Modeling the economy is especially difficult. It's over $20 Trillion and has hundreds of moving parts. I created our economic model back in 1995, a time when I had to go to the library to get the data out of a book once a quarter. By 1998 I could access the data on the internet, although I had to manually enter it into my spreadsheets, which wasn't fun when there were revisions to the data. It was mechanized in 2001 when the Federal Reserve added an online Excel tool to download the data. Other than adding the Business Activity index (which wasn't around when I wrote the original model), it has not changed.

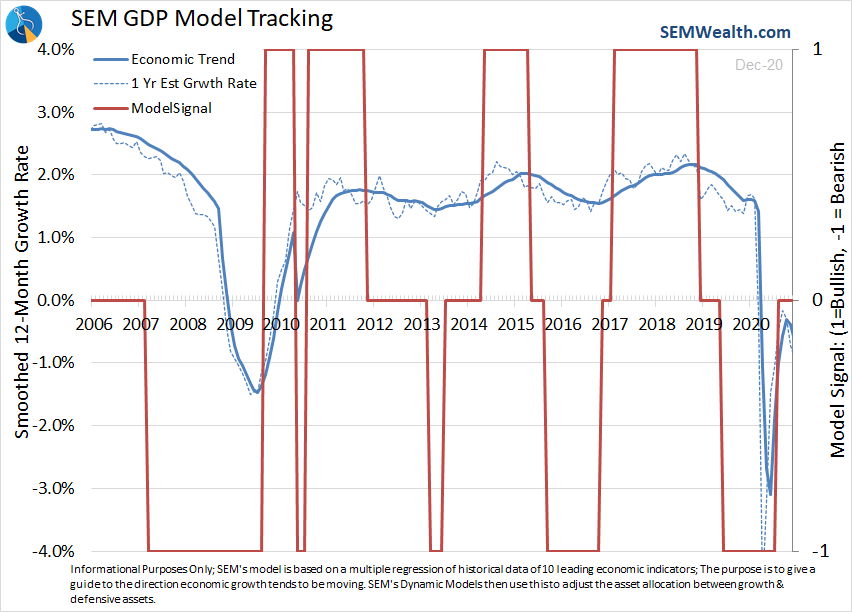

It has done an excellent job warning us about looming economic weakness. It helped us avoid the 2008 collapse and the near recessions in 2011 and 2015/16. It also helped us identify the weak economy that COVID attacked and had us safely positioned last winter well before COVID made news headlines. This recession was obviously one like we've never seen and gave us a chance to stress test our models.

One thing that was apparent was how quickly the economy can change during a recession, especially when you have mass interventions by the Fed and Congress. The issue was how do we MECHANICALLY identify a recessionary environment in order to adjust the model to a simulative environment. Last fall I was reading a lot of different Fed research pieces and saw several mentions of the "Sahm" rule. It is named after Claudia Sahm, an economist at the Federal Reserve who proposed a mechanical way of identifying a recession more quickly.

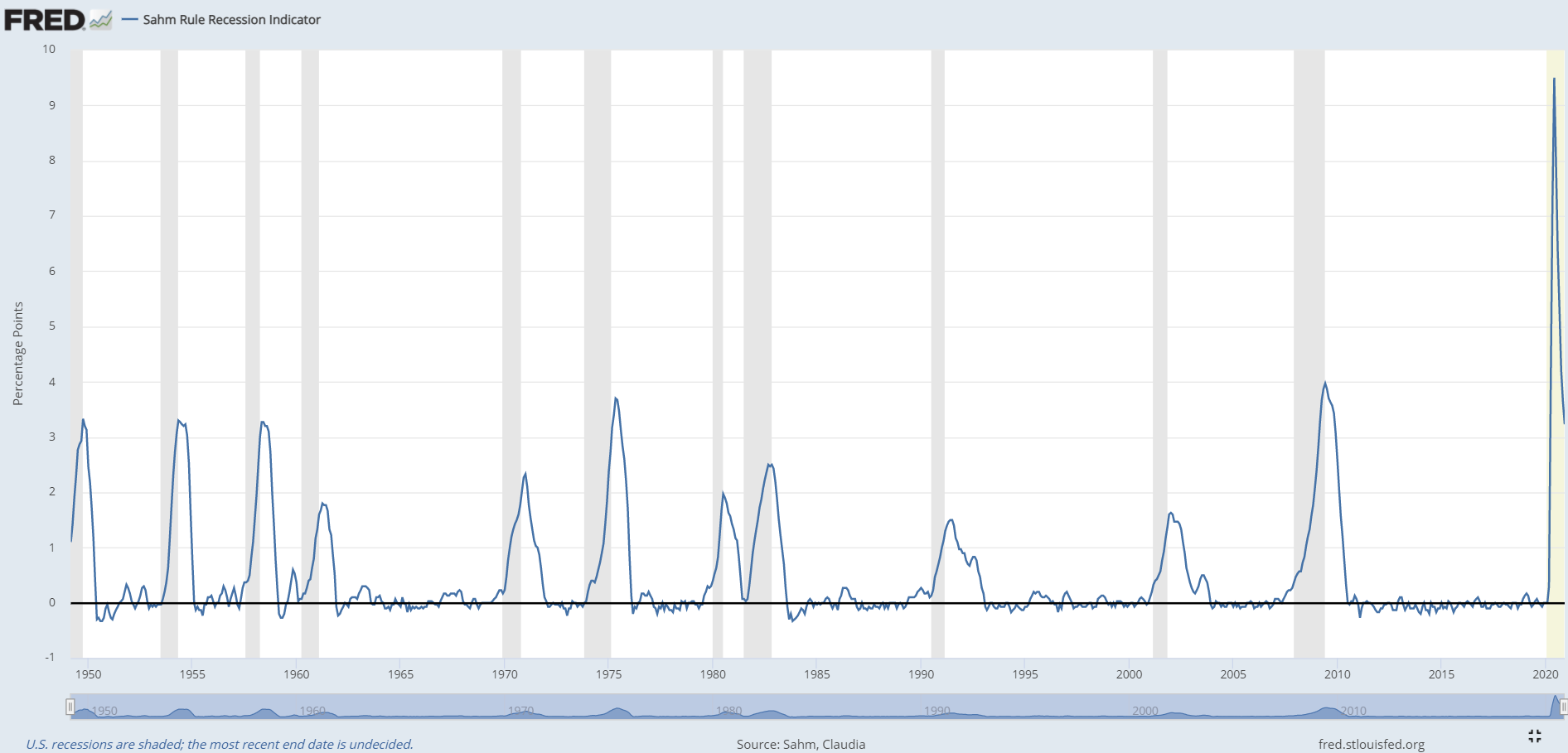

Essentially Dr. Sahm proposed that by comparing the average change in unemployment over 3 years and 12 months, you can identify when a recession might be looming. The data had been added to the Federal Reserve database in 2019 and I'd even tested it back in the fall of 2019. It didn't merit addition to our model because while it did a good job of identifying recessions, its usefulness waned the longer the expansion went on.

Lightbulbs went off last fall as I kept seeing this discussed – while the Sahm rule may not be a good indicator overall, it is a.) something that declares we are in a recession far faster than the official declaration of recession and b.) if the Fed is using it and it is saying we are in a recession they are likely going to be simulating the economy as much as possible. This means the environment has changed, which means our model needs to be more adaptive.

Normally our model looks at the rate of change over 12-month periods. The new rule I tested was if the Sahm indicator was negative we would adjust our look-back period to 3 months. This would allow more recent data to drive the model, both ahead of a recession and coming out of it. It did not change ANY of our pre-recession indicators. Apparently our model is even faster than the Fed's at identifying economic weakness. What the change did was get us back into "bullish" mode 3-5 months faster in 2003, 2009, 2011, 2016, and 2020.

We won't adjust any of our "backtested" results nor will we change the look of our model allocation charts. We want it to reflect what actually happened. Hypothetically the model would have gone bullish at the beginning of September (it would have remained bearish from mid-2019 just as originally tested). The recent economic weakness has it back to "neutral", which also aligns with the original model.

The shift would have certainly helped both Dynamic Aggressive and Dynamic Income in the 4th quarter, but they still both posted a solid year, thanks in part to a shift in both the duration models in Dynamic Income and the Global Economic Model in Dynamic Aggressive Growth.

Looking at other periods, the only other time there would have been a shift in allocations was back in 2000-2002. Even though the official recession didn't begin until late 2001, both SEM's model and the Sahm indicator began signaling a recession in early 2000. The impact on performance for the Dynamic programs was less than 0.4% during that period.

Hopefully we won't see the Sahm rule come into play very often in the future, but when it does, you can expect a much more responsive re-entry into the market.