Black Friday was supposed to be a quiet, generally optimistic day. Seasonally we're in a very strong period for the stock market. Consumer spending has been strong. Earnings have been "better than expected". Thanksgiving travel was supposed to exceed 2019 levels. Christmas travel and spending was supposed to set records.

Then the World Health Organization disclosed a new COVID variant discovered in South Africa (now named omicron). Sell first, ask questions later seemed to be the thought process on Friday. Fears of widespread travel restrictions and closures hit knocked 8-12% off travel and leisure stocks. "Shutdown" stocks like Zoom skyrocketed. Moderna was up 20%.

First off, let me say I think these fears are overblown. I'm not a scientist, but we should expect more variants that make the coronavirus more easily transmissible to emerge. That's been the message from the beginning. Secondly, I don't see Americans in particular putting up with national economic and movement restrictions given how many people have been vaccinated or already contracted COVID. Finally, lower volume days can cause large disconnects between market prices and reality.

That said, readers of this blog should not have been surprised that the market would move lower. We've talked for the last month about what our data says, which is much different than the bullish narrative being discussed in the financial and mainstream media.

- Personal income growth is now running BELOW the 2012-2019 trend as the effects of stimulus wear off.

- Consumer sentiment is at the lowest levels of the entire pandemic.

- Inflation is taking a huge bite out of the positive impact of the stimulus payments.

- Stock valuation levels are at or above the highest levels on record, which historically has meant 10-year compounded returns of 5% or less.

- Market breadth (advancing stocks vs declining stocks and up volume versus down volume) has been declining for the past month.

We've seen overwhelming evidence that conservative investors (and their financial advisors) have capitulated on their lower risk investments and started chasing returns. Whenever you have investors in risky assets simply because they want higher returns we learn quickly how little tolerance for risk they have. Sell first, ask questions later.

I've used the analogy of somebody driving on the freeway where all the cars are exceeding the speed limit. Many drivers will begin to accelerate to keep up with the flow of traffic. The longer you go without seeing an accident or a police officer, the more confident you become that you can go even faster. You know you shouldn't be speeding, but begin to believe there is no downside. The problem is the first car in the median you spot, you hit the brakes. This can cause a large pile-up.

On a short-term basis, this is what happened on Friday. How bad it gets depends on how quickly the "accident" is cleared. Over the more intermediate-term, our data says we should expect more accidents.

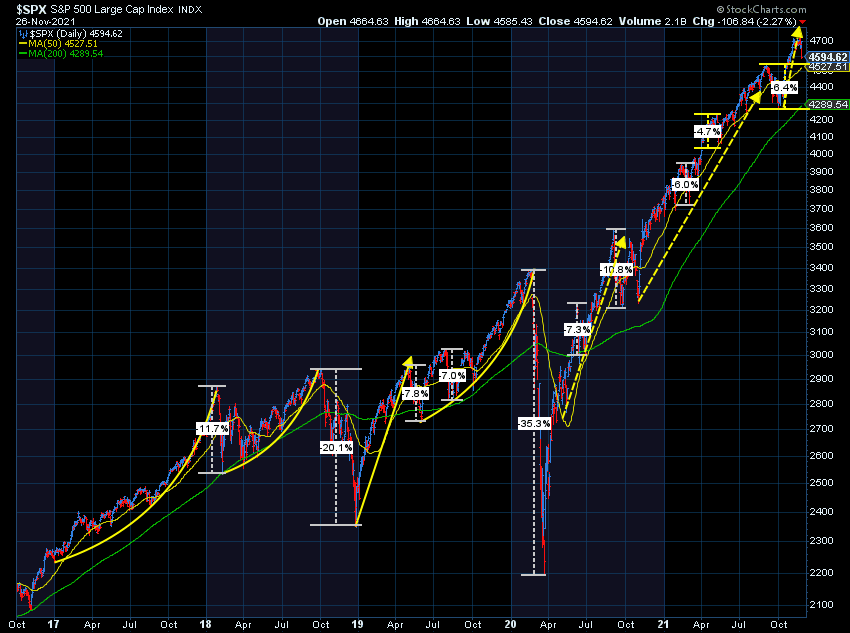

From a stock market perspective, the losses have only taken the S&P 500 back to the peak we hit at the end of August just before a 6% sell-off launched us into a furious October rally. The 50-day moving average, a measure many people use as a trend indicator remains below the market for support.

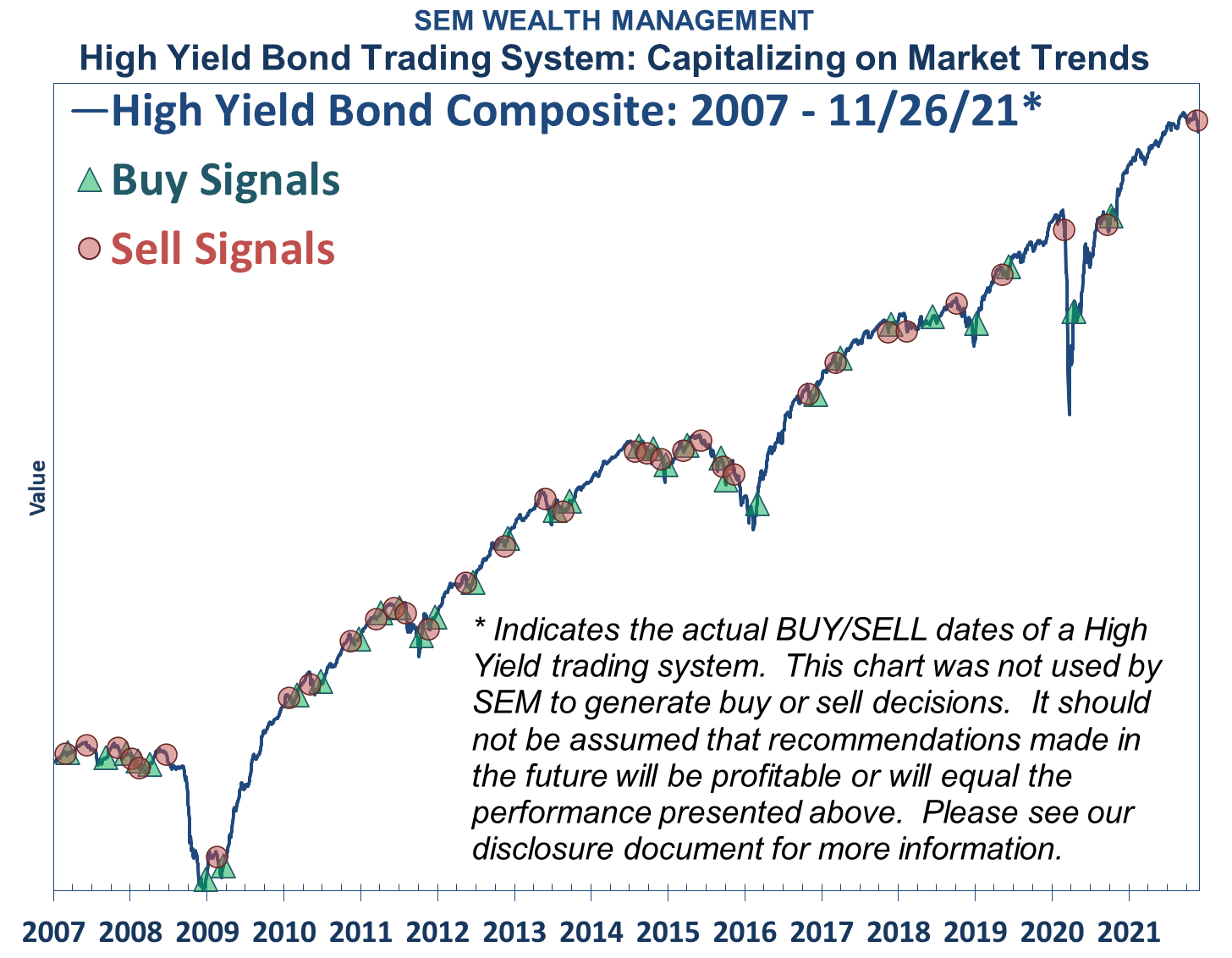

A bigger concern for us is the fact our high yield bond trend following models all triggered sells over the past week. We sold all of our exposure to high yields Monday, Tuesday, and Wednesday (before the big drop on Friday). We entered these positions over a year ago – in October 2020. Some of the positions were bought all the way back in April 2020 in the depths of the COVID panic.

These signals may not always be perfect, but anybody who has followed me for a little bit knows I watch this closely. Bond traders are smarter than stock traders when it comes to economic assessments. While stock traders only care about being able to sell their stocks at higher prices, bond traders actually have to worry about getting paid back. Therefore, when the start selling high yield bonds in mass, it is a sign that the smarter traders are worried about the health of the economy.

Maybe the market will reverse, maybe it won't. We don't speculate. We don't use our opinions. We don't guess. We simply follow the data and our trading systems to adjust our allocations accordingly. Friday was yet another example of the value this methodology plays in long-term success. Rick and I always give the rest of the SEM team the day off on the Friday after Thanksgiving. We watch our trading systems and make any trades necessary. While we would have liked a quiet day on Friday, but it sure was nice to not have to figure out what was happening in the market and how we should react.

Hopefully you were able to get away from the noise last week and spend time with your friends and family. It is SEM's job to watch the markets any time they are open and make any necessary adjustments. Whether the market regains all of Friday's losses and marches to new highs or if this will mark the end of the current bull market, SEM is ready. Regardless of your opinion, I would encourage you to take a look at your investment strategies outside of SEM and ask yourself if they are ready if reality catches up to stock prices.

We won't be blindsided. Will you?