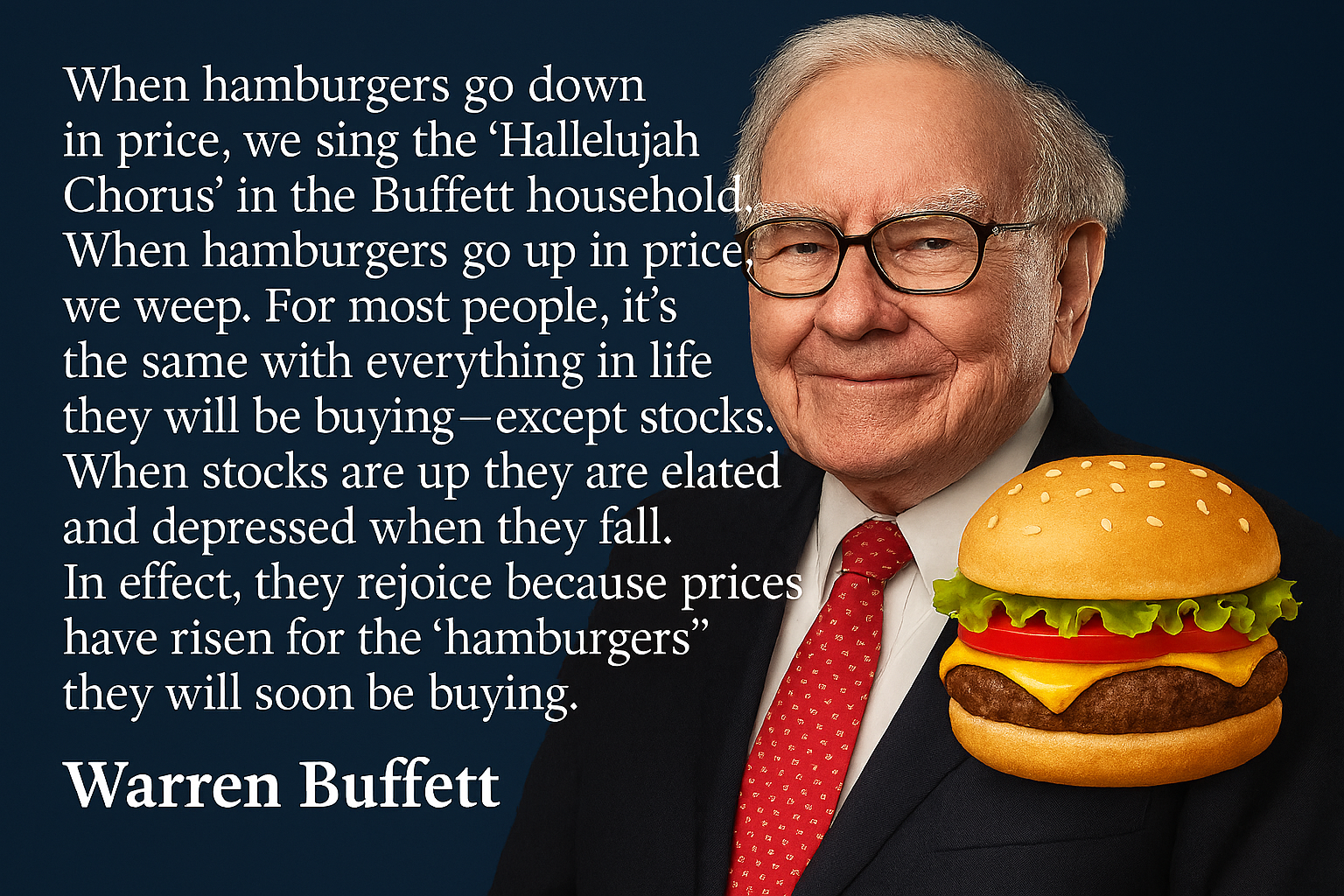

Last week’s market headlines offered a masterclass in economic complexity, with every story weaving into the next. The focus of course going into the week was the Fed’s rate cut which set the tone, sparking volatility across stocks and bonds and raising fresh questions about inflation’s staying

Last week was a reminder of just how interconnected our social, economic, and market cycles have become. From tragic headlines and the somber anniversary of 9/11 to major shifts in the labor market and jaw-dropping news out of the tech sector, investors were left to sort through a flood

It’s hard to believe it’s been 24 years since the terrorist attacks on our country. Today we take a break from the market and economic discussions to reflect on today’s somber anniversary. Given the murder of Charlie Kirk yesterday, this post has an especially heavy meaning. The

The labor market continues to show signs of strain. While the headline payroll number didn’t move much, digging into the details reveals a troubling trend. Job growth has essentially stalled over the last three months......something that historically happens just before or during a recession. We’re not

Given the shortened week following the Labor Day weekend, I'm going to keep my normally much longer market commentary to a minimum and let the charts tell the story of last week.