We spent the weekend in Virginia Beach at the season ending soccer tournament for our 15 year old twins. Having managed investments for 25+ years I've seen the ebbs and flows of interest in investing markets. I realize anecdotal stories cannot be relied on for any sort of market timing signals, but I found it interesting that during the down time between games I had several groups of parents commenting on how great the market has been. Even more interesting was the players on the sideline who recently started working part-time jobs asking me about what stocks they should invest in to "get rich" (maybe that's why we finished the tournament in second place for the second season in a row.)

A couple of the parents had mentioned how great their retirement accounts were doing, but asked if I had ideas on how to get higher returns. When I asked what funds they were using they weren't sure, but said they were the most aggressive. I said, "if that's the case you should be up 18-22%, which is a phenomenal year, which came on top of what should have been a great year in 2020." I then went on to remind them they should probably lower their expectations since these returns are more than double the long-term average. Neither the parents or the players seemed to like my guidance that the best way to "get rich" was to do it slowly by putting as much money as possible into the markets every single month.

It's not just soccer parents and their kids excited about the stock market. The last few weeks on CNBC I've heard discussions of the "everything rally". Everything seems to be going up and nobody seems to see any risks in the market. The more it goes up the more money people seem to want to make. With many people (including our twins) getting the entire week off for Thanksgiving, I didn't plan on writing too much today. There hasn't been much new news to change what I've been saying for the last few months, but after our experience over the weekend I felt I needed to again remind our readers about the dangers of this current environment.

There are quite a few risks developing that I'm confident few people are taking into account. Add the euphoria to the "everything rally" to that list. I went through several of those key things to watch in our latest SEM University last week. You can watch the replay here:

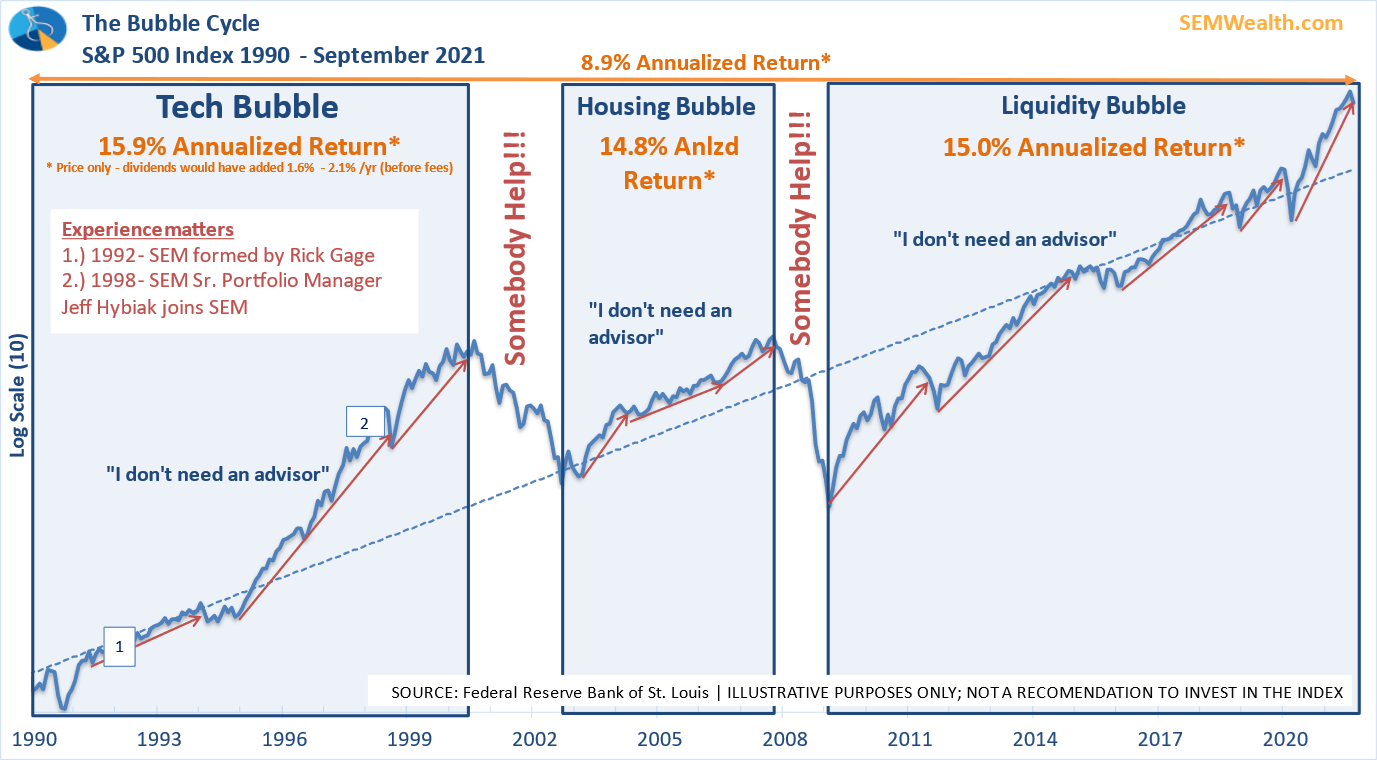

One of the charts I shared is the one I think most puts the risks in perspective:

Going back to 1990 the market has averaged a 9% return per year. However, we've had times where it was averaging in the mid-teens. During those times we had "everything rallies". We had euphoria over how much money our investment accounts were going up. We had people asking how they could make even more money. Despite all the seemingly great things happening, the market lost half its value in 18-24 months. It then took 6-8 years to recover those losses. For long-term investors just who are putting money into the markets every month or those who don't need the money for the next 10 years, and most importantly those who will have the stomach to stick with some investments when it turns into the "everything sell-off", these drops are a normal part of investing.

If you aren't in any of those categories or you are looking to put more money to work in the stock market simply because it seems everything is going up consider:

- Economic growth is slowing rapidly as the impact of the $5.3 Trillion stimulus has waned and there is little chance of meaningful stimulus checks being sent in the next year.

- Inflation is eating into the benefits of the past economic growth and will likely accelerate the slowdown.

- Personal income is now increasing at a pace BELOW the 2012-2019 trend, which will eat into future consumer demand.

- Consumer Sentiment is at the lowest level of the entire pandemic.

- The Federal Reserve is slowing their stimulus and is planning on ending it in 2022.

- Stock valuations are at levels where we should expect 10-year average returns 1/3 to 1/2 of normal.

I don't want to be a downer as we head into Thanksgiving. We have plenty to be thankful for, including the spectacular returns we've seen in the stock market this year. The Federal Reserve and Congress acted so quickly and in such a coordinated fashion they literally saved the economy from disaster back in 2020, but they also have created a massive bubble in risk taking. Stimulus has to be paid back either by below average growth in the future or a big reversion back to the mean. Obviously neither is good for those with less than 10-year time horizons or especially those just now jumping into the markets.

For our part, we remain active participants in this everything rally. Our lower risk tactical systems continue to barely hang on to our high yield bond positions. We've lost track of how many weeks we've been on the verge of a sell signal only to have a rally keep us invested. If high yield bonds start to sell-off that will likely be a clear sign there are problems ahead for the market.

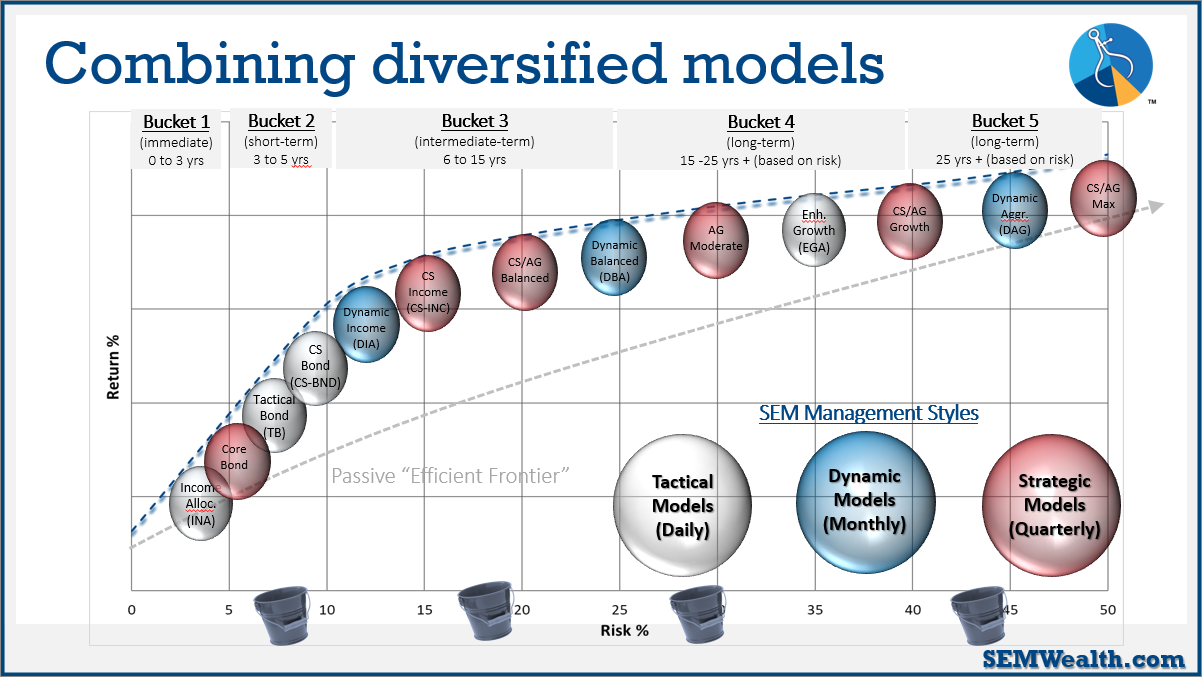

Our dynamic systems, which utilize our quantitative economic model are the most "bearish", but still remain heavily invested and participants in the rally. "Transition" modes, which is where we're at now, are the most volatile as the market participants dissect whether or not the economy can resume stronger growth or is heading to an economic slowdown.

Finally, our "strategic" systems remain fully invested and have enjoyed a well above average year. We're quite a bit away from any sort of sell signal in these models, which is how they are designed. These models are typically allocated in the longer-term buckets of the investment portfolios which means allowing them to stay invested longer than our other two management strategies. They did trim some of the risk by eliminating small cap exposure back in October.

One of the things I tell clients and advisors alike is our job is to watch the markets for risks and opportunities on a daily basis so they can focus on things they enjoy. We are set-up to do this in an unemotional way to prevent us following for the inevitable feeling that there are no risks in the market and that everything will continue to go up for the indefinite future.