We paused on Monday to remember all those who sacrificed their lives to defend our freedom. As I've said many time, we live in the greatest country in the world because in times of crisis Americans have always come together to sacrifice for the good of the country. I've always been optimistic that we will eventually figure things out and come out of any crisis.

For the past 15 months, that optimism has been questioned. The "solution" for the economic impact of the pandemic has been to dump trillions of dollars into the economy. Those who felt zero economic impact suddenly had thousands of dollars they did not need. For many people on unemployment, the benefits being paid come close to what they would make working full time at a physically draining restaurant or retail job. There are still others who cannot work (because schools are not back to in person learning 5 days a week).

We're adding an unprecedented amount of money to the deficit, even exceeding the pace we saw in the post-World War II recovery. While Republicans are now balking at the amount of money being spent, they don't have much of a leg to stand on as they willingly voted for President Trump's trillion dollar deficits at a time the economy was expanding.

I don't want this to turn into a political blog. As most readers know I'm an Independent, so I have no dog in this fight. What matters to me is what all of this spending is doing to our economy and what it will do to the stock market. I equate all of the stimulus to pain killers being used to treat cancer. Yes, you may ease the pain, but we are doing nothing to actually treat it. As time goes on, the patient needs more and more pain killers to maintain the same comfort level.

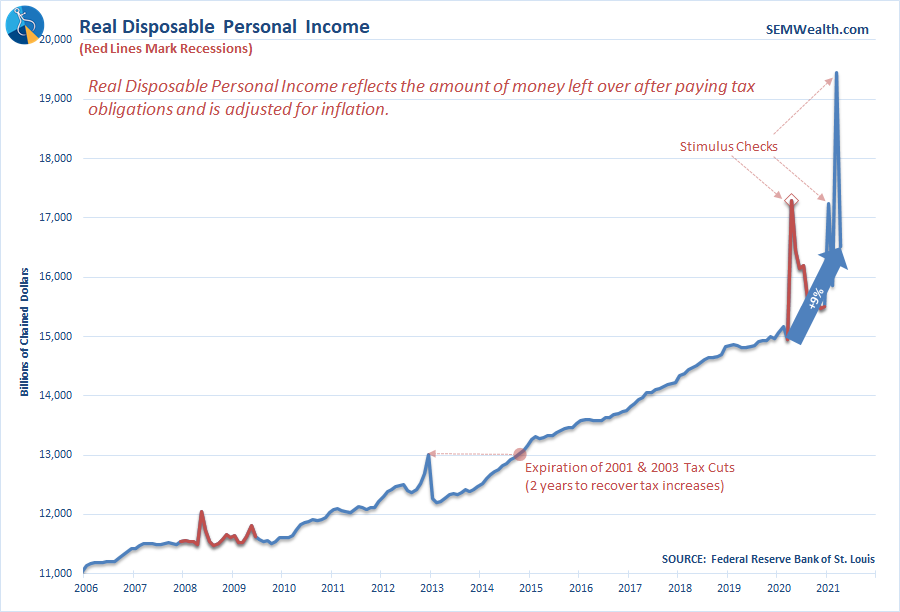

Overall, income is 9% higher than it was before the pandemic, yet Congress wants to spend even more money. The issue as I've said all along is those who didn't need the money received way too much and those who needed it the most received way too little. It was easier for Congress to just send most Americans large sums. This bought them time and more votes.

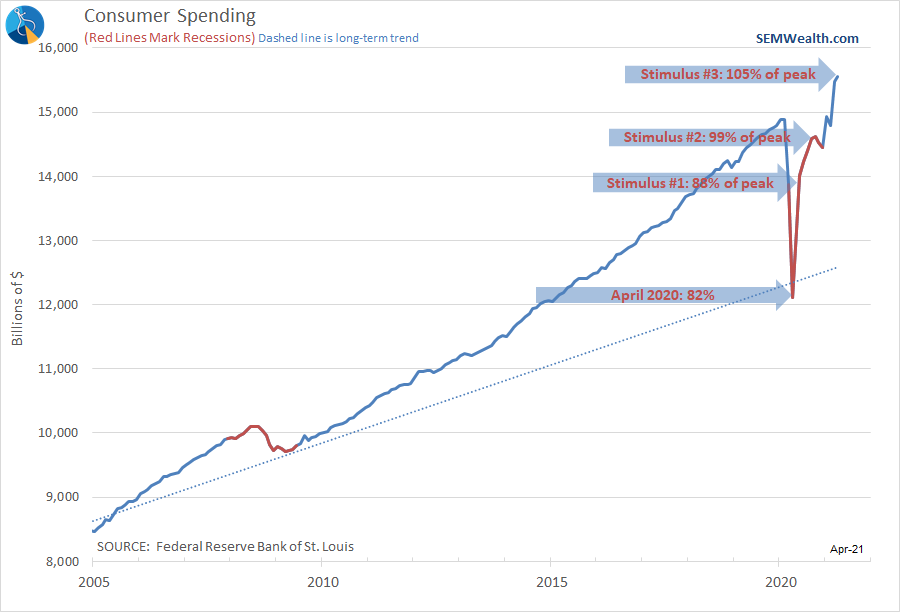

Consumer Spending has also come roaring back.

While it is great news spending has exceeded the peak, we have to keep in mind all of that money is now gone. Worse, we should not expect this to continue at this scale. The stock market is acting as if this stimulus will go on for infinity. Yes, we are likely to see a huge spike in travel and leisure activities, but I think people buying stocks at these levels are forgetting you can't simply take multiple vacations just because you didn't get one last year. There are only so many concerts, movies, and dinners out. We aren't going to be at home buying all kinds of things on Amazon, won't be buying additional Microsoft or Zoom subscriptions, and won't be watching everything available on the myriad of streaming services available.

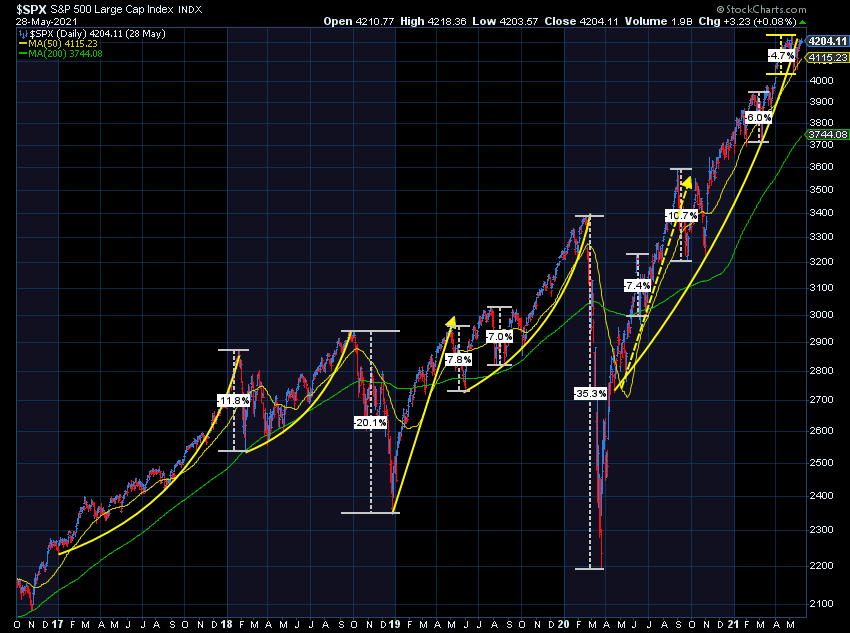

Subjectively I'm expecting the economy to be heading towards recession in late fall as the summer of freedom ends and all of the government (and Fed) stimulus ends. The Fed may believe inflation is "transitory", but that doesn't mean it isn't having an impact on consumers and businesses at the lower end of the spectrum. Stocks are priced to perfection with the assumption the spending we saw the last 12 months will continue indefinitely.

From a technical perspective, the economy remains in "expansion" mode and the trend is still higher. We are enjoying whatever gains we can squeeze out of this market knowing that time is short before the inevitable correction occurs. When that occurs our history has proven we should be ready to move to more defensive positions.

Please be careful chasing this market. I've been doing this for a long time and whenever we've had this type of euphoria it has ended up financially devastating far more people than those who get rich quickly.