The market is racing back to the highs following the early February 10% correction. I’ve seen a wide range of emotions from investors and advisors the past three weeks. Their current perspective of the market seems to be based on how far their “look-back” period goes.

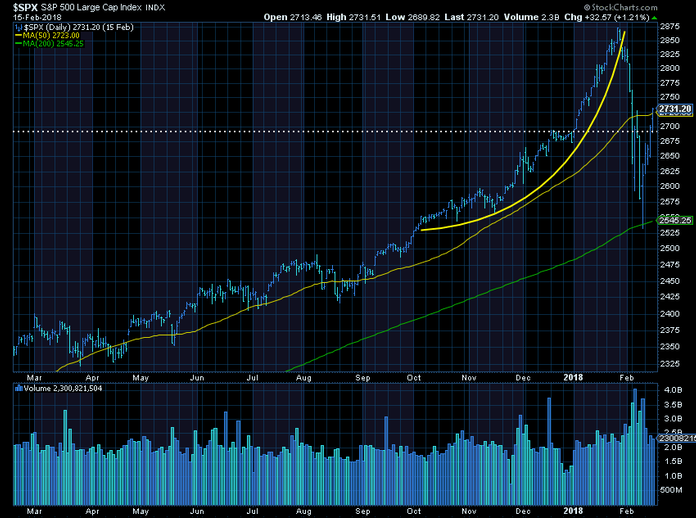

For those focused on the run-up since the election, the market drop was shocking. The market had gone parabolic in late 2017 and the first part of 2018. This sucked in a lot of money (all-time high inflows into stock funds). The 10%, 8 day correction was not what they expected.

The fast recovery will embolden people if the market keeps marching to all-time highs making them once again jump back in to “buy the dip” the next time it drops. For those that believe we are still in a prolonged bull market with little chance of a bear market on the horizon, this was simply a “return to the mean”.

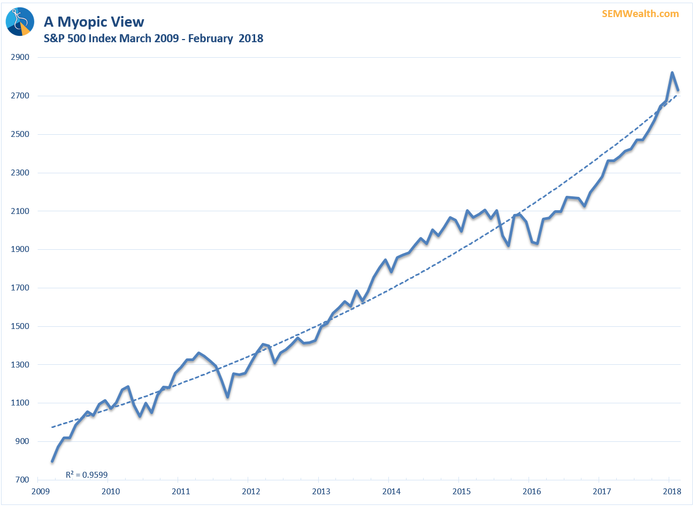

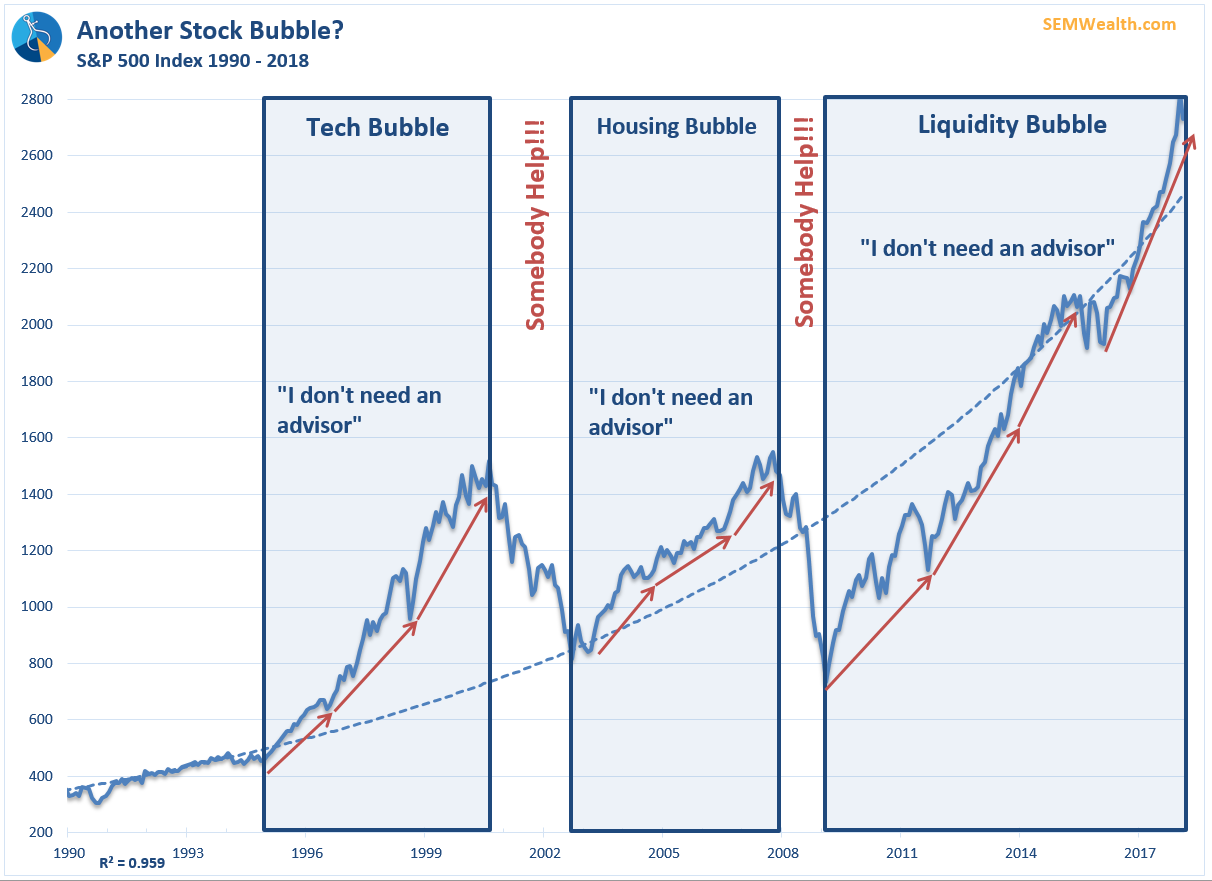

Note the “trend line” is actually an exponential trend line, something that should be a red flag as this is not normal and highlights the excesses that have been created with the Fed’s unprecedented easy money policies. Stepping back even further we can really put the current market environment in perspective.

The drop in the market did nothing to change the fact both the length and the magnitude of the current bull market should be a cause for concern. The rapid drop to start the month was a warning. If you are in portfolios that lost an uncomfortable amount of money over those 10 days, this rally is an opportunity to re-position into something that is designed to keep the overall risk of the portfolio in a more comfortable range.