“Markets can remain irrational longer than you can remain solvent” – John Maynard Keynes

“Quotations fluctuate constantly, reacting often illogically to all sorts of temporary and even trivial influences.” – Benjamin Graham

“The Stock Market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” – Seth Klarman

"I believe the market accurately reflects not the truth, which is what the efficient market hypothesis says, but it accurately and efficiently reflects everybody's opinion as to what's true." – Howard Marks

"There is evidence that the stock market is more efficient in processing information about what other investors are doing than it is in processing fundamental information about the underlying assets, which is why stock prices so often turn out with hindsight to have been crazy rather than rational." – Peter Bernstein

"When the price of a stock can be influenced by a "herd" on Wall Street with prices set at the margin by the most emotional person, or the greediest person, or the most depressed person, it is hard to argue that the market always prices rationally. In fact, market prices are frequently nonsensical." – Warren Buffett

"Only when the tide goes out do you discover who's been swimming naked." – Warren Buffett

I'm a student of history & have read books from all of the famously successful investors quoted above. Their words and advice are quite appropriate at this point in the market cycle. It's important to reflect on these words as they come from people who have successfully weathered all kinds of market cycles.

The stock market continues to "melt-up". Despite economic data which continues to weaken, earnings estimates continue to move higher.

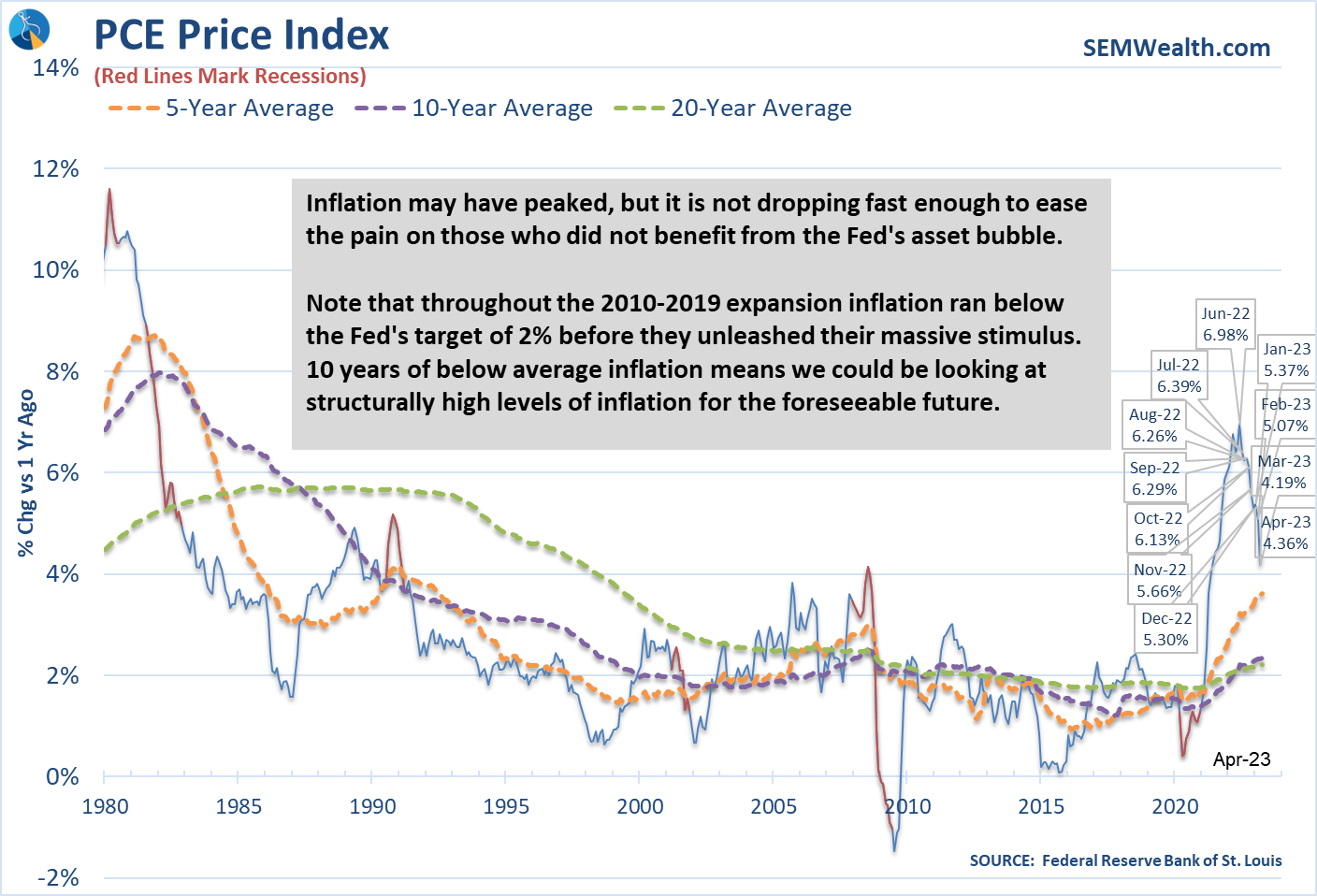

Inflation while lower, is still much higher than anything we've experienced this century. Only now has the 10 & 20 year average rate of inflation climbed above the Fed's so-called "target" of 2% annualized inflation.

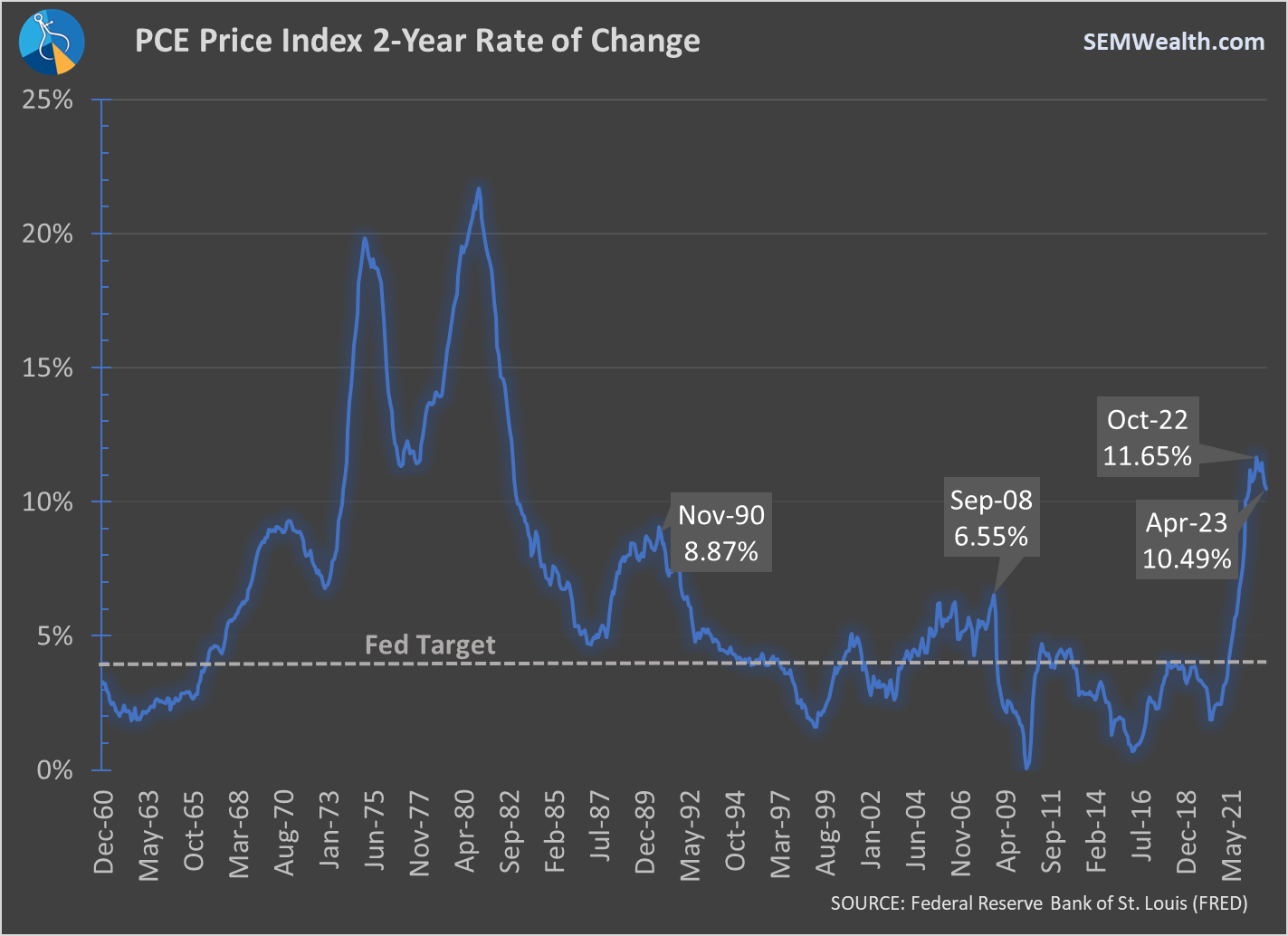

One of our advisors asked about the 2-year rate of inflation and if it truly was in the double digits. The answer is "yes". Here is what that looks like.

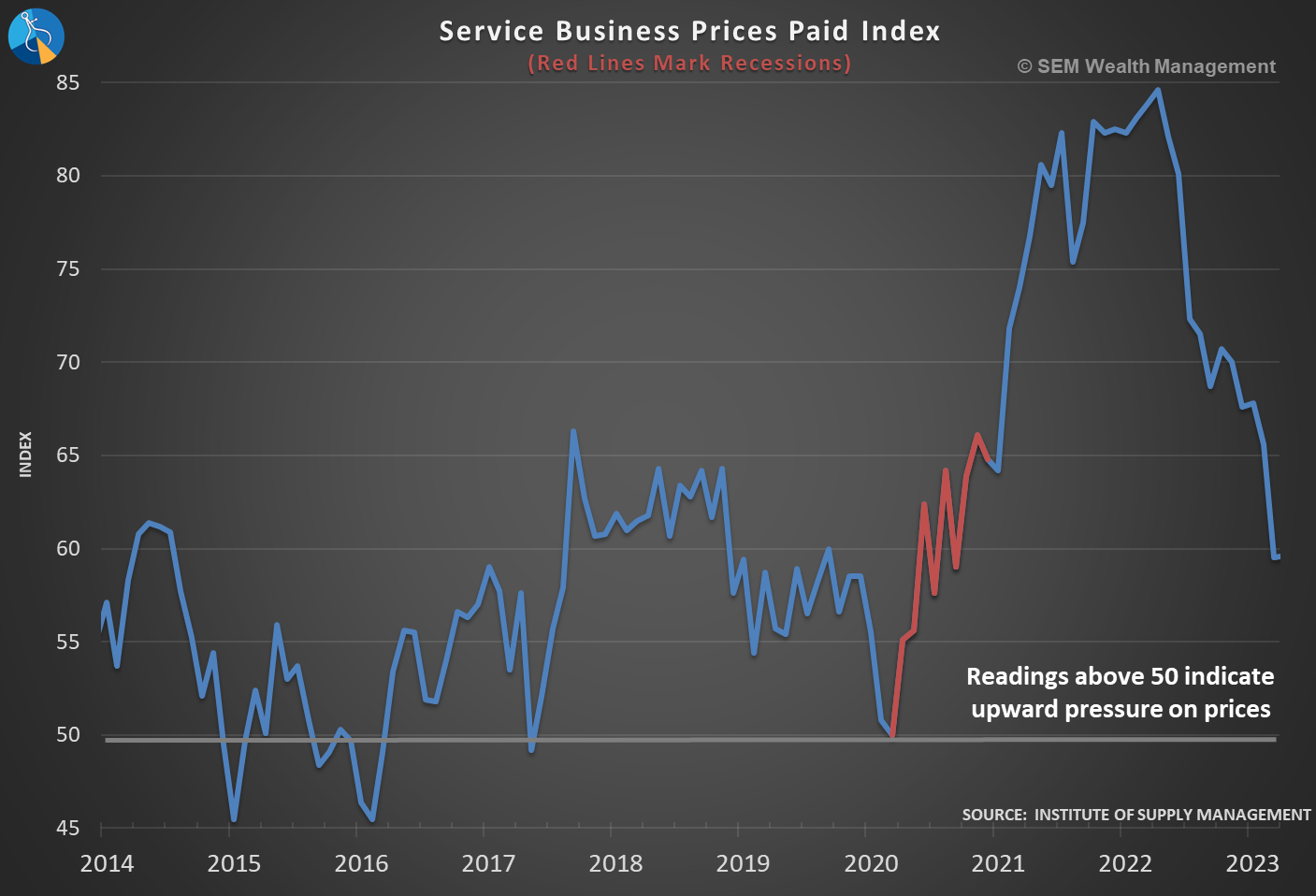

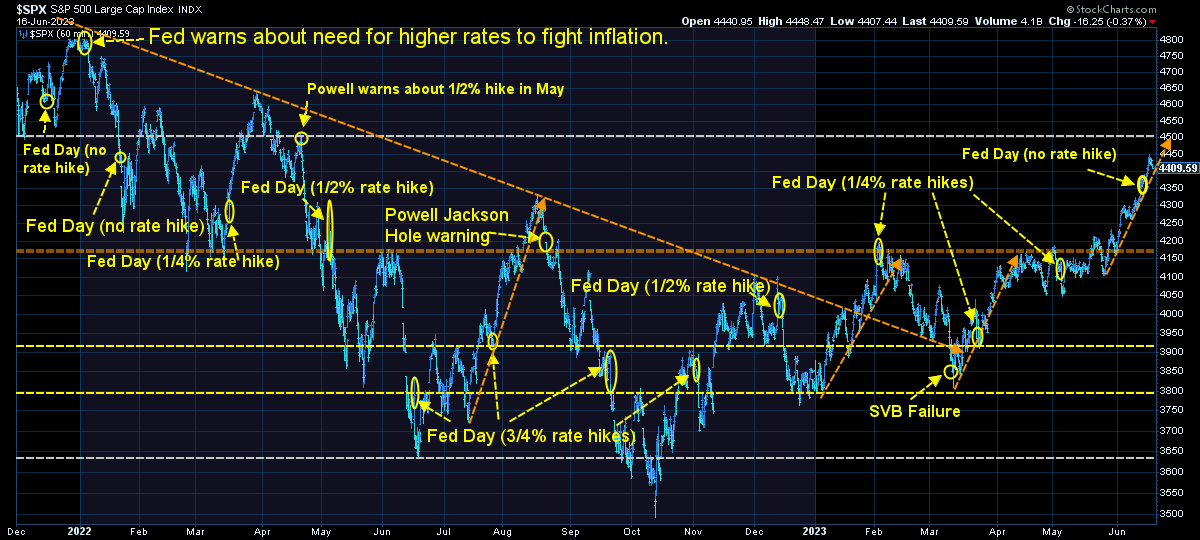

The Fed has a long way to go in their inflation fight. Just because they "paused" does not mean they will not be forced to hike rates again. Services inflation still shows signs of upward pressure on prices.

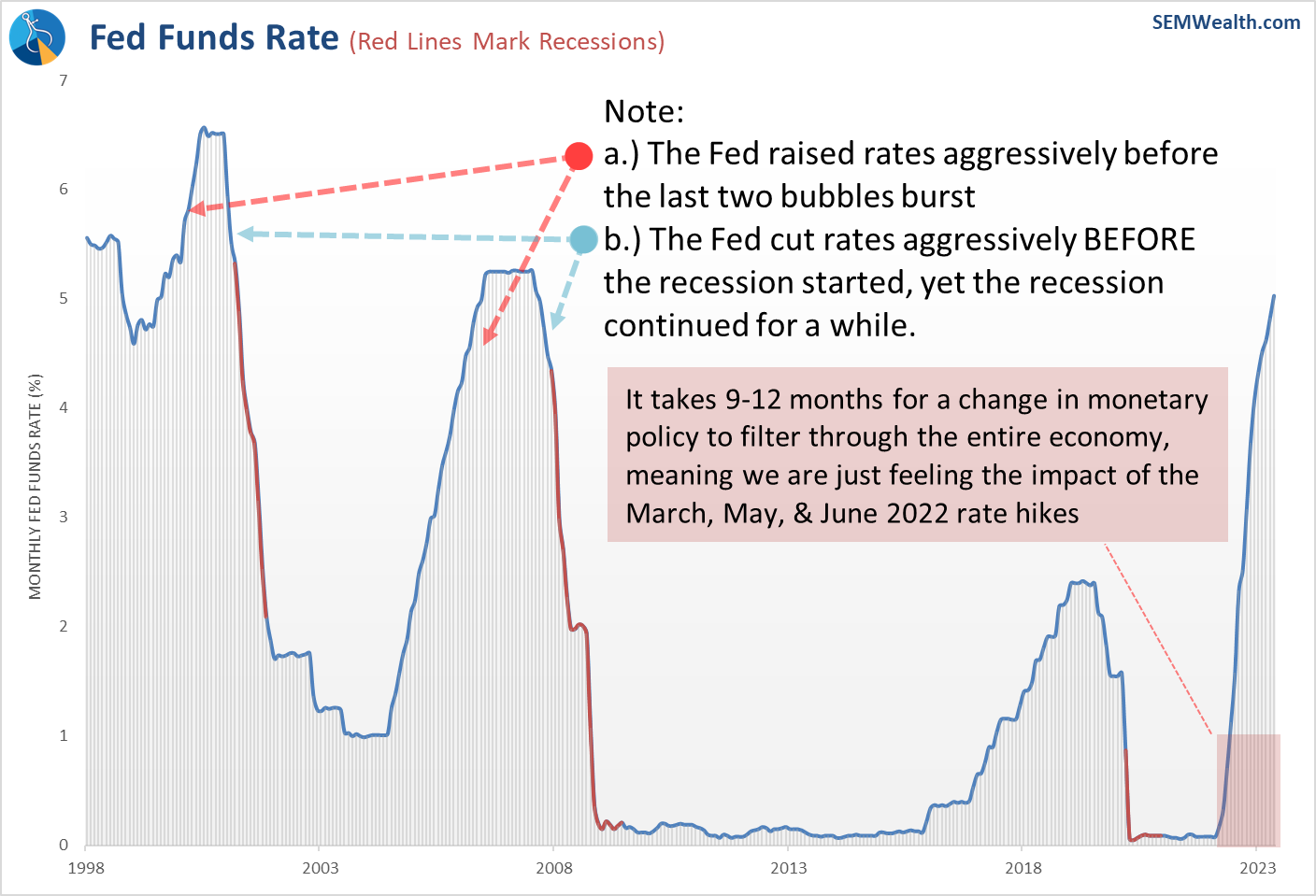

Even if the Fed is done RAISING rates, they are a long way off from cutting rates. Even if they cut rates, history tells us they cannot prevent a recession. By the time they cut rates it is too late.

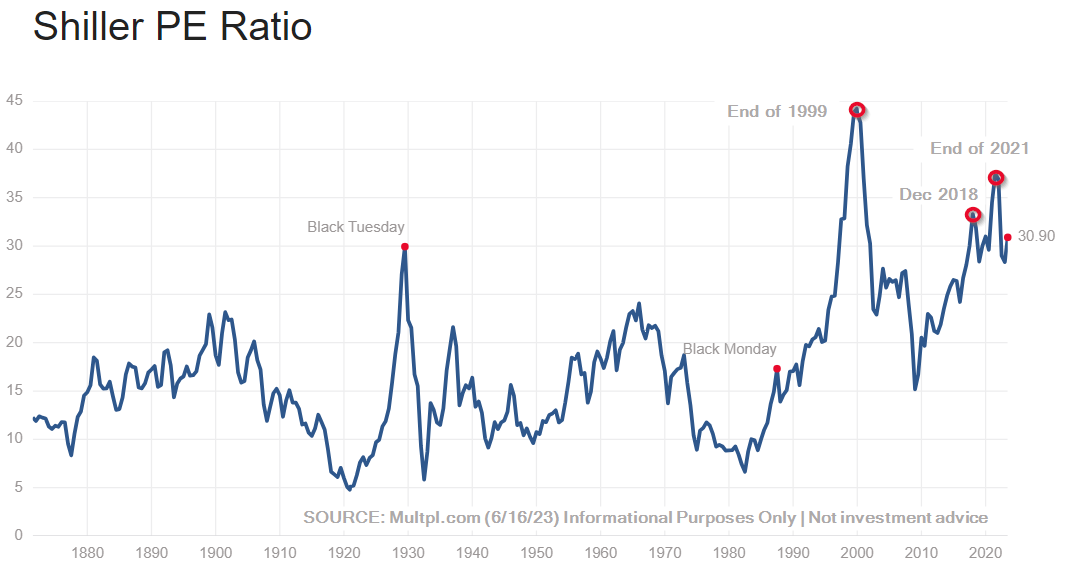

Valuation metrics are at a place where there is no tolerance for any sort of economic slowdown. A recession would crush stocks. The Shiller PE Ratio has again exceeded the level we saw just before the market crashed in 1929. The only times we saw a higher reading was in 1999, December 2018, and December 2021.

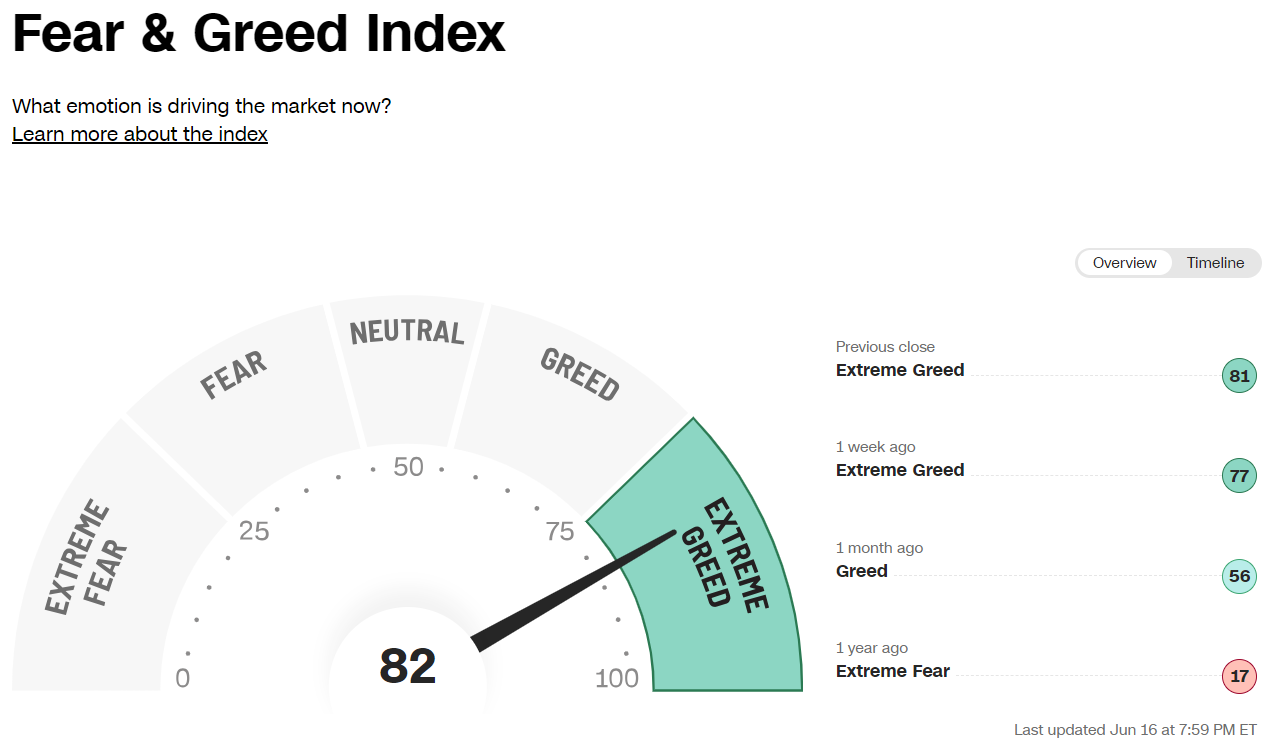

The CNN Fear-Greed Index, which measures 7 different sentiment indicators is back to "Extreme Greed" territory.

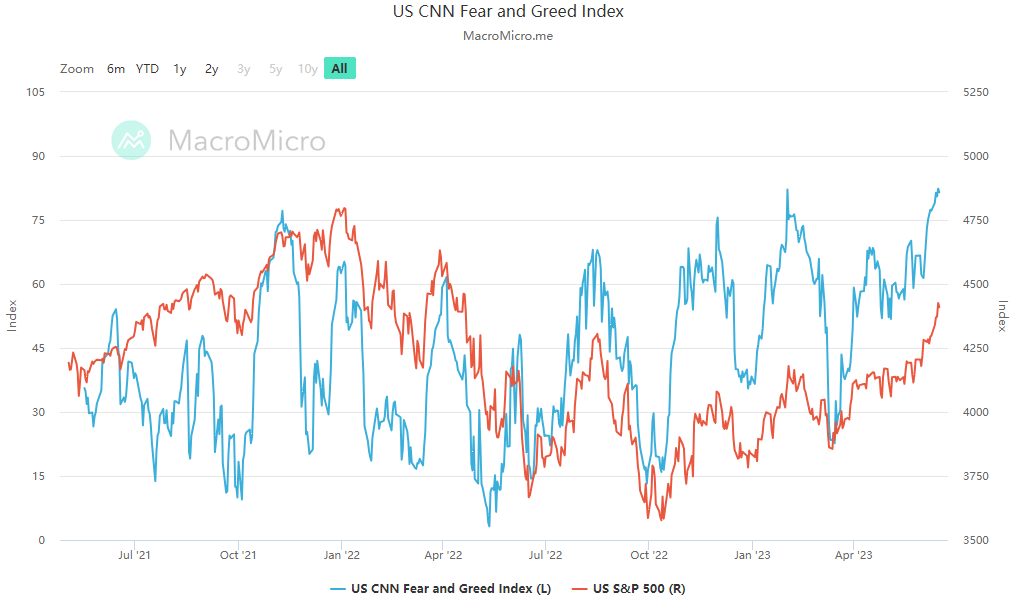

A look at the other times "greed" has been this high saw a sharp pull back in relatively short order. Whether it was the 6 to 7% drops in February 2023 or December 2022 or the 17% drop from August to October 2022 or the 24% drop from January 2022 through June 2022, at least for the short-term it is safe to say jumping in right now is extremely risky.

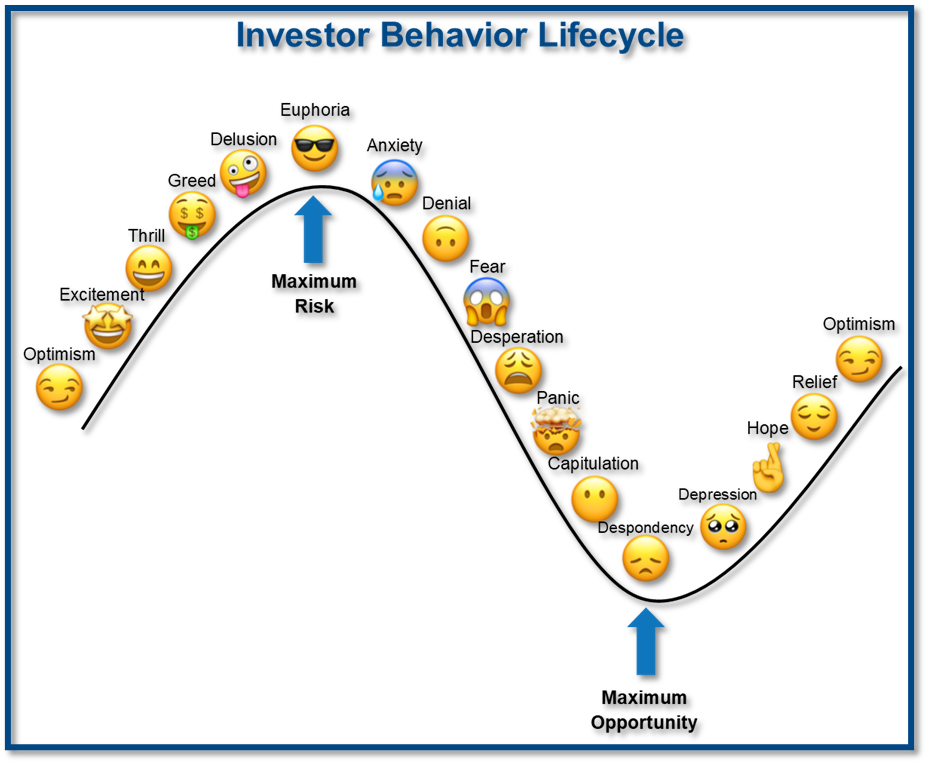

We are seeing signs of money leaving the safety of money market funds (and 5%+ yields) to chase stocks higher. This of course is what always happens late in a melt-up cycle – conservative investors give up on conservative strategies because they can no longer stomach the feeling of "missing out" on this "new era".

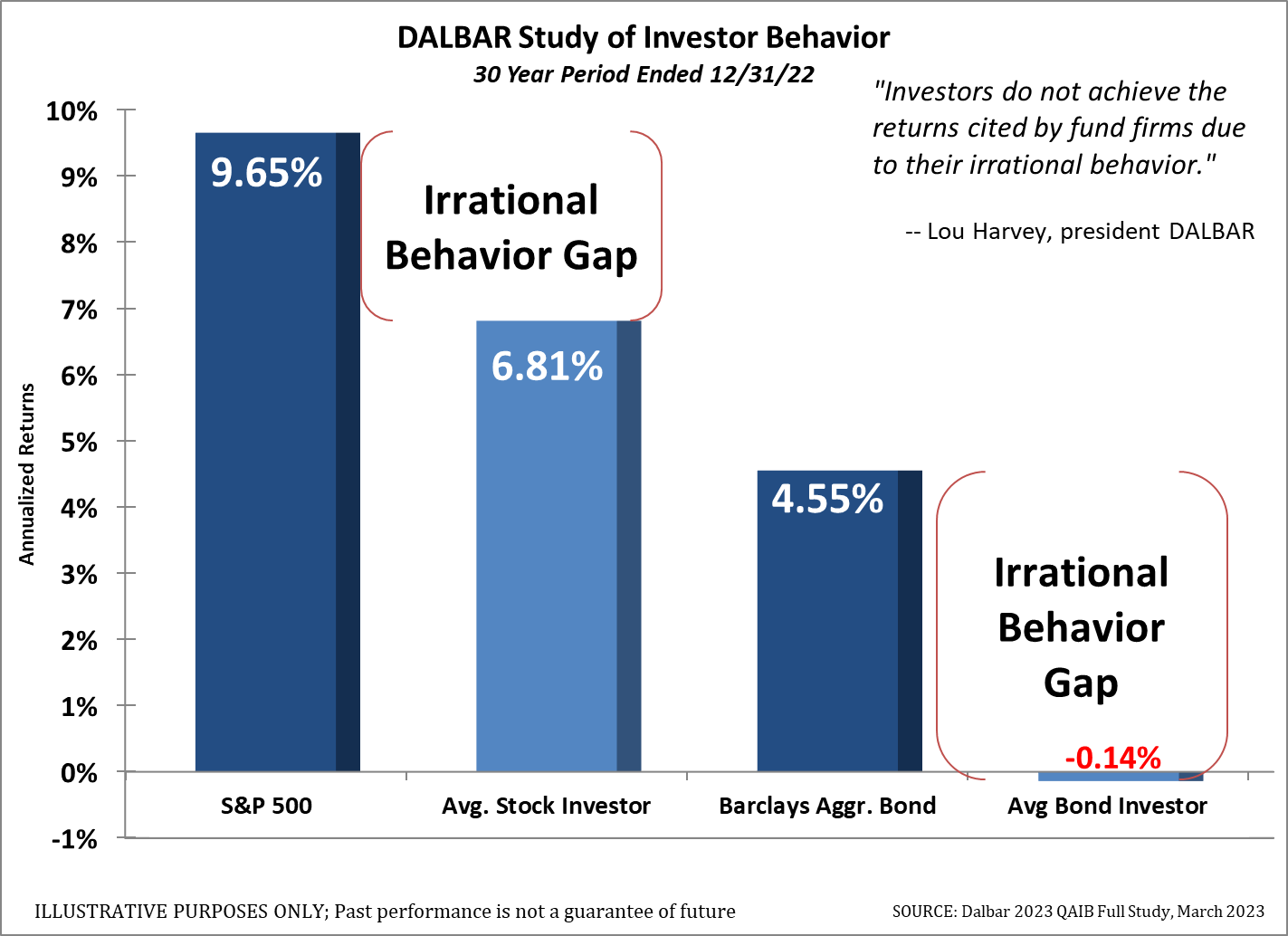

The average bond investor loses money because they continue to repeat the cycle of giving up on bonds and other fixed income investments after long periods of stock market gains only to jump to stocks just in time for the next bear market to begin. They then move back to bonds after the bonds have rallied.

Our goal at SEM is to prevent investors from following this natural cycle.

We illustrated last week how 'narrow' this rally has been, which makes it especially risky.

All of that said, we respect the move the market is making and understand the physics behind it. However, we also know sometimes the simple fact that the market stops stampeding higher is enough to bring on some "profit takers". This leads to more selling and all of a sudden with no real catalysts the physics of the melt-up are now working in reverse.

If you are somebody who has too much risk in your portfolio (based on your financial plan, cash flow strategy, and investment personality) I would seriously consider taking money off the table (or at least having a quantitative exit strategy).

This chart continues to be my guide to put the market in a long-term, valuation-driven perspective. Making money investing in stocks is 'easy' when the P/E ratio is below average. Making money investing in stocks is difficult when the P/E ratio is above the long-term average. When it is this far above, making money takes an extreme level of risk.

You don't HAVE to invest in stocks right now. There will be easier/better times to get in.

The bond market is far less optimistic about the Fed's ability to control inflation. They are certainly not pricing in any rate cuts this year. Ignoring the wide fluctuations, rates have essentially been flat since February.

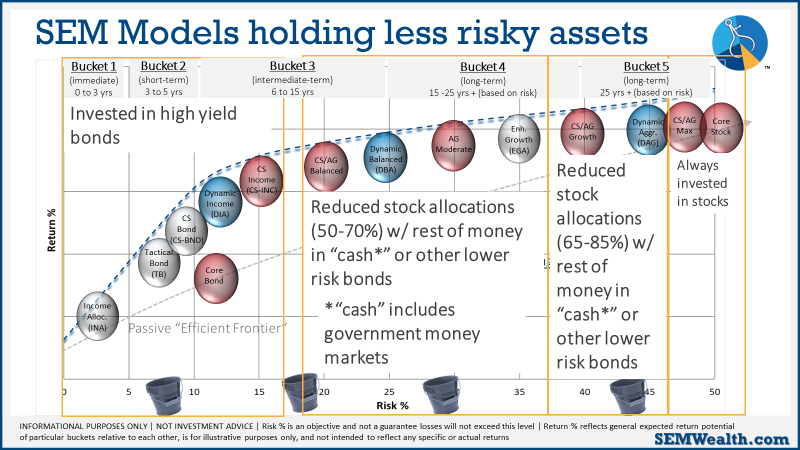

SEM Market Positioning

While all of the things above are certainly on our radar, we remain heavily invested. The key difference between our advice to readers and our own investments is we have a quantitatively based plan to leave the party when things start to look shaky.

There were no changes (again) last week in any of our models. We remain mostly invested in high yield bonds in Tactical Bond, Income Allocator, and Cornerstone Bond. We remain "bearish" in the Dynamic models (reduced risk exposure based on our economic model), and right in between minimum and maximum exposure in our 'strategic' models.

Our high yield model, which two weeks ago was close to a "sell" appears to be back in an uptrend. The other "trend" indicator which determines the overall asset allocation in our AmeriGuard and Cornerstone models needs to see either the 'breadth' of the rally to broaden out or a pull back to ease the current overbought "greedy" environment.

This chart summarizes where we are as we enter the week:

As always, our models will change if the environment changes. For now, calculated, short-term risks are acceptable with the knowledge things could change quickly.

No matter what happens, our models are designed to monitor the overall TRENDS. If Wall Street gets concerned, they will tell their largest clients and we will see trends change in the market. Regardless of the reason, we only care about where the money is flowing (both in and out).

That said, we will be watching more closely than usual the underlying holdings in our funds to make sure they are not taking on abnormal risks. We will keep you posted if anything changes in our positions.

We are already in the heat of the election and it's only going to get more heated. With that I will continue to close with my primary piece of advice during times like this:

Do not let your political beliefs influence your investment decisions. The markets (and economy) do not always react the way you think they will based on the ideological talking points showing up in your media feeds.