“One person’s financial assets are another’s financial liabilities (i.e., promises to deliver money). When the claims on financial assets are too high relative to the money available to meet them, a big deleveraging must occur.” – Ray Dalio, Big Debt Crises

“Debt is one person’s liability, but another person’s asset.” Paul Krugman, Nobel Prize winning economist.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

These quotes sound simple, but the concept is something I think few people understand. When a company borrows money it shows up on two balance sheets. Most people think when you own bonds it is a safe asset, but that is not always the case when the entity responsible for paying back the bond is unable to do so..

[UPDATE: This article was originally posted February 19, 2019. Ford bonds were downgraded to “junk” this week, so I decided to bump this article back to the top of the page. While the reasons behind the downgrade appear to be industry specific, it is also due to Ford borrowing too much without anticipating the impact of an economic slowdown. Ford is not alone in this aspect, which is something we’ve been warning about. Even if you’ve read this before, please keep reading to see why I am so deeply concerned that Ford’s downgrade is just the tip of a very large iceberg.]

If you’ve been in any meetings with me in the past six months you’ve heard me state my number one concern for the market and economy — Investment Grade Bonds.

Investment Grade Bond Concerns

-

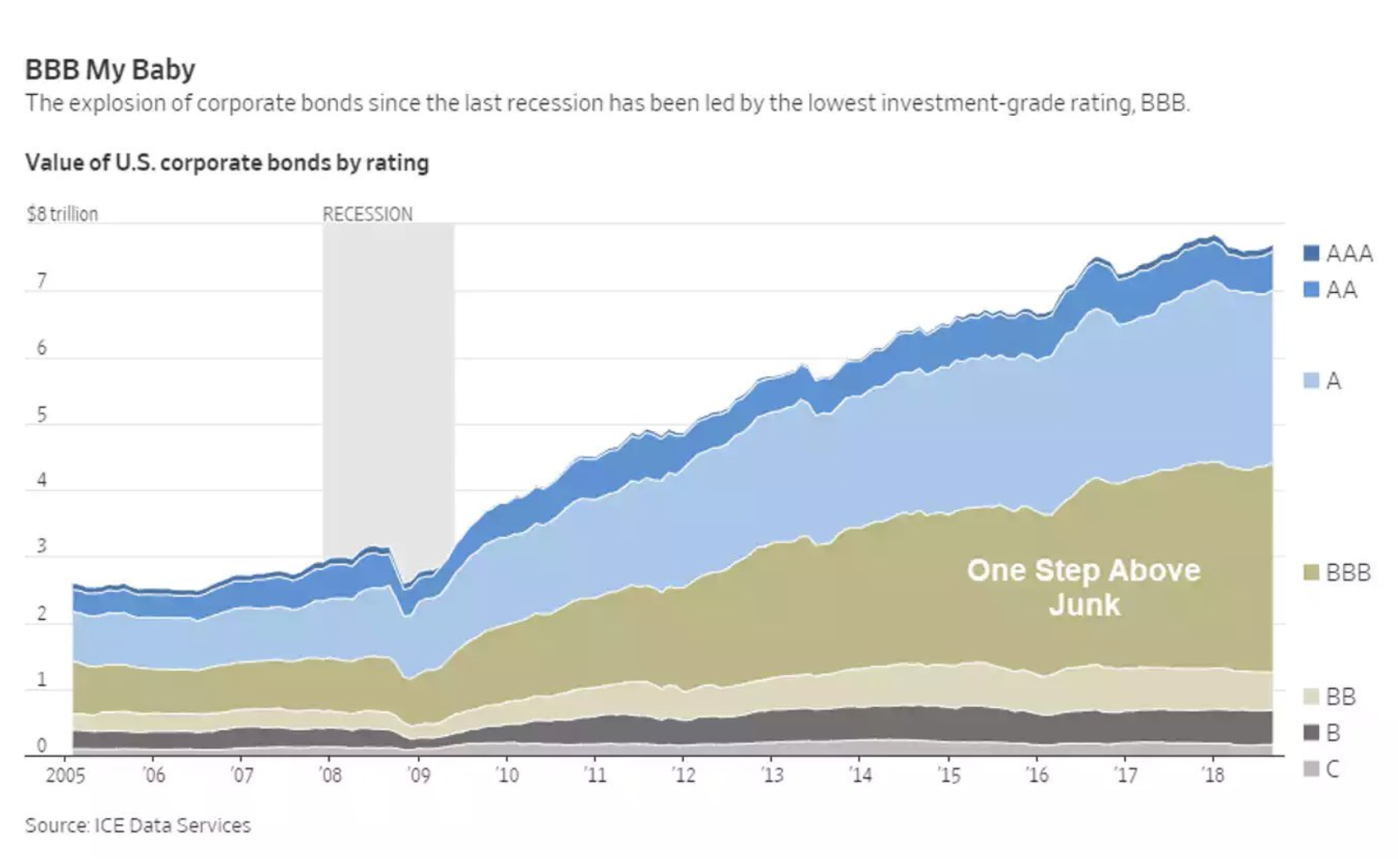

Over half of the “Investment Grade” bond market issues outstanding are rated ‘BBB’. This is one notch above junk. Over 85% of new Investment Grade bonds in the last two years were BBB rated (source).

-

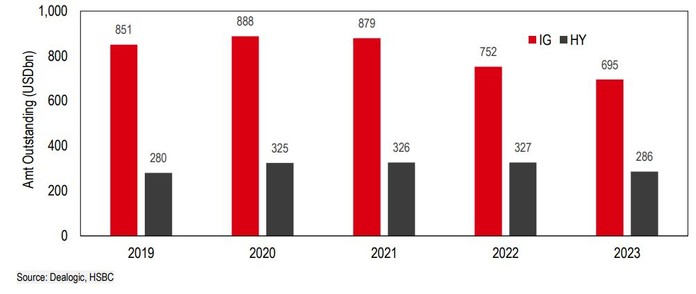

In the next 3 years there are $3.5 Trillon of corporate bonds that will mature (source).

-

The US Government will be borrowing at least $1 Trillion per year for the next 3 years (without a recession). This is DOUBLE the average per year in 2014-2016 (source).

-

Central Banks around the world have stopped buying debt. Some (like the Federal Reserve) have started unwinding their debt filled balance sheets.

-

There has been record fixed index annuity sales each of the past 3 years (source1& source2).

The last point is where I see people’s faces turn from agreement to confusion. Stay with me. The way a fixed index annuity functions on the insurance company side is to take the money received from the insured (after paying commissions, concessions to the broker-dealer, marketing costs, and other operating expenses) and purchase bonds. Insurance companies are limited by regulators from owning anything other than investment grade bonds, so this leaves government bonds or investment grade corporate bonds. [Note: there is some room for slippage, with most insurance companies allowed to own around 3-5% non-investment grade bonds. I’ve not seen any allowed to hold more than 10% in junk bonds.] They almost always choose investment grade bonds due to the higher interest rates and availability of new issues relative to government bonds. They then use the coupons to continue purchasing exposure to the stock market to cover whatever their contracts have promised.

I’m going to re-post the list from above.

-

Over half of the “Investment Grade” bond market issues outstanding are rated ‘BBB’. This is one notch above junk. Over 85% of new Investment Grade bonds in the last two years were BBB rated (source).

-

In the next 3 years there are $3.5 Trillon of corporate bonds that will mature (source).

-

The US Government will be borrowing at least $1 Trillion per year for the next 3 years (without a recession). This is DOUBLE the average per year in 2014-2016 (source).

-

Central Banks around the world have stopped buying debt. Some (like the Federal Reserve) have started unwinding their debt filled balance sheets.

-

There has been record fixed index annuity sales each of the past 3 years (source1) (source2).

Now re-read items 1 & 4 above. It is easy to see who has been buying all the debt as the Central Banks halted their purchases — insurance companies. Now re-read item #2. We are about to hit a wall of bonds that will be maturing. Companies did not issue debt to invest in projects that would boost future profits such as capital improvements. Instead they used it to buy back stock and issue dividends. In other words, they did nothing to improve their balance sheets, but instead made them weaker.

The Bond Bubble

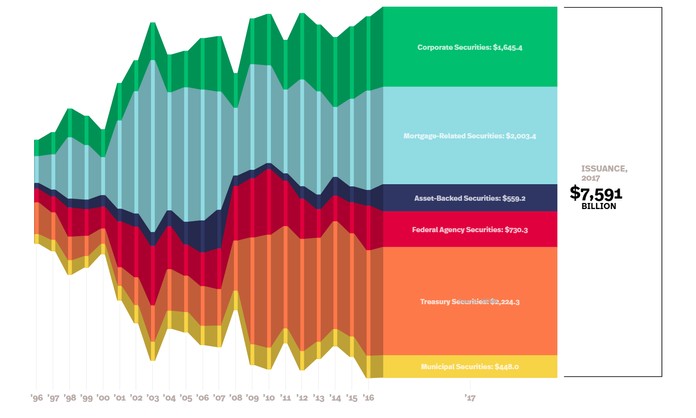

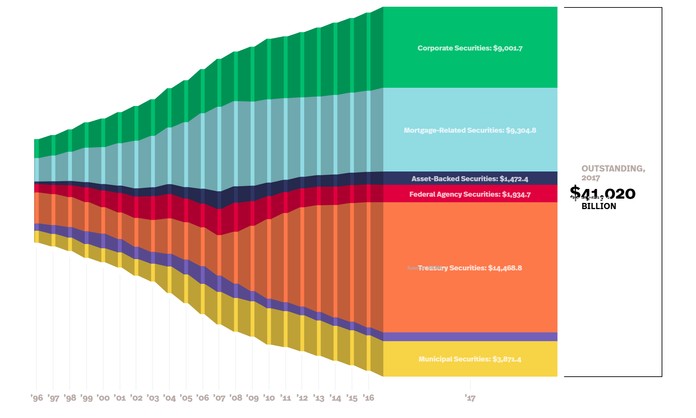

The Federal Reserve has been the great enabler of all this debt. Not only did they push interest rates low and allow companies to borrow at rates far below where they should have been, they created so much liquidity at the same time they bought up most of the stock of Treasury Debt, fixed income investors had no other place to go. Here’s a look at bond market issuance through 2017. The total issuance was a new record, and was gobbled up in part thanks to the strong demand for debt from the insurance companies selling fixed products.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

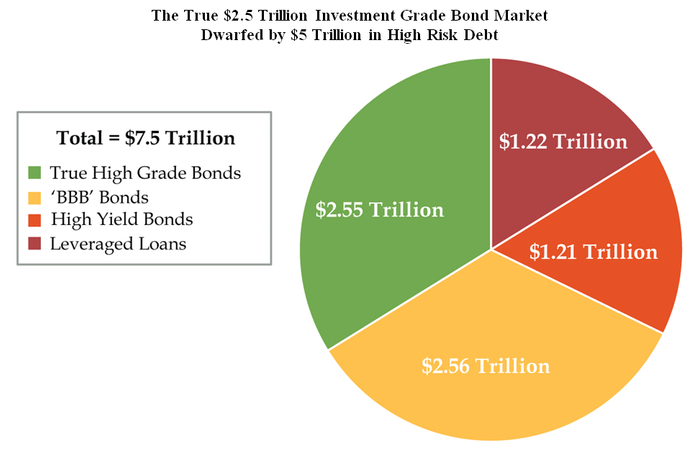

Danielle DiMartino Booth, a former advisor to the Dallas Federal Reserve, highlighted the real issues with the corporate bond market — 67% of the corporate bond market is HIGH RISK if you remove BBB from the “investment grade category.”

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

Maturity Wall is Coming Up Fast

Given the amount of debt that is coming due, the “maturity wall” that is about to smack all these bond issuers who did nothing to improve their balance sheet with the debt they used is going to be a SIGNIFICANT problem for bond investors (stocks will also be hammered if we start to see downgrades in the corporate bond market).

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

Companies borrowed trillions over the last ten years. This boosted the economy a little, but it caused the stock market to grow at nearly twice the long-term average over that time. At its core, debt is future spending pulled forward. If somebody making $50,000 borrows $10,000, they now have $60,000 of spending power.

Here’s Ray Dalio again in his book Big Debt Crises:

“Eventually the debt service payments become equal to or larger than the amount debtors can borrow, and the debts (i.e., the promises to deliver money) become too large in relation to the amount of money in existence there is to give. When promises to deliver money (i.e., debt) can’t rise any more relative to the money and credit coming in, the process works in reverse and deleveraging begins. Since borrowing is simply a way of pulling spending forward, the person spending $ 60,000 per year and earning $ 50,000 per year has to cut his spending to $ 40,000 for as many years as he spent $ 60,000, all else being equal.”

As a side note, Ray Dalio is the founder of Bridgewater, one of the largest hedge funds in the world. He has been managing money since 1975. He’s seen all kinds of various bubbles during his career. If you’re a market historian/nerd like me I’d encourage you to pick-up his book.

The Risks in the BBB Segment

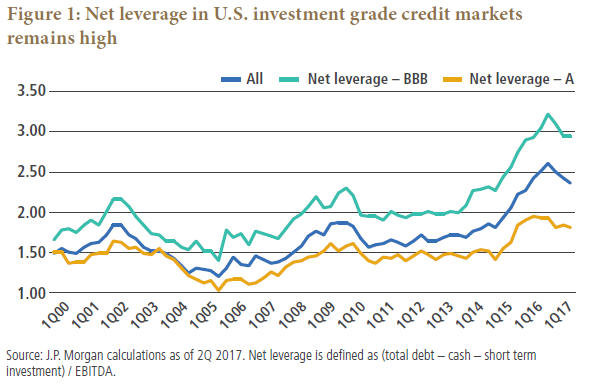

Pimco, one of the largest bond managers in the country, recently posted a report titled “Be Actively Aware of BBB Bonds.” In it they walked through the already deteriorating quality of the investment grade bond market. Interest coverage (net cash flow divided by interest payments) has been declining in rapidly in recent years. Worse, the amount of leverage investment grade issuers are using has increase significantly across the board, but the biggest concern is in the BBB segment. Issuers there are now sitting at a leverage ratio of 3 to 1. They were at a 2 to 1 ratio just ahead of the credit crisis.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

If the credit ratings services start to see companies struggling to pay back their debts we will start to see downgrades of BBB issuers. We are already starting to see some storm clouds on the horizon. Deutsche Bank reported recently $150 Billion of BBB rated bonds are on “negative credit watch”. This means 22% of BBB bond issues are in danger of being pushed into the junk category. If even half of these issues are downgraded as we run into the maturity wall it will get ugly.

This will make it close to impossible for those companies to issue any new debt. Worse, because insurance companies cannot own more than a small amount of assets rated below investment grade, not only will they have to SELL their existing holdings, there won’t be a market for the now junk rated companies to sell their new bonds. Defaulted bonds lead to bankruptcies, which lead to more downgrades, and more bonds being downgraded. It’s a horrible spiral, but one that cannot be stopped.

This will also put a serious crunch on the cash flow of the insurance companies. For more see our special report, “Guaranteed Risks in Your Annuities“.

Side Note: At some point I do suspect the Federal Reserve would do what the European Central Bank & Bank of Japan did the last 10 years — buy junk rated bonds in an attempt to prop up the market. I also expect regulators to relax the regulatory requirements on insurance ratings restrictions after the carnage has already begun. When that happens and how much it helps is not something I would be basing my retirement plan on (or my business).

Different, but Potentially Worse than the Last Crisis

Speaking of the last financial crisis. I continue to hear pundits say, “things aren’t as imbalanced now as they were in 2008.” They are right — households are not as leveraged as they were back then…………..in terms of mortgage debt. According to a just released report from the Federal Reserve, household debt set a new record. Student loan defaults continued to climb, but the biggest cause of concern in the household segment is the record number of Americans (7 million) who are now 3 months or more behind on their car loan payments.

Worse, however is the fact both governments and corporations have significantly more debt than they had before the financial crisis. Total bond market debt is 39% higher overall since 2007, but US Treasury Debt has grown by 220% & Corporate Debt by 69% (through 2017 source)

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

These numbers are staggering and should keep you up at night if you have too much of your client’s money “guaranteed” with insurance contracts or in passive fixed income investments (see our special report “Guaranteed Risks in Your Annuities”). Stocks of course will not be a safe haven given how much of the rally the past 10 years has been fueled with easy credit allowing companies to buy back stock and issue dividends. Many insurance companies will survive the next crisis as will many fixed income issuers (we just don’t know which ones and aren’t willing to risk being right or hoping the Fed saves them all). The people that will be hurt the most are the ones in passive (or near-passive) buy & hold stock investments who are not ready, willing, or able to go through another debt crisis.

Our Plan for Action

I don’t know how bad things will get or when they will start. I do know each bear market starts with a different catalyst. My job is to look at all potential issues, inform our advisors and clients about the risks, and then stress test each of our investment models to make sure they are set-up to do their job. I hope I’m wrong, but a simple study of market and economic history should tell you nothing can be done to avoid a bear market or recession. Both are designed to wash out the excesses created during the past up cycle. Anything that is weak will be wiped out, but the aftermath should allow for strong, healthy growth.

Our current situation is analogous to the Pending Forest Fire I used to describe what happened in the tech crash and then to predict what would happen in the looming housing crash. I was early then and probably early now (although I’ve been sitting on the idea for this article for at least 9 months because I didn’t see any signs of looming stress.) The signs are starting to increase and while we never invest money based on my “gut”, it is telling me the odds are increasing rapidly of some sort of credit event in the next 12 to 18 months bringing in unknown collateral damage to the markets.

I hope I’m wrong, but hope is not a strategy. As the Outsourced Chief Investment Officer (OCIO) of a group of advisors we call the SEM Platinum Advisor Group I take my job seriously. They have hired SEM to perform all due diligence on potential investment managers and to create custom portfolios based on the clients’ financial plan, cash flow strategy, and true risk tolerance. They also ask for assistance in crafting their message to current and potential clients. My message to them is simple — the stimulus used to fight the financial crisis went on for too long. It has created massive excesses in the fixed income market that has created a situation that is dangerous for anyone depending on their investments over the next 10 years. (If you’d like to discuss how you become part of this elite group of SEM Advisors, send me a quick note.)

Setting Expectations & Making Portfolio Adjustments

Returns could be lean for SEM’s models the next year or two because we focus first on keeping risks within the client’s true risk tolerance. For most people we test, they begin getting uncomfortable around a 20% or lower loss. When you get uncomfortable, you tend to become a little more emotional. When you become emotional you tend to make mistakes and do not always think rationally. This can blow-up the well-thought-out financial plan. We want to have cash available (and our clients still invested where they should be) to take advantage of what will be some tremendous buying opportunities. Especially for our lower risk fixed income models I start to get excited thinking about all the “good” investment grade bond issues that will be downgraded for no reason other than they look like other bonds that defaulted. This will allow us to buy so many bonds at “fire sale” prices.

Regardless of whether I’m right or wrong, markets do not go up forever. If I’m wrong, our customized approach based on the overall financial plan, cash flow strategy, and true risk tolerance often leaves clients with some potential to participate in the upside of the market. I’m especially not advocating moving money all to cash. I am however advocating EVERY advisor and client to take a look at their true risk tolerance and then stress test their current portfolios. If you’d like more information on how you can do this, let me know.