The problem with a Federal Reserve who says they are both 'data-driven' but calls the data 'noisy' is it is difficult to determine whether or not the most recent data will change their mind. Their track record in predicting things like an implosion of a tech stock bubble, a financial crisis, runaway inflation, or the failure of 3 banks which wiped out over 20% of the FDIC insurance fund should call into question their ability to determine whether or not inflation is under control.

For us it does not matter whether they are right or not. What we care about is the market's reaction. Last Friday we saw two data points that should raise red flags to anyone believing the stock market will continue its 9-month melt-up.

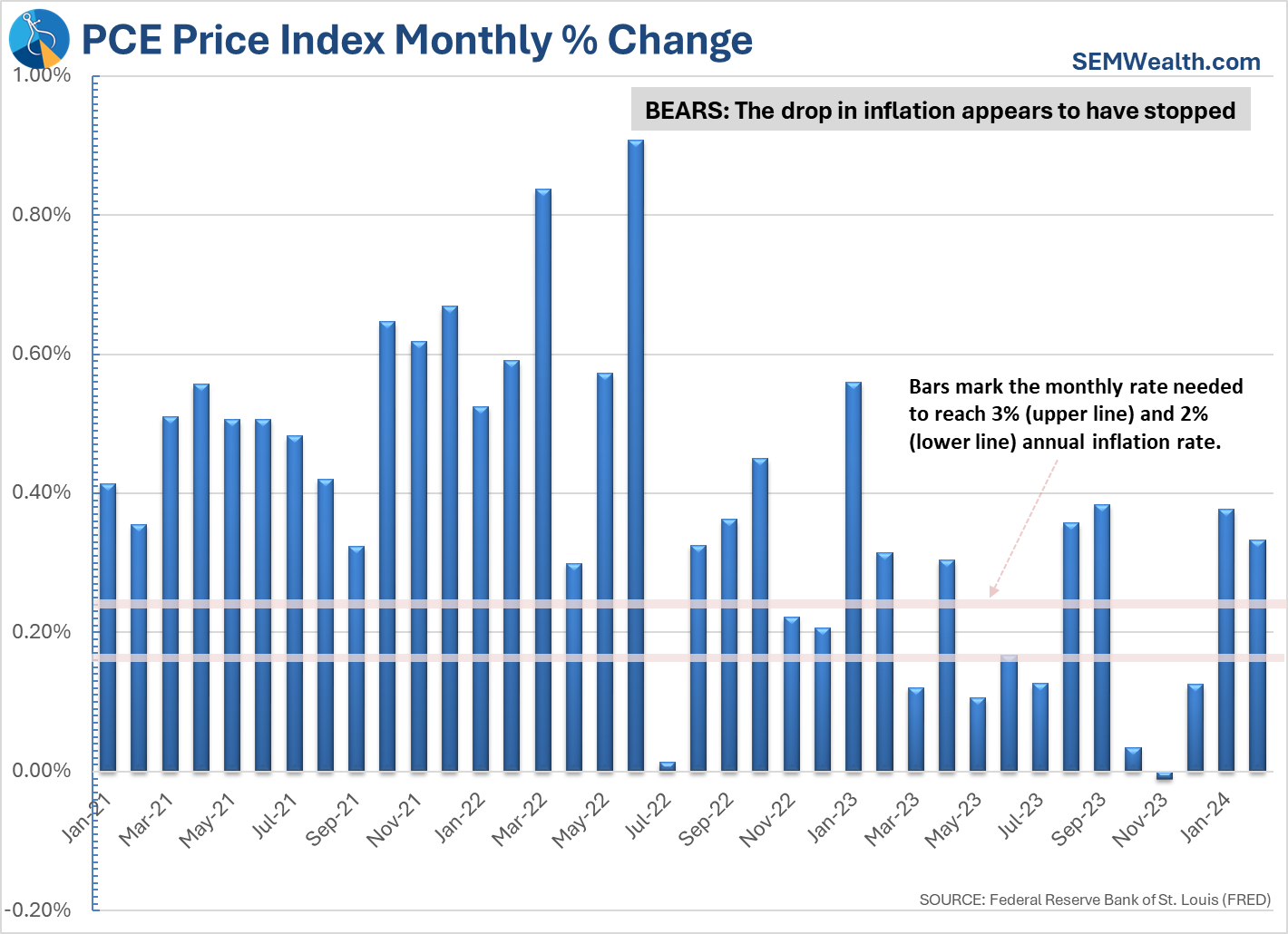

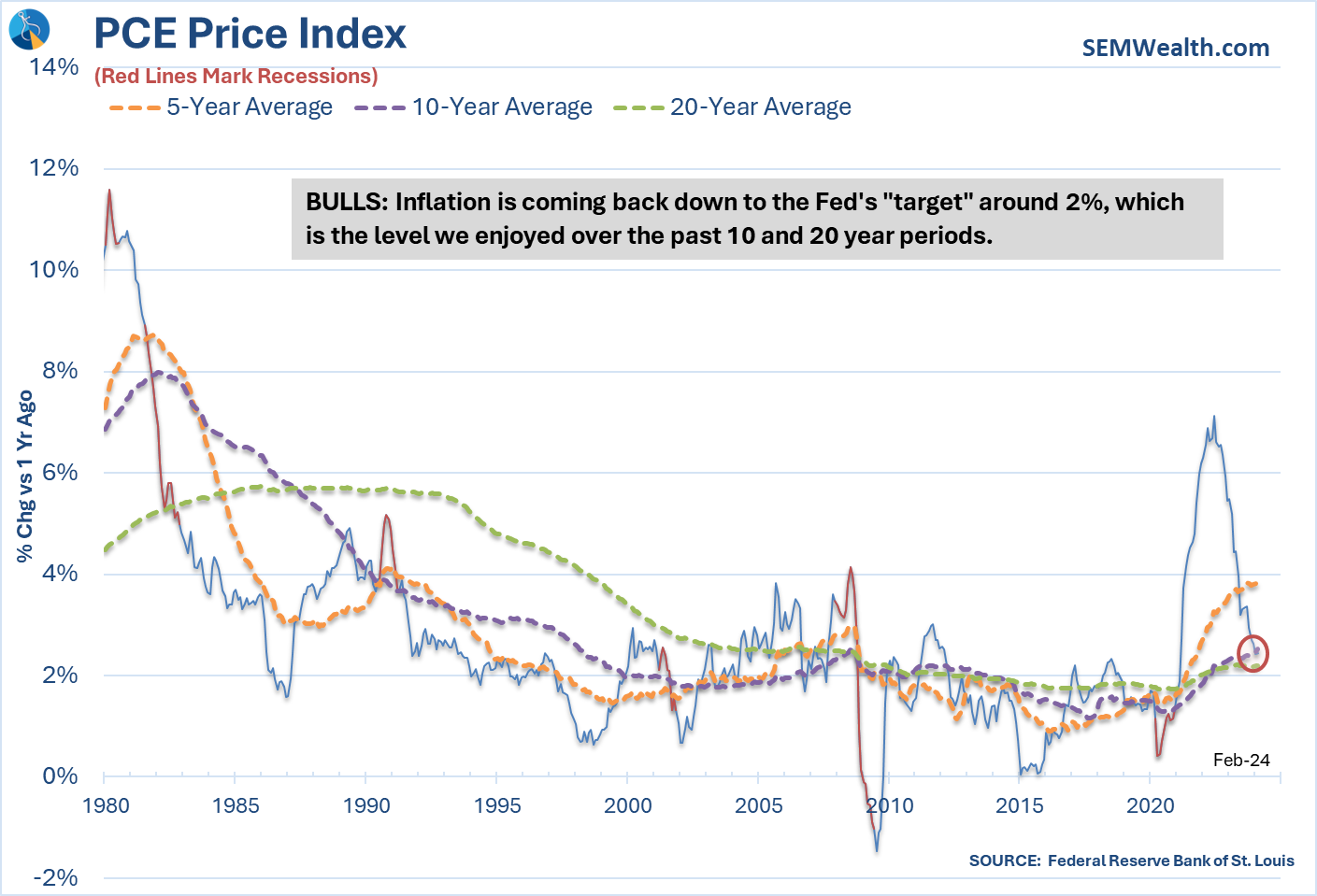

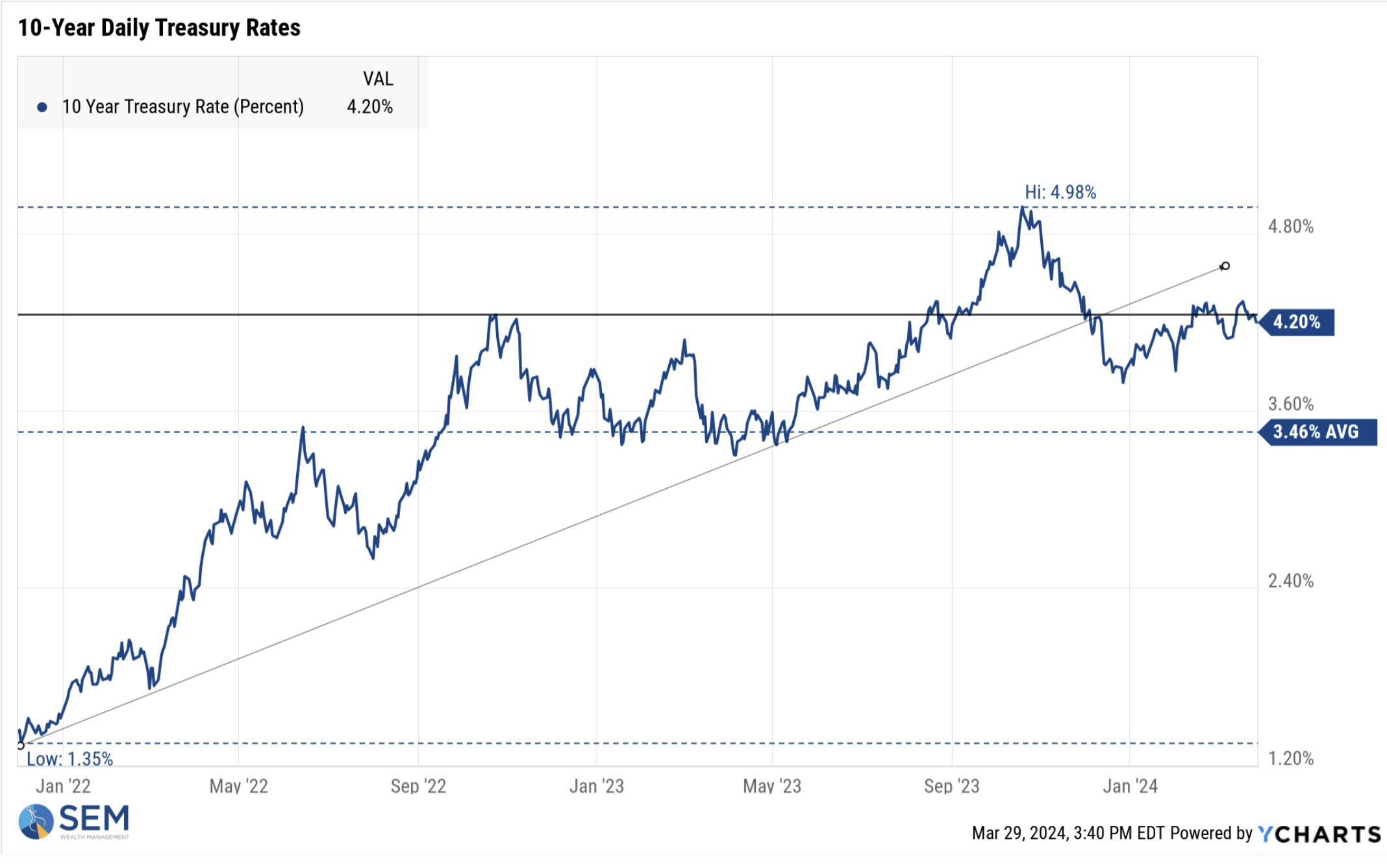

The first was the PCE Price Index, the Fed's so-called 'preferred' measure of inflation. The monthly data points to the problem. The uptick in the monthly numbers is a problem for the Fed. In the next 5 months we are going to drop 4 monthly readings from the 1-year data which were below the 2% annual rate. If they are replaced with numbers above that rate then we are going to be looking at inflation going into the fall well above 2% and possibly above 3%. That makes it hard to justify 3 rate cuts, which is the current market expectation.

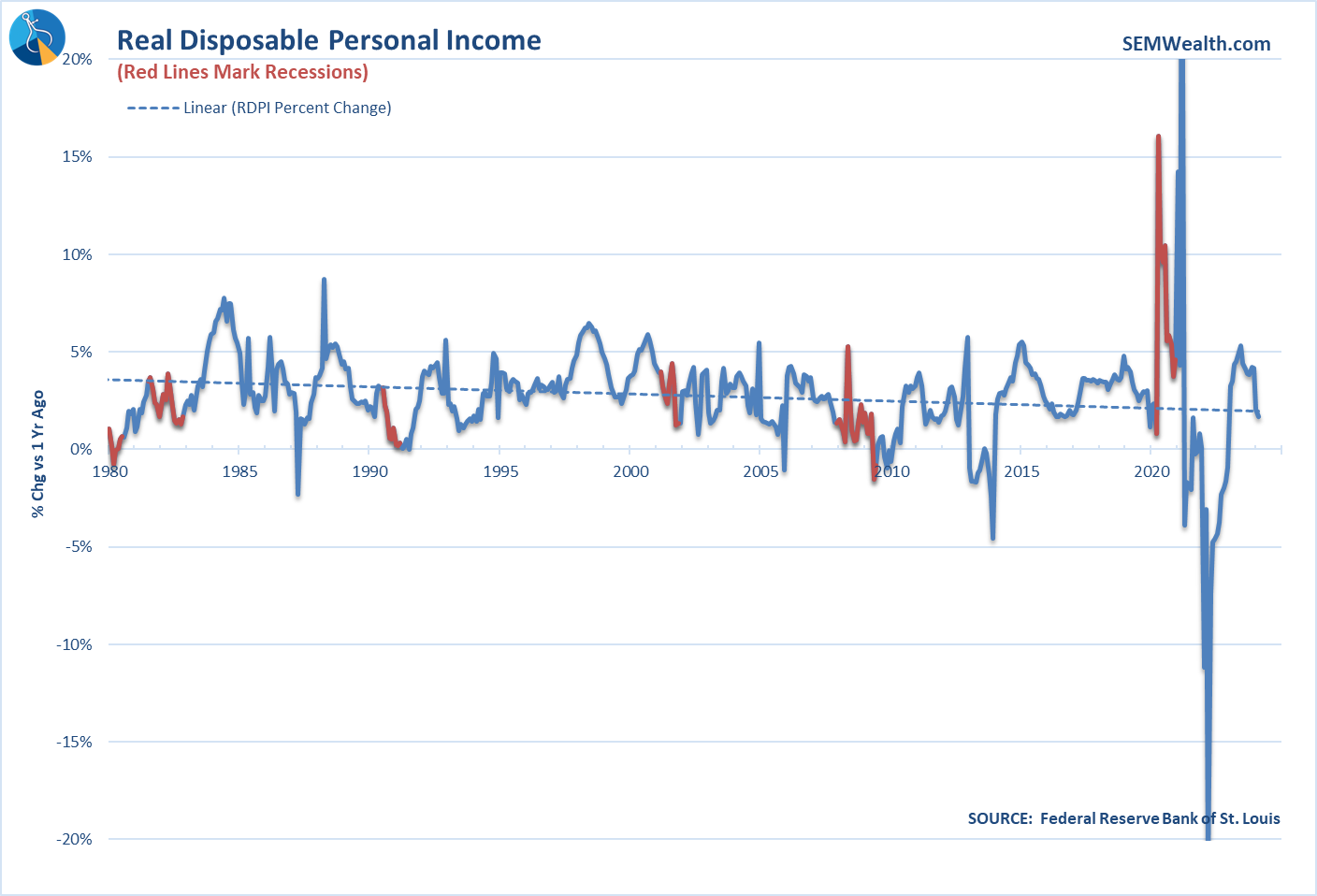

Within the same report, Personal Income growth fell to the lowest pace in 15 months.

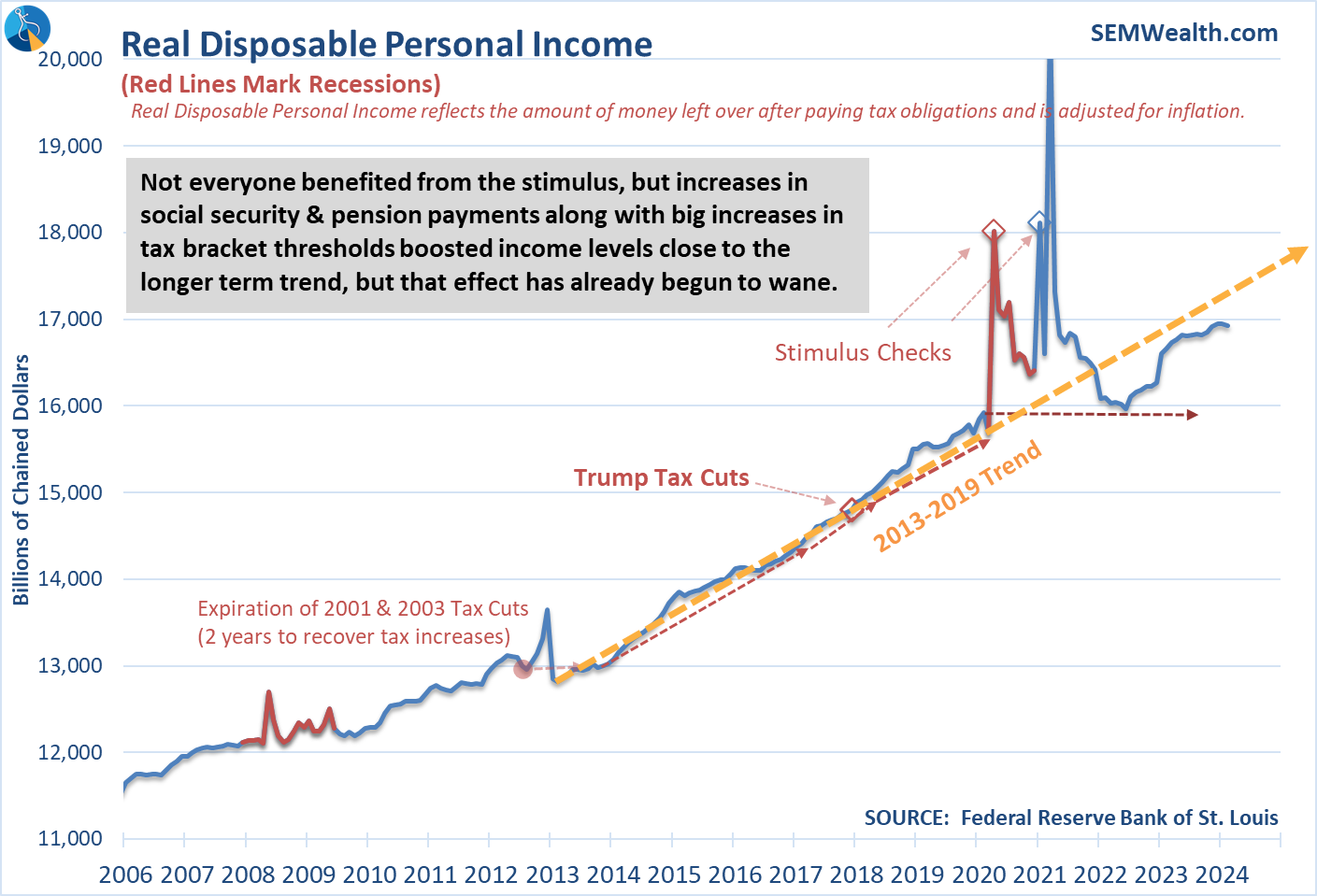

As we discussed last week, the Fed has the difficult task of helping the lower half of our K-shaped economy without further adding to the speculative bubble by also helping the upper half of the K. Personal Income has flattened and is below the 2013-2019 trend.

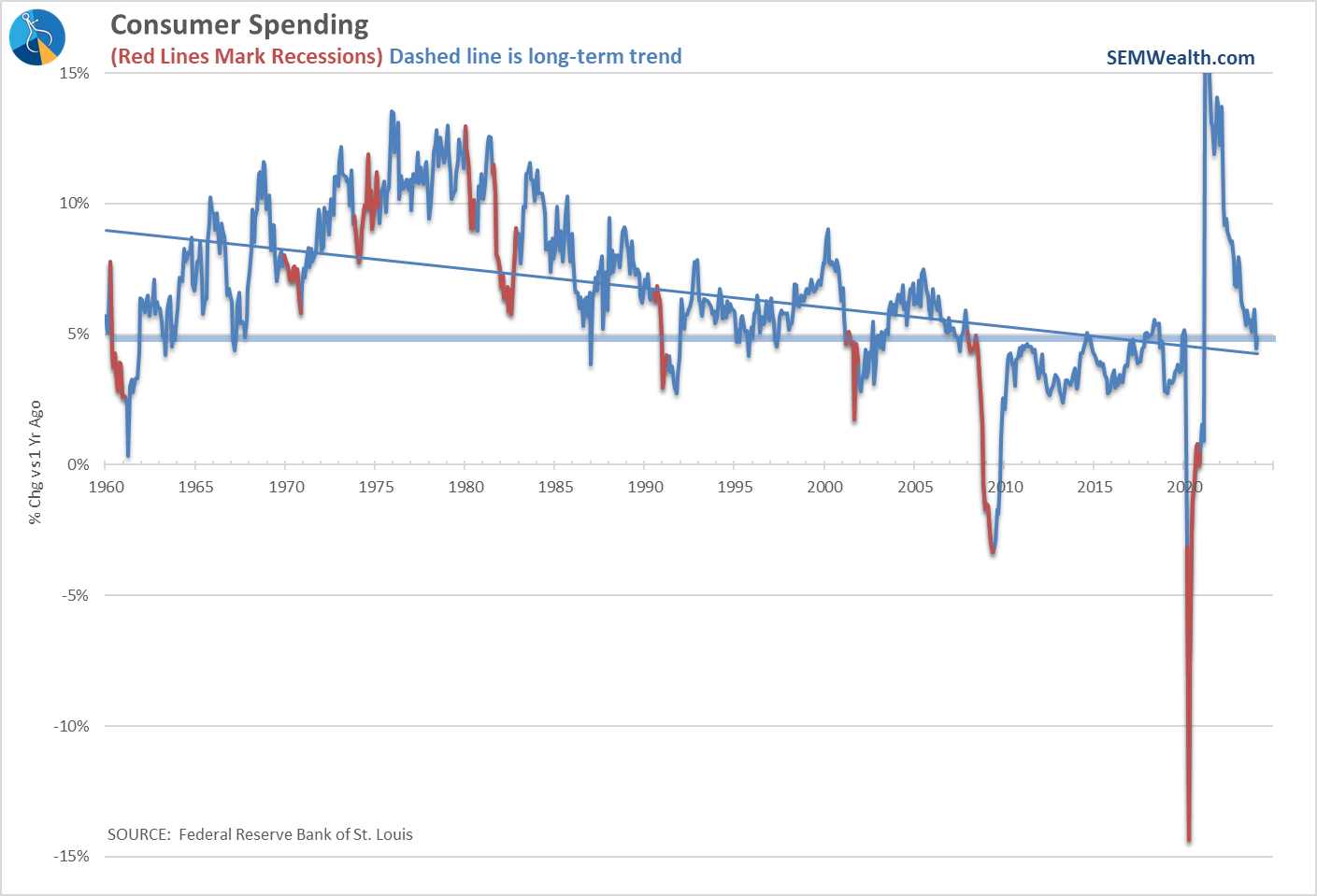

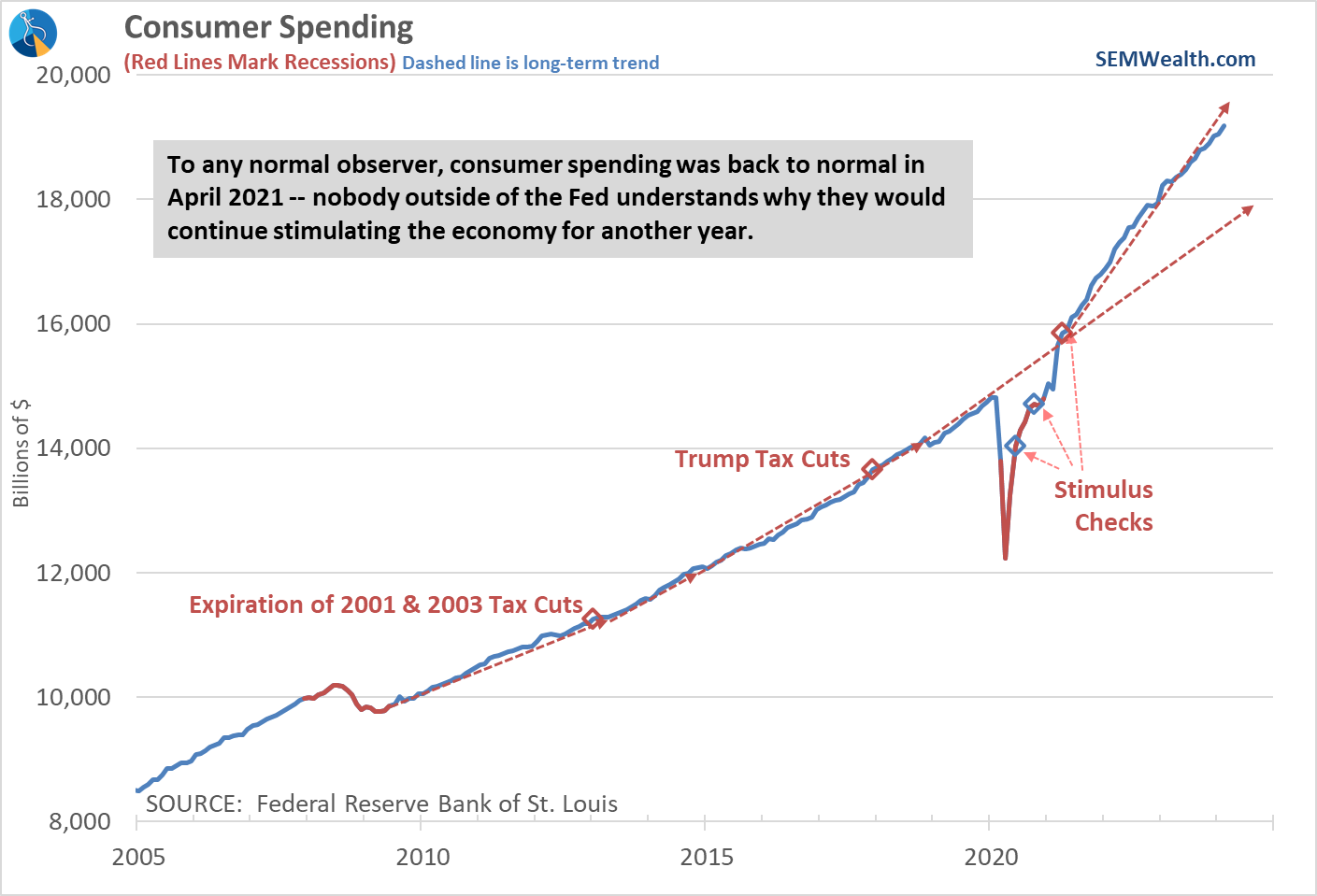

The problem is Consumer Spending continues to grow at nearly a 5% annual rate.

The stimulus fueled spending continues unabated and would hardly argue money is 'too tight'.

Despite this, the Fed appears to be focusing solely on their outlook that inflation is coming down to their 2% target which in their eyes means they should cut interest rates.

In fact Fed Chair Jerome Powell did not flinch at the inflation readings the past 3 months.

"The readings are along the lines of what we want to see despite the bumpy path. It's not as low as most of the good readings we got in the second half of last year, but it's definitely more along the lines of what we want to see." - Jerome Powell at a San Francisco Fed Conference, Friday March 29, 2024

Whatever the Fed does or doesn't do, we will continue to focus on the data.

Market Charts

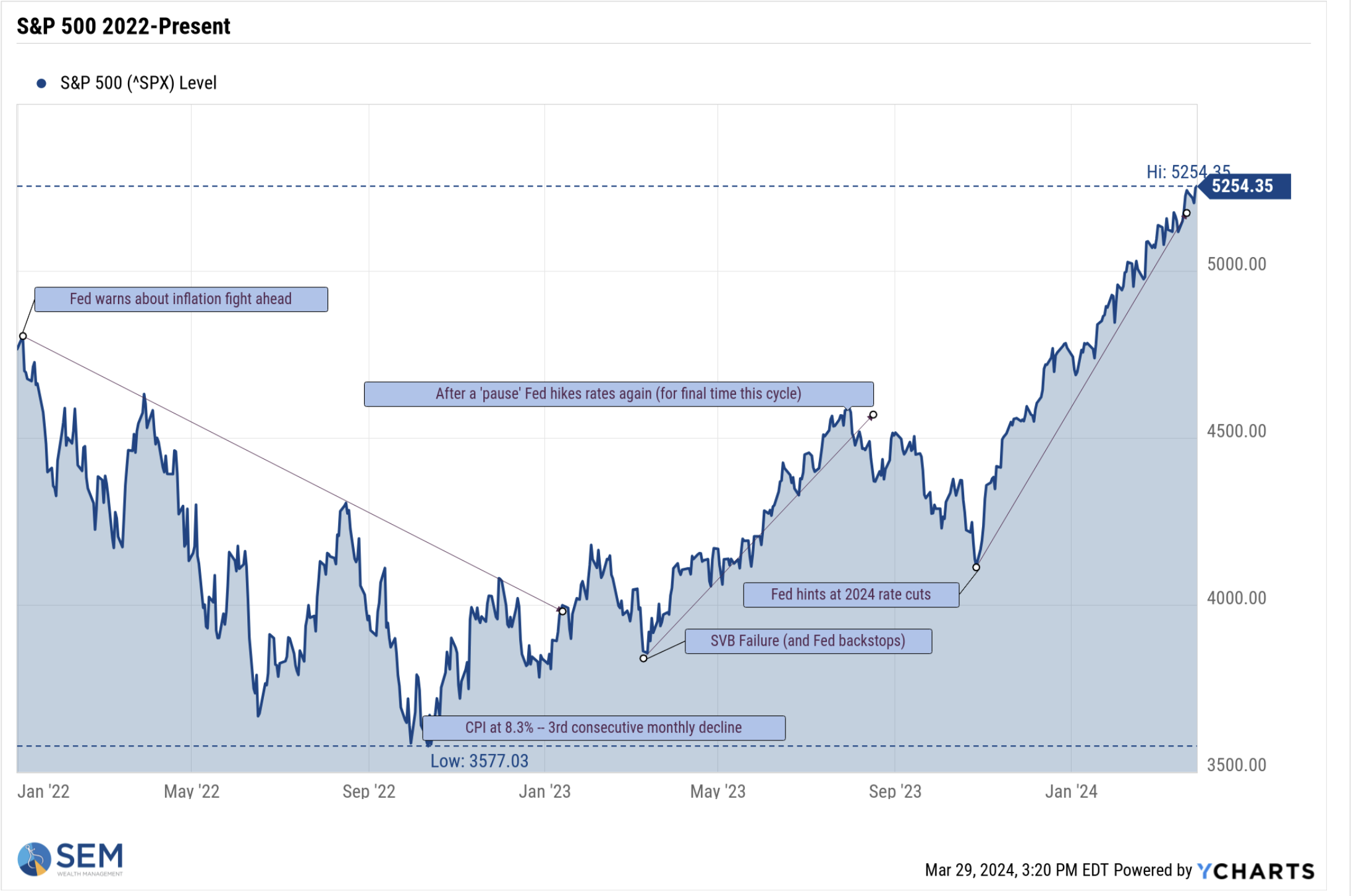

The S&P 500 closed the quarter at another all-time high. As we continue to say, 'higher highs bring higher highs.......until something comes along to change the trend."

JP Morgan currently seems to be the only Wall Street firm concerned about the market actually going down. Last week JPMorgan's chief global strategist Dubravko Lakos-Bujas warned investors may not be ready for the market to reverse directions. “Investors could be stuck on the wrong side of the momentum trade when it eventually falters.......they should consider diversifying their holdings and thinking about risk management in their portfolios. I continue to be concerned about the excessive crowding in the market’s best-performing stocks which raises the risk of an imminent correction."

It just might come one day out of the blue. This has happened in the past, we’ve had flash crashes. One big fund starts de-levering some positions, a second fund hears that and tries to re-position, the third fund basically gets caught off guard, and the next thing you know, we start having a bigger and bigger momentum unwind.” - JP Morgan Chief Global Strategist Dubravko Lakos-Bujas

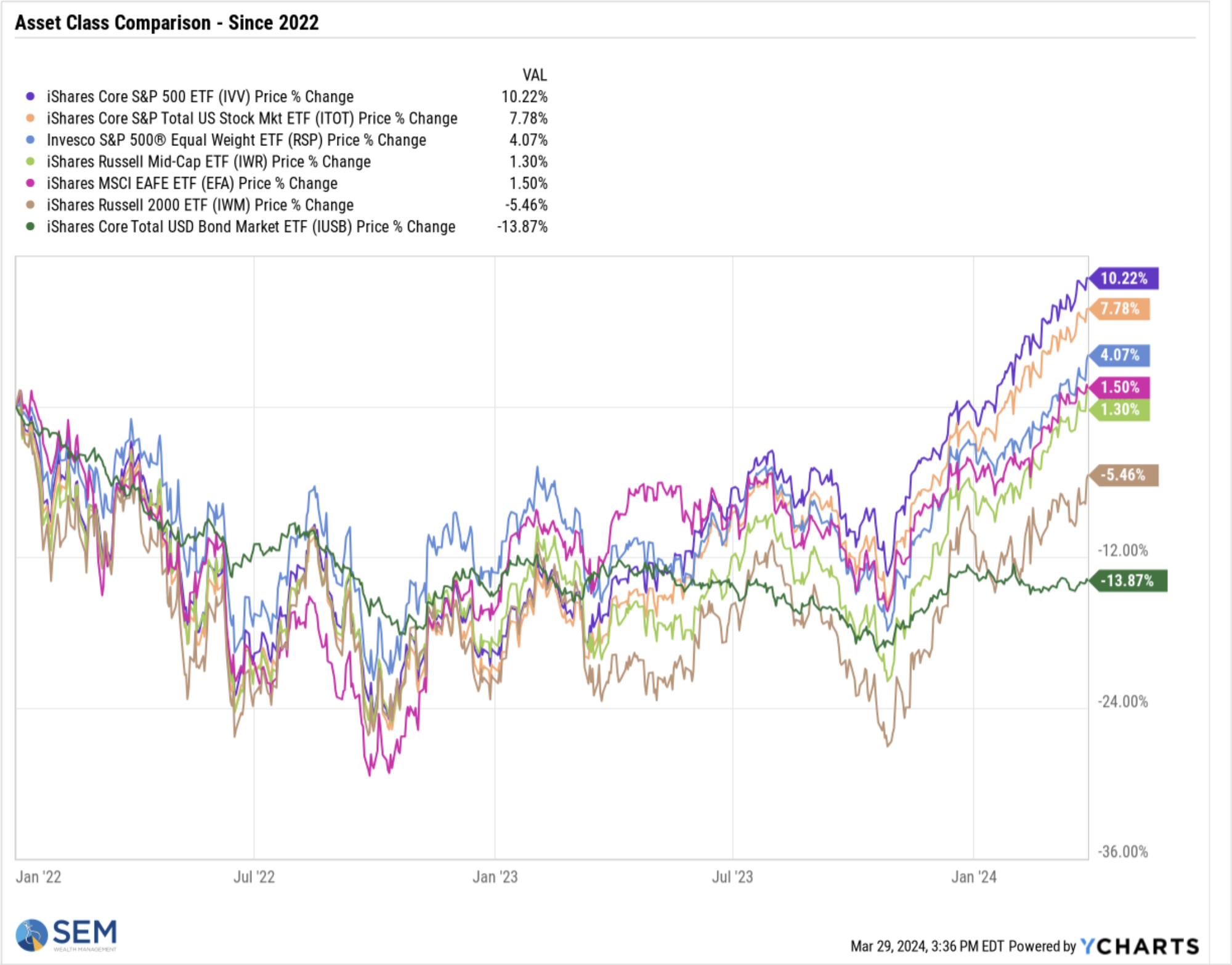

One thing I've been focusing on is the discrepancy between small and large cap stocks. In March small caps gained a bit of ground, gaining nearly 2% more than large caps. (Value stocks also had a big month). Both groups still lag by quite a bit on the 2024 leaderboard, but it was a positive development.

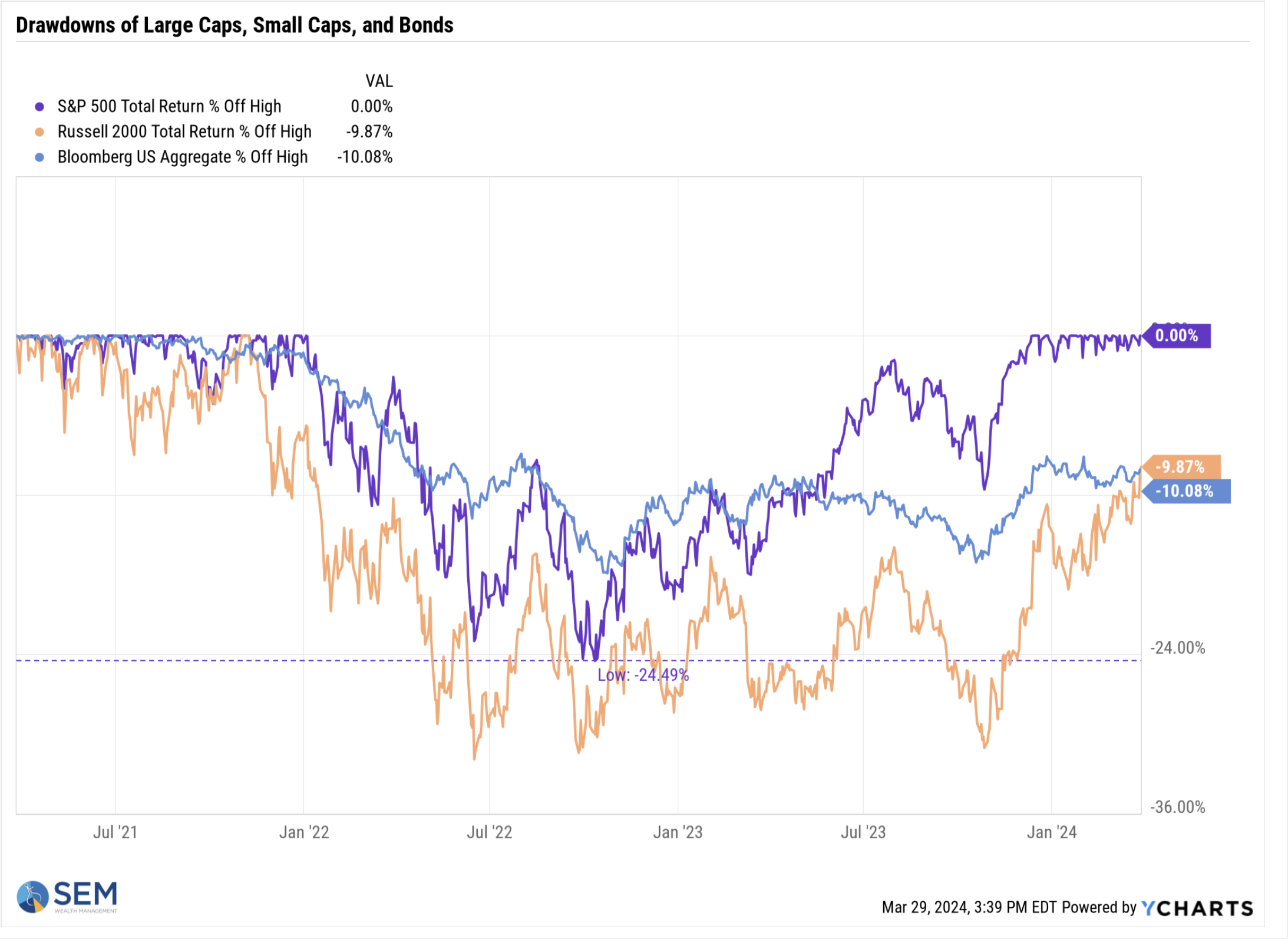

This chart tells the story of what remains a bear market in small caps and bonds.

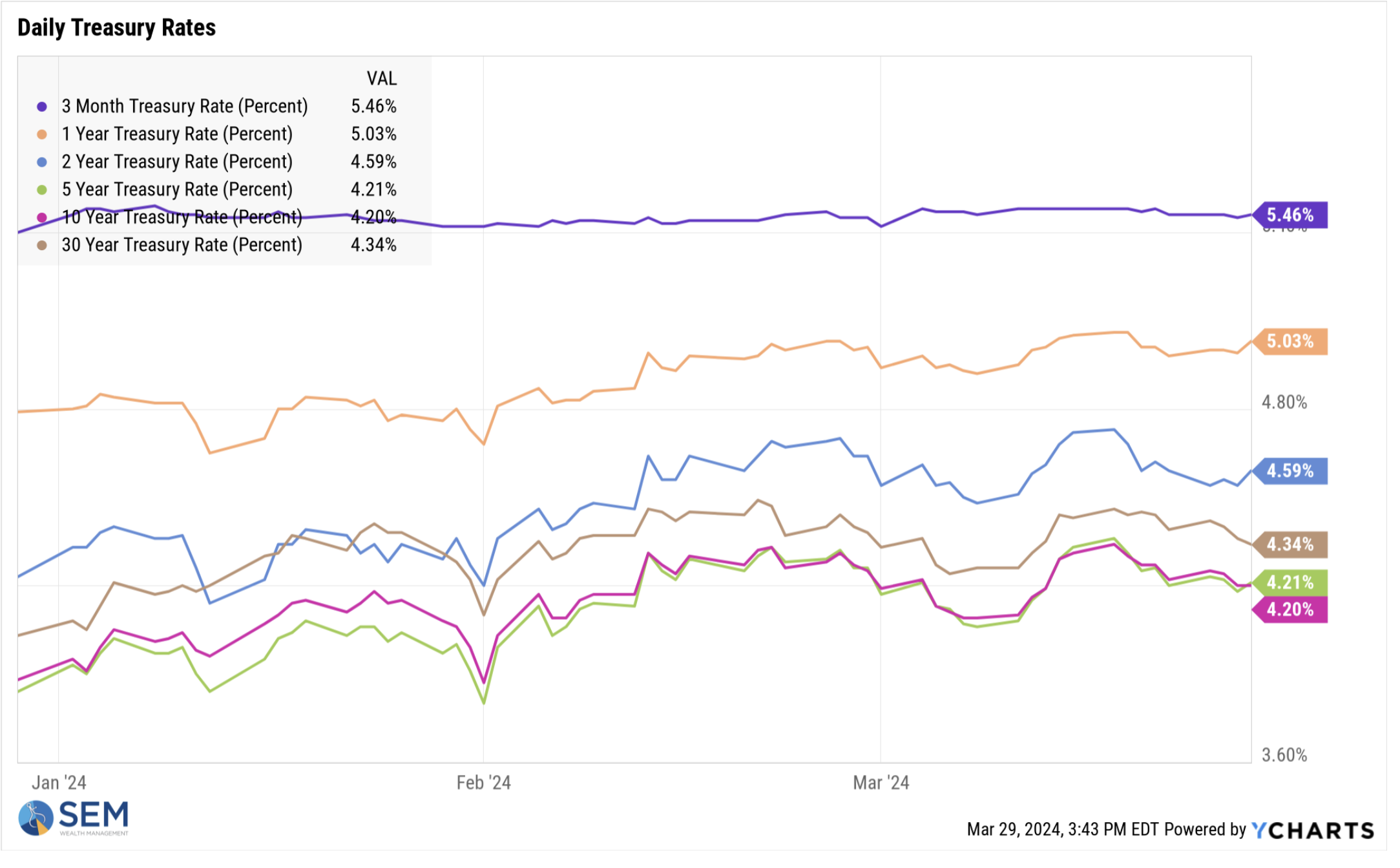

Turning to bonds, which continue to not share the stock market's enthusiasm for rate cuts. This is probably because the bond market understands inflation is still an enemy for bonds and the Fed cutting rates could cause inflation to once again be a problem.

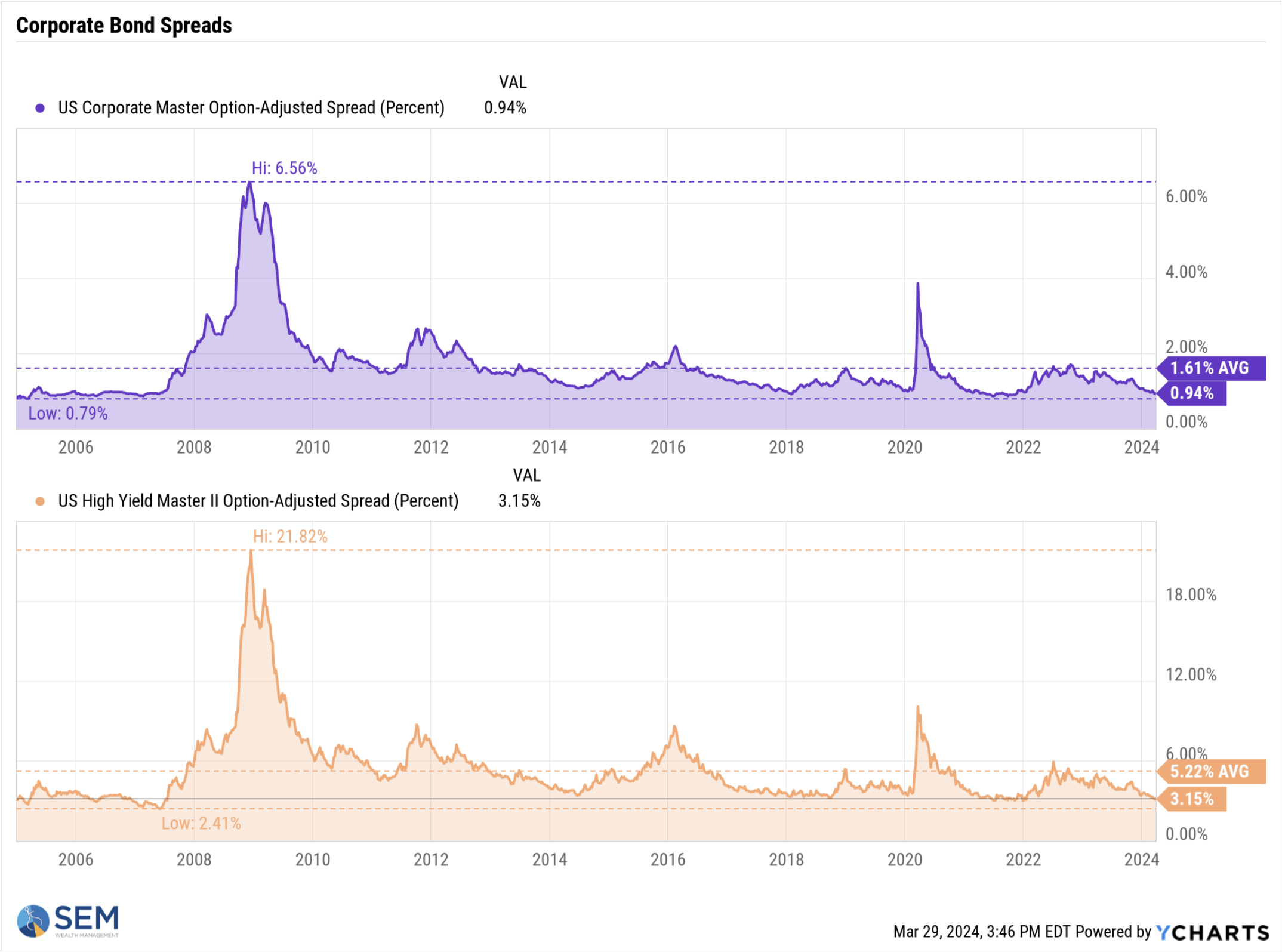

On the corporate bond side, the spreads between corporate yields and Treasuries continue to point to no concerns for risk (or tightness of credit conditions).

SEM Model Positioning

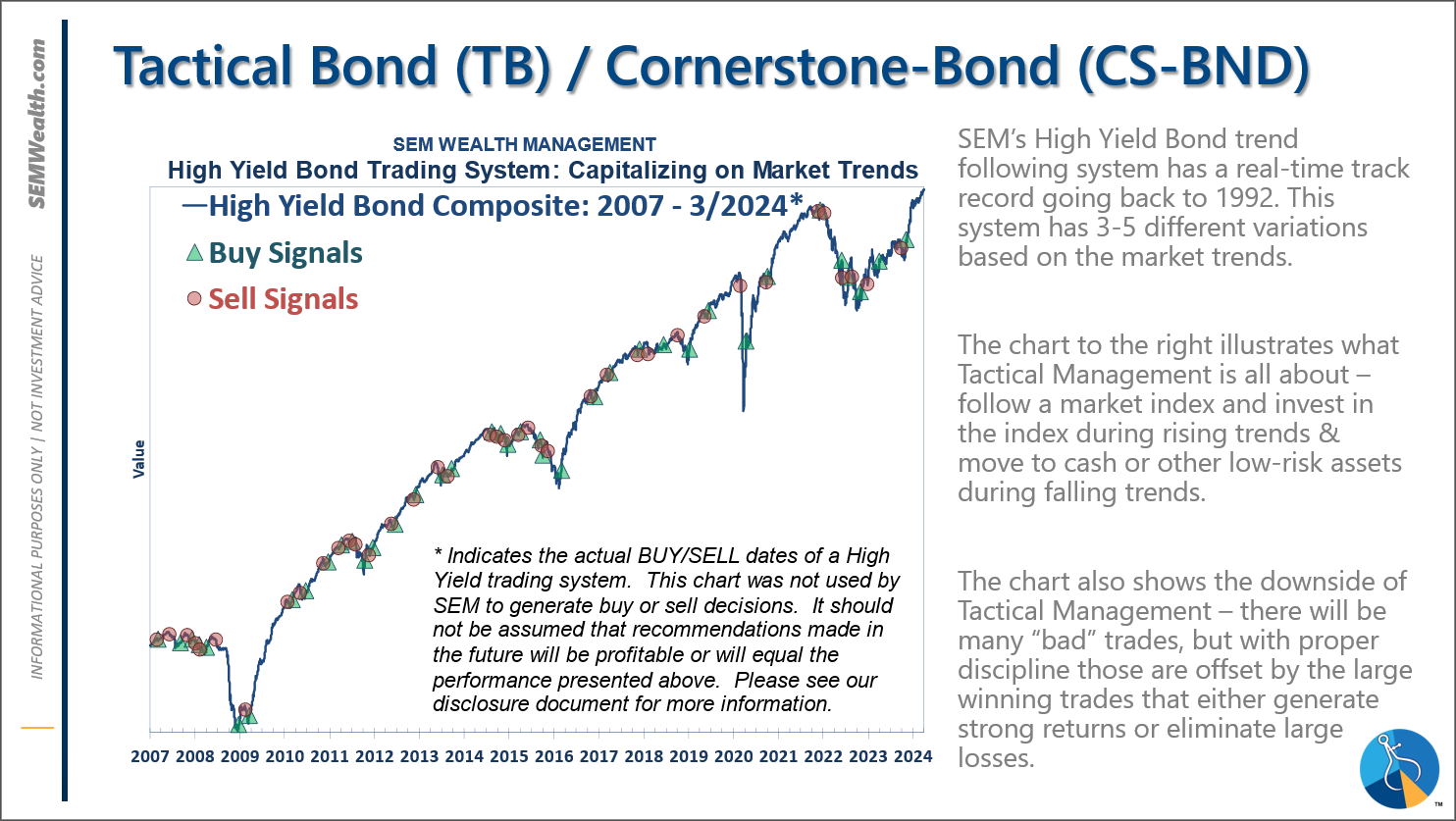

-Tactical High Yield went on a buy 11/3/2023

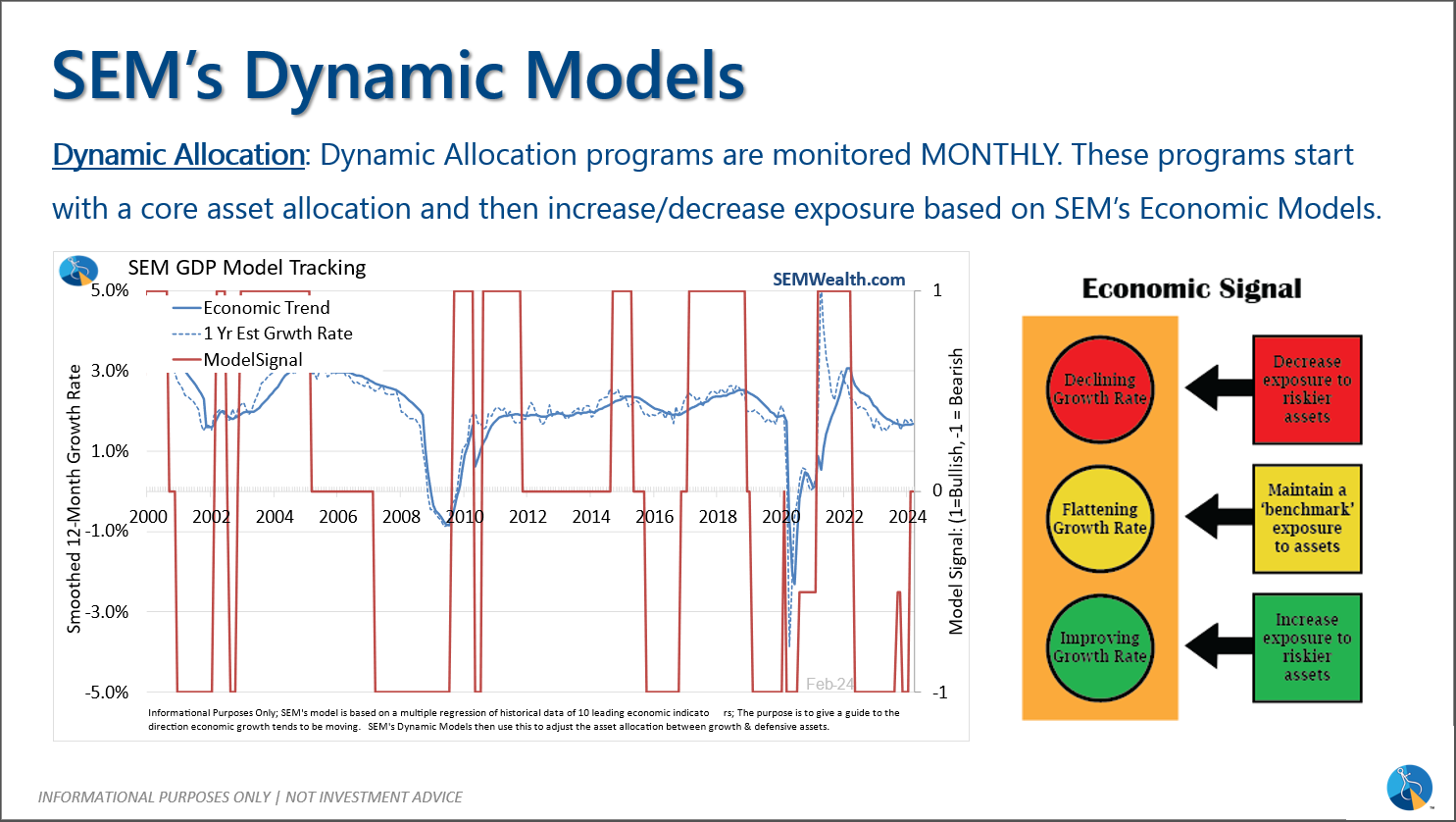

-Dynamic Models went to 'neutral' 2/5/2024

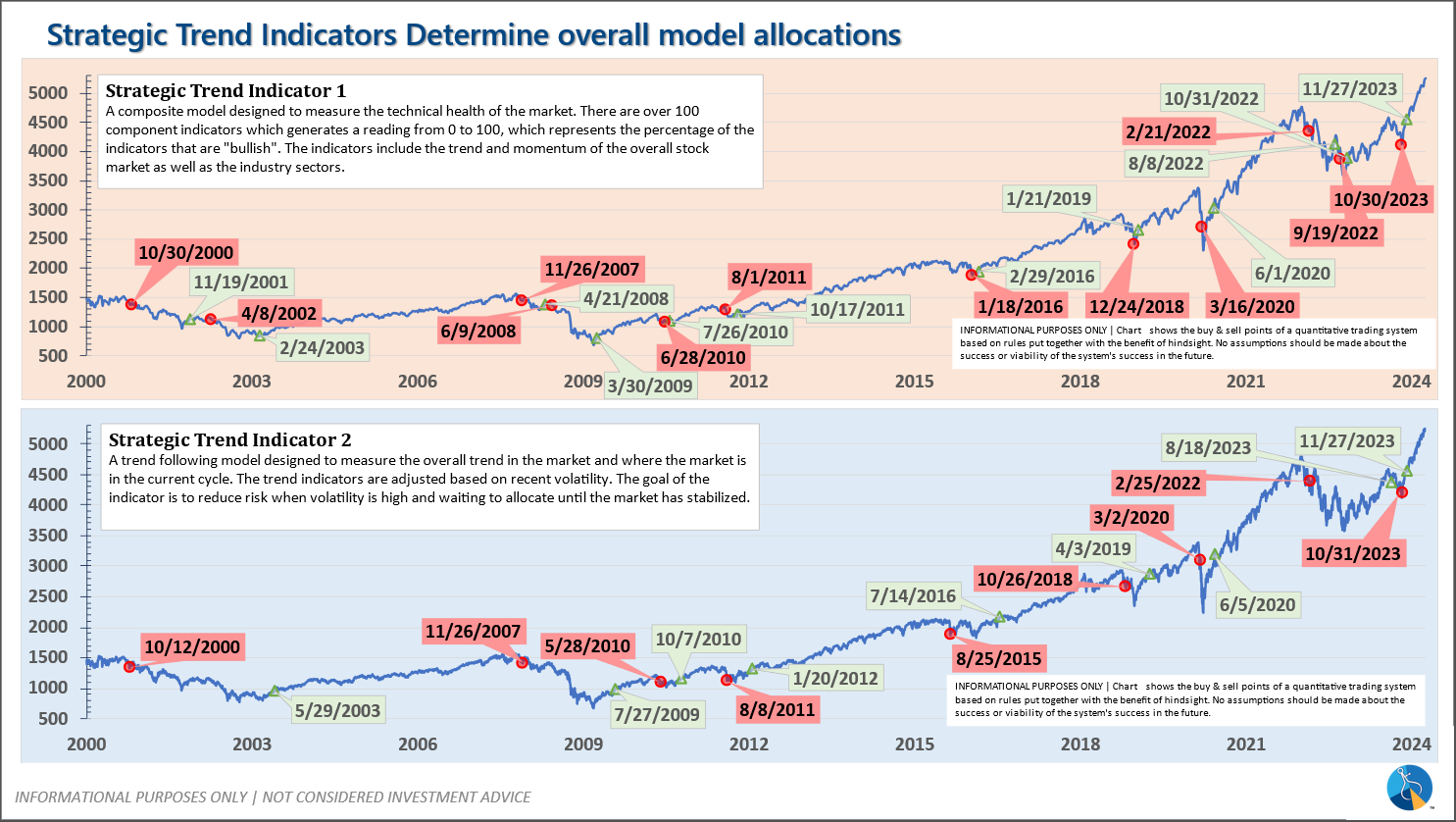

-Strategic Trend Models went on a buy 11/27/2023

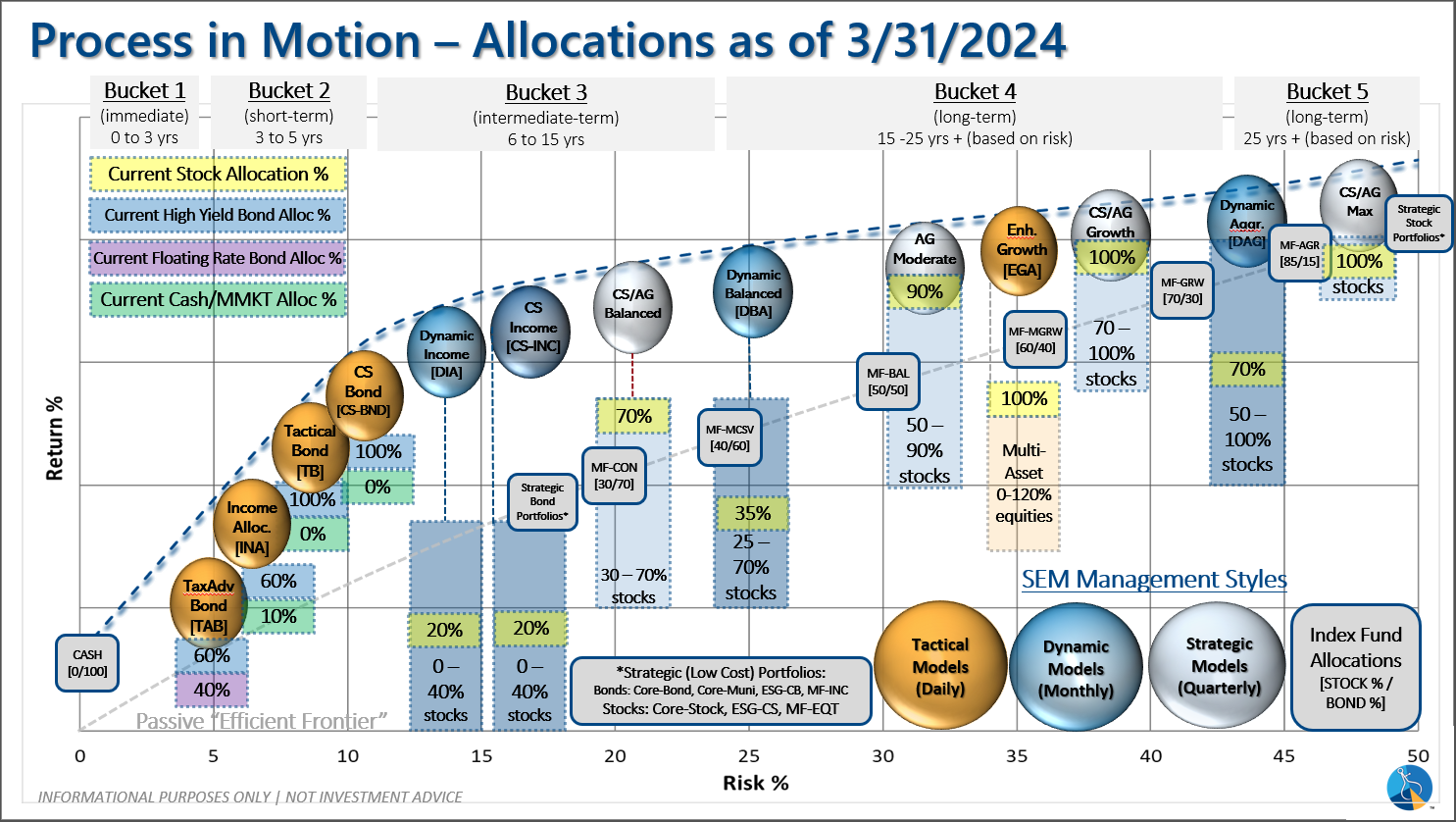

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The High Yield Bond system bought the beginning of April and issued all 3 sell signals 9/28/2023. All 3 systems were back on buy signals by the close on 11/3/2023. The bond funds we are invested in are a bit more 'conservative' than the overall index, but still yielding between 7.5 -8.5% annually.

Dynamic (monthly): At the beginning of December the economic model reverted back to "bearish". This was reversed at the beginning of February. This means benchmark positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth.

Strategic (quarterly)*:

BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change: