We all know simply changing the calendar doesn't change the environment, but after enduring all the terrible things we faced in 2020, most of us were hoping 2021 would be nothing but good news. That hope was shattered on the 6th day of the year last week. I think we've all heard enough about those events, and I'll try to keep today's musings focused on the market and economy, although they are intertwined with what is happening politically. This means we have to at least understand the landscape.

Long-time readers know I've predicted this type of divide for quite some time. The demographic, social, and economic cycles are all colliding in the first half of this decade. The ending of each cycle always brings some sort of turmoil. This triple cycle has us set-up for a very painful period that will likely change the entire structure of our economy. What follows though should be a generational opportunity. The trick is navigating and surviving it so you have money still available to take advantage.

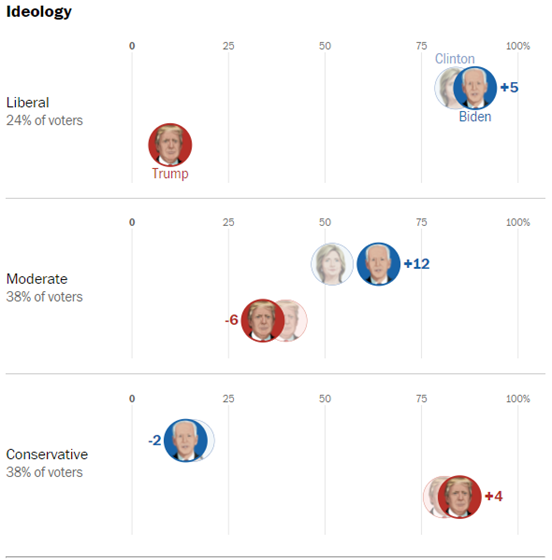

No matter which side of the political aisle you currently sit, or if you're like me, a registered Independent, it is important to put aside your political ideology and realize there is no singular solution to our country's problems. We will see what the fall-out is from last week's events. I've said since 2016 the future will include either a reformed Republican platform to be more inclusive of those frustrated voters, or we will see a powerful third party emerge. The election was decided by moderate voters who supported Donald Trump in 2016 backing Joe Biden in 2020.

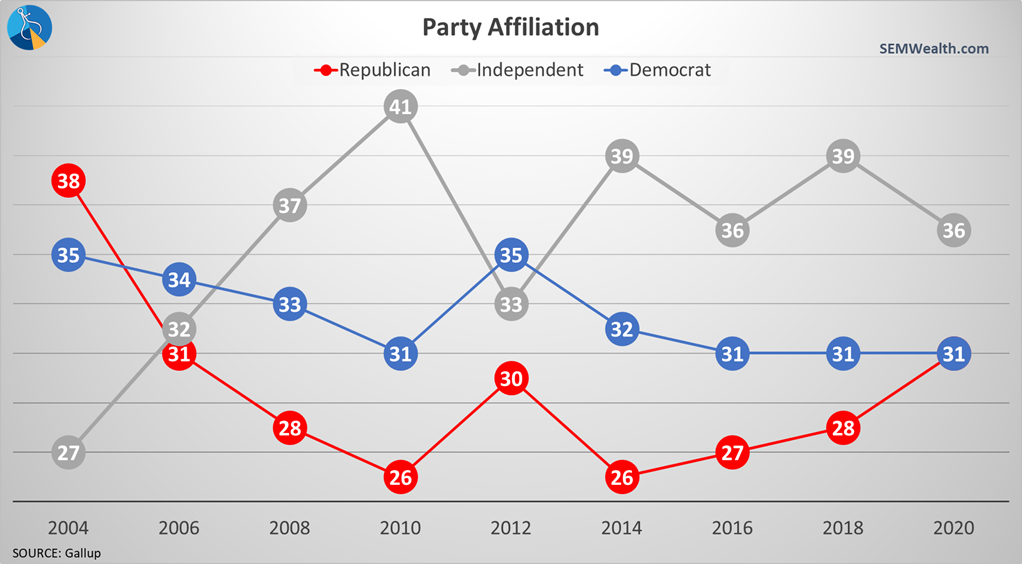

Both parties have lost voters to Independents the last 20 years. While America seems polarized, it is only because the two parties have continued to cater to the far left and right fringes rather than the rest of the country. The "Problem Solvers" Caucus, a bipartisan group of lawmakers who have committed to only working on things that both sides agree need addressed could be the early start to a more moderate party. If they garner the support from outspoken Republicans such as Mitt Romney they could be a major force the next two years as well as the group that dampens the polarizing rhetoric.

2020 was likely just a preview of what we should expect for at least the first half of the decade. I think SEM certainly proved our worth in navigating the unknown. Whether you are an individual investor or a financial advisor, if you are banking on a passive or do-it-yourself strategy that served you well the last 15 years to get you by the next 5, I think you're going to be in for a tough time. We all have enough to worry about, trying to figure out what matters and what doesn't when it comes to investing is only going to get more difficult.

In case you missed it, last week we posted the first in a new periodic series of short video musings.

Capital invaded, market rallies

By far the most asked question last week was how the market could rally despite the terrible events last Wednesday. The answer is fairly straight forward – earlier in the day we learned the Democrats will control Congress, making it easier for fiscal stimulus to be passed. The hope is the stimulus will be enough to fill the growing air pocket we are seeing in the economy.

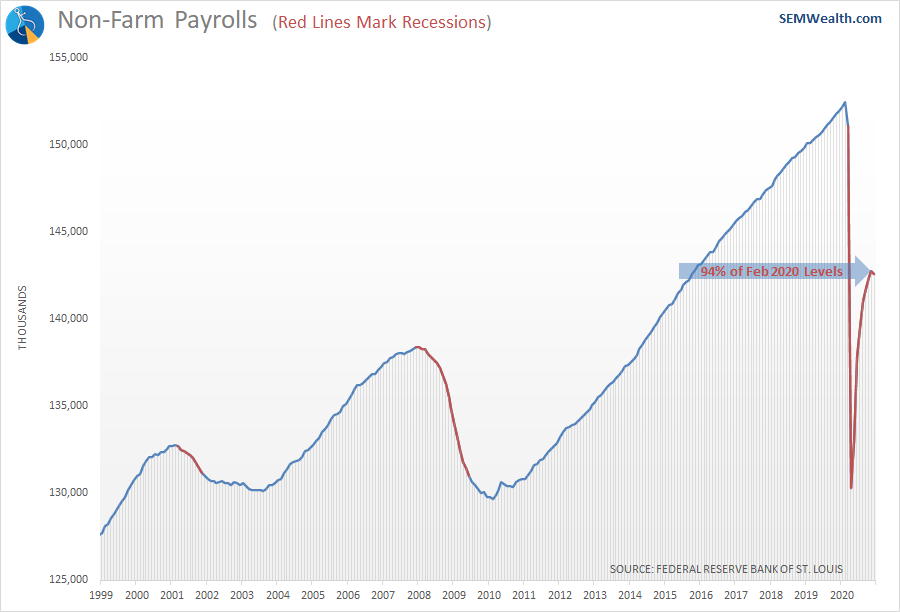

Even weaker than expected

The economic data continues to weaken. There is now a chance we will see a negative GDP number again for the 4th quarter and possibly even the 1st quarter depending on how much and how effective additional stimulus is. The labor market stalled in November and fell in December. The number of jobs is just 94% of where we were at a year ago and is all the way back to 2015 levels.

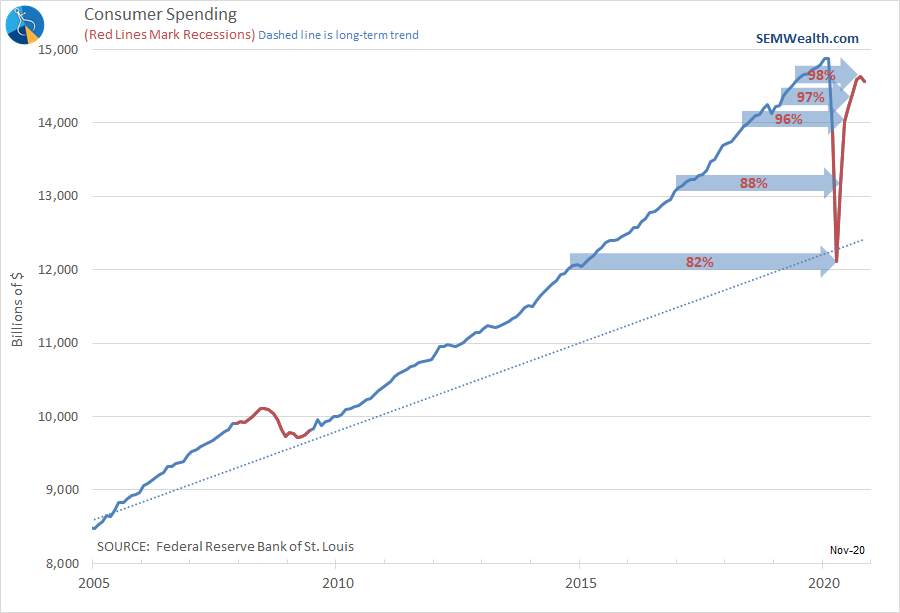

Consumer spending, which is a month behind the jobs numbers appears to be on the same path. Spending, though is at 98% of the peak in early 2020.

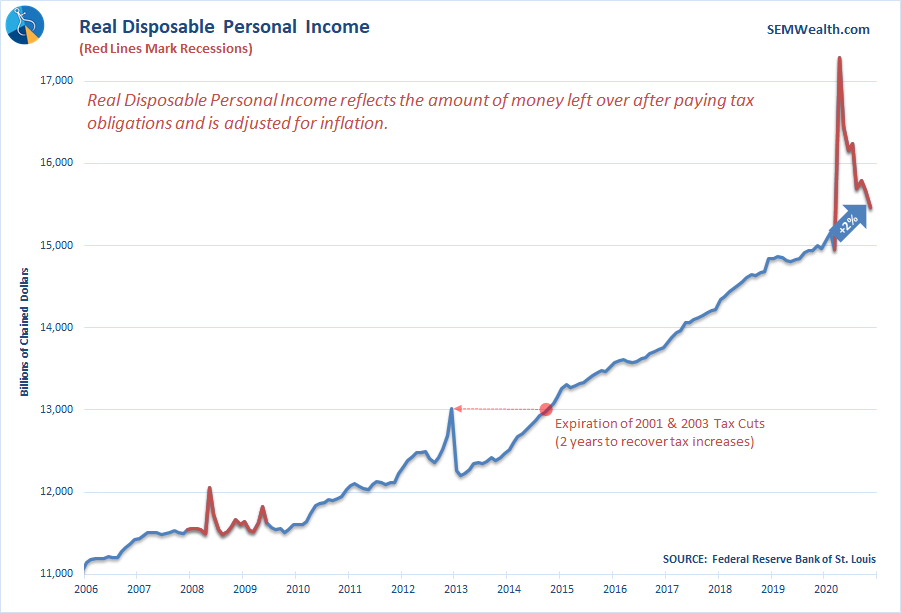

The reason spending is a little better than jobs is simple – a large group of people (which likely includes nearly everyone reading this) were able to continue working. Many of those people still received stimulus checks and will be receiving them again. This led to a spike in personal income overall.

This has been fantastic for stocks, but the question is whether the underlying weakness in the rest of the economy will begin to hurt corporate earnings and thus bring down the market. The stock market is betting it won't, but we choose to focus on the data.

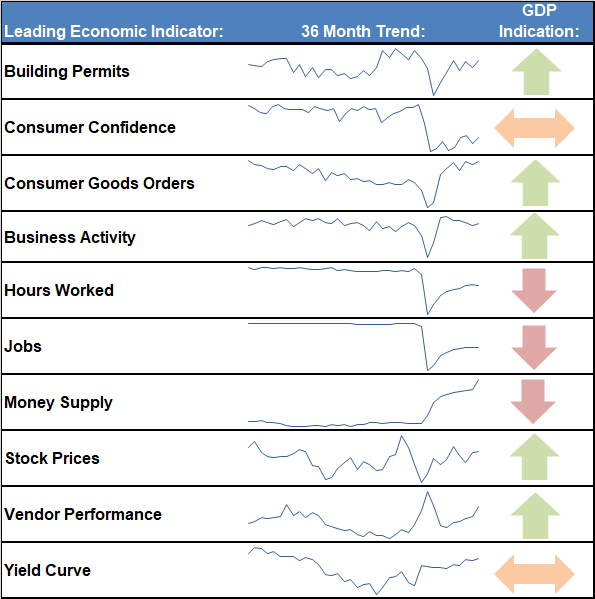

Overall, our leading indicator dashboard remains mixed.

Rolling Over

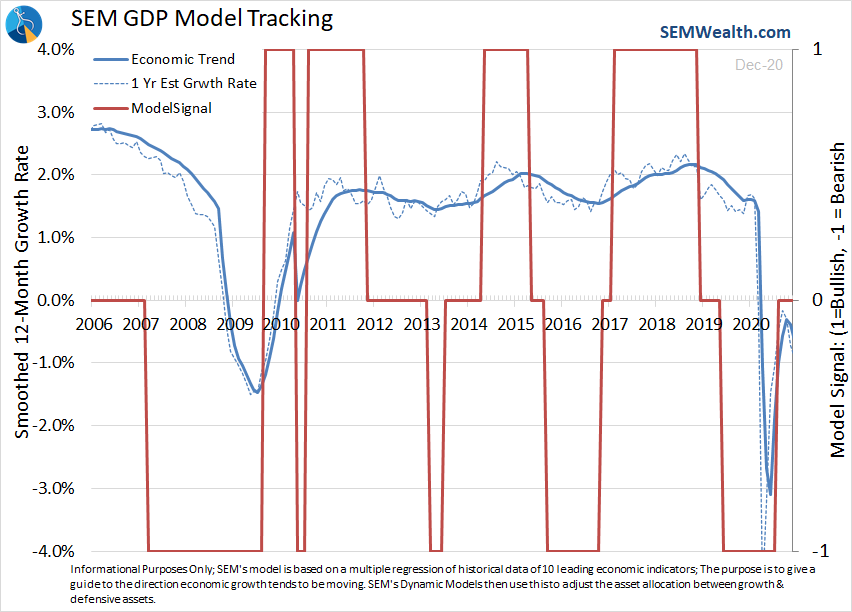

While the number of positive and negative indicators remained unchanged last month, the drop in jobs and income along with the slowing growth in spending has had a big impact on the economy as shown in our economic model.

The next few quarters (and years) could be dicey. Last fall we upgraded our economic model to make it more responsive during times of recession. Check out the details here:

Locking in some gains

Since April it has appeared very easy to make a ton of money in the stock market. With so much money flowing into the economy, those who did not see their income disrupted have poured money into the stock market. Until the last few months, large cap growth stocks have by far been the leaders of the market.

One thing I say to anybody boasting about the money they've made in a particular stock or sector is, "it's not a profit until you cash out." Until then it's just a gain on paper. Unrealized gains can quickly disappear, which is why I always recommend trailing stop-loss orders for anybody speculating in individual stocks.

While we do not have stop-loss orders in our models, we do have mechanisms that look to cash in our gains if the momentum in a sector wanes. AmeriGuard did this the first week of October, moving about 30% of our AmeriGuard-Growth portfolio into Small and Mid-Cap Growth. (Balanced, Moderate, Aggressive, and Max made similar adjustments). This was a timely move as those two sectors nearly doubled the performance of large caps during the quarter.

This quarter AmeriGuard sold another 15% of the Large Cap Growth positions, replacing it with Small Cap Blend. This leaves AmeriGuard-Growth weighted at 60% Large Cap, 15% Mid-Cap, and 25% Small Cap. (Again Balanced, Moderate, and Aggressive have a similar split). AmeriGuard-Max has a similar split, but only has about 12% in Small Cap. The remaining balance was added to Emerging Markets.

Our Cornerstone Models made similar adjustments.

Time will tell if these are good moves. In general, the moves in large cap stocks have made them historically expensive, meaning the chances for continued out-sized gains are diminished. From a growth perspective smaller companies should have much more potential if the expectations for mass stimulus come to fruition.

The last surge?

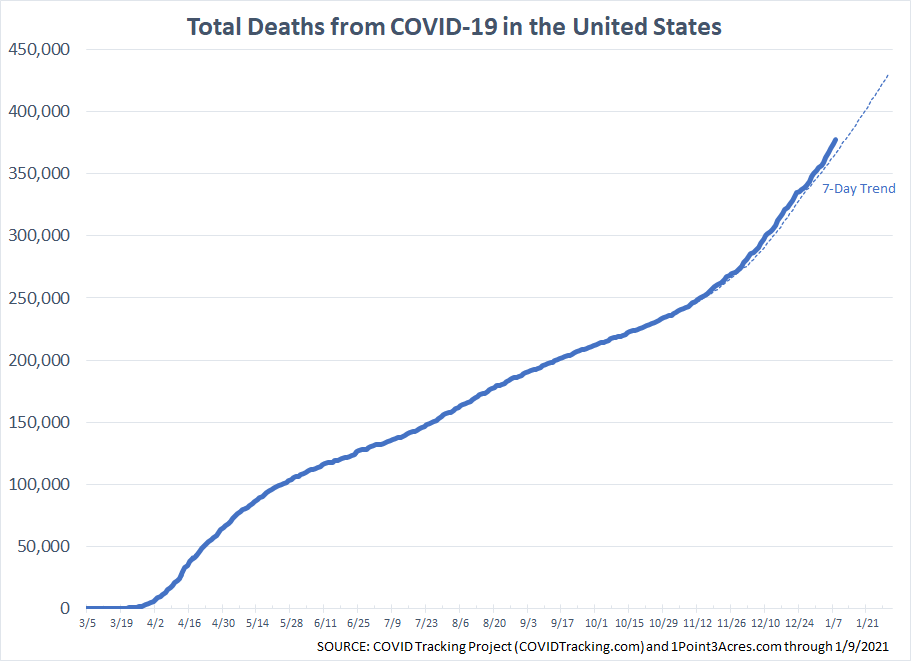

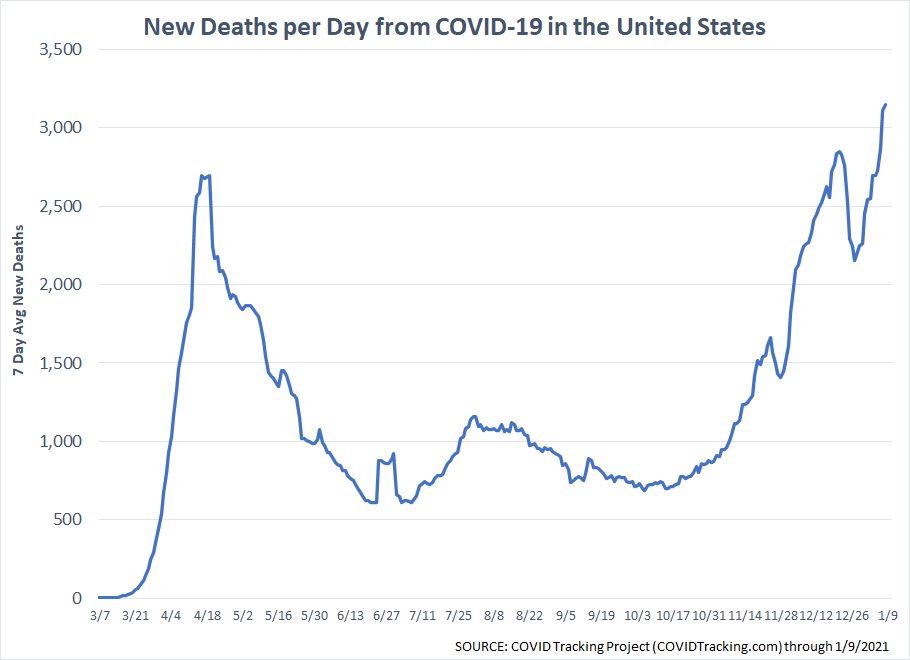

I mentioned last week the COVID fatigue we're having here, which I'm sure is the case for most of us. The on-going surge in cases, hospitalizations, and deaths shows we cannot be complacent. Whatever mutation variant is currently spreading it is staggering how many people I know have caught it in the last two weeks, including several of our advisors.

The pace of COVID related deaths has escalated rapidly.

Please be safe out there.