What's happening with inflation? Why do we have it? How long is it going to last? I've been receiving a lot of these questions lately, so I decided to explain what we're currently seeing with inflation right now.

We also have an upcoming webinar, "Navigating a difficult year," on Wednesday, May 18th at 12PM ET. For more information on the webinar and to sign-up click here.

For those of you who would rather read than watch videos, here is what I covered:

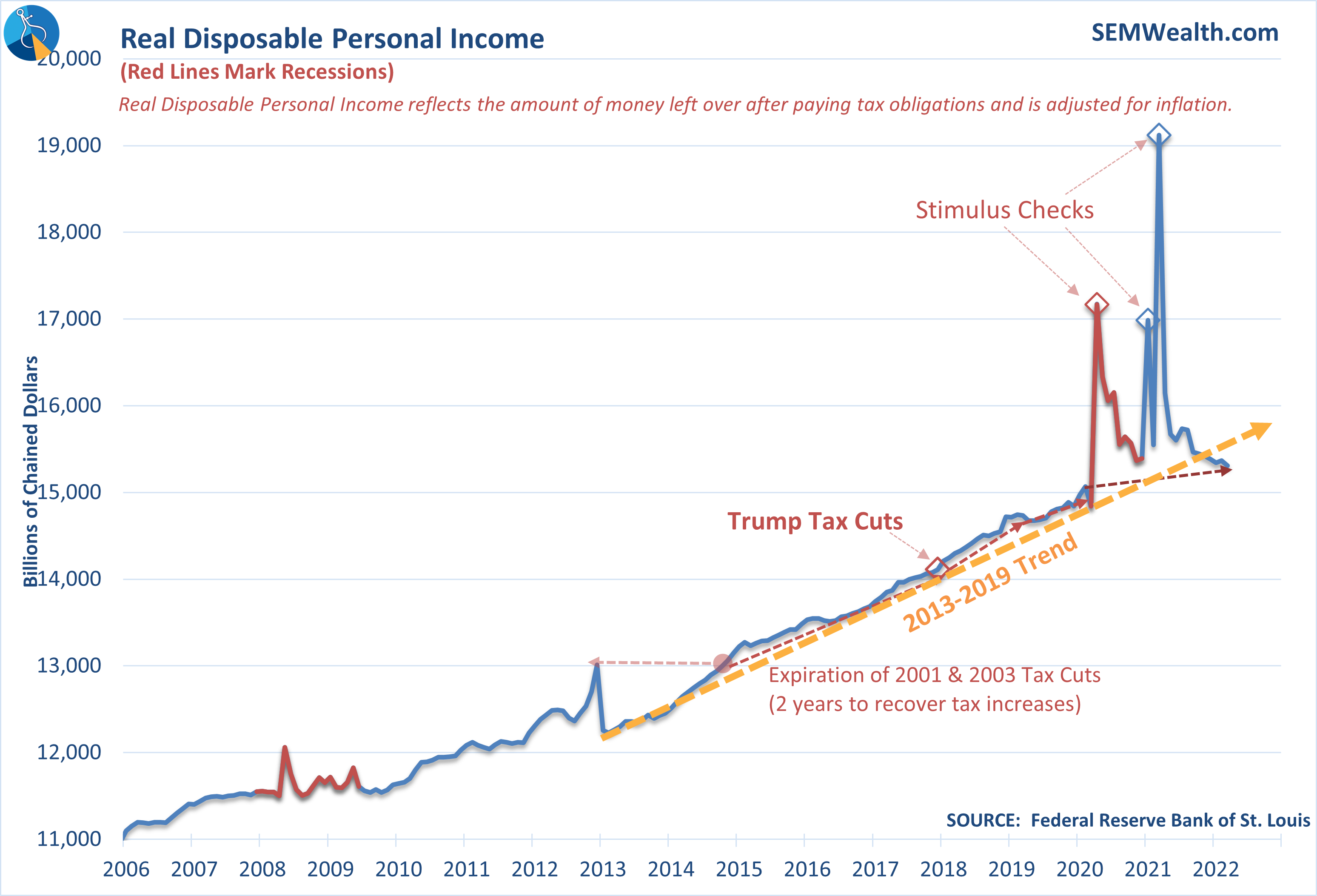

The big spike in income via the stimulus checks gave Americans plenty of excess money to spend. This allowed Americans to not return to work, to change careers, or start-up small businesses. It has had a significant impact on the availability of workers, which impacts the SUPPLY of goods and services.

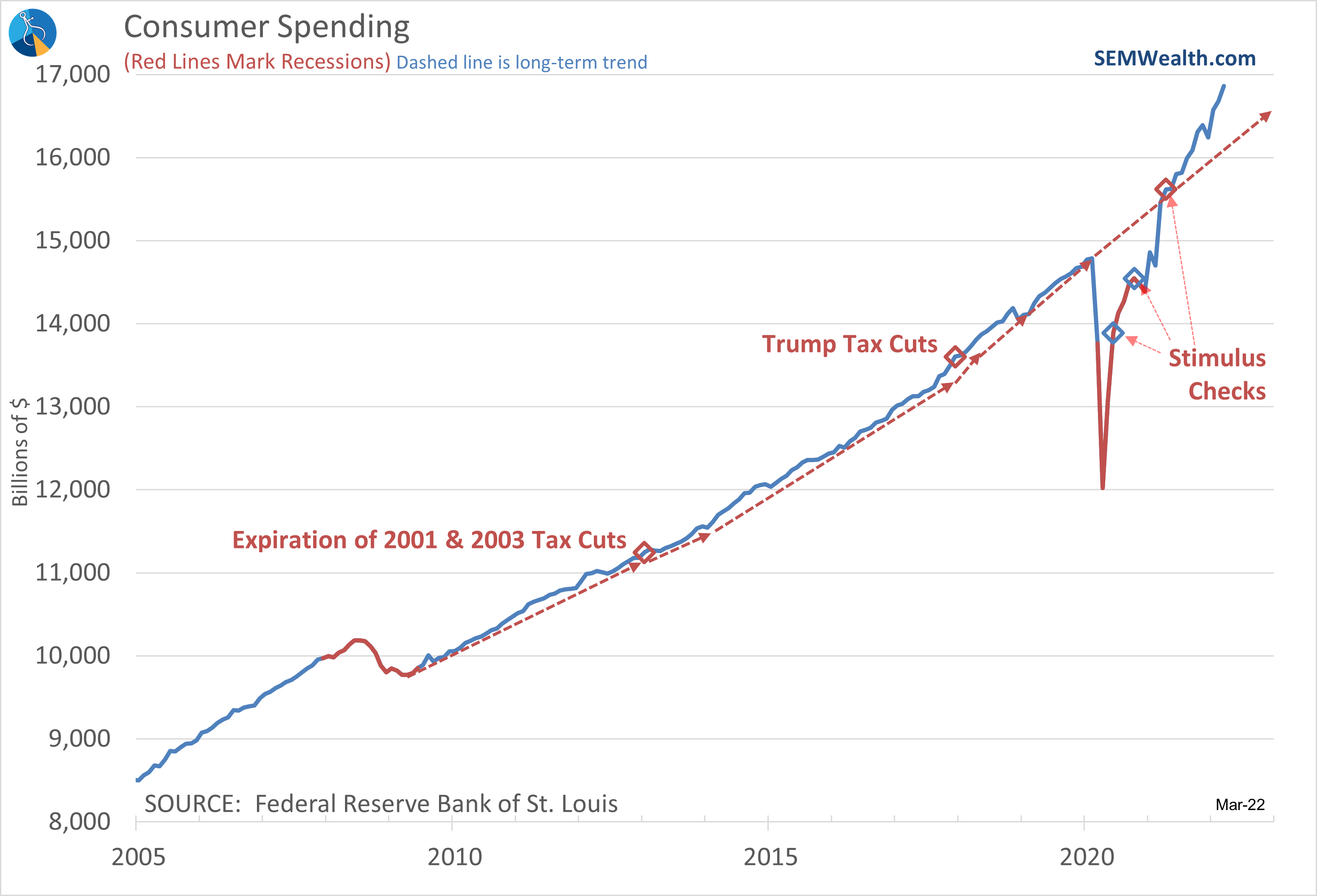

Americans spent a large chunk of the money they received as you can see from the consumer spending chart. With so much of the service economy shutdown, the money was spent on "goods", which created a shortage of SUPPLY.

The availability (supply) of goods & services was impacted by the stimulus checks and the economic shutdown. Unfortunately, this means much less supply and much higher prices. Even when the supply issues are mitigated (which could take several years), the "demand" curve will likely look different, which means lower economic output.

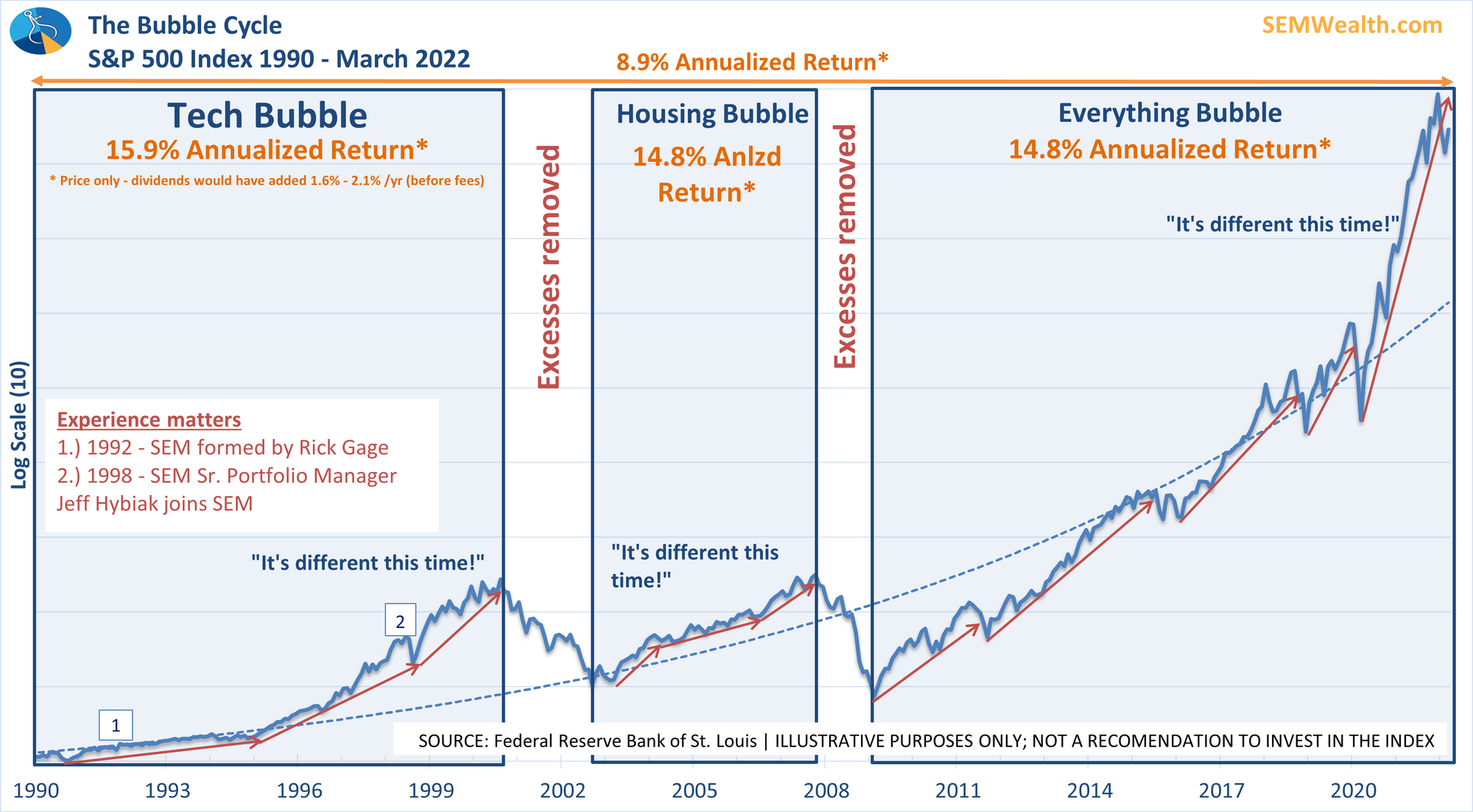

When you combine the supply/demand disruption with inflation and rising interest rates we are looking at a situation that very few people remember in their investment lives. Many people in 2021 were saying, "it's different this time," which is always a dangerous thought. A study of market history and my experience tells me it is never different this time. Markets get way ahead of the fundamentals and then some sort of event causes those excesses to be removed.

It is very possible the spike in inflation which will lead the Fed to raise interest rates could be the very thing that causes the next bear market. At SEM we always have a plan. I detailed some of the things we've already done and what we are looking at going forward in this week's Monday Morning Musings: