We're in the homestretch of 2021 where many people are making their plans for the new year. This is also the time of year where there are dozens of lists, articles, tv segments, videos, and social media posts with an opinion of what the year ahead will look like. 2022 will be SEM's 30th year. Having been around so long we know the December predictions are often wrong. Many times the year ahead is the opposite of what most people believe.

At SEM we don't need to make predictions about what will happen. At its core, investments go up if more people buy than sell. They go down if more people sell than buy. This means human behavior is the primary driver of investment direction. What this really means price and volume are the only inputs we need for our investment decisions. That said, we realize we have a wide range of readers of this blog who may or may not be utilizing SEM's investment services (or who may have investments outside of SEM's models.)

A year ago I posted a list of the positives and negatives facing the stock market in 2021. Pretty much everything that could have gone right this year, which was enough to overcome the negatives. The market is always looking forward, which means we have to ignore what went right in 2021 and focus on what can drive the market higher in 2022. Unlike last year there are some major headwinds facing the market. We're going to have to see new catalysts to lead stocks higher. It doesn't mean it cannot be done, but it does mean we may not enjoy the year many people are expecting.

Here's the updated list.

Positives

- More Stable Government: I was clear ahead of the election and have stated it many times since – Joe Biden was not elected on a far left liberal agenda, but rather by moderates hoping to see more stability out of the government. Whatever your opinion of Donald Trump is, he certainly was not traditional and that made enough Independents (who now represent 42% of voters) uncomfortable enough to try something different. With mid-term elections in 2022, politics will unfortunately take the stage. It is no coincidence the last time the market was down was in 2018, which was a very divisive mid-term election that placed the future economic direction in question.

- COVID Vaccine: It's hard to remember, but a year ago we had just gotten a viable vaccine. Whatever your opinion on COVID or the vaccine, there were enough people concerned about COVID to keep the economy down. Rolling out the vaccine allowed a large majority of Americans to move about more confidently, which obviously helped boost the economy. In 2022 the focus will be more on boosters, variants, and vaccine mandates. It's hard to see any of this as a positive.

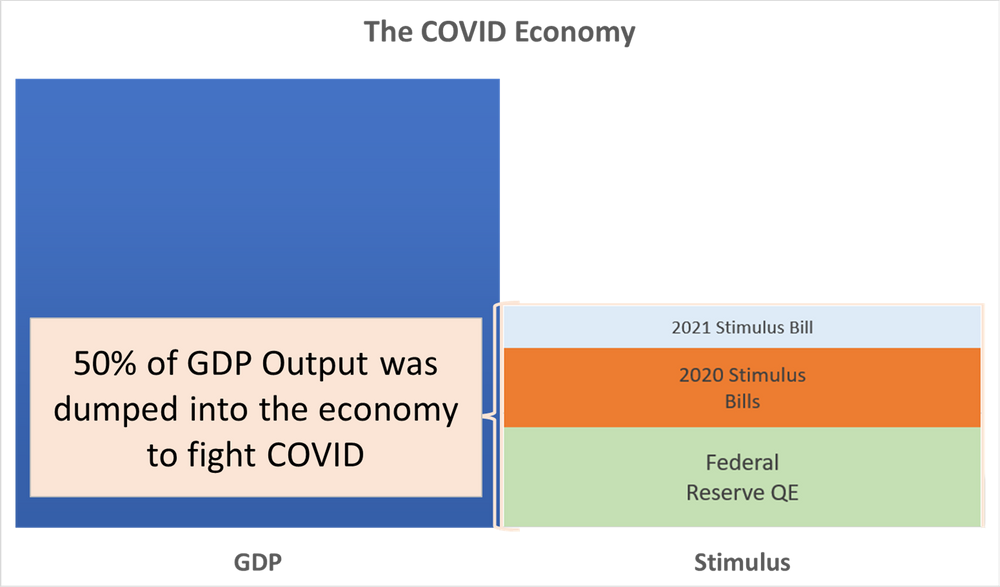

- More Stimulus: In 2020 the government sent to huge stimulus payments to Americans on top of other bailouts of a wide range of businesses, schools, and local governments. A year ago there were promises of more stimulus, which we received in the first quarter. This included some extended child tax credit monthly payments. Going into 2022 even if the "Build Back Better" bill which passed the House and is still hung up in the Senate is passed it is obvious we are not going to receive anywhere near the stimulus we saw in 2020 or 2021.

- Friendly Fed: I've long been a critic of the Federal Reserve for one reason – they use stale, slow moving data to make real-time decisions about their policies. Since 1998 they have focused too much on the stock market and have attempted to micro-manage the economy based on market direction. This leads them to create even larger swings in the economic cycle. They stimulate for too long and when they finally start to pull back the stimulus it often leads to a vacuum in the financial markets that starts the ball rolling on the next economic slowdown. I do believe the Fed had to act in March 2020, but once again they stayed far too long, have created many asset bubbles along the way, and are not stuck dealing with inflation numbers we haven't seen in nearly 4 decades. They have hinted they are going to have to pull back this stimulus much faster than anticipated, including some rate hikes in 2022.

- Strong Technicals: I won't bore everyone with the details, but the "technicals" in the market are all driven by price and volume. The major stock indexes are "capitalization" weighted, which means the price can be driven higher by just the largest stocks. A healthy market has a large majority of stocks rising driven by strong volume. A year ago we saw the market widening from the narrow "FAANG" rally that drove the market for the better part of 2020. The last month or so we've seen some of our underlying technicals weaken. It's not enough to cause any selling yet, but the indicators are much less positive than they were a year ago.

Negatives:

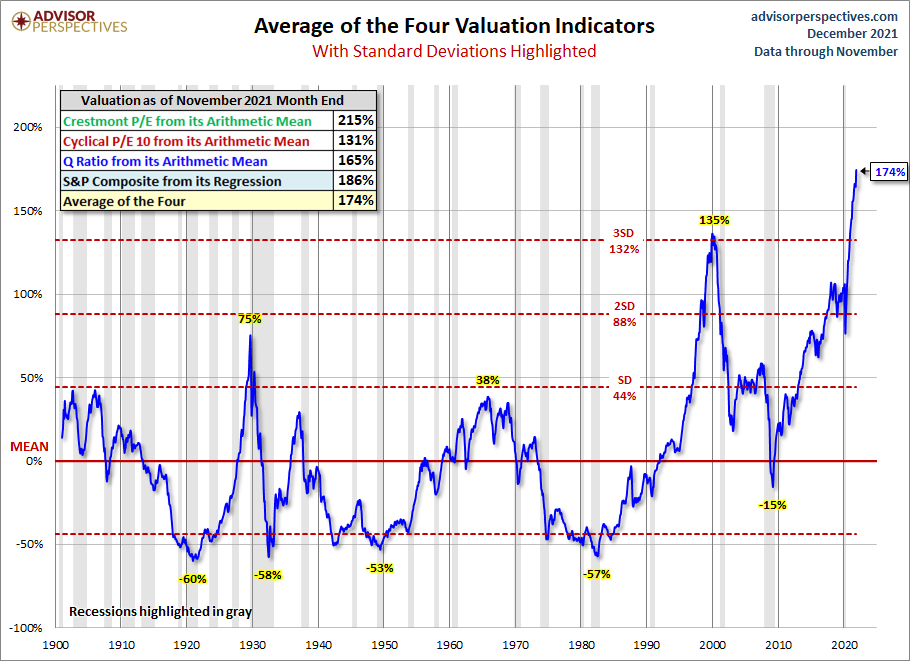

- Stocks Overvalued: Stocks being overvalued are not reason enough to see them go lower. It is simply a warning that future growth rates need to continue to move higher to justify paying the currently high prices. In 2021 we saw a strong rebound in earnings, but because stocks rose so much we are now even more overvalued than a year ago.

- COVID Worries: I think we're all tired of talking about COVID, but the panic surrounding the omicron variant made it clear negative developments on the COVID front could be a major obstacle to growth in 2022. No predictions here, just hopes and prayers we don't see this happen.

- Economic Air Pocket: We talked about the "K-shaped" economy quite a bit in 2020, including our personal story about our son Tyler. Whatever your opinion of the stimulus bills, they did help close the air pocket that had emerged. The problem is those stimulus payments are mostly gone and we have some major structural issues still inside our economy that need addressed. Inflation hurts the lower income families much more than the higher income families. I left this as a '?' in my list, but my opinion is this could be a major issue again in 2022.

- Short-term Tools: The problem with the stimulus checks and the Fed's "solutions" was they were only designed to ease the pain over the short-term. The infrastructure bill that was passed will help some over the long-run, but it will take time. With 2022 being an election year we're likely to see far more focus on the short-term instead of discussion of how we turn our economy around for the long-run.

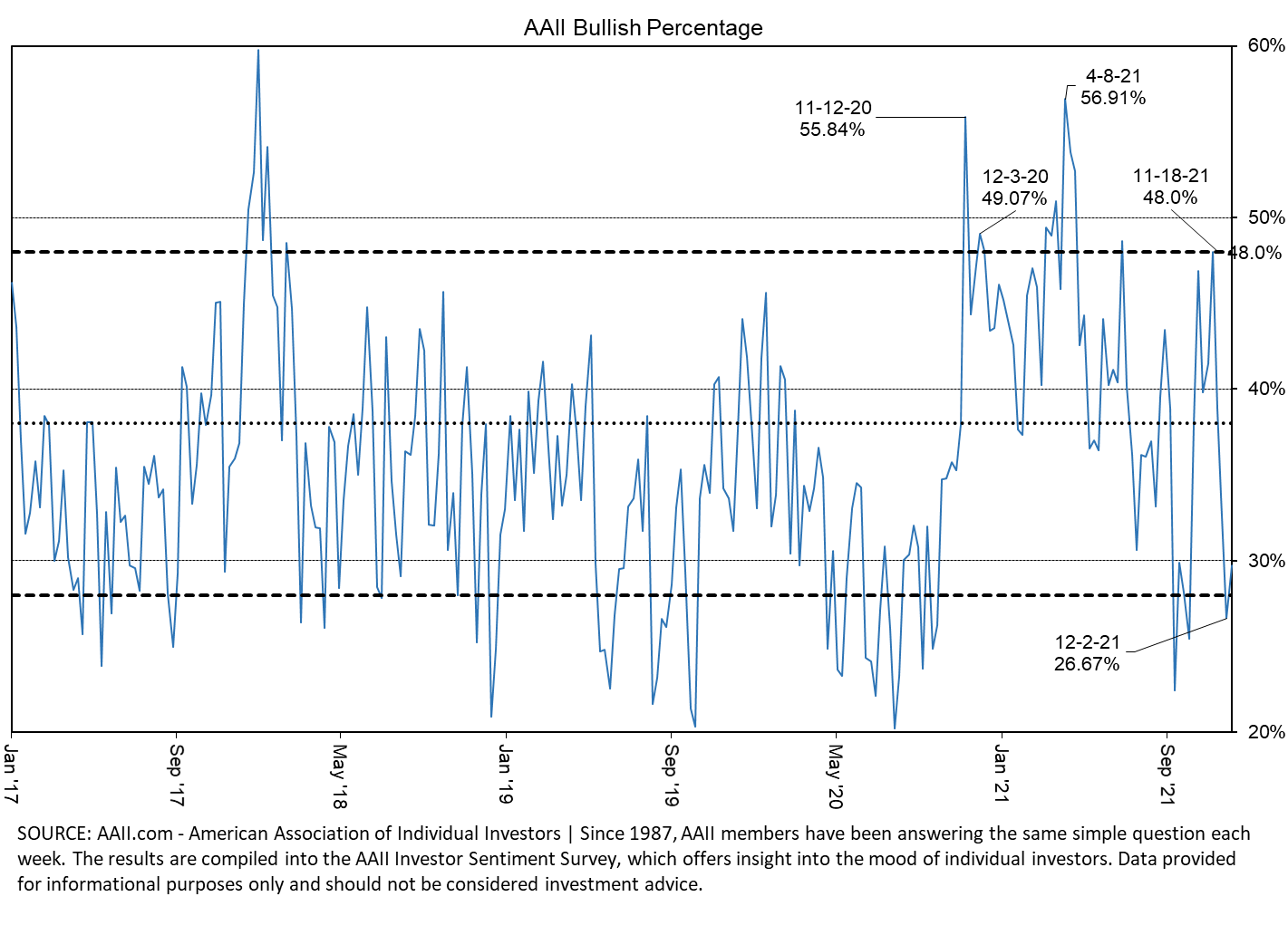

- Sentiment at Extremes: Remember, at its core, the reason stocks go higher is there are more buyers than sellers. They move lower when there are more sellers than buyers. One of the best indicators of how many potential buyers and sellers there are in the market are is the American Association of Individual Investors Investor Sentiment survey. This weekly survey has been around since 1987. A year ago, sentiment was above the upper band, which is typically when the market is at most risk of a large correction.

A year ago market sentiment was high. Back on November 18, the same time I wrote about the risks of the "everything rally" it was back at a high level. We saw how quickly stocks could fall when at these sentiment levels when we heard about the omicron variant. The S&P 500 lost around 5% in a couple of weeks. Sentiment is currently at more attractive levels, but as we saw in 2021, that can quickly change.

Conclusion

Obviously, the stock market is able to overcome the negatives. All of the things listed in 2021 in the "negatives" column happened except for one. It didn't bother the market because the "positives" were much stronger for 2021 than the negatives.

That was last year. We need to look forward and keep things in perspective. Unless we have a major sell-off in the last 3 weeks of the year, this will be the third consecutive years of 15% or higher returns for the S&P 500. The last time we saw this was the late 1990s. This doesn't mean 2022 will be down (we saw 5 straight years of 15% or higher returns through 1999.) It simply means we need to see significantly positive developments occur to drive the market higher.

At SEM we don't make predictions. We're still heavily invested – for now. Even our most conservative high yield bond models are back to "risk-on" investments after a 2-week sell signal. The difference is we can adjust at any time should the negatives start to be an issue at any point in the year ahead. This has been the key to our success the last 30 years.