I don't know if there was ever a more anticipated new year in my lifetime than this year. After what felt like ten years' worth of news, 2020 is finally over. Many people have said, "2021 can't be any worse than 2020." I hope they're right, but there are a lot of unresolved issues facing our country, the economy, and the stock and bond markets. Here's what's on my mind the first week of the new year:

The Election

We had warned during our pre-election webinars about the prospect of not having the election resolved until January. The president and a group of his supporters are certainly trying to throw uncertainty into the mix, but I think too little attention is being paid to the Georgia Senate elections on Tuesday. The outcome literally will determine how much of the far-left agenda will be able to be implemented in the next two years.

The November election was clearly not a mandate for a far-left push, but that doesn't mean the Democrats will not try to use control of Congress as a way to push their agenda anyway. If anything the election was a mandate for a more moderate government from BOTH sides.

The recent stimulus shenanigans is a perfect example of all that is currently wrong with our government. A bipartisan group of Congressional members (aka the "Problem Solvers Caucus") came up with a simple stimulus bill designed to take care of the most pressing needs. Then Mitch McConnell, Nancy Pelosi, and their far right and left members got involved saying they wouldn't support it without (fill in the blank). Before we knew it we had over 5000 pages of legislation that included so many things that have nothing to do with the US economy and ways to recovery from the coronavirus.

The market has been laser focused on stimulus and how much more it can get. They may initially see a win by Democrats as a victory, but in my opinion that will be short-sighted. The economic and other policies Joe Biden ran for may be necessary to help make the economy more balanced, but it will create some short and intermediate-term hits to many parts of the economy and market to implement it. Unlike our current president, I don't see Joe Biden as somebody who treats the level of the Dow as a scorecard, meaning he is not likely to back down on some policies just because the stock market fell 5%.

Economy Grinding to a Halt

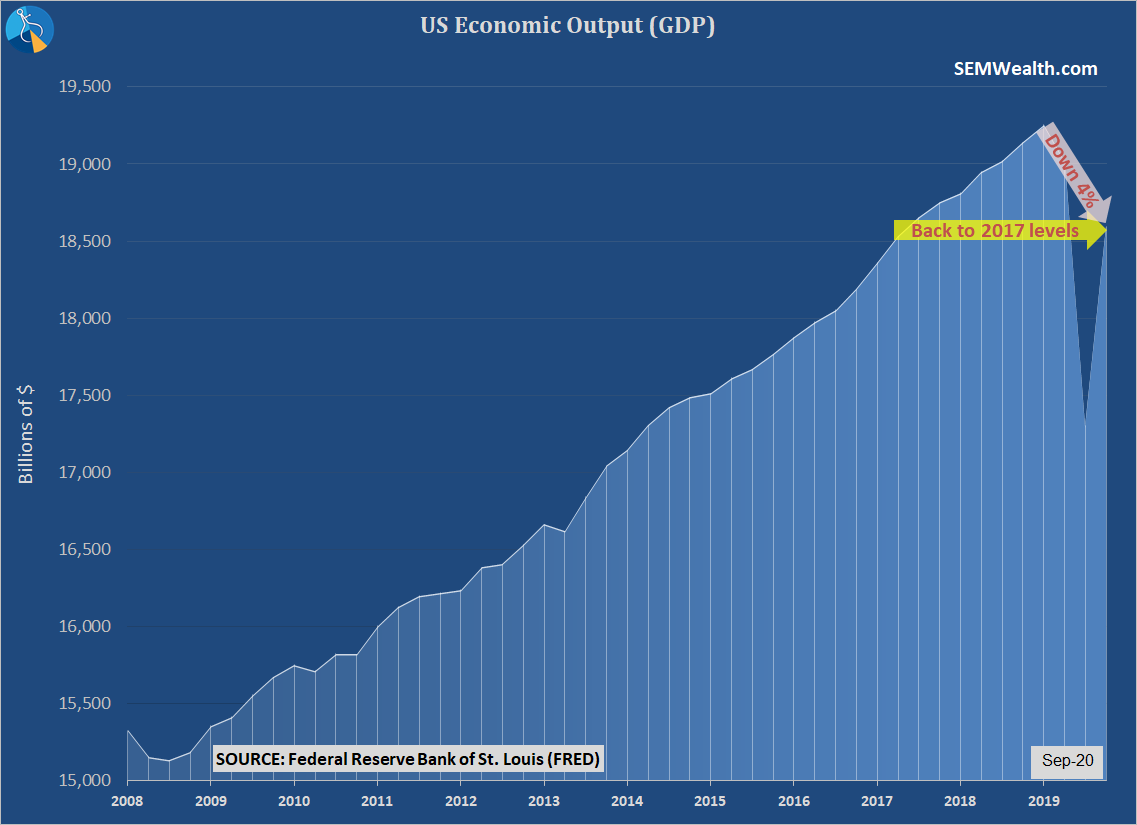

The market is focused on the 2nd half of 2021 as the time economic growth gets back to normal. They may ignore the next couple of quarters, but we shouldn't ignore the long-term damage that is taking place. As the duration of unemployment continues to increase, small businesses close their doors, and families have to decide which bills to pay this month, the risk is for significant structural damage that will be shift the long-term growth rate lower than analysts are pricing into the market.

We'll dive deeper into the economy next week after we get this week's December economic data. For now, here's a reminder of the damage done to our economy in 2020.

Record Inflows

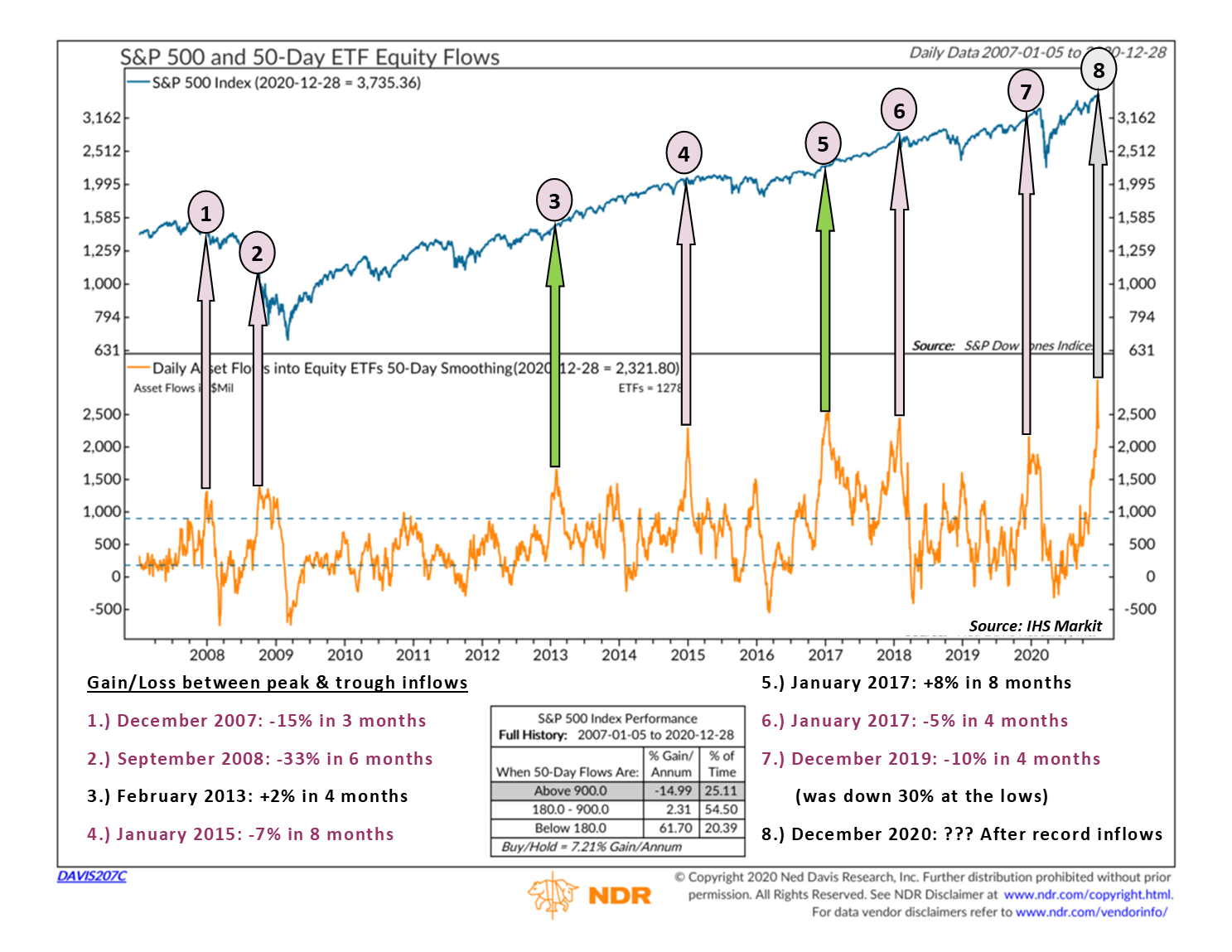

I've discussed many times how dangerous euphoria can be for the average investor. We see headlines of record highs. We hear our friends and co-workers talking about how much money they've made. We see commercials about how easy it is to make money in the market. This leads to FOMO (Fear of Missing Out). In December, we saw the highest 50-day average inflows into ETFs on record.

I marked on the chart past spikes in flows. As you can see in 5 of the 7 times we saw a large drop in the market following those big spikes. Note the big outflows during those periods. People panicked and bought in at the highs and then panicked and sold near the lows. It's the same story over and over again.

2020 was another "proof of concept" year for SEM. We started the year just as "bullish" as anybody, but in mid-February our systems began to cash in our gains. Our systems guided additional selling the first couple of weeks of March. When most people were selling anything they could, our systems stood ready to buy, which they started doing in mid-April

Record inflows do not necessarily mean the market is for sure going to fall, but it is a sign that we are in a euphoric stage of the market, which is very dangerous to those without the systems in place to exit when the momentum wanes.

A Focused Portfolio

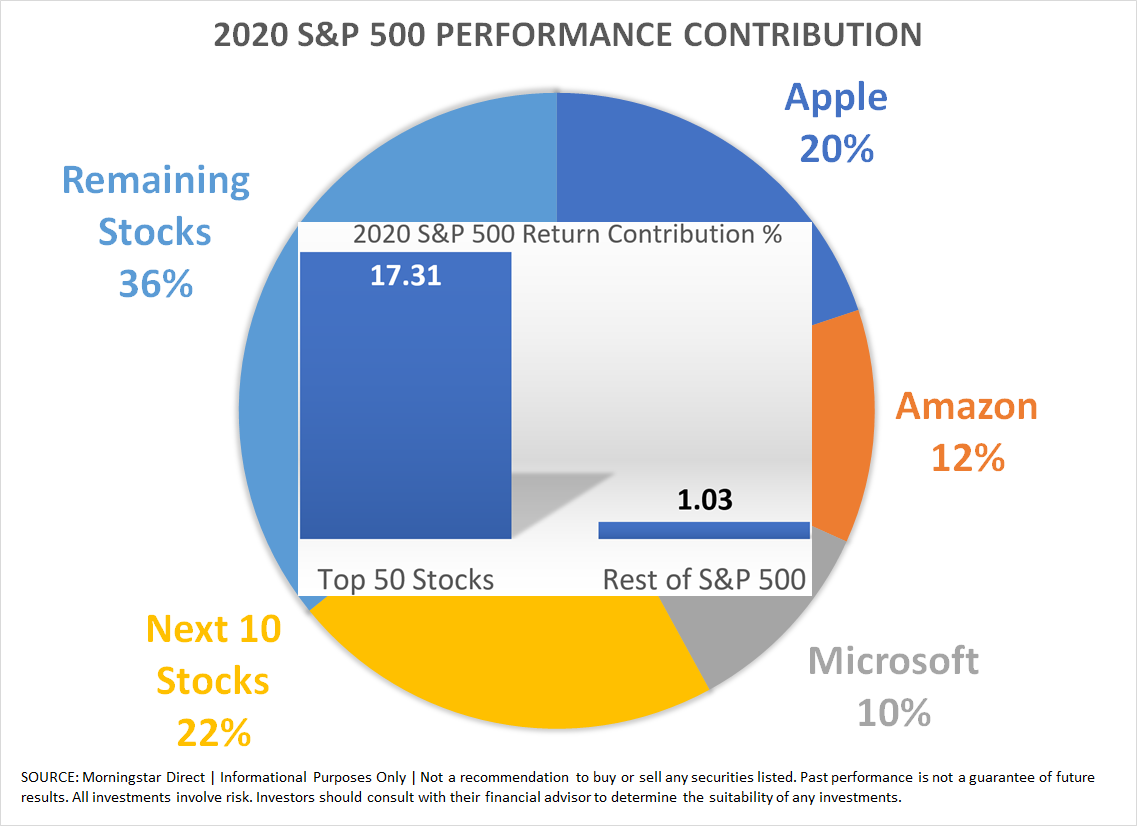

We've fielded many calls and emails from clients asking about buying Apple, Amazon, Microsoft, and Tesla (among others). Our response, especially after Tesla was added to the S&P 500 has been, "you already own a bunch of it via SEM's AmeriGuard and Dynamic models and probably own a bunch in your 401k, TSP, or other employer plan." The reason is those stocks represent a large chunk of the S&P 500, so any index fund is heavily exposed to their performance.

That obviously paid off well in 2020, but what happens in 2021? Unlike those following a passive or do-it-yourself approach, SEM has mechanisms in place to reduce our exposure to those stocks. In October, AmeriGuard scaled out of Large Cap Growth to add positions in small and mid-cap stocks. It is likely when we run our quarterly allocations this week we will see further reduction in our large cap positions.

Here's the problem the S&P 500 is facing — the companies who led the market higher all benefited from the "stay-at-home" economy. Their earnings were up in a bad year for the economy because so many people needed to purchase their services. Are we really to expect those companies will experience the same level of growth in 2021? Even if the other S&P 500 companies see growth, will it be at the same rate we saw from the big tech stocks?

2021 could be set-up similar to 2000. Remember in 1999 businesses and consumers alike had to upgrade their hardware and software to be compatible with the "new" 4 digit dates (for younger readers, computers last century read the year as a two digit code). At the same time Congress and the Federal Reserve had provided significant support to the economy to ease the transition. When 2000 rolled around we learned not only did demand fall for technology, but the Federal Reserve had to "normalize" their policy out of fear the free money the created had created an unsustainable bubble.

I don't see the Fed pulling back as quickly in 2021 as they did in 2000, but they have hinted they could if the economy started to gain traction. At that point we'll see how capable the economy is at standing on its own. More importantly, we'll see what the new "normal" is for spending levels across many industries.

COVID Fatigue

We started the Monday Morning Musings (MMM) the week back in March when the whole country suddenly woke up to the potential damage done by the novel coronavirus. I'm tired of writing about it. I'm tired of wearing a mask. I'm tired of questioning the activities of people we let into our "bubble". From the start I've been a proponent of following the science and giving them a chance to learn about this new virus.

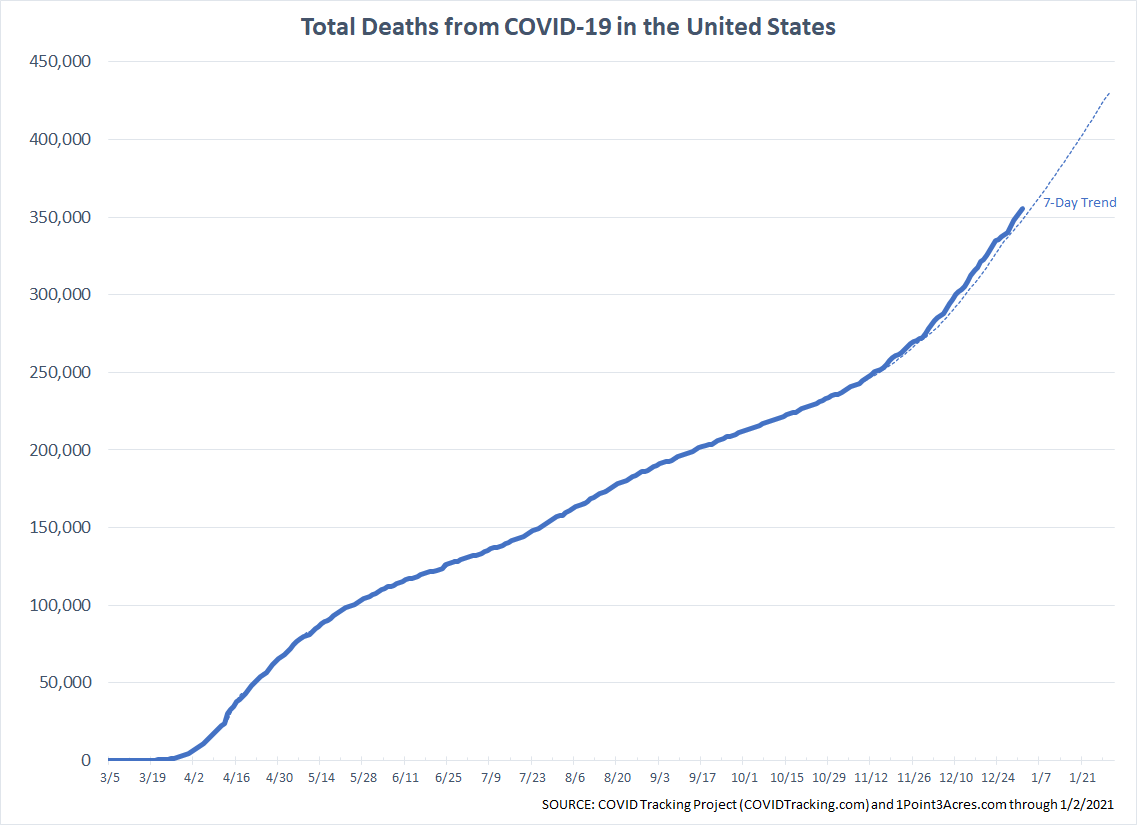

Scientists were the stars of 2020, yet due to the politicization of the coronavirus (from both sides) since the outset in January, we are still seeing far too many deaths, hospitalizations, and suffering. I may be tired of it, but it doesn't make it any less dangerous. In fact, as I predicted when we first heard about the "faster spreading" strand in the U.K., that strand has also been running rampant in the US. We have two vaccines, but both political stances, and incredibly inefficient distribution plans only a fraction of the population has been vaccinated. At the same time, we have more deaths each day now than we had back in the spring. It's likely to get worse before it gets better.

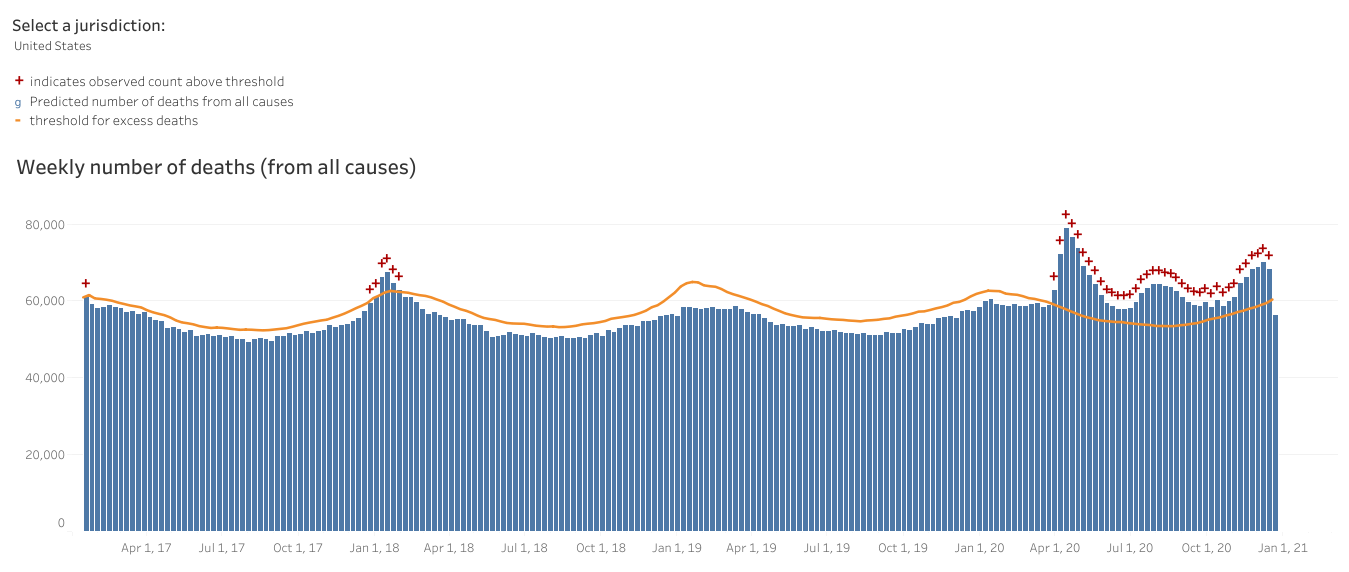

I understand there are questions about the data and how many deaths were cited as "COVID-19" where the patient had underlying conditions. COVID19 predominately attacks the weak. The chart below from the CDC plots the "normal" expected death rate based on historic averages. The red crosses are weeks excess deaths were higher than normal. Whatever the cause, far more Americans died this year than is "normal".

Please be safe out there. It may not be deadly to some, but we've heard from too many people the past month who let their guard down and now are in the hospital, struggling to survive.