As expected, the debt ceiling negotiators have worked out a deal to avoid "catastrophe". The stock market never really thought the debt ceiling wouldn't be raised/temporarily cancelled. The bond market has been showing a bit of a concern over short-term liquidity as well as putting in place plans to make sure 'defaulted' debt was still able to be traded (because the bonds would eventually be paid back).

We shouldn't be surprised as the non-event this has been because we've been here before. The financial regulators, clearing agencies, and Wall Street banks put in place plans to handle this happening again after the Debt Ceiling Circus of 2011. Granted, we should still expect some shenanigans this week as various members of Congress voice their "displeasure" with the deal, but it will eventually pass.

We've been posting videos on our various social media channels discussing this. The main point of all of them has been – if we refuse to do anything about Social Security & Medicare we may as well not have a debt ceiling. This "deal" means we will still be borrowing several trillion dollars a year. All it does is kick the can down the road to 2025 when the new Congress and winner of the presidential election get to do this all over again. (This is the same year the individual Trump tax cuts expire.)

This means the next time Congress has to act on the debt ceiling we will be 3 years from the Medicare hospital insurance trust fund running out of money, 6 years for the rest of Medicare to be insolvent, and just 8 years before Social Security is insolvent. There isn't much more time for Congress to kick the can down the road, but you better believe they will do their best.

Here is a 1 minute video we posted last week trying to diffuse the misinformation over the debt ceiling. Reading the comments on our videos the lack of understanding along with the polarizing ideals of the other side are apparent.

@finance_nerd There is a lot of misinformation about the debt ceiling. Here’s 5 quick facts you need to understand. #debtceiling #debtceilingseries #part2 #debtceilingcrisis #debtceilingexplained #debtceiling2023 #biden #trump #politics #debt #republicans #democrats #datafocus #socialsecurity #medicare #socialsecurityscam #boomers #babyboomers #genx #taxes #governmentspending ♬ original sound - Finance Nerd

The main theme is:

(from the far left) – we need to tax the rich.

(from the far right) – we need to stop wasting money on progressive policies

Neither side wants to do anything with Social Security or Medicare. We could wipe out the entire US government and still have to borrow over a trillion dollars per year because of the combined shortfall of FICA tax receipts and the IOUs that are inside the trust funds.

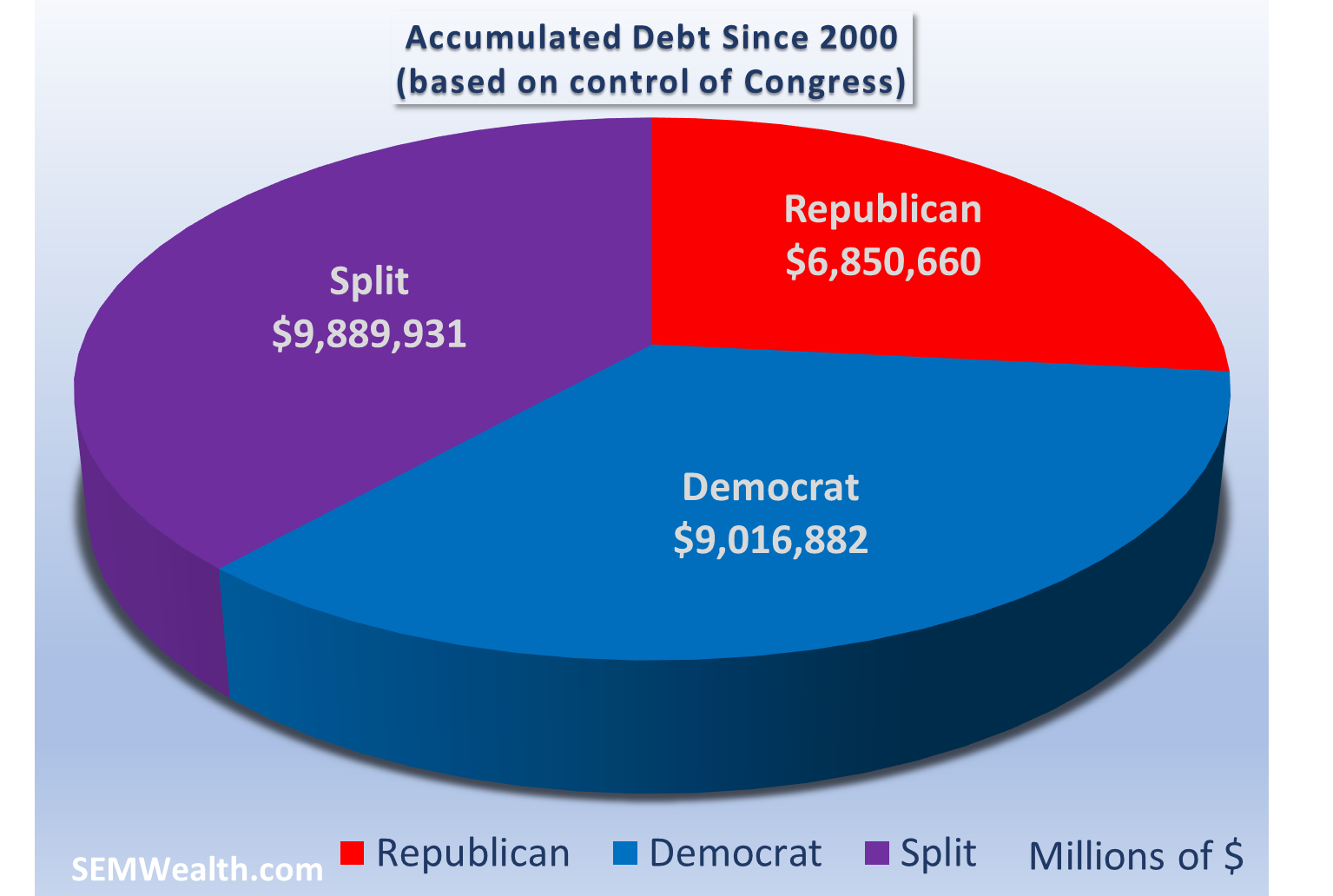

Split Congress the Most Expensive

Looking at this deal you have to ask "what was the point?". I shared a few weeks back a chart showing the accumulated debt from each party based on who was in the White House. One of the commentators on TikTok asked what this would look like based on the composition of Congress. I think this is telling — we've accumulated the most debt when Congress has been split. It seems paying off both sides is expensive. The second most debt is when the Democrats control Congress. There is more fiscal constraint when Republicans have full control (although they are still accumulating debt).

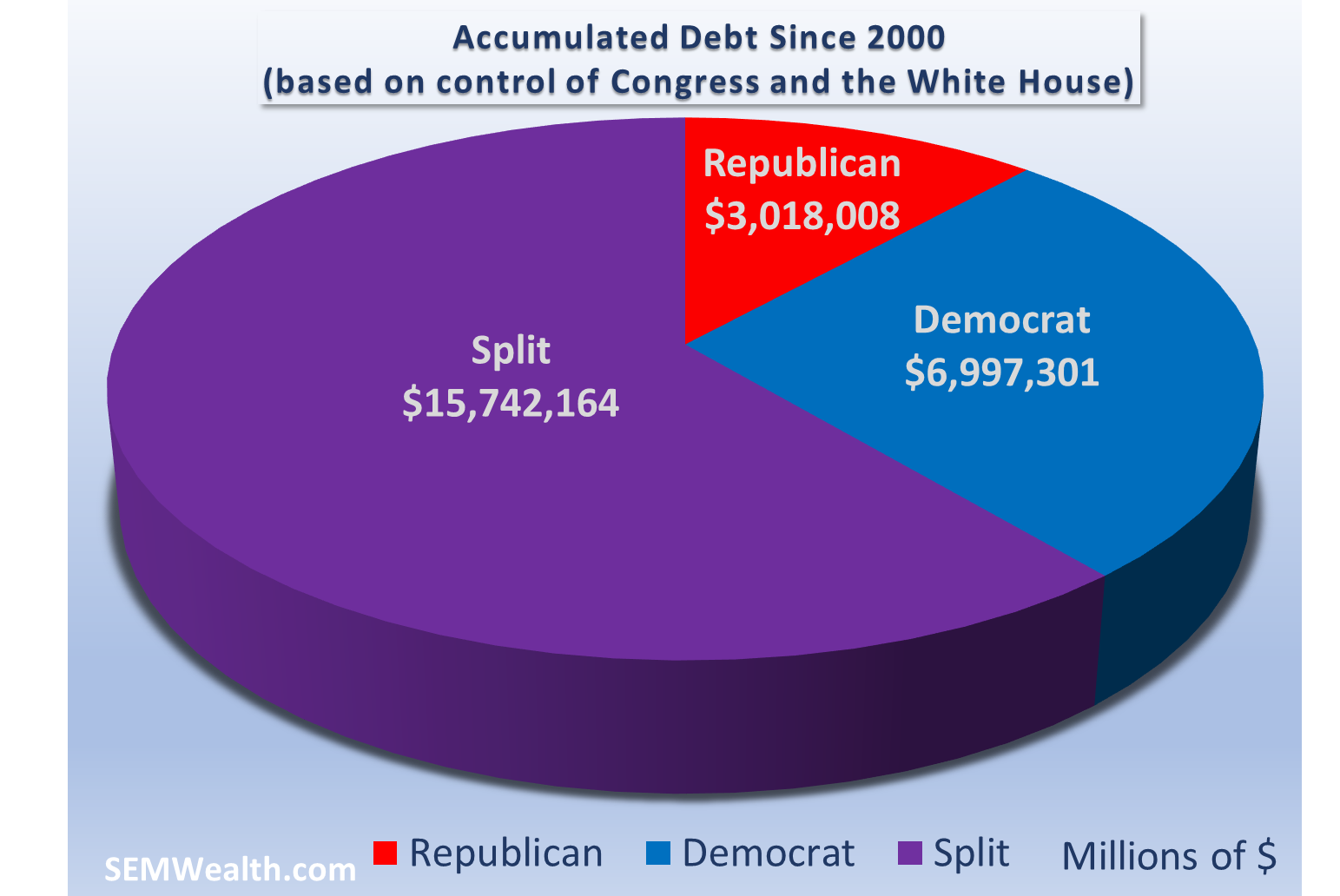

It gets even more striking when you add in who controls the White House. "Compromising" to get deals done has been quite costly.

I'll end there (for now). We are also going to be posting much more commentary on this as the story progresses. You can find all of our content here:

TikTok Facebook Instagram LinkedIn

Will AI save the market?

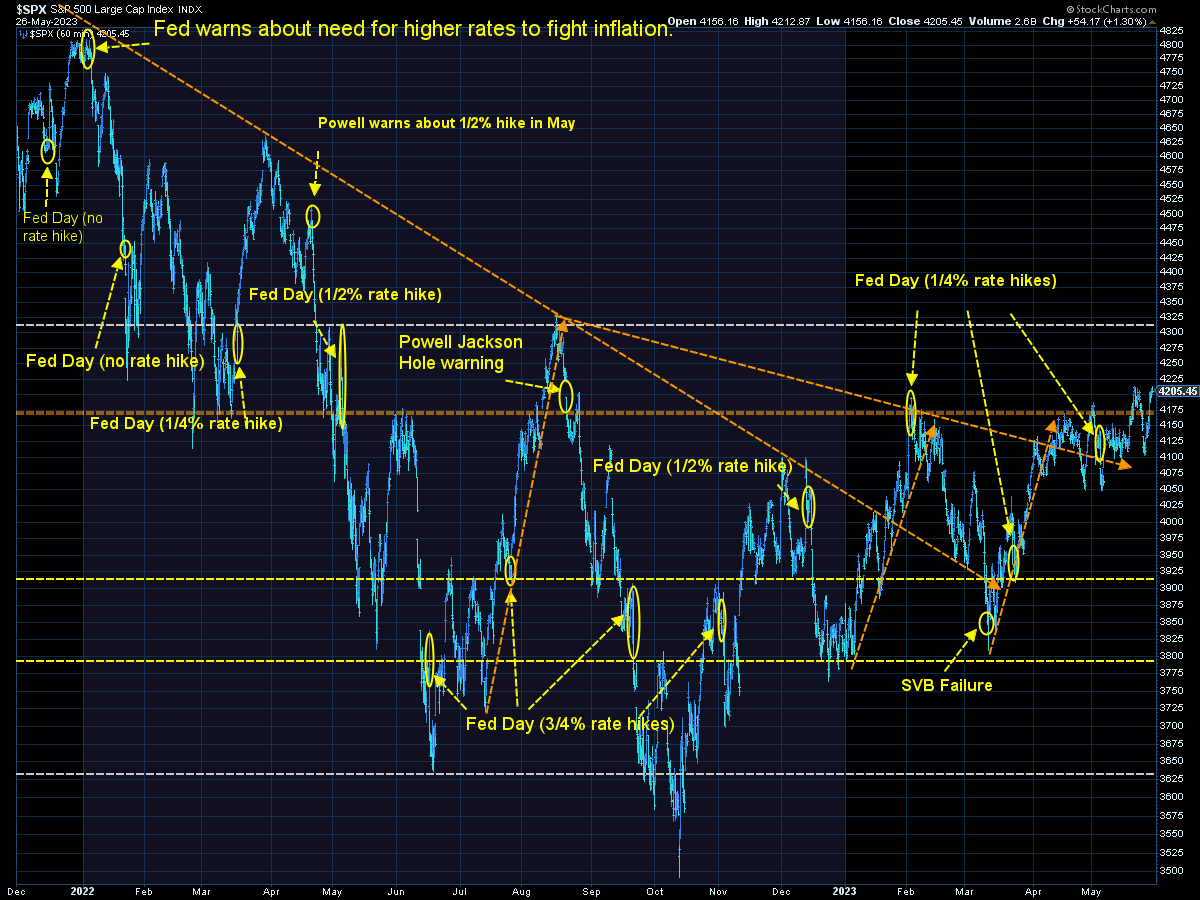

Turing to the markets, the debt ceiling was the least of anybody's concerns if you look at the stock market last week. On an hourly chart the S&P 500 is still trying to get above the February highs.

This was driven almost entirely by Nvidia as they raised expectations with their earnings call and announced another chip to help drive the AI 'boom'. Looking at recaps of earnings calls this last quarter, the primary focus of all of them is how much AI will be helping their earnings. Companies are quickly learning if they talk about AI they will be able to boost their stock. This is similar to using 'crypto' in 2021 or 'dot-com' (in the late 90s.

I'm not saying AI is not a big thing that could help a lot of companies become more productive, but profit margins are already squeezed and actually taking advantage of this improved technology will require something S&P 500 companies have not been willing to do the last 15 years – INVEST their earnings in long-term projects rather than using the earnings to buy back stock (and boost their share prices).

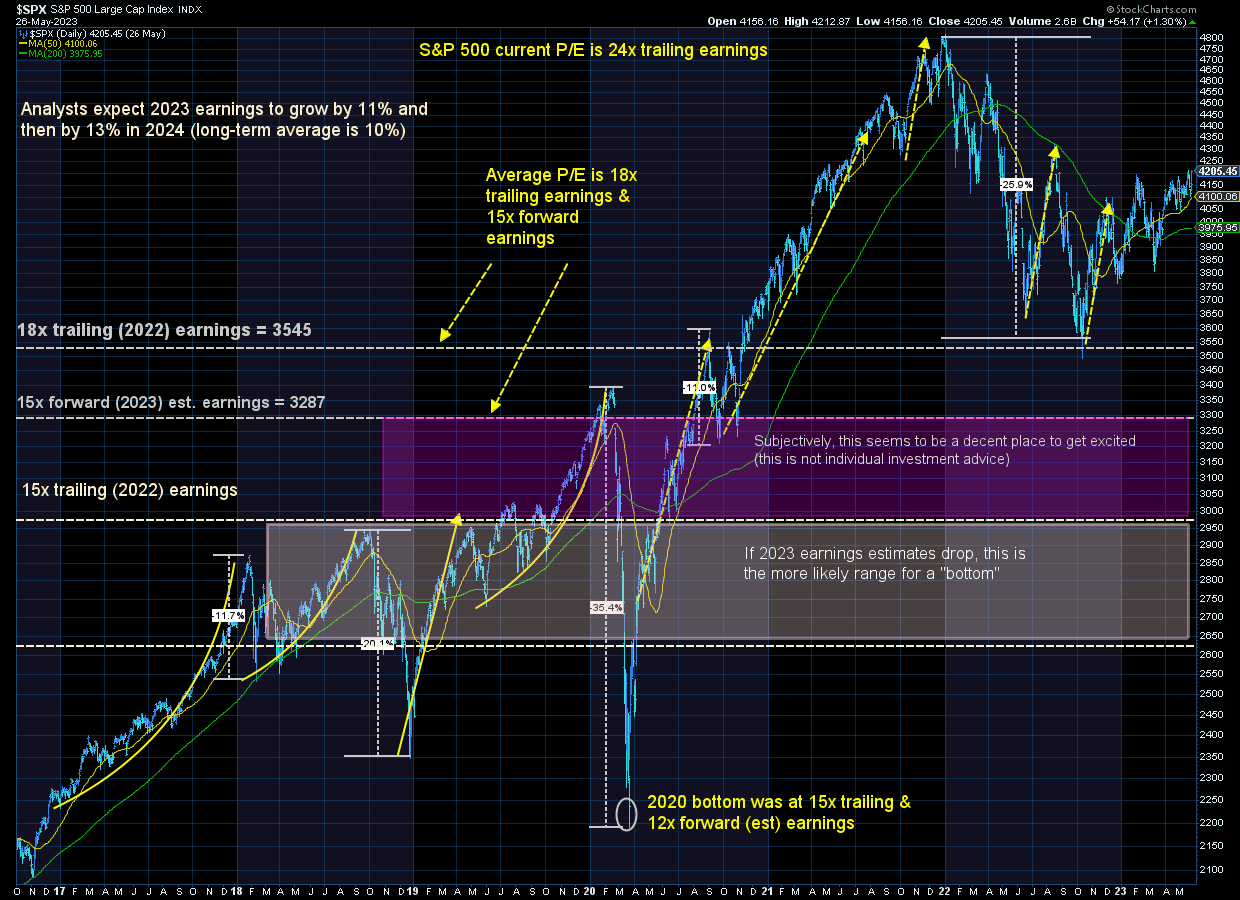

The PE ratio for the S&P 500 is now above where we were at the end of 2021. Think about that. We've had a "bear market" yet the PE is now higher than when it started. This means over the next 10 years buying and holding stocks is likely to generate very low if not negative returns.

High valuations are ok if we have either above average earnings growth rates or low interest rates. We'll have our monthly economic update next week, but at first glance the model will remain 'bearish'. In addition to the economy the S&P 500 have a lot working against it:

Small Caps are Weak

A healthy market/economy would include strength in small companies. That simply isn't happening.

Dollar is Strengthening

From a consumer's perspective, a strong dollar is a good thing (makes foreign goods cheaper). The problem is if you are a company selling products overseas a stronger dollar makes your products more expensive. 40% of the S&P 500's sales are generated overseas. The technology sector generates nearly 60% of its revenues from overseas sales.

The 'bottom' in the market last October occurred shortly after the Dollar peaked and started falling. This is no coincidence.

Interest Rates are Rising

Higher interest rates are obviously a problem for companies who rely on debt to finance their growth. This could be why the Russell 2000 is struggling as those companies have a much higher debt/equity ratio than the S&P 500. However, from a valuation stand point, higher interest rates would lower the valuation for stocks.

SEM Market Positioning

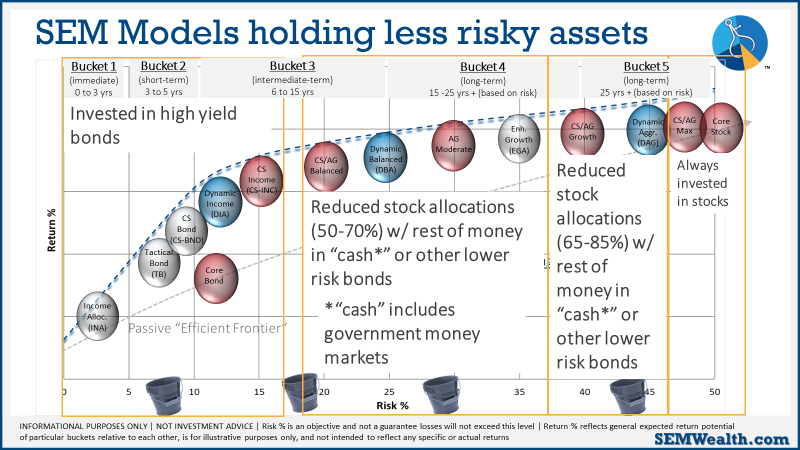

While those things above are certainly on our radar, we remain heavily invested. There were no changes (again) last week in any of our models. We remain mostly invested in high yield bonds in Tactical Bond, Income Allocator, and Cornerstone Bond. We remain "bearish" in the Dynamic models (reduced risk exposure based on our economic model), and right in between minimum and maximum exposure in our 'strategic' models.

We are getting very close to high yield bond sell signals in Tactical Bond, Cornerstone Bond, and Income Allocator.

This chart summarizes where we are:

As always, our models will change if the environment changes. For now, calculated, short-term risks are acceptable with the knowledge things could change quickly.

No matter what happens as we wrap up Part II of our Debt Ceiling Circus, our models are designed to monitor the overall TRENDS. If Wall Street gets concerned, they will tell their largest clients and we will see trends change in the market. Regardless of the reason, we only care about where the money is flowing (both in and out).

That said, we will be watching more closely than usual the underlying holdings in our funds to make sure they are not taking on abnormal risks. We will keep you posted if anything changes in our positions.

I feel as if I should close with my primary piece of advice during times like this:

Do not let your political beliefs influence your investment decisions. The markets (and economy) do not always react the way you think they will based on the ideological talking points.