Stocks have essentially gone nowhere since mid-April. It seems all of the catalysts that led to the parabolic rally in the market for the past year have come and gone. Now the question is – what's next?

For most of this year we've talked about the 4 pillars of the rally:

- Federal Reserve Stimulus

- Congressional Stimulus

- Expanding economy

- End of COVID

Working backwards:

- New COVID cases are at levels we saw last June before the summer spike. Anybody who wants a vaccine can get a vaccine. There is no telling what the fall is looking like, but it should look better than last fall.

- The economy is expanding although the pace of new jobs has been far below expectations. It's likely to remain weak until the fall when kids should be back in school full-time and the extended unemployment benefits are set to expire. Inflation has also started to dampen growth. The cost of travel has skyrocketed in recent weeks. Transportation costs are starting to filter into retail prices, which cause disappointing retail sales numbers. And this week we saw housing starts decline with home builders specifically mentioning the cost of materials hurting demand.

- Congressional stimulus is also being called into question. We clearly will not get another $5 Trillion this year. The third round of stimulus checks have been either spent, used to pay down debt, or put in a savings/investment account. We may see a temporary boost with the expanded child tax credit program shifting to monthly checks in July.

- Federal Reserve stimulus is likely to be the first pillar to crack. The minutes from the Fed's latest meeting this week showed members discussing tapering their asset purchases far sooner than expected. Some are concerned about asset bubbles and hidden inflation hurting the economy. While discussing tapering and actually doing it are two different things, I think most investors are using the assumption the Fed will be backing stock prices for the foreseeable future.

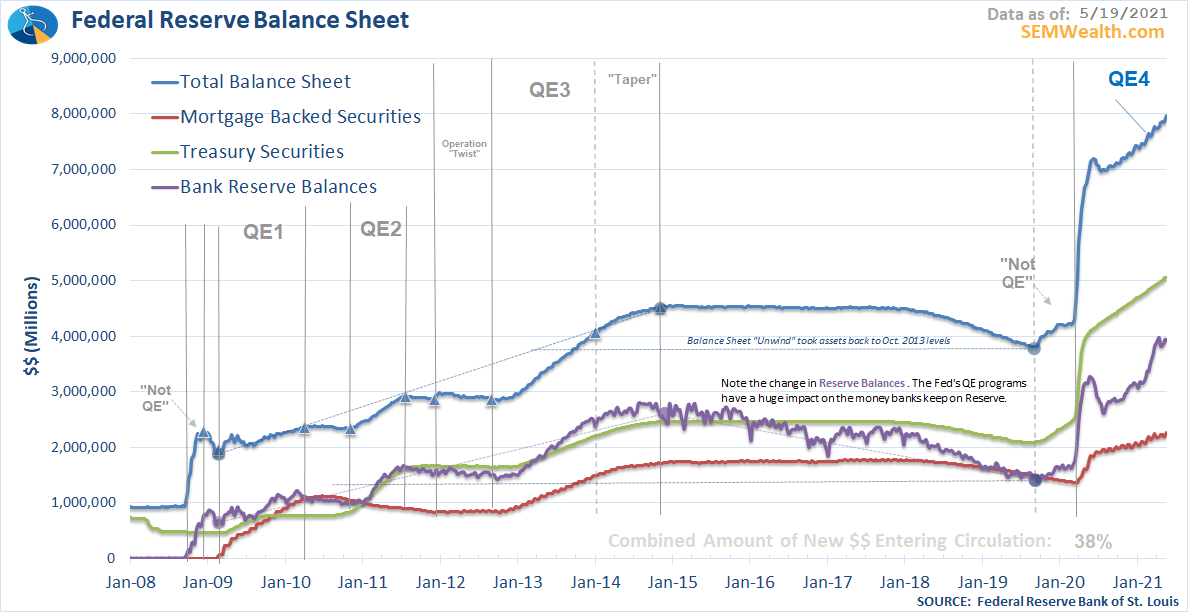

This chart of the Fed's Balance Sheet shows how much the Fed has been adding to the financial system via their asset purchases. Most of the funding has been to Treasury Bonds, which has gone right back into the reserve accounts of the Wall Street banks. The Fed has purchased over 1/3 of all new Treasuries in the past year. Somebody will need to step in to pick-up the slack if the Fed decides to taper their purchases.

In summary, the pillars have taken a hit. Some more than others. For investors just wanting to get more aggressive in stocks the question they should be asking is, 'what is the NEXT catalyst for a big rally?' All of the above has already been priced in. In my opinion prices went too far to justify the growth we will ultimately see. When investors realize this, prices will likely be adjusted downward. This usually happens faster than expected.

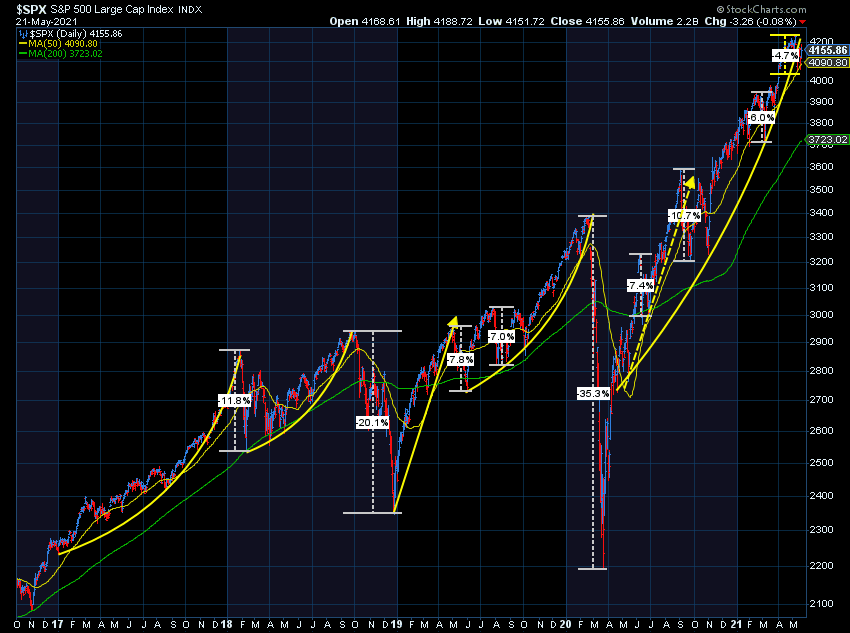

The parabolic move in the market is still in place for now. This chart shows how quickly we've seen large losses at the end of those moves. I've had conversations with many clients the past couple of weeks who want to increase their exposure to stocks. I would encourage patience at these levels. The financial plan should dictate allocation adjustments to our models, not the feeling like this is a good buying opportunity because stocks are 5% off their highs.

On a shorter-term basis, the market has been consolidating for the past month. The market could still break higher, but it could also break lower. Most of our models are still holding on and waiting for the trend to change.

From a bigger picture standpoint, I would encourage you to 'taper' your expectations. I discussed some of the reasons in this short video a few weeks back.