The stock market is supposed to be "efficient", at least according to academics (and those firms who have bought into this theory). Supposedly, the market (mostly) reflects all known information. In my experience this is not even close to reality. There have been dozens of times where we see a stock lose 5, 15, 25, or even 40% of its value in a single day following an earnings announcement. Most of the time, it is obvious to an outsider, the people forecasting earnings should have had some inkling the rosy projections may be a little too optimistic.

We saw this throughout 2022 when companies missed earnings estimates due to (pick one or several) inflation, inventory issues, rising interest rates, or slowing demand. These were all things that were obvious (at least to us), yet Wall Street completely missed what was happening and stocks went through a difficult year. After the disappointments, stocks would drop, but then magically optimism would kick in and stocks would rally again, only to be disappointed again.

I firmly believe based on the data and my experience, the market is set-up for yet another disappointment later in the year. Last week I posted our latest economic update, which again shows the economy (based on our data) is still slowing. The market is looking at this as a good thing as they believe this will lead to the Fed halting their rate hiking cycle, which they (mistakenly) believe will spark a massive market recovery.

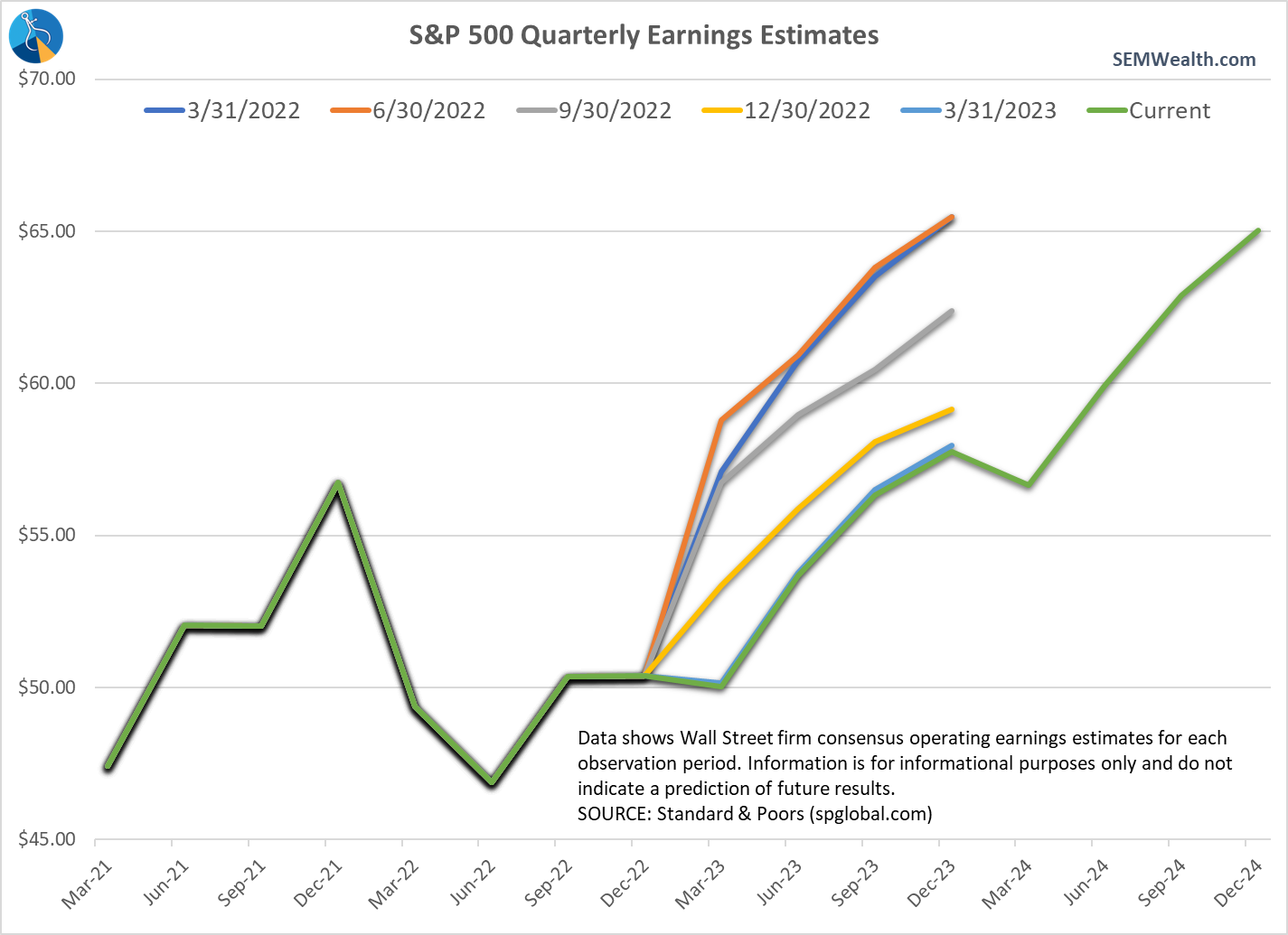

After doing this for over a quarter century, I shouldn't be surprised by the overly optimistic assessment Wall Street has for earnings, yet here I am again, in disbelief at how great the future looks for Wall Street analysts. Take a look at quarterly earnings estimates for the next year and a half:

You can see the drop in earnings in 2022. Going into the year Wall Street did not have any clue this would happen. You can also see how throughout 2022 they believed we'd see a sharp recovery in earnings. Again, they were wrong. They are currently expecting a small dip in the 1st quarter (the earnings being released this month), but then a miraculous recovery all the way through the end of 2024.

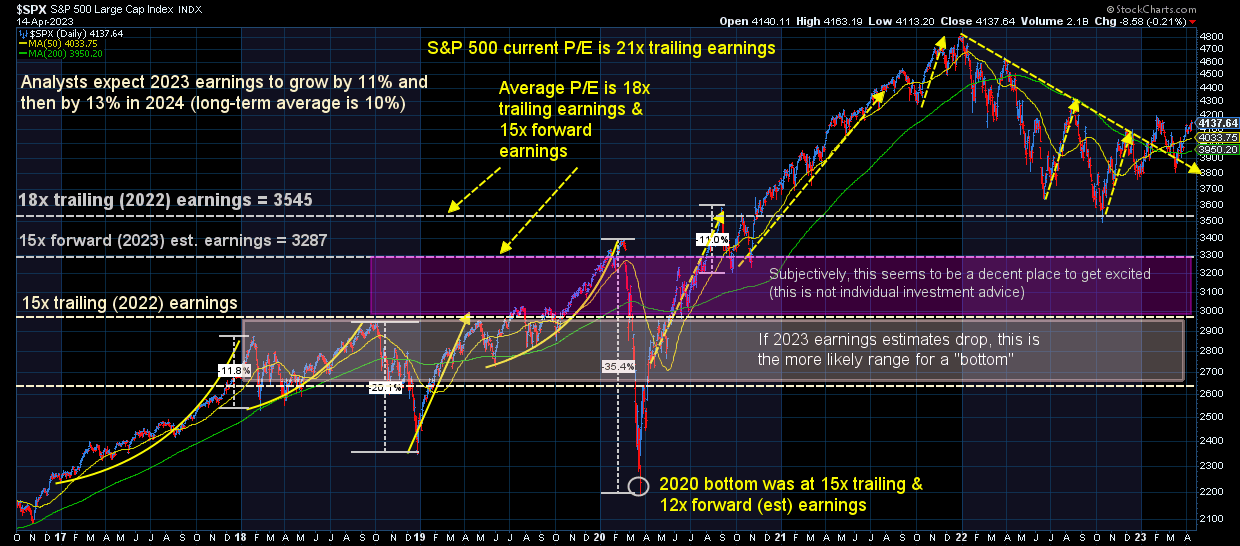

In other words, Wall Street believes we will not see any sort of recession in earnings. Maybe they are right, but their track record is abysmal. If they are wrong, we could see a massive repricing in stock prices (again). If (and this is a big if) analysts are right, stocks are still overvalued. The P/E ratio is back to where it was when 2022 started.

I continue to (subjectively) look at the 3200 to 3000 range as the place I'd get excited about stocks. Remember, during a recessionary bear market, both earnings estimates and the P/E multiple come down, which is a double whammy to stock prices. If our data is correct about the reality facing the stock market, investors with too much risk exposure could be in for a lot of pain.

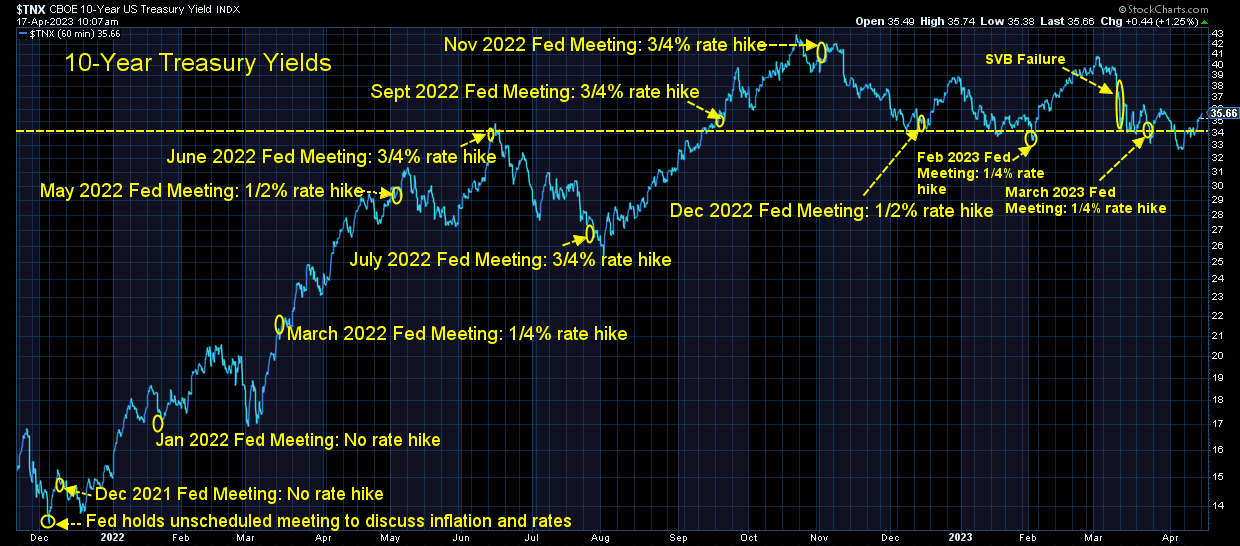

The bond market will likely continue to be the story. 10-year Treasury yields briefly broke the 3.4% barrier 2 weeks ago, but moved back above it once again.

Looking shorter-term, the S&P 500 ran into a bit of resistance around 4160, which was the peak at the beginning of February. Looking at the steepness of the rally since mid-March, stocks are certainly due for a pullback, but I also know the old saying, "stocks can remain irrational longer than you can stay solvent".

The short-term trends are still up. Our high yield bond models have moved back into high yields inside of Tactical Bond, Cornerstone Bond, and Income Allocator.

The intermediate-trend is still mixed as the volume behind the rally remains lackluster (meaning it is likely traders not investors driving prices higher). This leaves the trend models inside of AmeriGuard & Cornerstone (Balanced & Growth) halfway invested – a position they took at the end of October.

The longer-term trend is still down, which shows up in our Dynamic models (which utilize our economic model) and the overall allocations across our portfolios. We have cash (money market funds yielding 4 1/2 -5%) on the sidelines which are both buffering the volatility in our portfolios as well as ready to deploy when valuations become more attractive.

The reality is this is still a bear market. We are likely still heading to a recession. Stocks are significantly overvalued. This is all based on DATA, not our opinions.

As we've said throughout the bear market when we see a sharp rally – for anybody overexposed to risk, this is a great time to readjust your risk exposure. If you aren't sure, you can use our risk questionnaire to find out.

Follow us on social media

While I still prefer to read my news, not everyone does. In order to get more people to see what we view is valuable, common-sense content, we've been posting more short-form videos on social media.

April is financial literacy month. We plan on posting a ton of content all month, so please follow along, share anything you think more people need to hear, and send us any ideas on topics you'd like covered.

You can find all of our content here: