42 weeks ago our country began to panic over a virus which had started making headlines in early January. I'm sure nobody will forget 2020. It's been quite a year and one where we've all learned a lot about ourselves, our families, our co-workers, and our fellow Americans. Everybody's experience was different. For the past 42 weeks I've attempted to share my perspective from a market, economic, investments, and personal point-of-view.

With most people taking the week off, I'll reserve any deep thoughts for the coming weeks. We have news of the president signing the nearly trillion dollar stimulus bill and talk of even bigger payments sent to Americans. As I said last Monday, the checks are way too much for those Americans who have been able to continue working and not enough who have lost their jobs. It's a blunt instrument that will boost the economy. It's just not a very efficient way to do it.

Either way the market will celebrate. I find it interesting that a year ago I was talking about how giddy everyone seemed to be as we prepared to enter 2020. It was tough to find anybody who had any concerns about the year ahead. Stocks were the only place to be. I didn't think it was possible, but it seems people are even more giddy now than they were a year ago.

Stocks were overvalued to start 2020, were fairly valued for about a week in late March and are extremely overvalued as we end 2020. There is no possible way the S&P 500 as a whole will be able to produce earnings growth to justify the prices being paid today. By most measures stocks are more expensive now than they were in 2000. I've had at least 5 inquiries in the last two weeks about investing in the Ark Innovative Tech ETF (ARKK), which is up over 150% this year. I've reminded those interested in this highly focused, highly risky ETF that somebody who in March 2000 bought the NASDAQ 100 (QQQ), which was the 1990s version of ARKK would have been underwater for 15 years. The 20+ year annualized return is just over 4%. I'm pretty sure that's not the expectations people had for that ETF back in 2000.

As I've said throughout the crisis and for the past 25 years — we will take what the market gives us and will remain invested as much as possible. We actually own ARKK in a new model launched earlier this year – the Concentrated Stock Model. It was designed for some clients who had been asking to own individual stocks. While we do have some risk management triggers to take money out of the market if too many things start to fall, it is still extremely risk. If you're interested in learning more, here are some of the details.

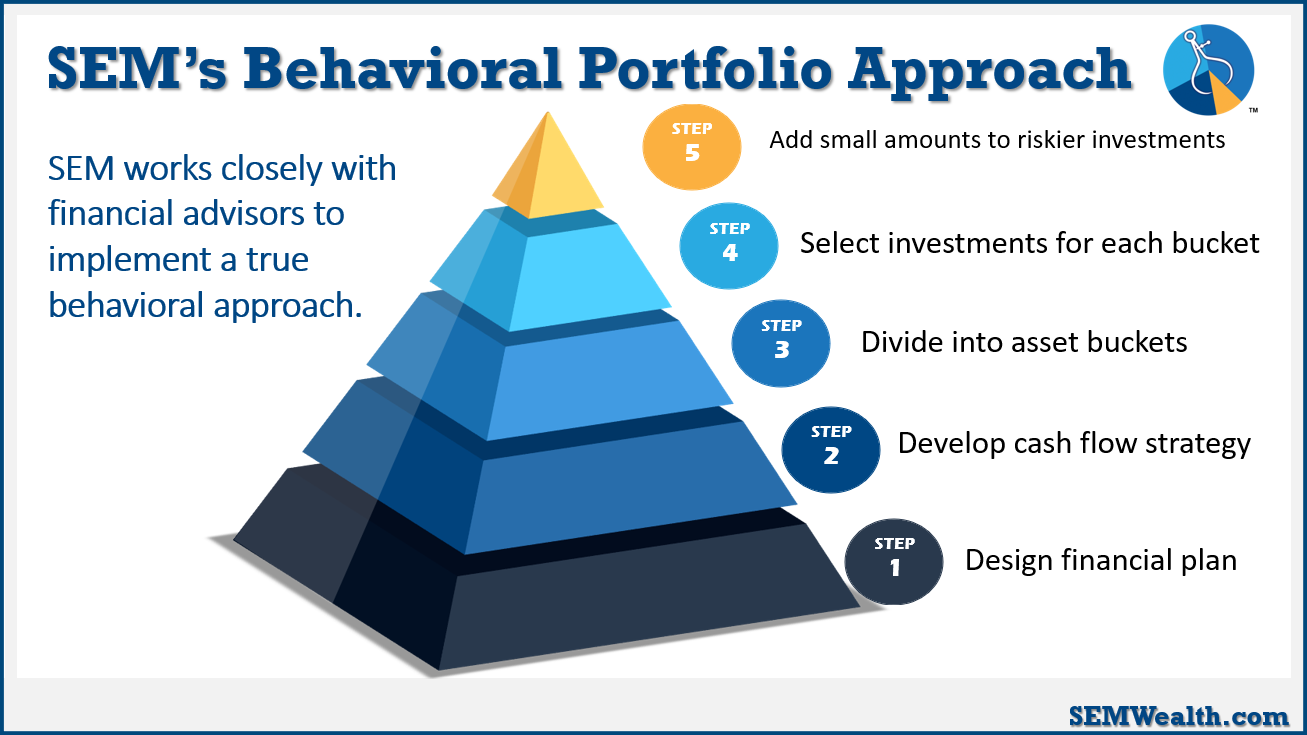

Whether it's our Concentrated Stock Model, ARKK, or some other risky bet. Those investments belong in the "top part of the pyramid" in our Behavioral Portfolio. The key for long-term success is to start with a financial plan and cash flow strategy. From there creating a portfolio designed to work with those two along with the overall personality of the investor allows for a well diversified, wholistic approach. If there is room in the plan, the top part of the pyramid allows for "fun" investments. It is critical to not take too many risks with the core part of the portfolio.

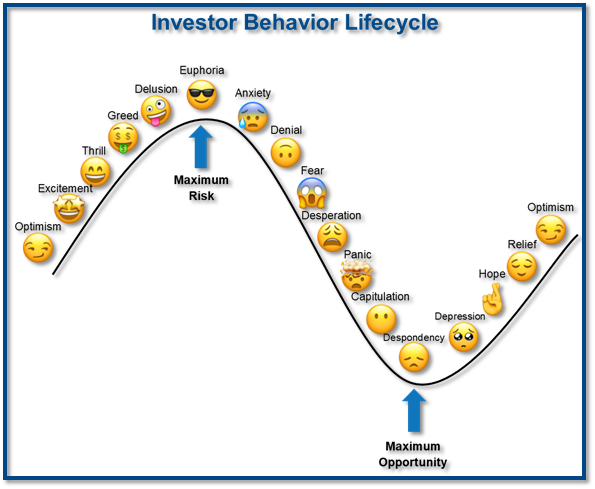

I'll close the year with my favorite chart – the investor behavior cycle. There is no indicator where we are in this cycle. Each person is different, but overall, it is clear to me we've passed the "greed" stage and are somewhere between "delusional" and "euphoria".

We learned in the spring how quickly an overvalued market can go from "euphoria" to "panic". The Fed and Congress never let us get to "despondency", but that doesn't mean it won't happen again. I hope you enjoy the rest of 2020 and use this week to prepare your mind for the year ahead.