Last week I started the Musings with some quotes from some famous investment managers. The key takeaway from all of them was essentially, "stock prices reflect the feelings of the market at the current time not the underlying value of a company." Long-term, the true value always shakes out, but over short and intermediate-term periods stocks move based on human emotions. Because we are human, we all have certain biases which will cause stocks to overreact in both directions.

There is no reason the market should be up as much as it is based on the underlying fundamentals of the economy. The problem with these kinds of rallies (we saw the same thing in 2021) is if they are not based on any fundamental reason, the market is at risk for a steep sell-off. Sometimes stocks start going down simply because they stopped going up. All the people who jumped into stocks to get in on the "unstoppable" ride start to get nervous and cash out. Those who were in early in the move decide to take their profits before they give them all back.

In other words, there will be no reason the market starts to drop other than people stopped buying.

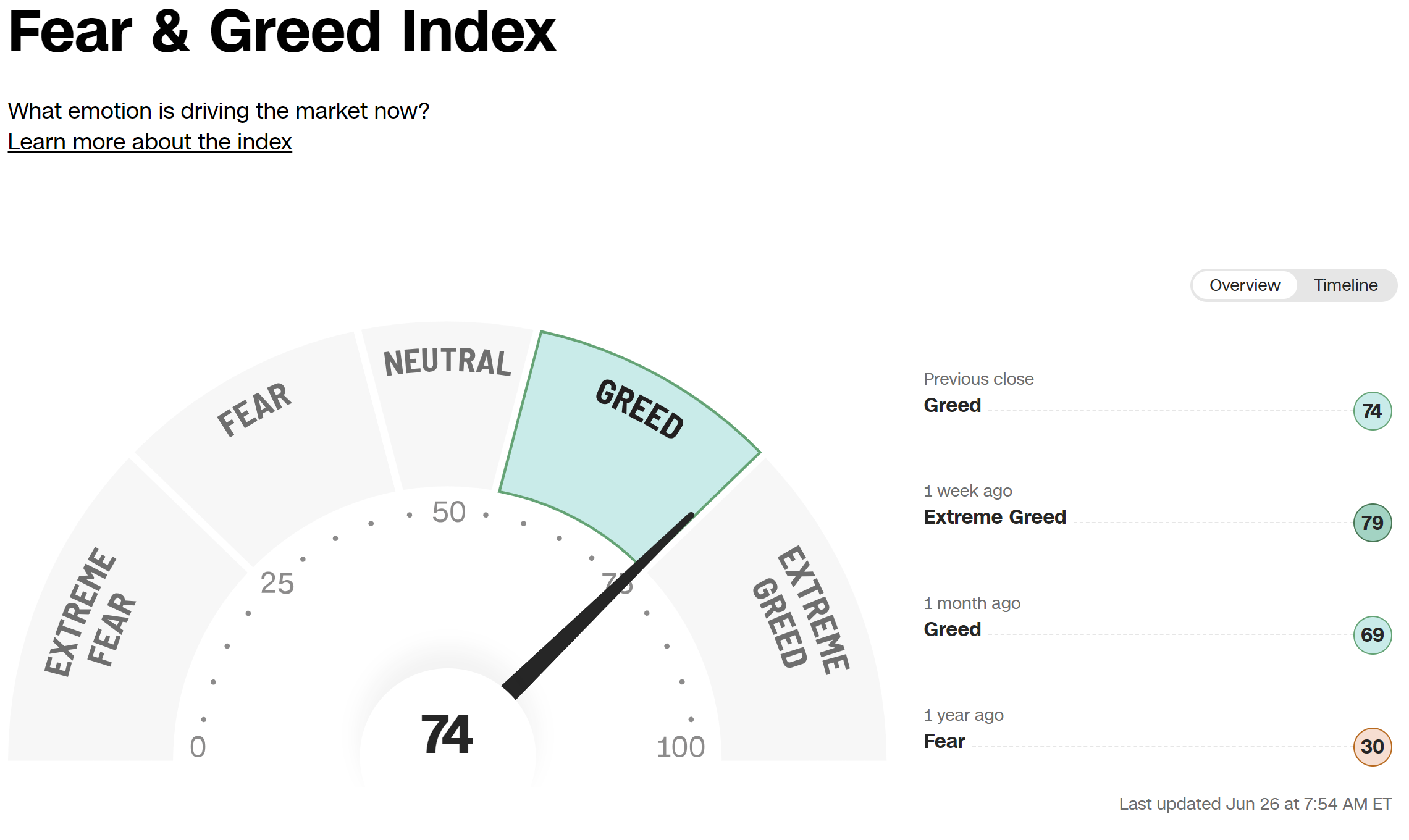

Last week I shared the CNN Fear-Greed Indicator. It was in "extreme greed" territory, which historically led to a 6 to 30% pullback in stocks. The market almost always peaks at least for the short-term when we hit that "extreme greed" marker. It's usually an indication that pretty much anybody who wanted to buy stocks has already bought them.

The sell-off in stocks last week pushed it down to the upper edges of "greed", which is still too high.

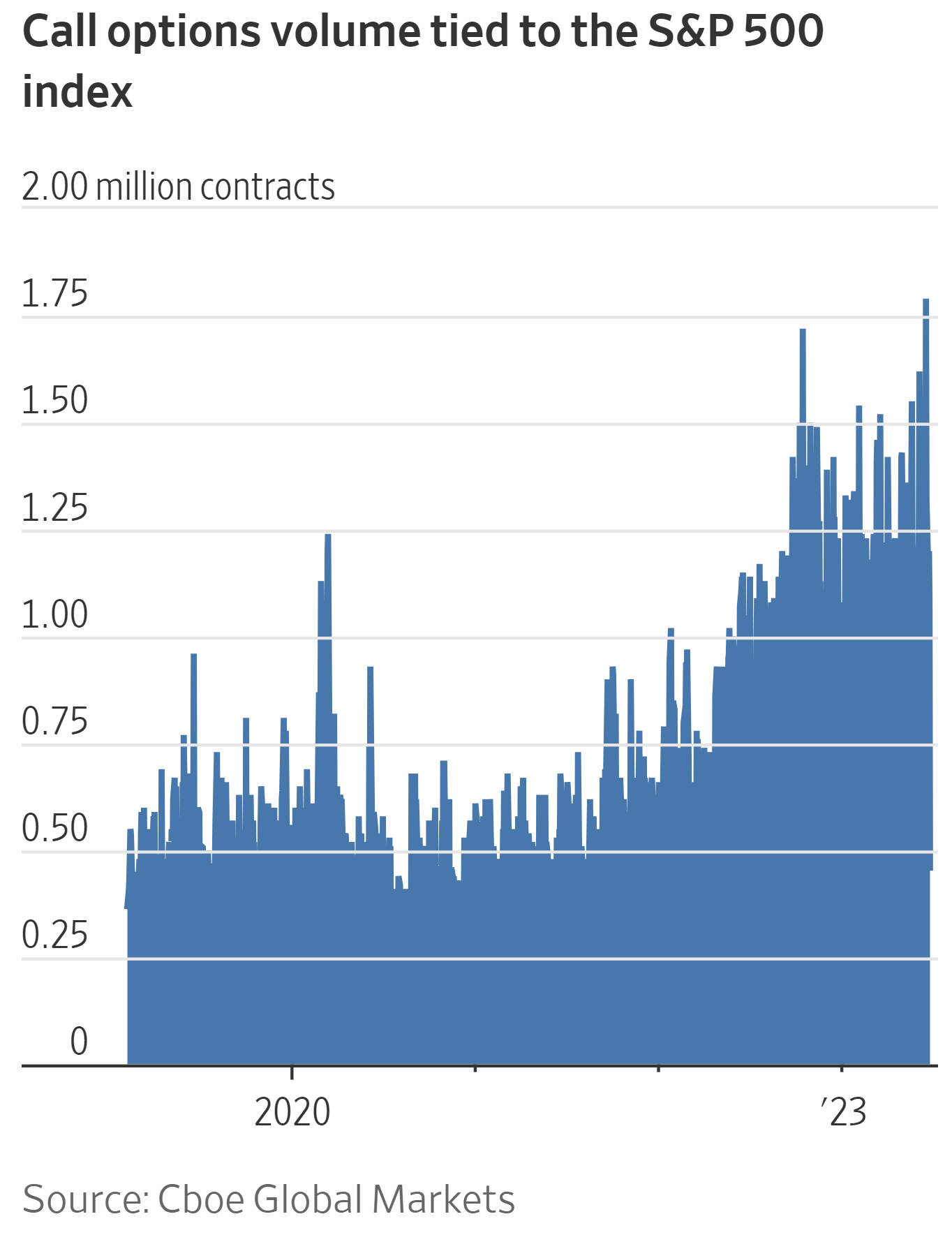

Two weeks ago we illustrated how just a handful of stocks account for all of the S&P 500 index's returns for the year. Nearly half of the stocks in the index are down. Instead of leading to caution on the part of traders/speculators we instead of seen them piling into bullish bets on the market (part of the Fear-Greed index).

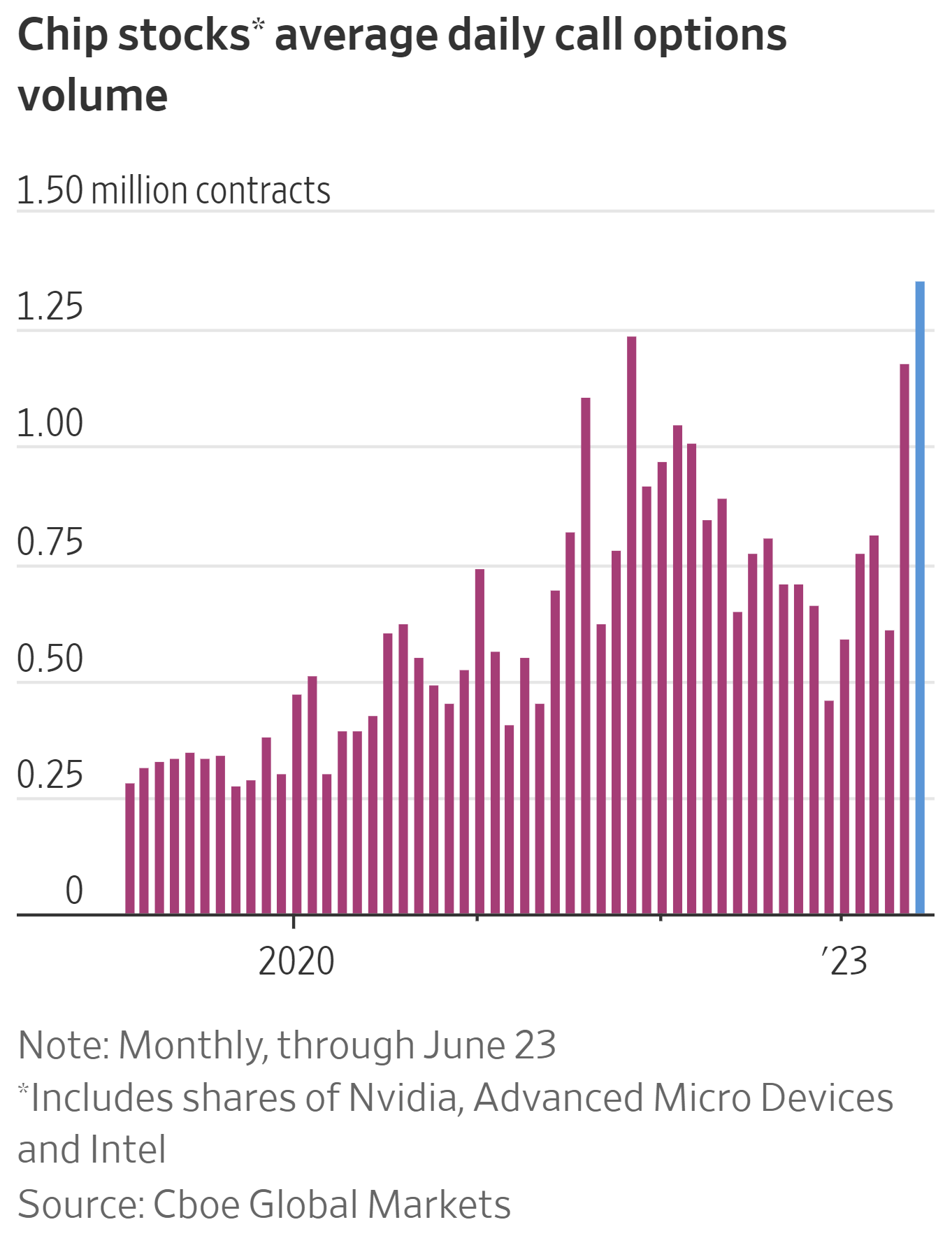

The Wall Street Journal this morning illustrated this with a couple of charts. First, look at the activity in chip stocks.

This is the highest amount of activity since November 2021 (just before the market peaked). Overall people are betting on the S&P at the highest rate since the end of summer 2022 (just before the market peaked).

This type of activity can drive stocks higher for a while, but almost always leads to a correction of 5% at a minimum. After that it will depend on how much conviction traders/speculators have in the move. Three weeks ago we provided updates to our economic model. The underlying fundamentals remain weak, which means the market is at risk of a big sell-off.

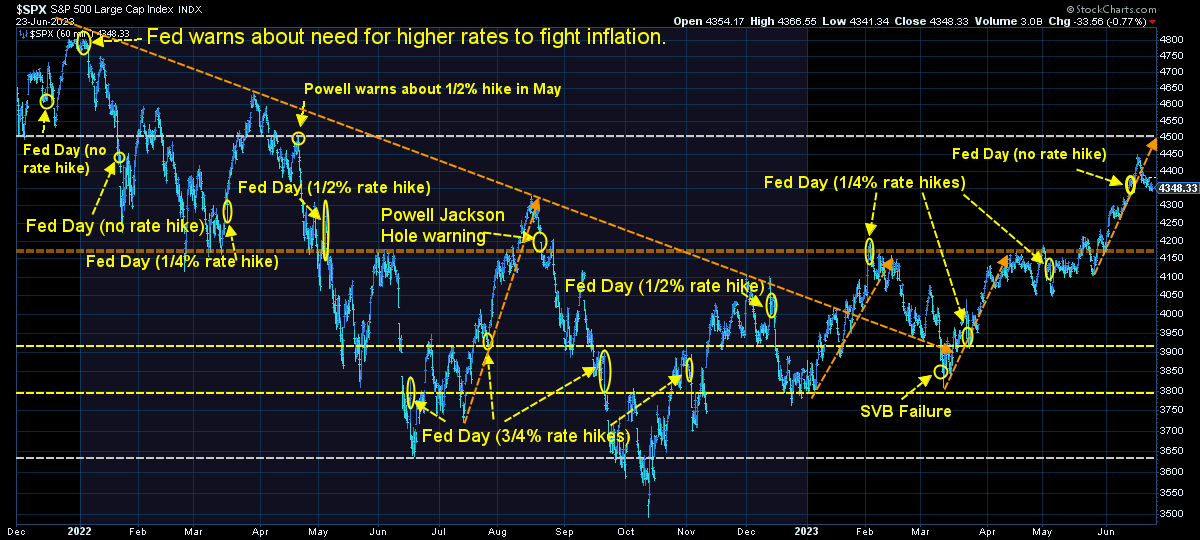

For now the market will be driven by how many people want to attempt to buy the latest dip versus how many want to take their profits while they are still there. When traders/speculators are driving the market round numbers tend to be support/resistance levels. In other words, if the market holds 4300 we are likely to see buyers jump in. If it breaks, 4200 ends up being the next likely stop. The same cycle will probably repeat.

On the chart above pay attention to the orange up arrows. Note how after a big run the market ended up peaking for no real reason before giving back 5% or more. In other words, if you are waiting to jump into stocks patience will be important.

Bigger picture I continue to focus on this chart. Stocks are extremely expensive and we are likely to find better entry points. Note those entry points will come when most people are afraid of stocks (when the Fear-Greed index is back down to 'fear' levels.)

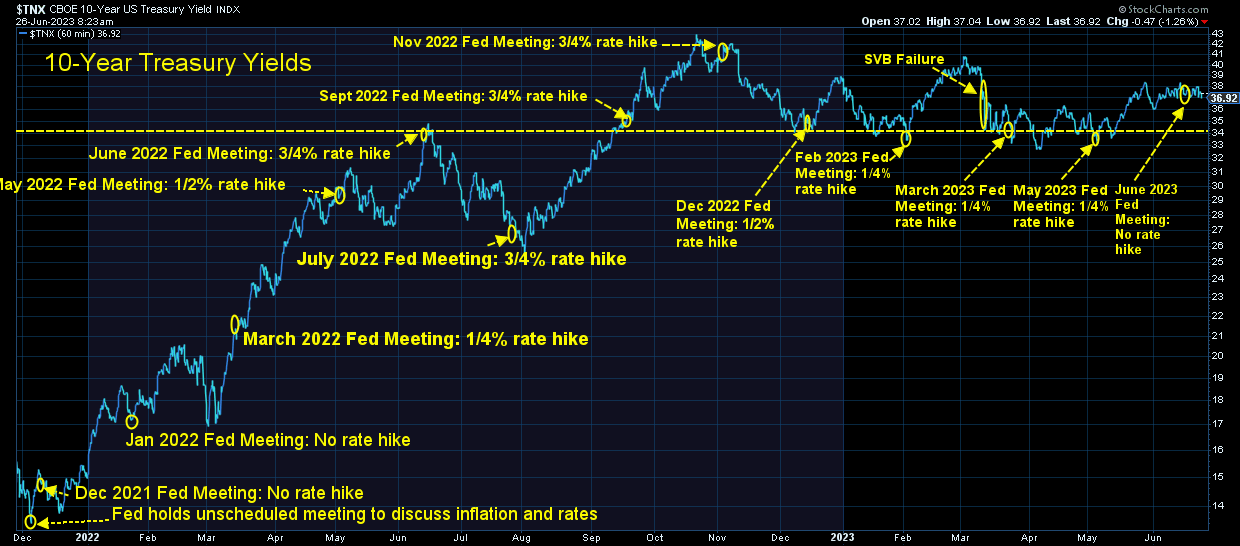

On the bond side of things, Treasury yields remain 'flat' as bond traders wait for the next inflation readings. The Fed is talking a different position than the stock market is pricing in. Fed officials including Chair Powell all went out of their way last week saying a.) rates are probably still going to go up this year and b.) we are a very long way off from any rate cuts.

This means at a minimum we are going to be stuck at these yields for the foreseeable future, which will be a drag on economic growth (and corporate earnings).

SEM Market Positioning

While all of the things above are certainly on our radar, we remain heavily invested. The key difference between our advice to readers and our own investments is we have a quantitatively based plan to leave the party when things start to look shaky.

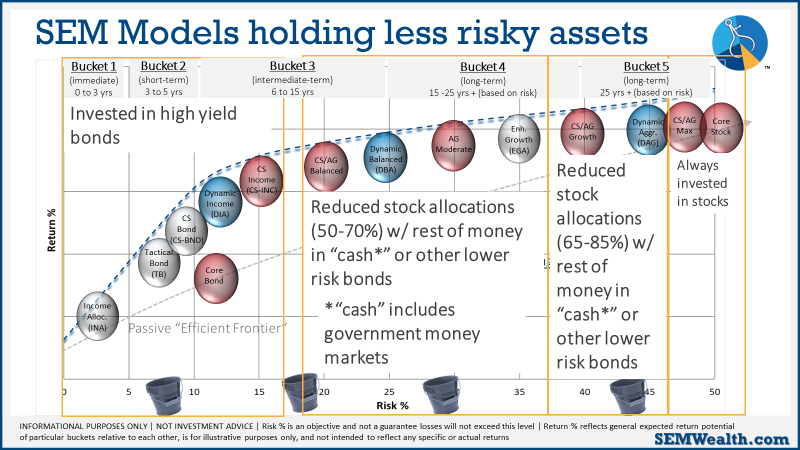

There were no changes (again) last week in any of our models. We remain mostly invested in high yield bonds in Tactical Bond, Income Allocator, and Cornerstone Bond. We remain "bearish" in the Dynamic models (reduced risk exposure based on our economic model), and right in between minimum and maximum exposure in our 'strategic' models.

Our high yield model, is once again close to a "sell" signal. The other "trend" indicator which determines the overall asset allocation in our AmeriGuard and Cornerstone models needs to see either the 'breadth' of the rally to broaden out or a pull back to ease the current overbought "greedy" environment.

This chart summarizes where we are as we enter the week:

As always, our models will change if the environment changes. For now, calculated, short-term risks are acceptable with the knowledge things could change quickly.

No matter what happens, our models are designed to monitor the overall TRENDS. If Wall Street gets concerned, they will tell their largest clients and we will see trends change in the market. Regardless of the reason, we only care about where the money is flowing (both in and out).

That said, we will be watching more closely than usual the underlying holdings in our funds to make sure they are not taking on abnormal risks. We will keep you posted if anything changes in our positions.

We are already in the heat of the election and it's only going to get more heated. With that I will continue to close with my primary piece of advice during times like this:

Do not let your political beliefs influence your investment decisions. The markets (and economy) do not always react the way you think they will based on the ideological talking points showing up in your media feeds.