Cody was out the back half of last week and the first part of this week. After watching the markets from afar the last four weeks, watching the day-to-day intricacies for the past four days I see a market that is HOPING we've seen the worst. We saw two large drops in the first part of the trading day only to be followed by a strong rally in the last half of the day.

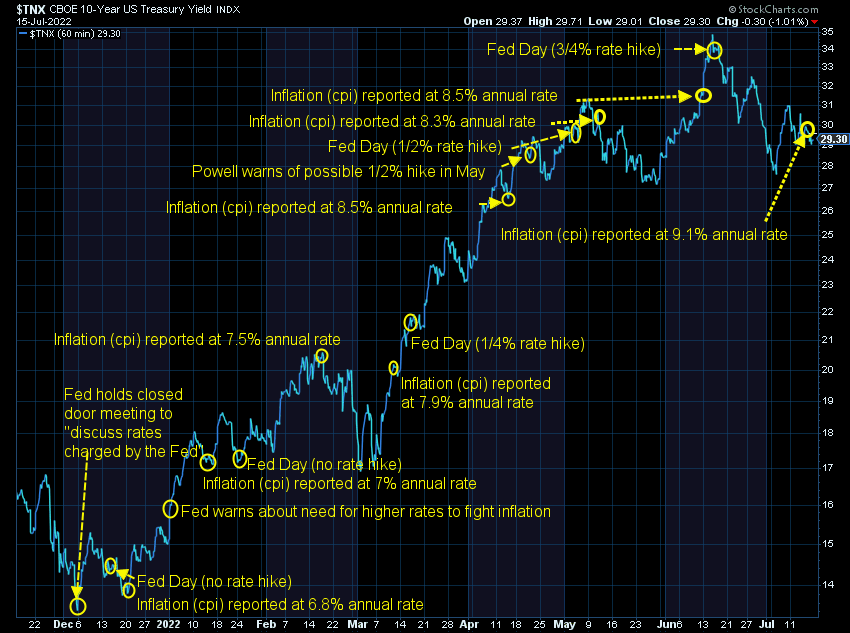

Thursday was the biggest change after CPI came in at 9.1%, well above expectations. This was on the same day JP Morgan management warned of "difficult" challenges in the path ahead (which contradicts what the JP Morgan analysts have been saying about the markets and economy). On Friday a "positive" retail sales number and some not horrific bank earnings from some other big name banks led to a nice rally to close the week.

On Friday EVERYTHING rallied (on very light volume), which means somebody decided to put money from the sidelines to work. Light volume rallies can lead to something bigger, but my reading of the data (along with our time-tested trading systems and 25+ years' of experience) tells me we could be looking at more pain ahead.

Some thoughts I had this week as I looked at the data:

- The numbers inside the CPI report show some problems which could persist in the months (year) ahead.......commodities actually peaked, but housing and shelter costs remain persistently high and are likely to continue at these high levels for at least several months; services are starting to see strong increases – insurance, day care, health care, all saw 1.5% or higher MONTHLY increases in July; and of course we have food prices, which are still accelerating with nothing on the horizon to slow things down.

- The Fed has to raise rates, but it is a very blunt instrument. Yes it will slow down speculation as well as some of the "excess" portions of the economy (think leisure and hospitality as well as 'upgrades' in housing, autos, etc.), but raising rates also HURTS those suffering the most from inflation. It also discourages investment in new equipment, factories, or anything else that would help ease the LONG-TERM inflationary pressures we are facing. I said it then and continue to say it – the time to raise rates and end QE was in the spring of 2021. Now that they are forced to raise rates, the "base case" should be a Fed led recession/slowdown, which will cause stock prices to go even lower.

- The "strong" retail sales report is misleading – it includes inflation, which as we know was 9% on a year-over-year basis. The "real" (adjusted for inflation) retail sales number was DOWN, which means inflation is digging into spending even during the "revenge" vacation season, which will be over in a few months.

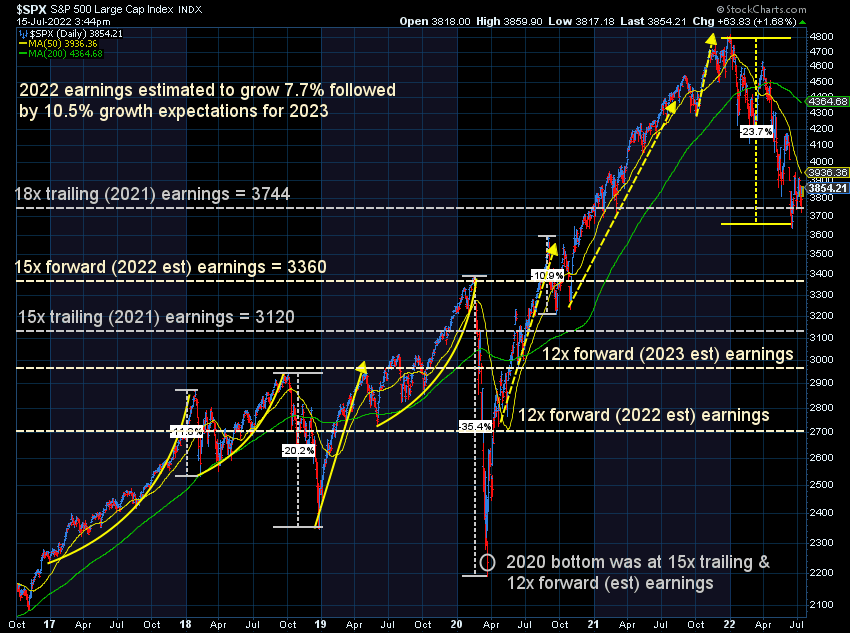

- For whatever reason, S&P 500 earnings estimates have barely budged lower for 2022 or 2023. The stock market is banking on a very temporary slowdown that does not hurt corporations. I think that is a mistake. Earnings are unlikely to be able to withstand the Fed's inflation fight, consumers are going to be forced to make hard choices, and companies will see their margins hurt. We should expect both P/E ratios and the estimated earnings to be lower before we see an actual INVESTABLE bottom.

Of course, the beauty of working with SEM is we don't have to rely on my opinion (or anyone else's) to make our decisions. If I'm wrong it doesn't matter. We let the systems change paths when the DATA says we should.

A walk through the charts

Starting with the longer-term chart as it accompanies the last bullet point above. I wouldn't begin to get excited about buying stocks for a long-term holding period until AT LEAST 3360 (or preferably 3120) on the S&P 500. If we assume a.) this is a recessionary bear market and b.) valuations do what they have in past bear markets then 3000 is a likely target. That's 21% below last week's closing price.

Shorter-term, stocks are trying to hold the 3700-3900 range, which was put in after the last Fed meeting. Note that each Fed meeting has brought a new lower trading range. We'll see what happens after this next one.

One encouraging sign (not for the economy) is bonds may be trying to bottom. I had said if the Fed finally showed they were serious about fighting inflation we could see Treasury rates peak. So far that seems to be the case, although they remain volatile.

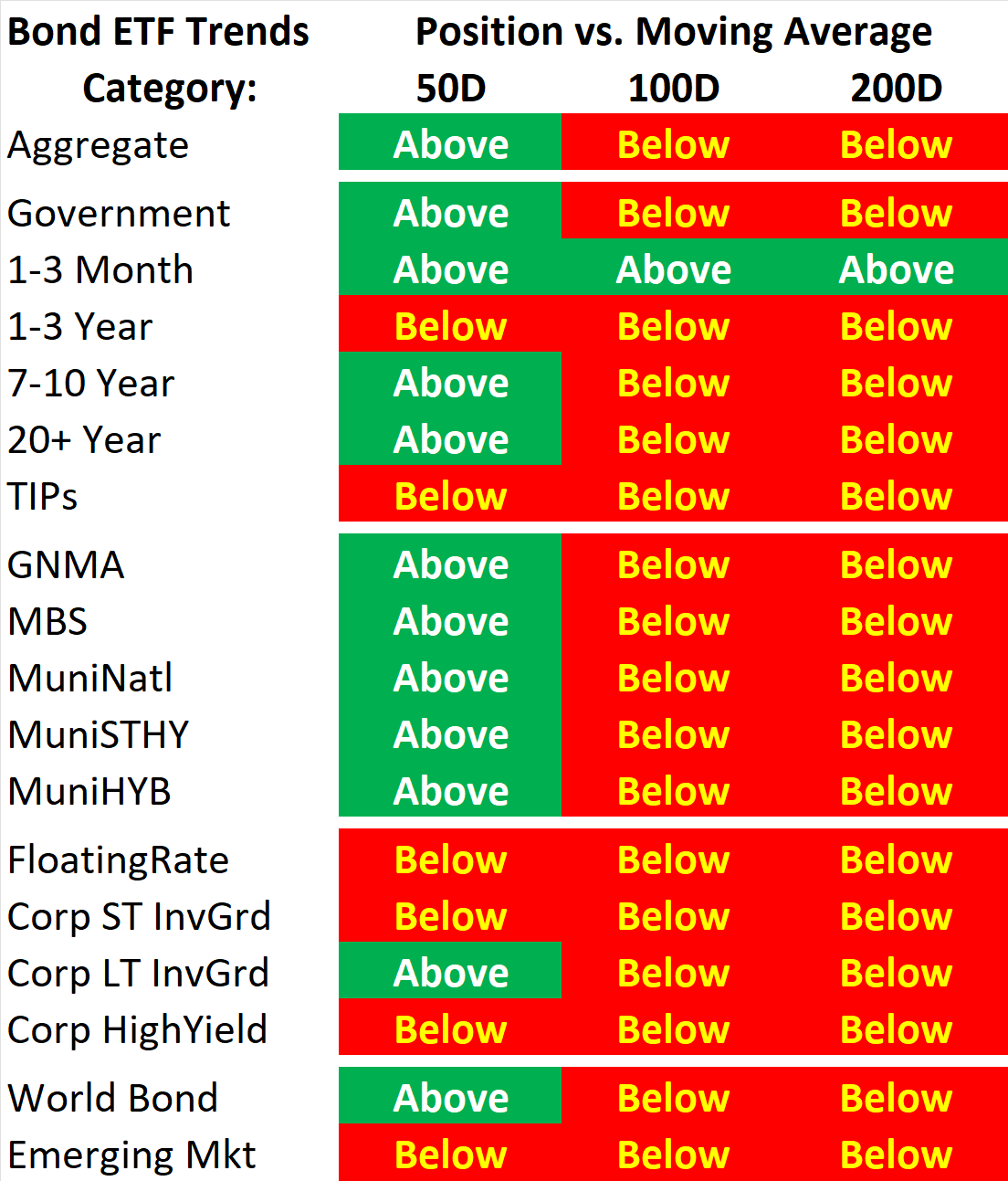

Most government bond categories are back above their (falling) 50-day moving averages, which is a sign that portion of the market is trying to bottom.

It's interesting to note the 1-3 Year Treasury, which had been stronger than the longer-term bonds fell this week (leading to another 'inversion', which is typically a signal for a recession on the horizon in the next 6-12 months). Also note the riskier bonds (high yields and emerging markets) remain in a downtrend, which is a reminder that there is still some dangerous areas of the bond market even if overall it has "bottomed".

It's much too early to tell whether or not the market was showing amazing resiliency or just sucking in more naïve investors. Please remember our Bear Market Tips:

- Don't panic

- Ignore the media

- Be patient

There will be plenty of weeks where it looks like the worst is over followed by plenty of other weeks where it looks like stocks will never go up again. Both feelings will be wrong.