The S&P 500 index hit an all-time record high on Tuesday. Many people are celebrating what is officially the shortest bear market in history. A typical bear market sees stocks losing 35-55% over 12-18 months and then taking 5-8 years to fully recover those losses. I've argued since the beginning this was not a bear market due to the relatively short amount of time the market was going down. A true bear market is emotionally draining as investors see their account values going through a painfully long period where it seems they won't ever go up again.

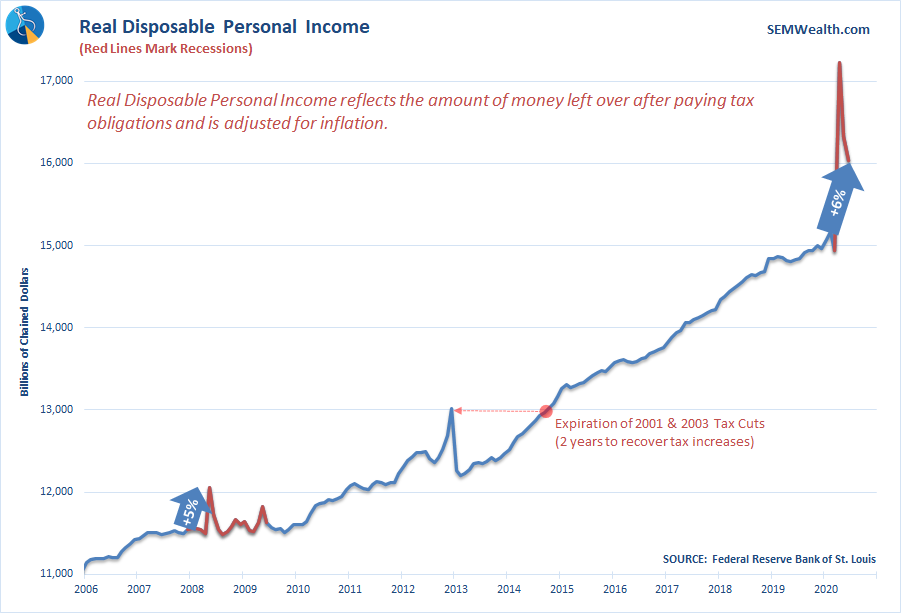

We've covered the reasons the stock market has been able to avoid a true bear market many times. The key reason is the unprecedented amount and velocity of money flowing to consumers and investors from Congress and the Federal Reserve. Despite payrolls currently only 92% of where they were in February, personal income is 6% higher.

What is hidden in the new all-time highs in the S&P 500 is the chasm between the 6 biggest stocks and the rest of the stock market. We mentioned in our Summer Newsletter how the FAANGM stocks (Facebook, Amazon, Apple, Netflix, Google, and Microsoft) comprised 25% of the S&P 500. The S&P 500 is "capitalization weighted", which means the higher the value of the company, the more it controls the index.

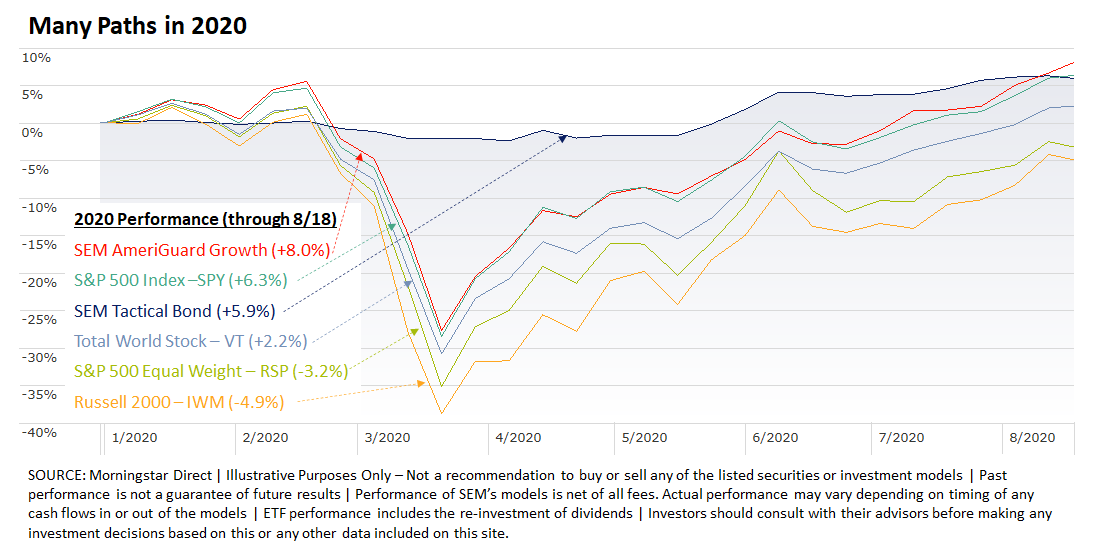

It's great the S&P 500 is at an all-time high for those who own that index. Following sound financial advice and holding a diversified stock portfolio means you are probably still negative for the year. An equal weighting to the S&P 500 components is still negative in 2020 along with Small Company stocks.

The thing that jumped out at me yesterday when the S&P 500 hit new highs was the completely different experience SEM clients and advisors could have had the last 6 months. The two edges of the SEM risk spectrum, Tactical Bond and AmeriGuard-Growth have both provided returns similar or better than the S&P 500. The difference is the path they took to get there.

Where we go from here is anybody's guess. My experience tells me investors need to be extremely careful. I outlined my assessment of the current market environment and my advice to investors in this week's Musings:

In my opinion 2020 has once again proven the value of our data-driven process. Both on our Tactical fixed income and "Strategic" growth models we've been able to navigate the unknown without emotions or guessing. With the S&P 500 at an all-time high I couldn't think of a better time for advisors and investors alike to re-evaluate their current portfolio holdings. Both Tactical Bond and AmeriGuard-Growth are available on the Adhesion/Flex UMA, Orion (formerly FTJ), and Geneos/Axiom platforms along with our Dynamic models (which are also close to the S&P's 2020 returns). This allows advisors to utilize SEM's key building block strategies either direct or on their selected platform.

The beauty of working with SEM is our full behavioral approach is designed to adapt to both advisor and investor natural human behaviors to allow a much smoother path to financial success. There is no guessing at SEM on what to do next.

Are you confident in what happens in the next few months heading into the election or the next few years as our country figures out how to repair all the damage done this year? Do you want to be the one making the decisions and adjustments to your portfolio as the environment shifts? Are you set-up to re-direct all your energy to managing your investments at a moment's notice, putting all other responsibilities on hold?

If the answer to any of those is 'no', we should talk.