Last week we addressed the concept of a “wave” election (a single party wins the White House & takes at least 20 additional seats in the House & wins at least one extra Senate seat). This type of “mandate” tends to lead to a bold president that wants to take advantage of the momentum and move aggressively towards enacting his (or her) favorite policies. Obviously that type of situation tends to hurt the market as investors do not like uncertainty. This week in our Blog we also discussed why the markets seem to be biding time waiting the outcome of the election. This type of short-term focus is something we are hired to do at Strategic Equity.

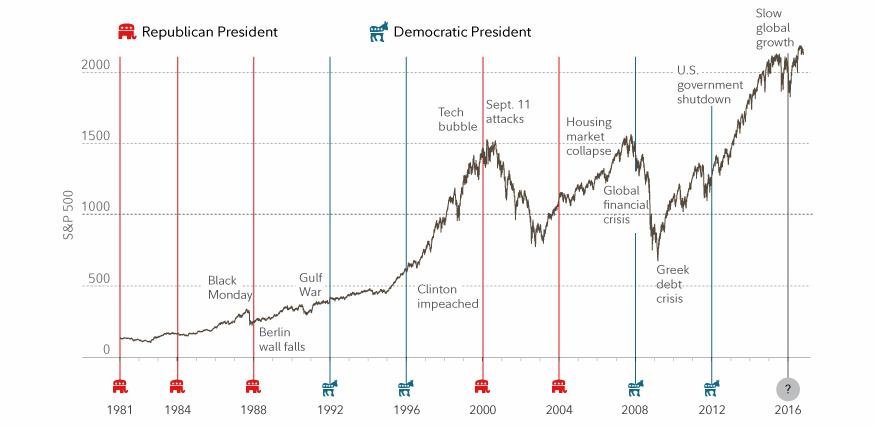

Our clients and advisors are better served to focus on the bigger picture and most importantly selecting the right portfolio given the risk tolerance (how much money they can afford to lose, how much of a loss they are comfortable with, the importance of the money to the overall financial plan, and the time horizon) and the overall investment direction. This week’s Chart of the Week was provided by Fidelity and it shows how little value can be added by changing investments based on who wins the White House. It also highlights how little most “MAJOR” events have actually mattered in the big scheme of things.

I wouldn’t be called “Mr. Sunshine” if I didn’t point out how SOME “MAJOR” events CAN cause serious damage to a portfolio, which brings us back to the key focus for all clients and advisors — selecting the right portfolio. In our opinion a mixture of our Tactical programs and our new Dynamic programs offers a solid option. The Tactical programs are designed to focus on capital preservation should the election turn into a major event that matters (or something else) while our Dynamic programs are designed to provide CONSISTENT allocation to the market while still utilizing some active management to help enhance the returns and reduce the overall risk relative to a buy & hold approach.

For more check out our Dynamic Portfolio Presentation (and in particular part 3 on Scientific Portfolio Allocation).

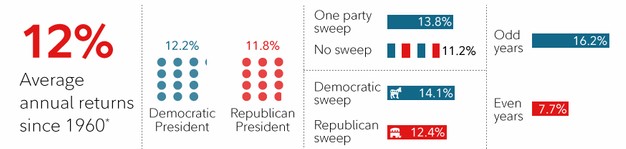

Finally, for those of you that are interested, since 1960 a Democratic President has had a slight edge in terms of market gains. However, correlation does not mean causation. There are many other factors that come into play. As the data shows, you would have been better off only investing in the odd numbered years than basing your asset allocation on which party controls the White House.