If I told you at the start of the year we'd have the second largest bank failure in the history of our country in March, you'd probably expect the stock and bond markets to have a rough quarter. While we saw a short sell-off, stocks finished the month with a bang, leading many "experts" to cheer the "resiliency" of this market. 2023 saw the worst performers of 2022 post spectacular returns. I'm not saying we're back in 2021 mode, but it is concerning to see the leaderboard so far given all that is happening behind the scenes.

Here are some of the things on my mind as we start the quarter:

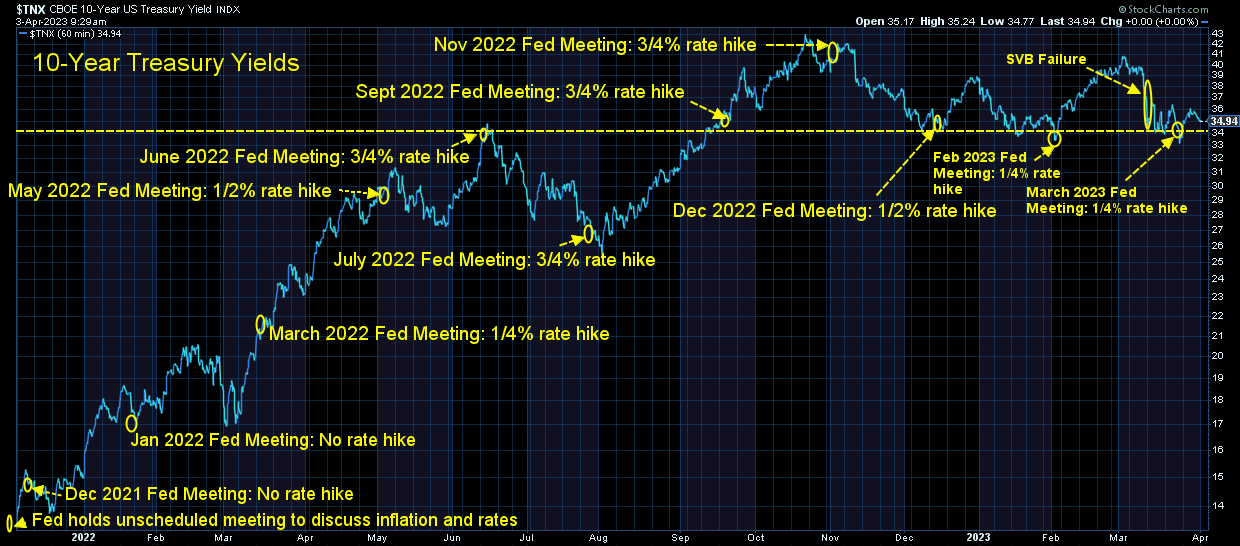

Tech Leading: The short-term "playbooks" that every Wall Street firm seems to have programmed are always fascinating. One of the "plays" is if interest rates drop, it's good for tech stocks. With the panic in the banking sector leading to a large drop in 10-year Treasury bonds, everyone's playbook said "buy tech". The Technology ETF (XLK) was up 10% in March and a whopping 22% for the first quarter.

Good time to rebalance: It's easy to take huge jumps in performance as a sign of something good happening in that sector, but there is no way we will continue to see all the easy money flowing into tech start-ups continuing this year. More importantly, tech spending will likely continue to fall which will lead to disappointing growth in earnings. My opinion – the fundamentals have gotten worse for tech, so this rally is a good chance for those of you overweight tech stocks and large cap growth to get your portfolios back into a more reasonable balance.

A Bank Crisis is NOT a good thing: I know I shouldn't have to say it, but another "play" is to pour money into stocks when the Fed ends a rate hiking cycle. This of course ignores the reason WHY the Fed might be halting their rate hikes. Bankers are notoriously behind the curve in their lending/investment activity. They are also about to see their fees going up and their regulatory oversight increasing. All this means less appetite to lend/invest, which means slower economic activity. Inflation will be coming down because the bubble caused by the Fed and Congress dumping 1/2 of GDP output into the economy to fight the pandemic is bursting. Anything the Fed or Congress does to fight this latest crisis will be a short-term solution that will have to be paid for later.

What happened to the "soft" landing? At the start of the year, stocks rallied at the prospect of a "soft" economic landing, meaning the Fed would be able to control inflation without causing a recession. Even though the Fed's track record was quite poor, both the Fed and market participants were quite confident the "base case" was a soft landing this year. Now the base case seems to be at least a "mild" recession, but for the reasons above, stocks are rallying.

I'll stick with history, data, and logic in my assessment – a recession is not good news for stocks. The only reason the first quarter rally can be justified is if the US avoids a recession. Otherwise, earnings will fall and stock prices will have to come down 18-35% from here.

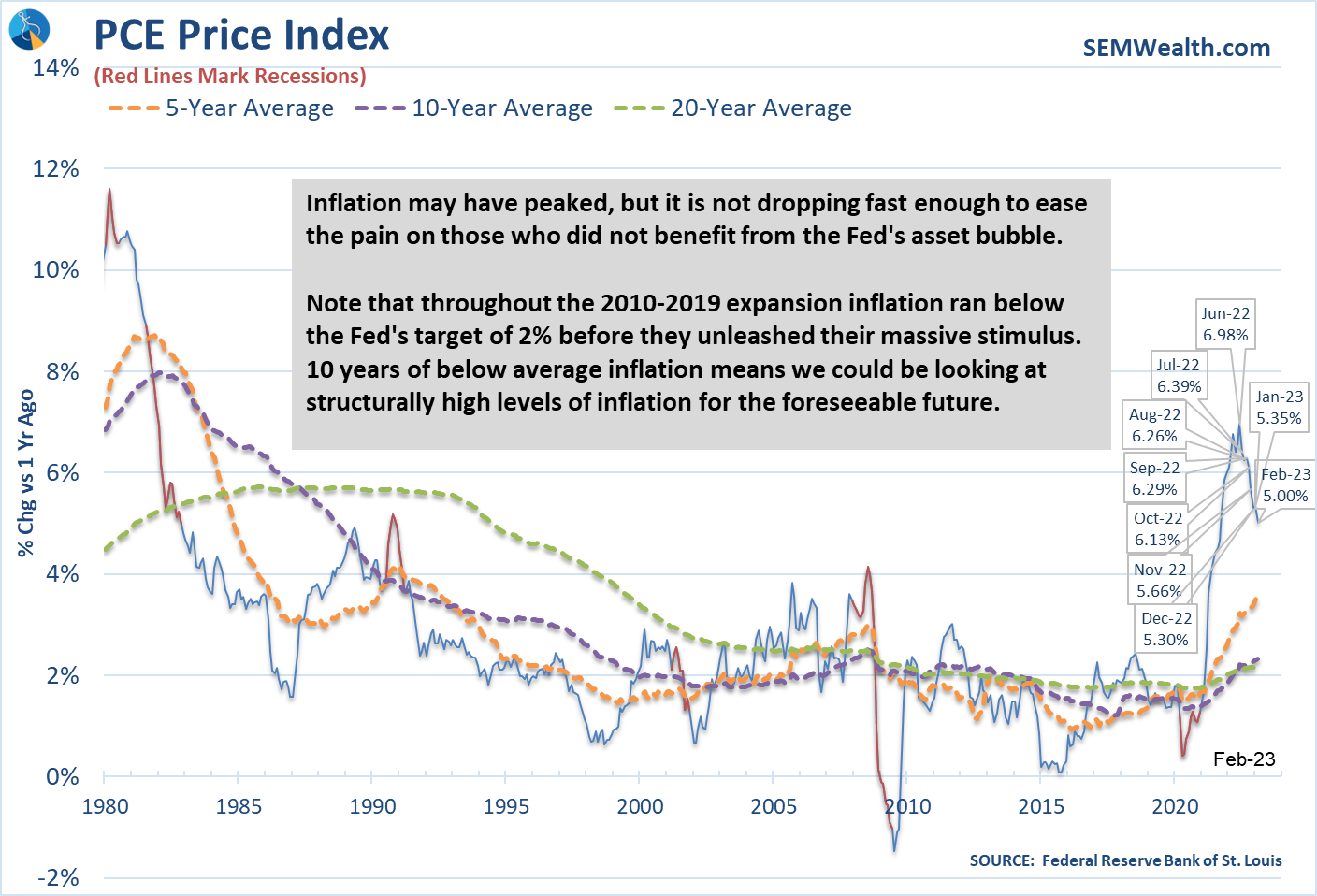

Inflation still too high: Last week the market cheered the "lower" inflation readings from the Fed's "preferred" inflation metric – the PCE Price Index. The chart below highlights a few things:

1.) We are still 3% above the Fed's 'target' of 2%.

2.) The 5-year average is now a staggering 4%.

3.) The 10 & 20-year average is finally above 2%.

Remember the Fed has been targeting a 2-3% inflation level this entire century to get there. They tried and tried by using unconventional measures. As I warned throughout the issue was FISCAL policy (Congress/White House). They tried to use MONETARY policy to change it. When we saw massive FISCAL stimulus the Fed should have just let it play out. Instead they essentially doubled the stimulus by financing it via Quantitative Easing and suddenly we had (too much) inflation.

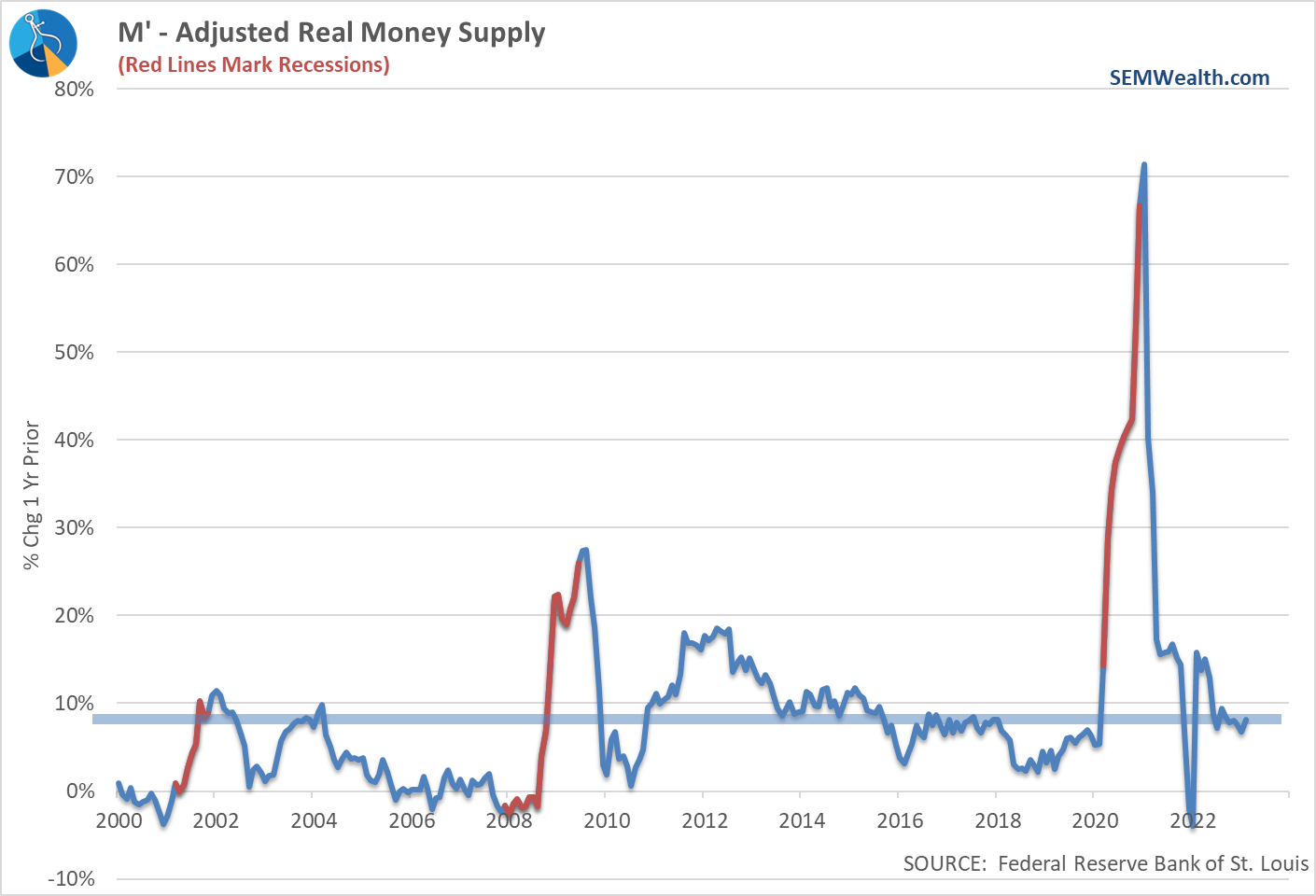

PhD Logic: An advisor asked me about the money supply and its impact on inflation. We were all told in economics class that increasing the money supply tends to increase economic demand which tends to increase inflation. This advisor asked how much the Fed had brought down the money supply and he was surprised at my response – they haven't. This chart shows the year-over-year % change in the money supply or put another way, how much more money has the Fed put into circulation compared to last year.

So even though the Fed is saying they are trying to squash inflation, the money supply is 8% higher than a year ago. As a reminder, it wasn't until last March that the Fed finally got around to raising interest rates.

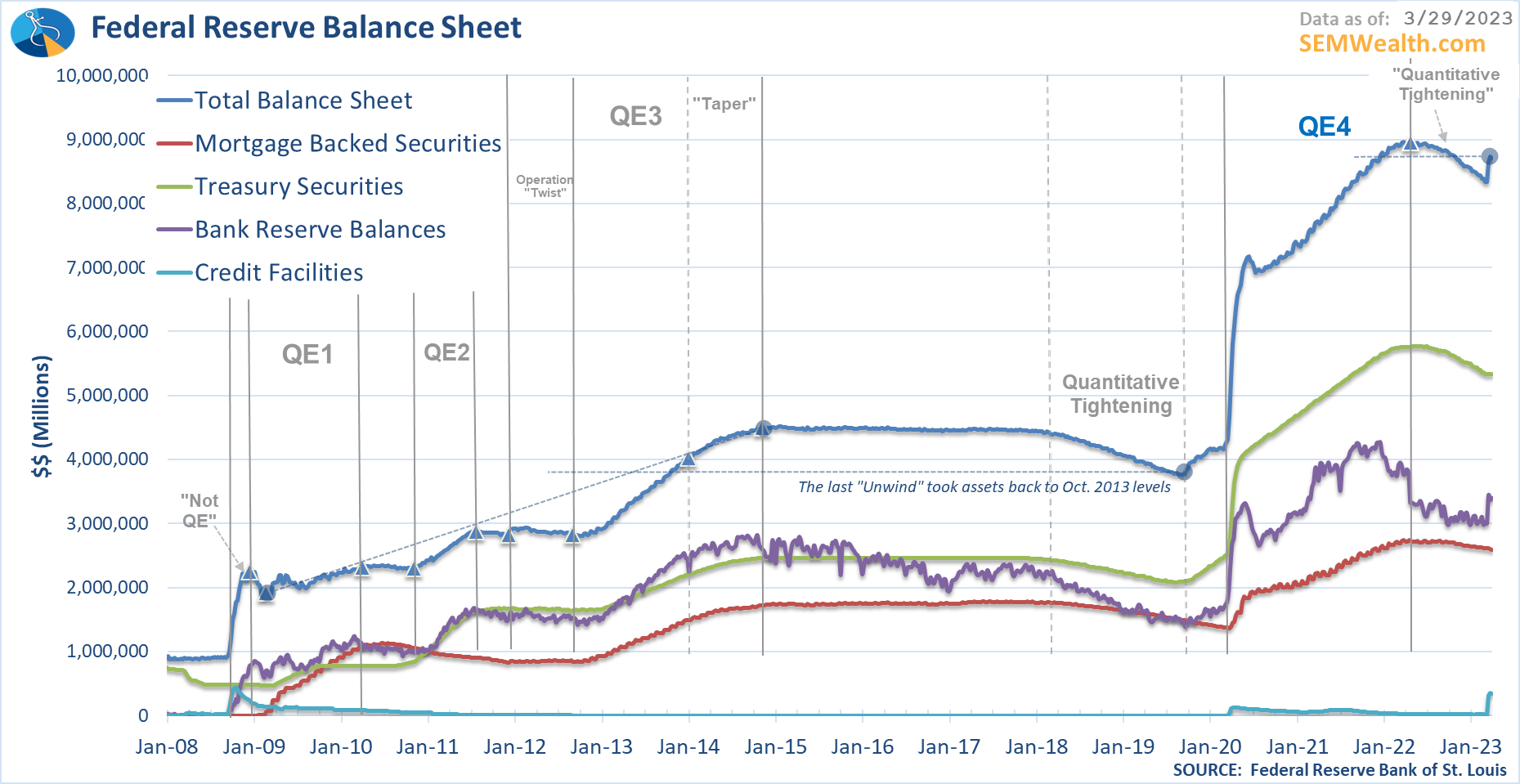

Bank Pressure Easing? Last week I updated our Federal Reserve Balance Sheet chart to include "Credit Facilities". This allowed us to see the usage of the Fed's "emergency" lending facilities designed to stem the bank runs. At least for last week we saw it decline a bit, which is a good sign (for now). The question is, will the Fed ever be able to unwind their balance sheet, if a mere 12 months of Quantitative Tightening and interest rate hikes led to a banking crisis.

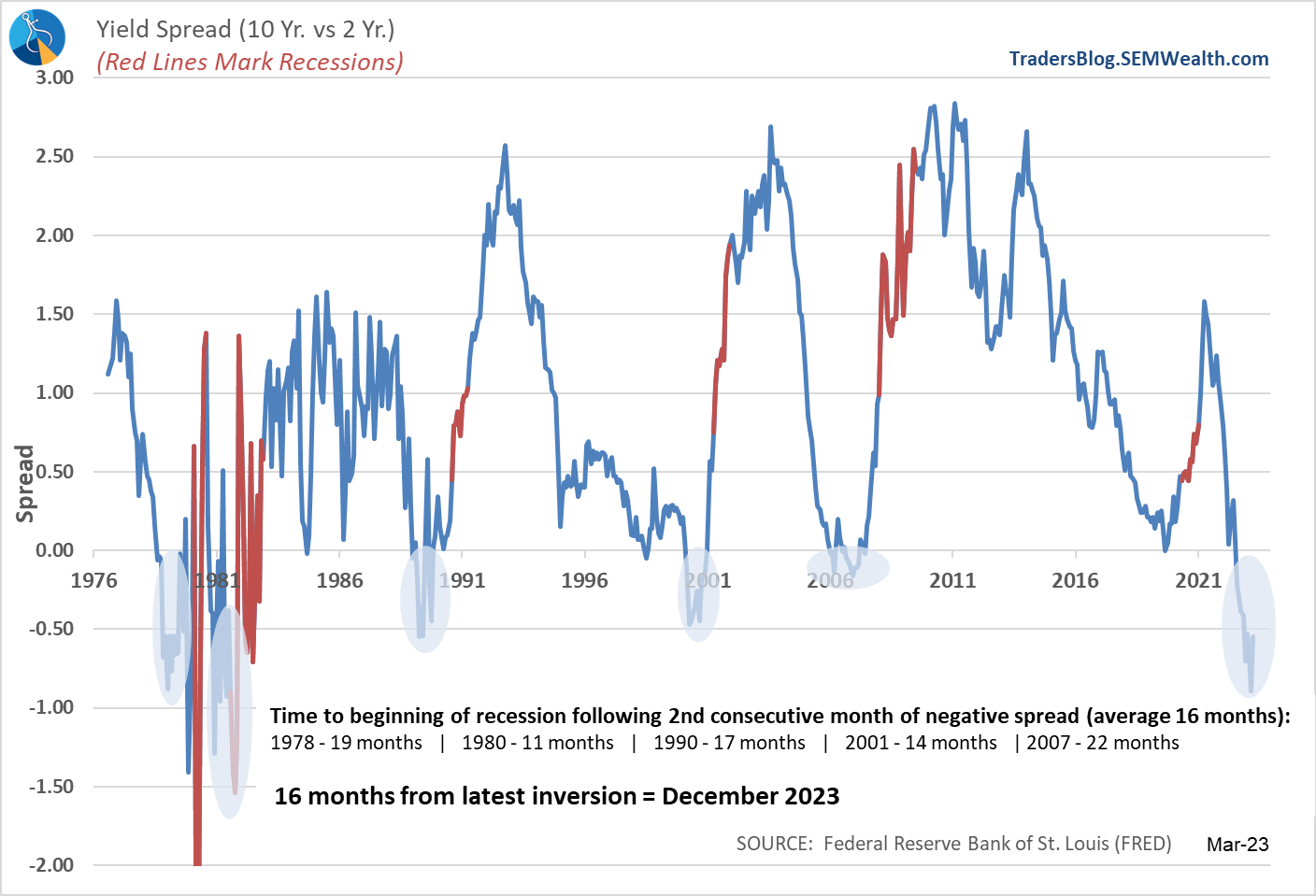

Yield Curve still not friendly: If there is anyting investors, economists, and the Federal Reserve should be worried about it remains the condition of the yield curve. Most of the issues in the banking system are due to too many banks not forecasting inflationary pressures that would lead to a reversal in interest rates. When long-term rates are higher than short-term rates it is very difficult for banks to make money, which leads them to pull back on lending/investing. This usually leads to a recession.

While the yield curve improved a bit last month, it is still heavily inverted which will continue to put pressure on banks.

Short-sighted decisions: For most of last year, I heard advisors and investors lament how low bank savings rates and CDs were. Now we're seeing banks offering 4 1/2 - 5% (and higher) rates for deposits/CDs. While I understand banks needing to attract more deposits, the issue they will be facing as the economy slows and long-term rates come down is the fact they paid too much for the deposits and will have fewer opportunities to offset those costs. I'm no longer a banker, but it seems the committees who make the decisions continue to suffer from "recency" bias (believing the short-term trends will continue indefinitely.)

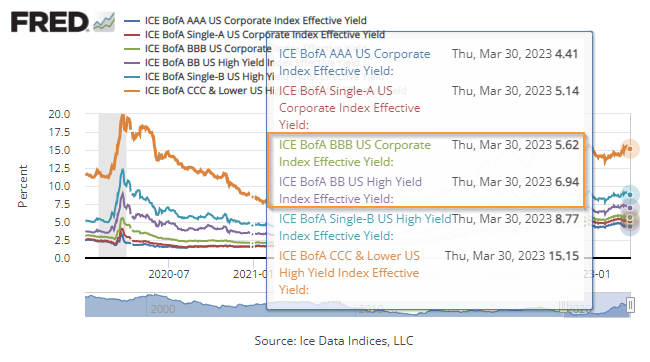

Be wary of "guaranteed" returns: After the struggles of bonds the last three years, I understand the draw of some of the "guaranteed" returns I'm seeing. Many of these are now above 5%, which is obviously quite attractive. My first question is always, "how is the issuer investing to generate these returns?" Let's look at the current bond market environment. We know the issuer doesn't do this for free, so if they are guaranteeing 5%, paying the advisor the average 1% fee/commission, and then paying themselves (including internal expenses) 0.5%, they would need to make 6.5% on their investments in order to guarantee a 5% return over the life of the contract. This means their underlying investments would need to be in the lowest investment grade and highest "junk" rated bonds.

I know these companies have sophisticated "hedging" operations and actuaries with PhD's which allow them to generate 6.5% returns without taking on "too much" risk, but as we learned from past financial crises if too many people are doing the same thing, something will break.

Now I'm not knocking anybody putting their clients in these products. There is a legitimate place for these in many financial plans, but I always become leery when I see the big inflows into these products. We all should remember past lessons – an "A-rated" company can still have problems if they get overexposed to one idea.

More importantly, the real risk of locking up money into a "guaranteed" product is the "opportunity cost". We know from history the currently high valuations will eventually be squashed back down to below average levels. Having the liquidity and investment strategies to take advantage of those prices could lead to well above average returns which when spread over 3, 5, or 7 years would far outpace the "guaranteed" rates being offered.

Everybody's financial plan is different. If somebody NEEDS 5% returns over the next 10 years and you have a product that will "guarantee" those returns and the investor doesn't need access to the money (or the withdrawal policies are not excessively restrictive), then great. I think the bigger risk is those who are going to the 1 - 3 year guarantees. We likely will have much lower interest rates when those products renew (if we have a recession) and at the same time we likely would have seen the lowest valuations in more than a decade during that time.

Remember, when prices are low, future expected returns are high (above average). This means the ability to generate higher returns with lower risks.

The bottom line – there is no such thing as a "guaranteed" investment. All investments involve some sort of risk. Some of those are missed opportunities, while others are putting money with an issuer who wasn't as "safe" as everyone believed. Please be careful.

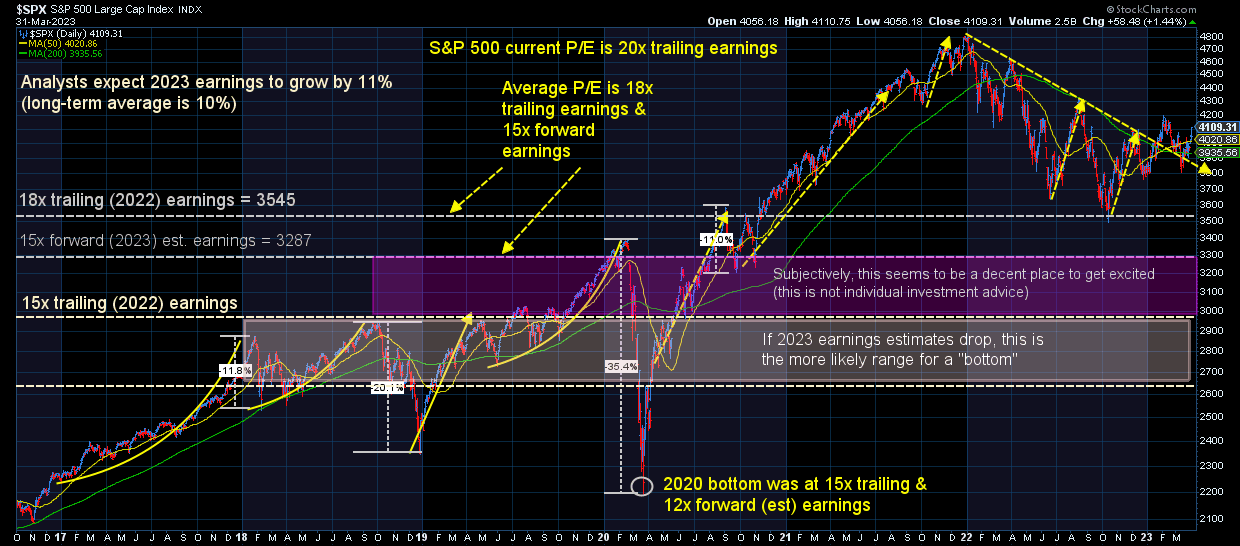

Hard to be excited about stocks: I've been adding annotations to the hourly chart of the S&P 500 throughout the bear market to help put things in perspective. The March move matches similar trajectories we've seen throughout. Most recently it was the big run to start the year. We are quickly approaching the 4150 point, which is where the market was at following the Fed's "pivot" in February to 1/4% rate hikes.

I will continue to post this chart for those wanting to focus on long-term investing. It's hard to argue stocks are attractive at the current valuation levels, especially when you consider analysts are expecting above average earnings growth this year.

Turning to bonds, I have no idea why, but the 3.4% level on the 10-year seems to be the current floor. You can see how quickly yields fell when SVB failed (remember the rumors of the SVB failure started a few days before that). In general, we've seen yields go up when the bond market believes the Fed is getting control of the inflation battle and they've jumped when the bond market believes they are still too far behind.

The battle we are seeing right now is the question of whether or not the fears of a banking crisis are enough to control inflation or the actions by the Fed, FDIC, and Treasury department will actually make the inflation battle more difficult.

We also have the bigger question about whether or not we go into a recession. There is a bunch of economic data out this week, so I plan on having our monthly economic update next Monday. If we do head towards a recession, we could see Treasury bond yields decline and corporate bond yields increase. Prices would move in the opposite direction. Stocks would likely see a big drop in that scenario (18-35%).

There are times investing is easy and times where it is hard. Right now it is one of the most difficult I've encountered in my 25+ years of doing this, which makes me grateful for our disciplined, quantitative approach which removes our natural human biases and emotions from the decision-making process. I've talked to several advisors and money managers over the past few weeks who are virtually paralyzed about what to do. This is a situation we've never had to deal with at SEM.

It will get easier. We continue to have sizeable amounts of money in (almost) "guaranteed" government money market funds (technically they are not guaranteed, but if the US Government cannot cover their short-term bonds, do you really think the FDIC or any other government guarantees will not also fail?). We will continue following our models as they look for a better place to deploy our money out of those accounts.

Follow us on social media: While I still prefer to read my news, not everyone does. In order to get more people to see what we view is valuable, common-sense content, we've been posting more short-form videos on social media.

April is financial literacy month. We plan on posting a ton of content all month, so please follow along, share anything you think more people need to hear, and send us any ideas on topics you'd like covered.

You can find all of our content here: