2017 was the least volatile year on record. While 2018 is not going to break records for volatility, after being lulled into a sense of complacency the past several years, 2018 has reminded us why having a well thought-out plan is important for long-term financial success. The stock market has gone through its second 10% correction of the year and again we are seeing clients and advisors in a panic wondering if the bull market is coming to an end.

The hardest hit segments of the market have been the ones that have performed the best the last few years (growth stocks). This includes SEM’s investment models, with our AmeriGuard & Dynamic Aggressive Allocation models taking big hits in October. These strategies are not designed to catch every movement in the market. It is inevitable they will be hit when a decline begins. Their role in a portfolio is to provide more consistent participation in the market while still looking to reduce exposure during MAJOR moves in the market (bear markets).

Click here for our Video Portfolio Update

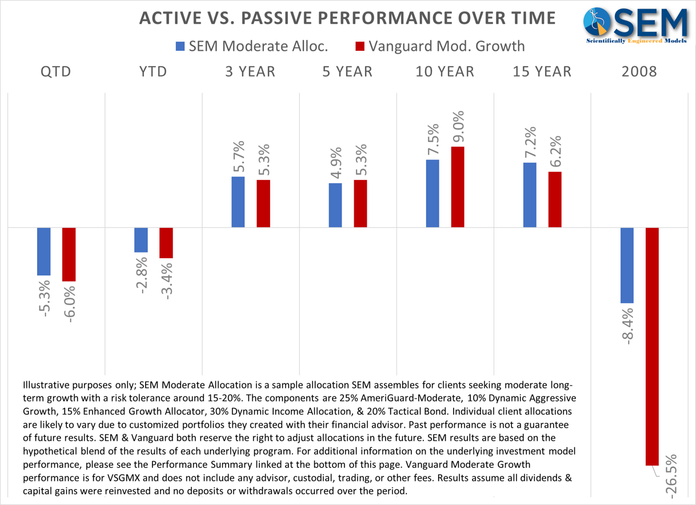

However, our tactical models, which are monitored daily have shined during October — doing what they are supposed to do. From Tactical Bond to Enhanced Growth and all the models in between exposure to risky assets has been sharply reduced, with all at or near their lowest risk exposure. Rather than focusing on individual models, I think it is more useful to look at a blend of various strategies, something we’ve been advocating for years.

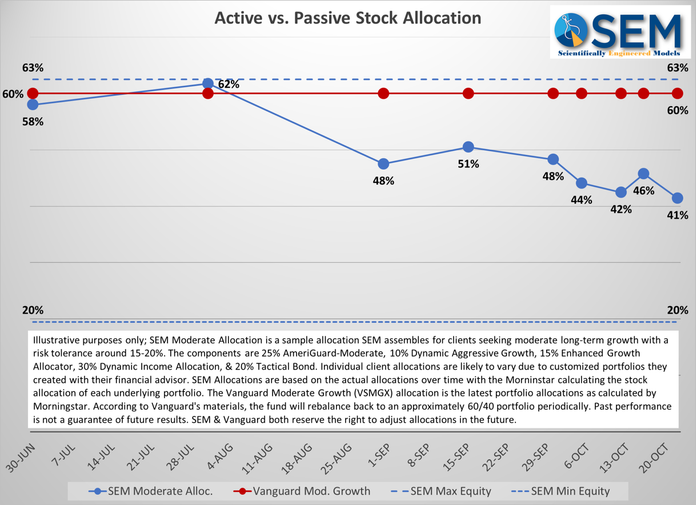

In my experience, most clients end up scoring in the “Moderate” category. This can mean different things, but to us it means around a 50 to 60% average exposure to stocks. We also note most clients tend to not want to lose more than 20%, so consider a 15-20% risk target to be the average. We advocate a blend of our strategies — tactical (daily managed), dynamic (monthly economic based models), and AmeriGuard (quarterly “strategic” models). The advantage of this approach is a truly diversified portfolio with different trading strategies, time horizons, and asset classes. With our “Moderate” blend our stock market allocation can go from 20% all the way up to 63%. Contrast this to the Vanguard Lifestyle Moderate Growth fund, which conveniently has a goal of always having 60% exposure to stocks (think of this as the “balanced” portfolio so many advisors recommend).

Looking at our allocations since June, you can see the activity that took place across the “Moderate” SEM Allocation.

The first 3 weeks of the quarter, we’ve already seen the value of the risk reduction. This has also led to out-performance so far in 2018. Over the bull market this may slightly detract from the performance, but when the market starts to fall the value of having active asset allocation is clear.

Only time will tell if the two 10% corrections will turn into a full fledged bear market, but valuations, the market cycle, and simple logic tells us a bear market is on the horizon. During a bear market the value of active management is glaring. What is important at this point is to make sure the overall risk of your portfolio matches the risk you should be taking. As you would expect from SEM, we’ve applied as much science as possible to what is typically a very “artistic” decision. If you’re an individual investor I would encourage you to take advantage of our WhatsMyScore.net free financial assessment. If you’re a financial advisor, I’d encourage you to begin using this useful tool with your clients.

Click the picture below to jump to our Free Assessment