When we started offering our Biblically Responsible Investment (BRI) options, the biggest questions centered around performance. Will I have to sacrifice performance if I switch to a BRI portfolio? Seeking better performance was never our reason behind getting into BRI; however, we do know it is a big obstacle for investors when making the decision to switch (mostly due to false or misleading information regarding BRI investing). Given the current economic environment right now and so many people concerned about their investment portfolios, I figured it would be timely to briefly discuss BRI performance. [On a slightly different note, if you are worried about the bear market, SEM Portfolio Manager, Jeff Hybiak just made a short video with 3 tips for dealing with this bear market.]

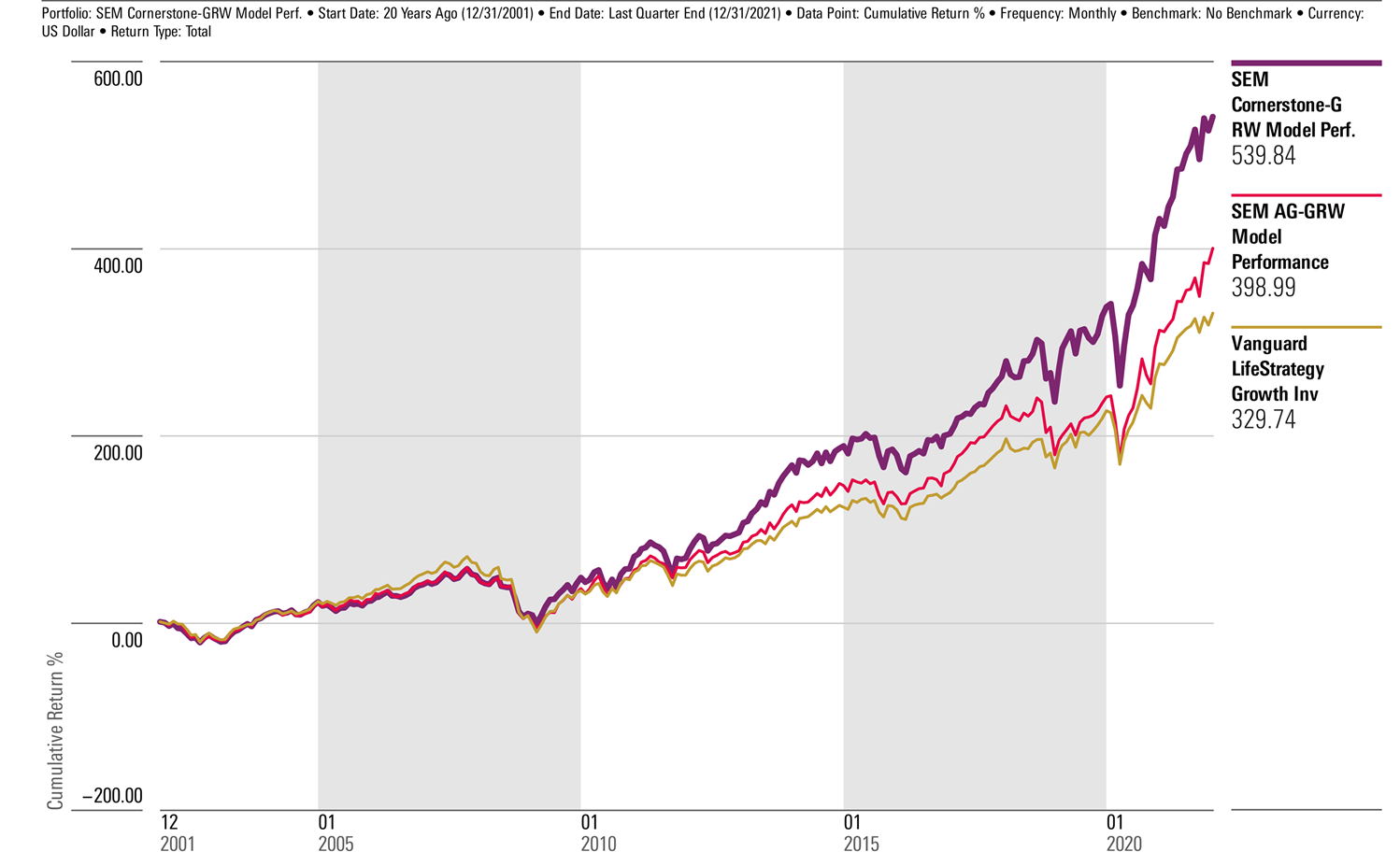

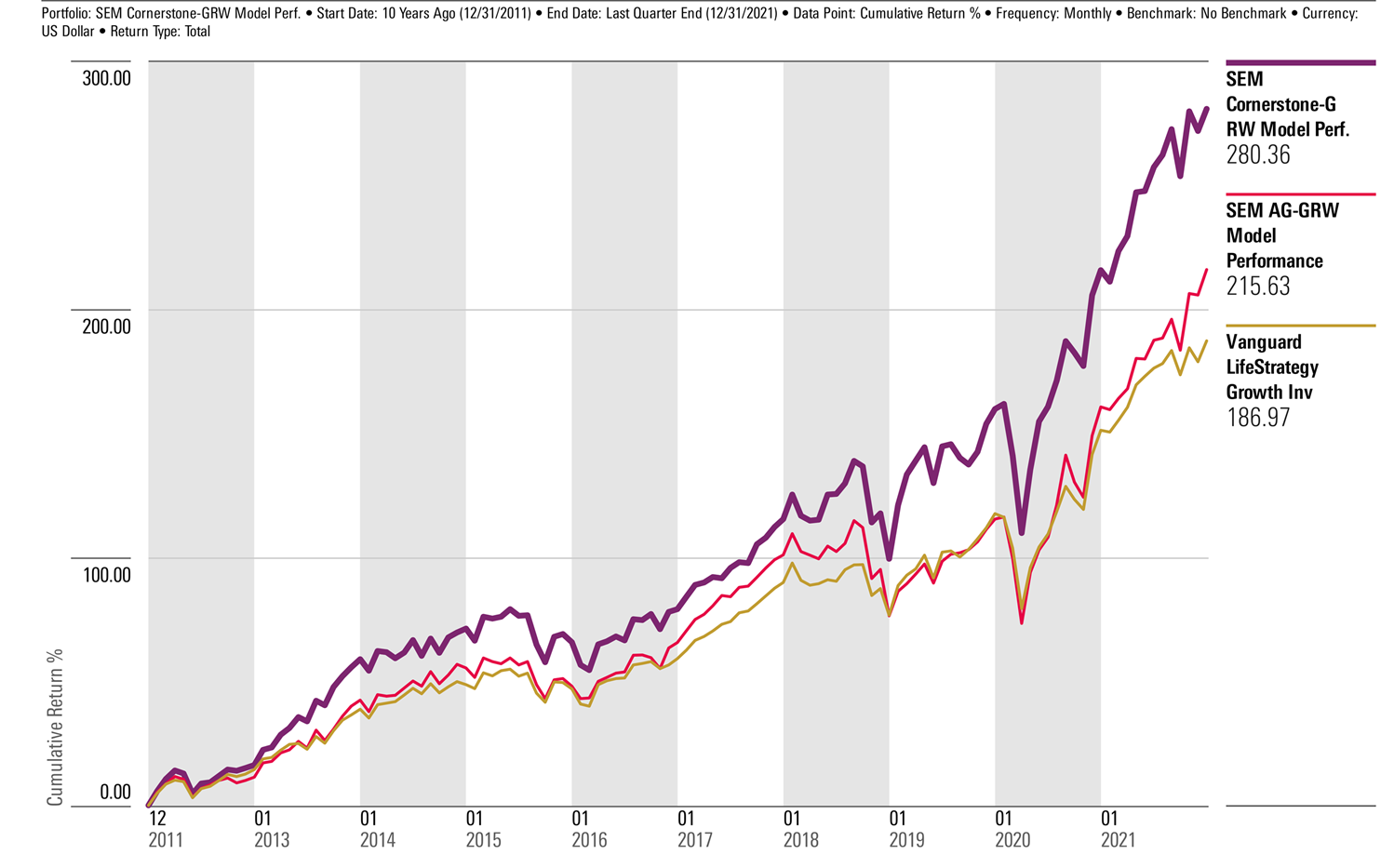

The main point of sharing the below charts is to demonstrate that you do NOT have to sacrifice performance when you have a BRI portfolio. Today, I'm just going to be sharing data for Cornerstone-Growth (CS-GRW) and Cornerstone-Bond (CS-BND). [Note: just like with SEM's other models, there are several Cornerstone models which allow clients to customize their portfolio to meet their needs/investing personality]

Cornerstone-Growth (CS-GRW)

20 Year Model Returns

10 Year Model Returns

Looking at the above charts for Cornerstone-Growth, it does historically outperform our AmeriGuard models. When you look at shorter periods of time, you will see one doing better than the other, but we don't recommend just looking at short periods of time when evaluating investments. The main takeaway from these two charts is, you don't have to sacrifice performance with BRI – the data shows that you can make an impact with your investments while also gaining value.

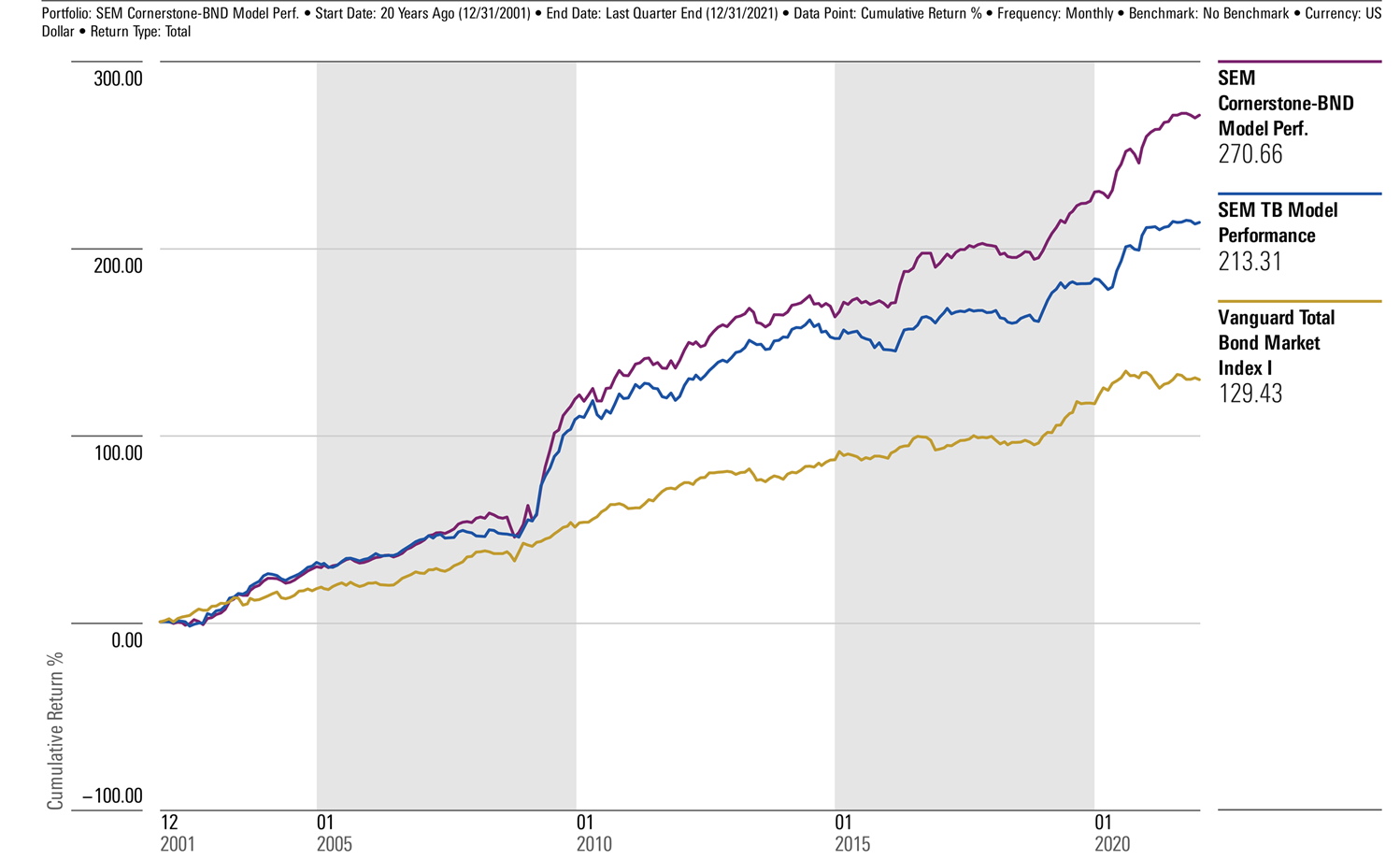

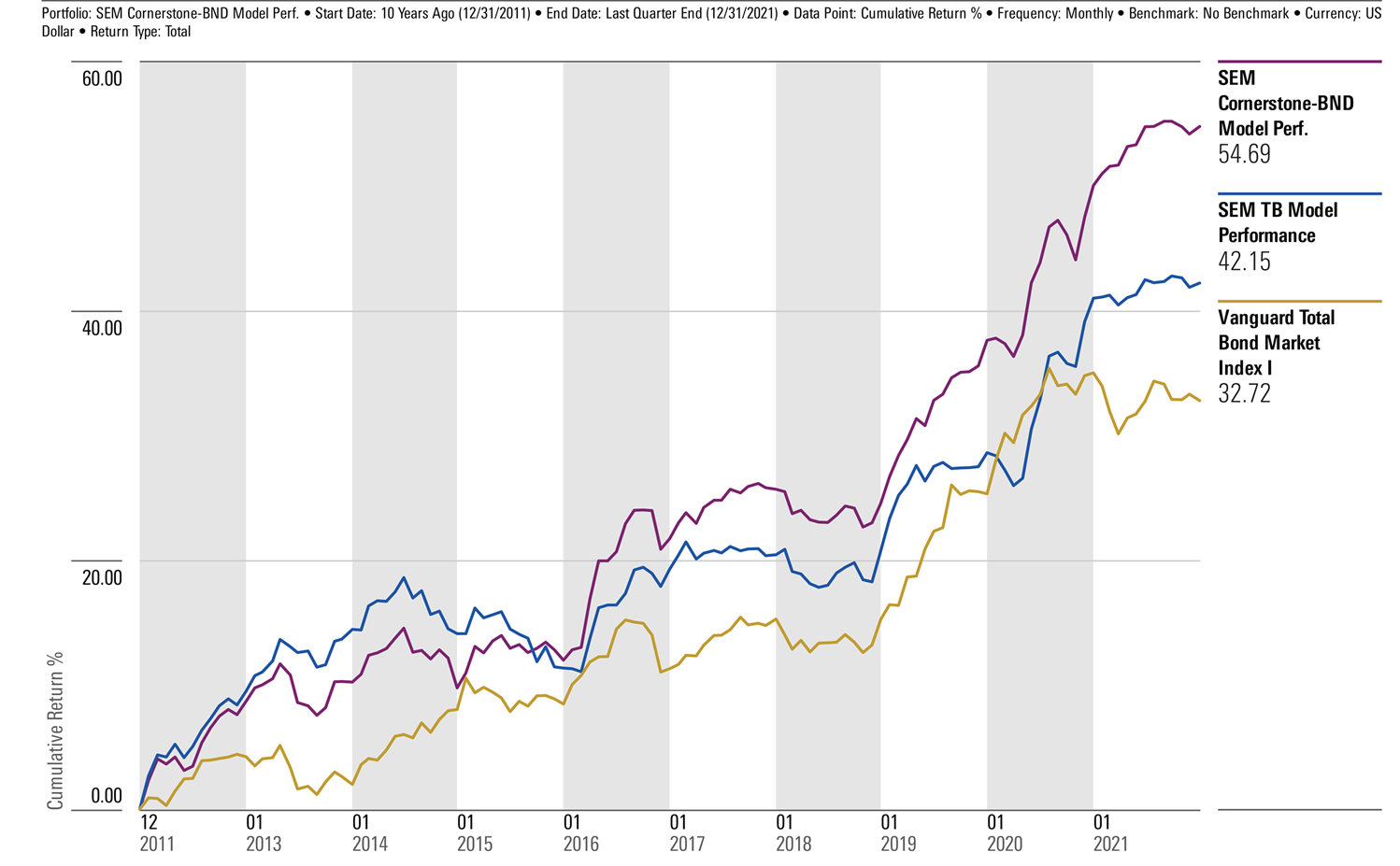

Cornerstone-Bond (CS-BND)

I'm also going to share the same charts I did above, but for Cornerstone-Bond. The same conclusion can be drawn from them – you don't have to sacrifice performance with BRI.

20 Year Model Returns

10 Year Model Returns

We understand performance is important and you want to make smart financial decisions, which is why I wanted to share some of the performance comparisons today. However, we believe the WHY behind your investments is more important than performance:

Why choose Cornerstone?

Source of profit matters

"Treasures gained by wickedness do not profit, but righteousness delivers from death." - Proverbs 10:2

As Christians, we are called to use the resources God provides for us in ways that will honor God – one of those resources being money. It's important for us to not be profiting (investing) in companies that promote sinful and immoral activities – even if it means not making as much money.

Our Cornerstone (BRI) Portfolios have three mandates to follow: Avoid, Embrace, Engage. We want to avoid the companies that do NOT align with our values, embrace the companies that DO align with our values, and engage with companies to advocate for positive change.

Align your values with your money

"So, whether you eat or drink, or whatever you do, do all to the glory of God." - 1 Corinthians 10:31

Investing in companies is ownership. You don't want to own companies that don't align with your values. As Christians, our values should align with God's and support His work. Stay tuned for an article on the embrace mandate that will cover more on aligning your values with your money.

Be a good steward of your money

"The prudent see danger and take refuge, but the simple keep going and pay the penalty." - Proverbs 27:12

Everything we have is God's, that includes the money you have. Therefore, you want to steward your money well. With SEM's Cornerstone Portfolios, there are over 70+ investment options, on-going due diligence, and customization to your needs. We will help you steward the money you're putting towards investments well!

Are you ready to make the switch? Click here for more information on our Cornerstone Portfolios and to fill out a short contact form.