A year to remember

For most of us, 2020 felt like the longest year of our lifetimes. It’s easy to forget everything that transpired in 2020. What is interesting about investing is how our assessment of our portfolios is based on what has happened most recently. A year ago, we wrote about the excessive risk taking happening in the market and the concern we had over the very narrow leadership in the stock market. With the spectacular rally off the lows in the spring, many people have forgotten how quickly our concerns turned into very heavy losses for those in a buy & hold portfolio.

Thankfully for most, the Federal Reserve and Congress bailed out investors with unprecedented action. That has led to the assumption they will always be there to do the same the next time the market falls. We would caution anyone from trusting the bureaucrats to save them from poor investing decisions.

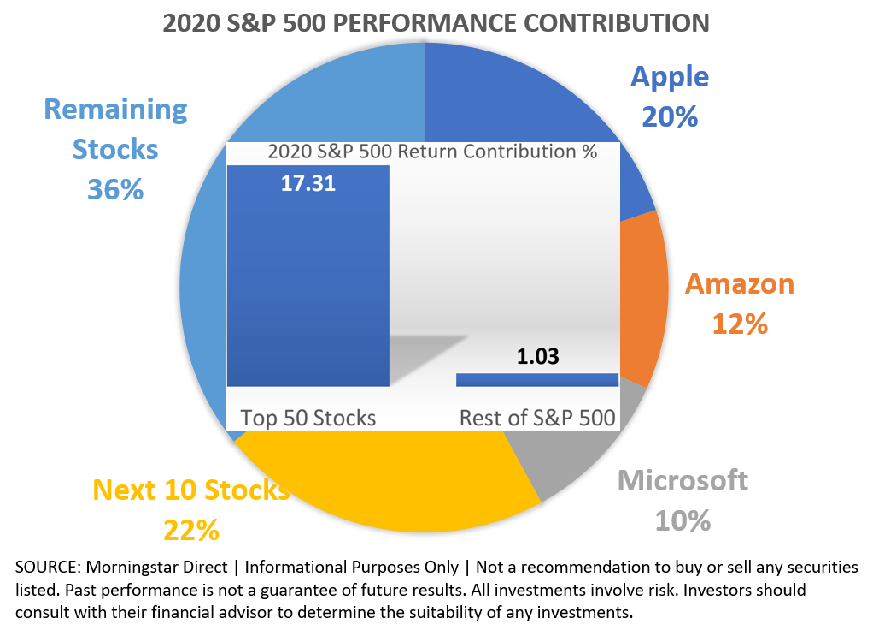

As we enter 2021, we find the stock market in a markedly similar position as it was at the start of 2020. While the S&P 500 posted impressive results, just a handful of stocks contributed to the performance.

Investors in passive index strategies find themselves in a precarious position where a large portion of their portfolios are invested in just a few stocks.

Our nearly 3 decades of experience tells us caution is warranted. When nearly every “expert” is expecting strong performance at a time where stock market valuation measures are at or near all-time highs it often leads to disappointment. Don’t get us wrong, we enjoy when the market moves higher. Across the board the SEM investment models enjoyed a nice year, with most beating their benchmarks and some even posting returns better than the S&P 500.

While it’s nice to celebrate a great end to a difficult year, it’s important to not lose track of the big picture.

Your Personal Benchmark

Whenever you see popular stock market averages close the year at record highs, it is natural for investors to wonder whether or not they are invested in the right portfolio mix. Based on history, investment fund flows, and market data very few people participate in the gains of the S&P 500 over the long-run. That is actually ok.

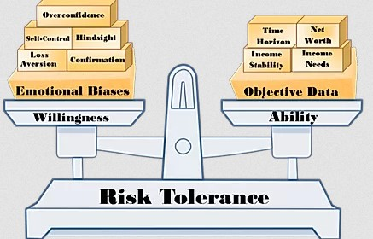

The S&P 500 is not the appropriate benchmark for most investors, especially those working with SEM. Instead, each of our clients should have their own personal benchmark determined by two factors:

1. Your Financial Plan (how much do you need to make to meet your goals?)

2. Your Investment Personality (how much risk can we take without causing you to become uncomfortable?)

For most people, their return benchmark is somewhere between 3-6% per year depending on the two factors above. In order to generate higher average returns than that, you would have to be comfortable risking 25-50% of your investment value. Very few people will tolerate that sort of loss. The good news is, if your portfolio beat your personal benchmark you are ahead of the game!

If you would like SEM to take a look at your current portfolio and compare it to your own personal benchmark, go to risk.semwealth.com

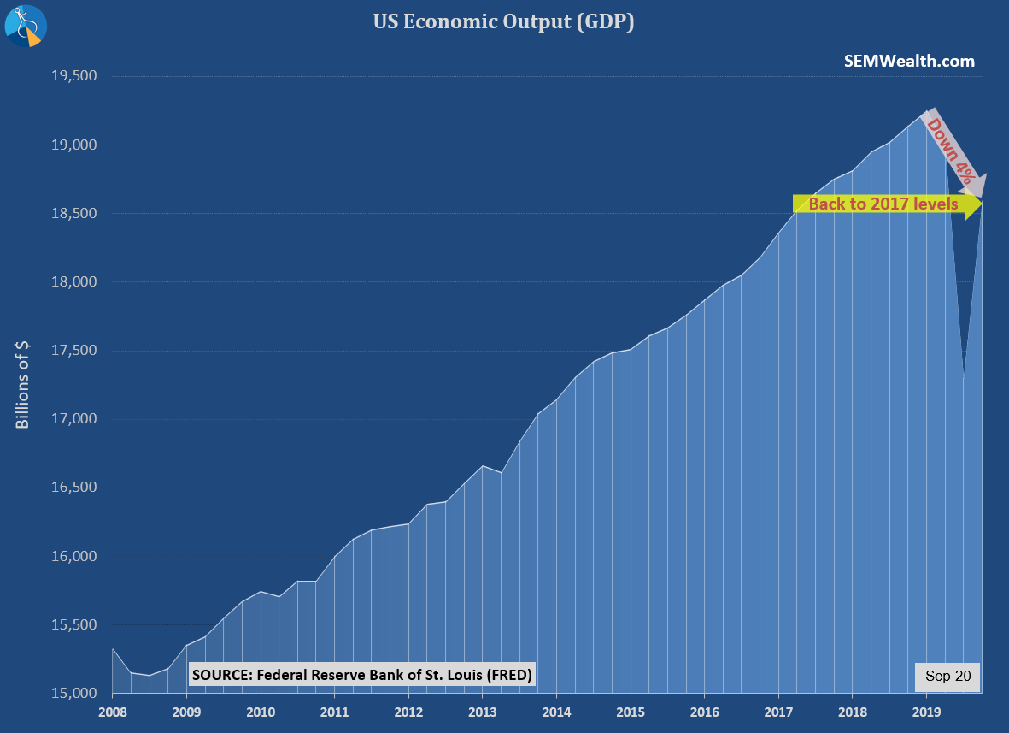

The market is not the economy

A year ago we discussed the large disconnect that took place in the stock market and economy during the 2010s. Over the long-run the stock market should not be able to grow at a rate faster than personal income, economic growth, and inflation. We won’t bore you with the math behind it, but that’s just a fact of investing. Over the short-run, however, the stock market can exceed personal income and economic growth for many reasons.

In 2020 many companies benefited from the pandemic, while too many others suffered. The companies who benefited drove the stock market to new all-time highs. The question for 2021 will be whether or not the economy can recover quickly enough to justify the gains or if the stock market will need to re-price the “new normal.”

The economic divide we discussed at the end of 2019 only widened in 2020. Solving the divide without hurting the market will be a difficult task for our leaders.

Stay tuned to SEMTradersBlog.com for more details on economic developments in the months ahead and how we are positioning our portfolios.

Download / Print version of the newsletter

News & Notes:

2020 Year-End Tax Statements – what to watch for early 2021:

For taxable accounts, federal law requires your custodian to mail your IRS Form 1099 to you by January 31. Due to the increasing amount of reclassified mutual fund distributions, E*Trade Advisor Services has had this extended to February 15, 2021.

SEM strongly recommends you do not make your tax appointment until after February 15.

The 2020 Consolidated 1099 mailings to you includes cost basis and sales proceeds for investments sold during 2020. This provides essential information needed to complete your Federal Tax Filing Form 1040 Schedule D and Form 8949. Please wait until you receive E*Trade’s 2020 Consolidated 1099 prior to completing your taxes.

For those clients that consolidated taxable accounts from another custodian to E*Trade, you will receive forms from both custodians.

SEM will be posting additional information on the tax reports on our website: SEMWealth.com/tax-information

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.