For far too long (in my opinion) the Federal Reserve has tried to manage the economy, inflation, and the stock market under the guise of 'financial stability'. This manipulation has caused what used to be the normal economic cycles to last longer, but have much higher and lower swings.

During economic expansions, money flows easily, and seemingly every idea is a 'winner', therefore companies with fringe ideas are funded with the easy money. Recessions are designed to take away the money given to the bad ideas so it can be reinvested in more stable ideas which enhance future economic growth. The more freely the money is flowing, the more 'bad' ideas are funded which eventually limits future economic growth.

The problem the Fed is facing today is the economy was purposely broken to fight the pandemic and then the solutions and complications this created made the break even bigger. I discussed this "K-shaped" economy throughout the pandemic and summarized it in this video a year ago.

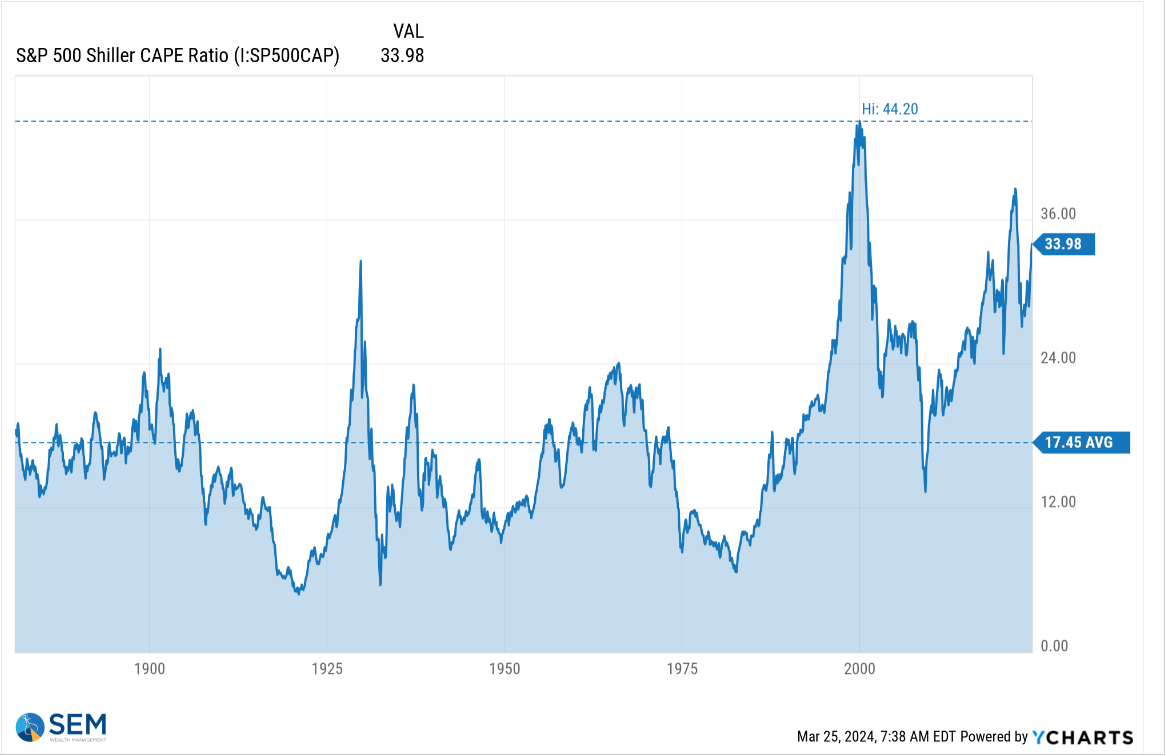

The Fed is in a tough spot. The easy money has poured into the 'magnificent 7' stocks which have driven the S&P 500 to record highs and near record valuation levels (and nearly double the long-term average).

When the largest companies are absorbing the bulk of the money flowing to the investment markets, it dries up innovation and hampers long-term growth. At the same time the Fed's inflation fight has been an annoyance to the upper part of the "K", but devastating to those in the lower half of the K.

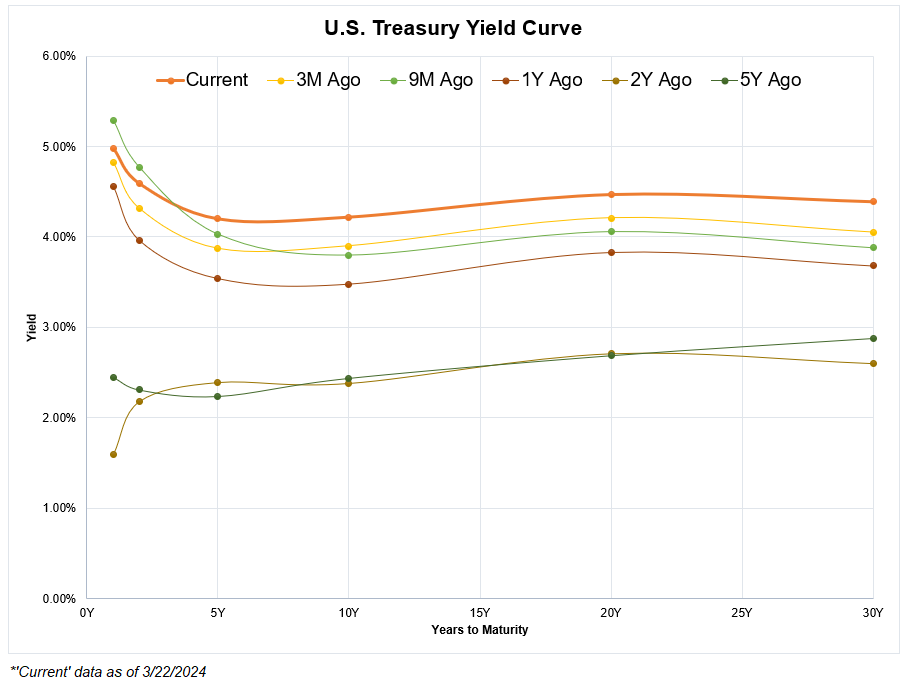

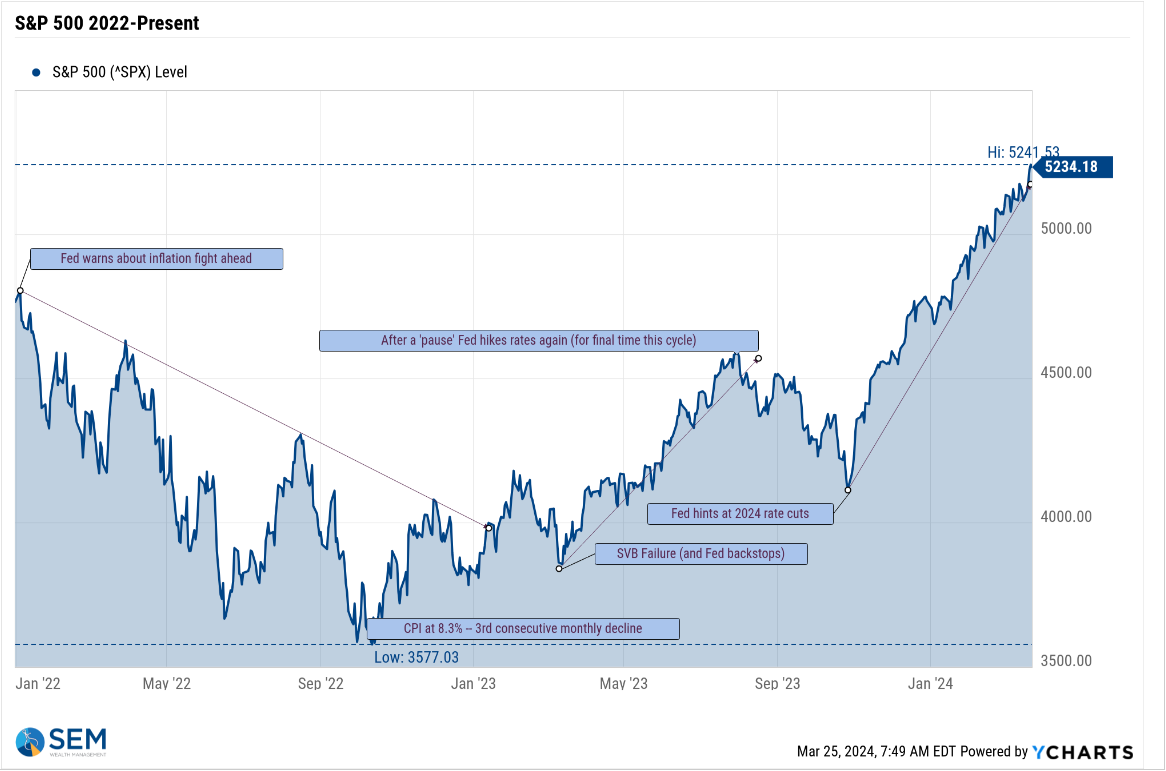

So while the stock market is approaching the point of nearly impossible valuation levels, the Fed messaging last week appears to be they are ready to ease financial conditions. 9 months ago the Fed first gave an indication they were not only done raising interest rates, but likely to cut them in 2024. Since that time the S&P 500 has risen 22%. Interestingly enough the bond market has INCREASED interest rates.

Put simply, the bond market does not believe the Fed will slash rates mostly because they are skeptical that inflation is under control. The stock market has already put on their party hats and are ready for yet another up-leg in what we have called the "everything bubble".

The Fed is in a difficult spot — do they squash the 'magnificent 7' bubble by keeping financial conditions tight knowing that the lower half of the K is not enjoying easy financial conditions? Or should the Fed try to help the lower half of the K by easing rates and risk creating a bubble bigger than the tech bubble (and likely causing inflation to spike again)?

Regular readers of this blog know that we don't make bets or let our opinions get in the way. Keep reading for what the DATA is saying and how our QUANTITATIVE investment models are positioned.

Market Charts

Despite a pause to the rally the last few days, the S&P ended the week with yet another gain. As I keep saying, higher highs tend to lead to higher highs --— until something causes the trend to shift. The problem is when the market is this overvalued and the uptrend has lasted this long, it doesn't take much to turn into a big correction.

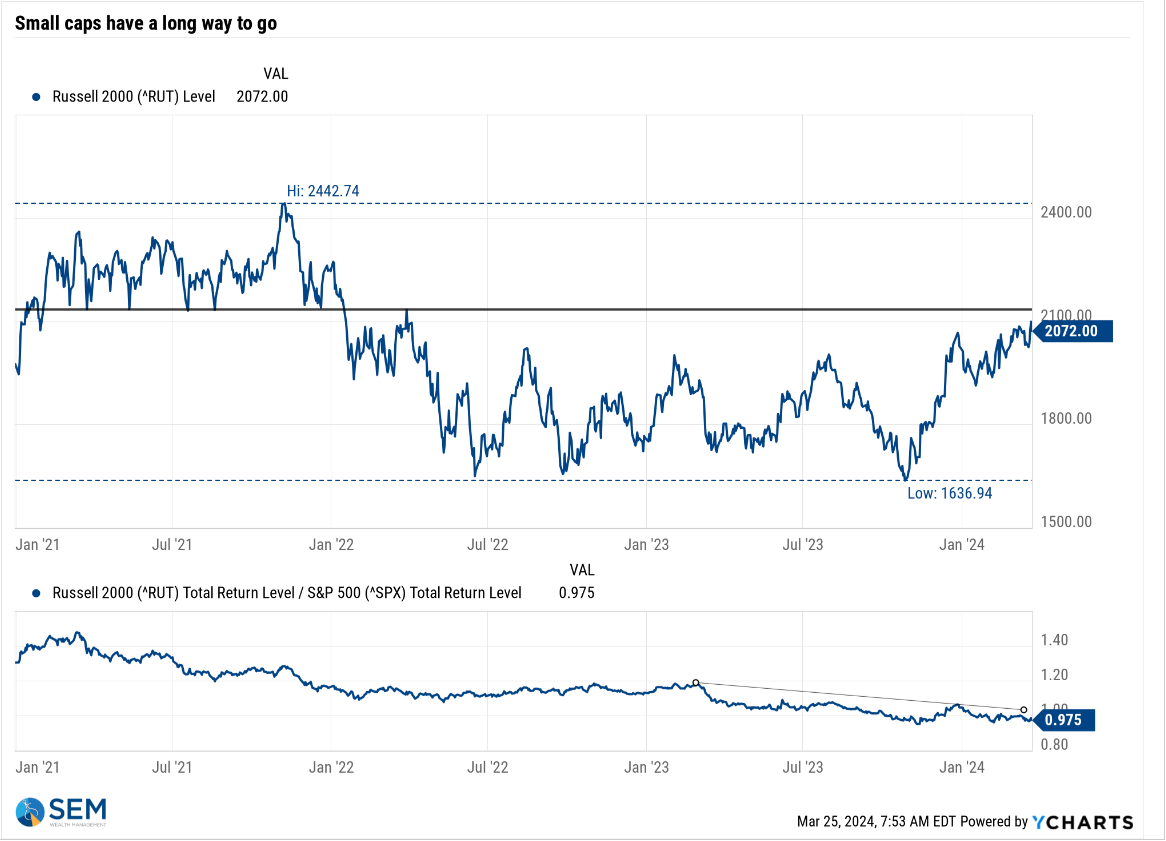

This chart illustrates the Fed's dilemma – Large cap stocks have enjoyed a huge rally since the start of 2023, yet small caps are pointing to continued struggles for the economy. Should the Fed crush the large cap bubble and risk decimating the smaller companies or should the Fed try to relieve the pressure on smaller companies and risk creating a massive bubble in large cap stocks?

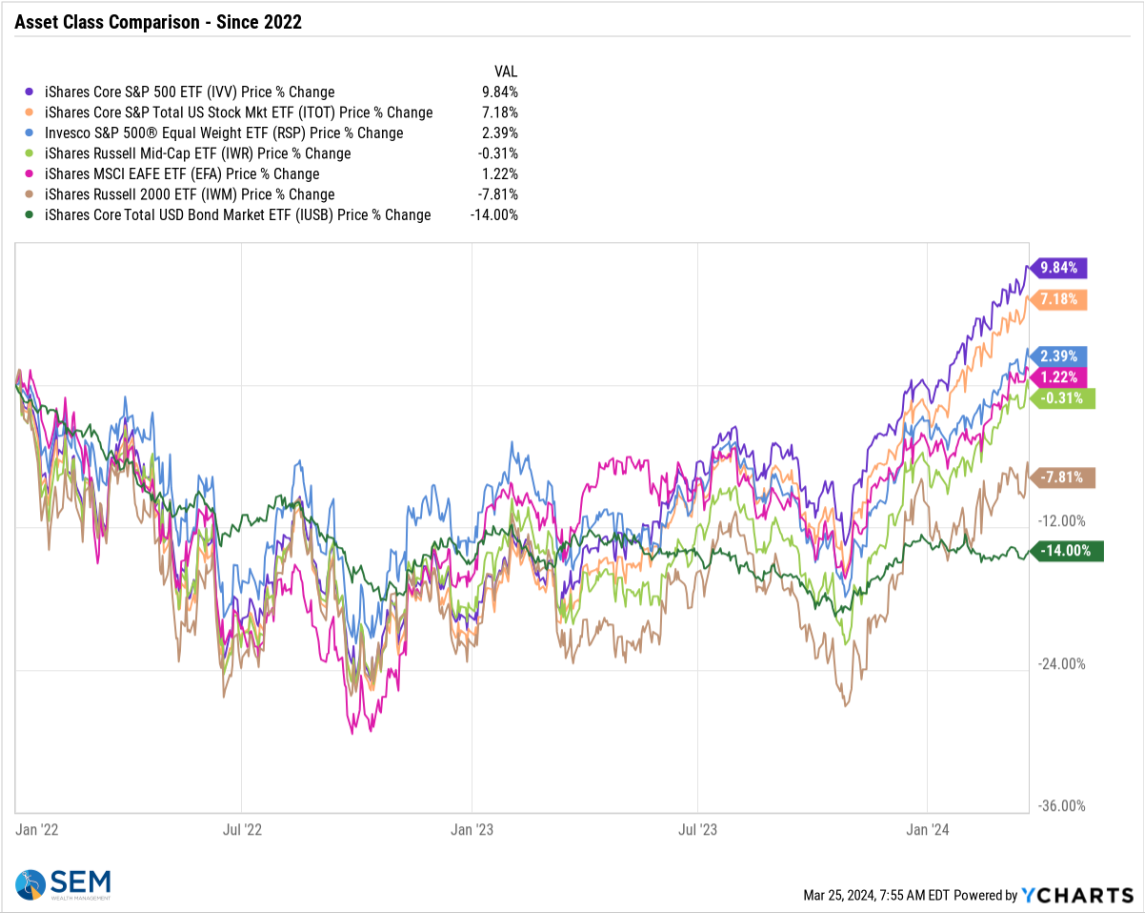

This chart shows the disconnect between the cap-weighted S&P 500 and everything else.

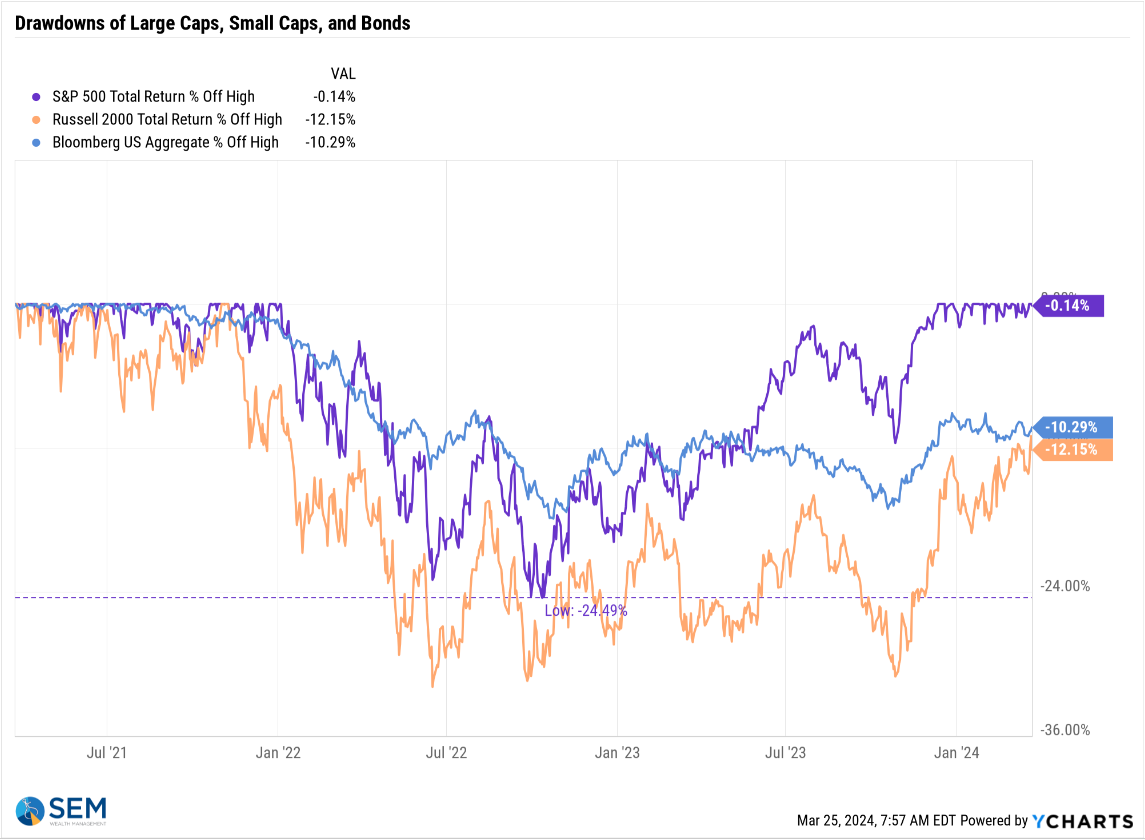

Looking at it another way, this 'drawdown' chart (% from the high) tells the same story.

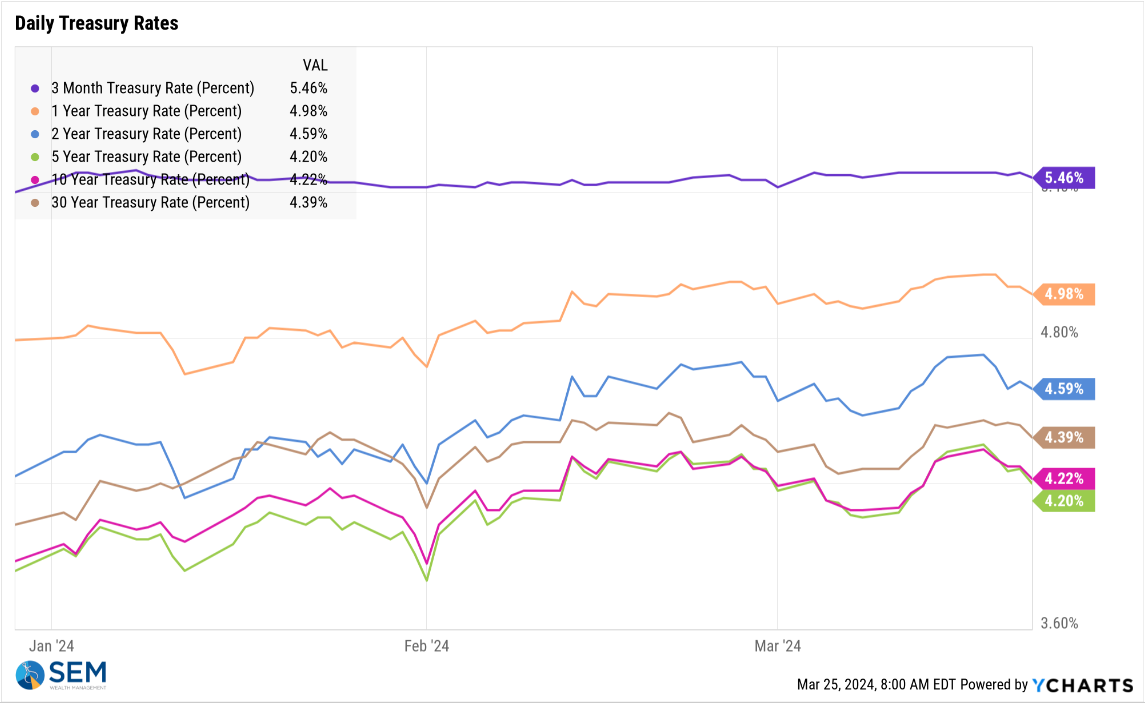

Turning to interest rates, as mentioned above, the bond market is not as convinced as the stock market that the Fed will be cutting rates 3 times (or that inflation will continue to be a problem.)

Across the yield curve, rates remain elevated.

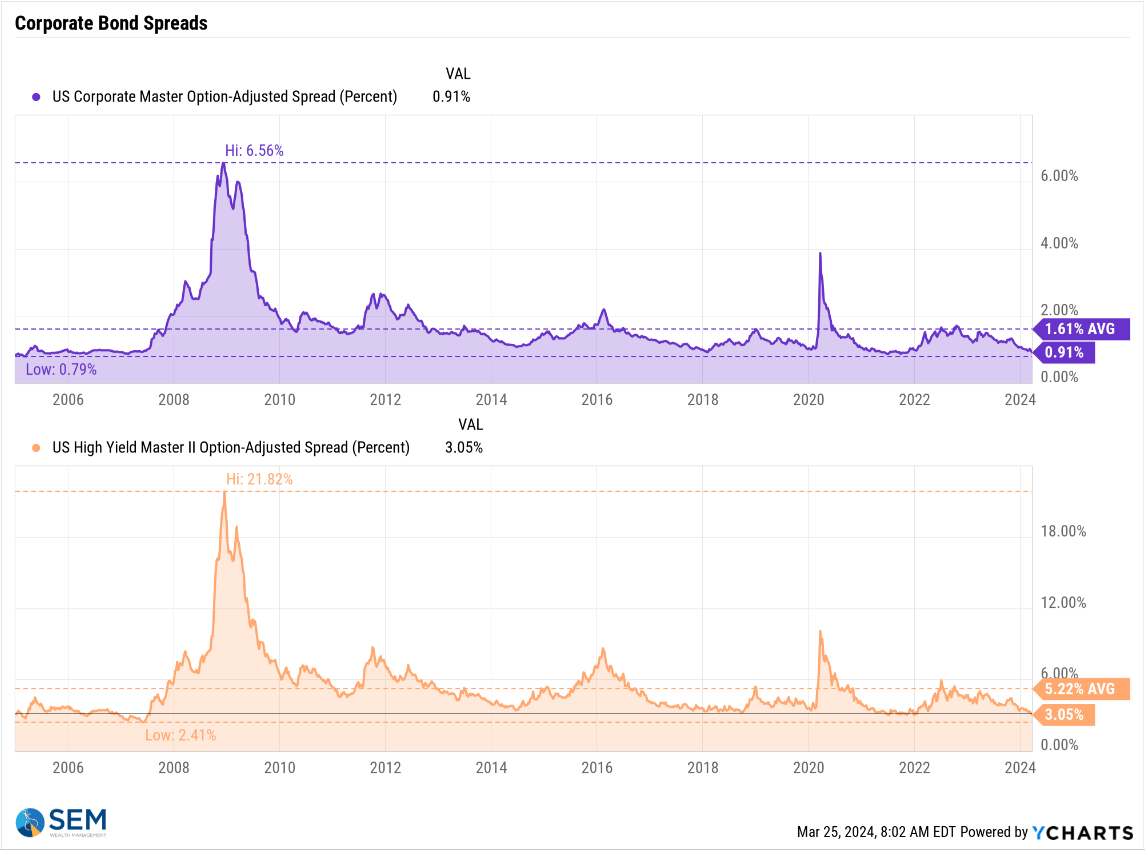

Despite this the perceived level of risk as measured by the spread between corporate bonds (which should have much higher repayment risk than Treasury bonds) is approaching historic lows.

We will continue to enjoy this upswing as long as possible as noted in the section below. At the same time, investors and advisors should be cautious trying to chase this higher just for the sake of higher returns. SEM watches the markets daily and has a plan to get out when the sailing is no longer smooth and easy.

SEM Model Positioning

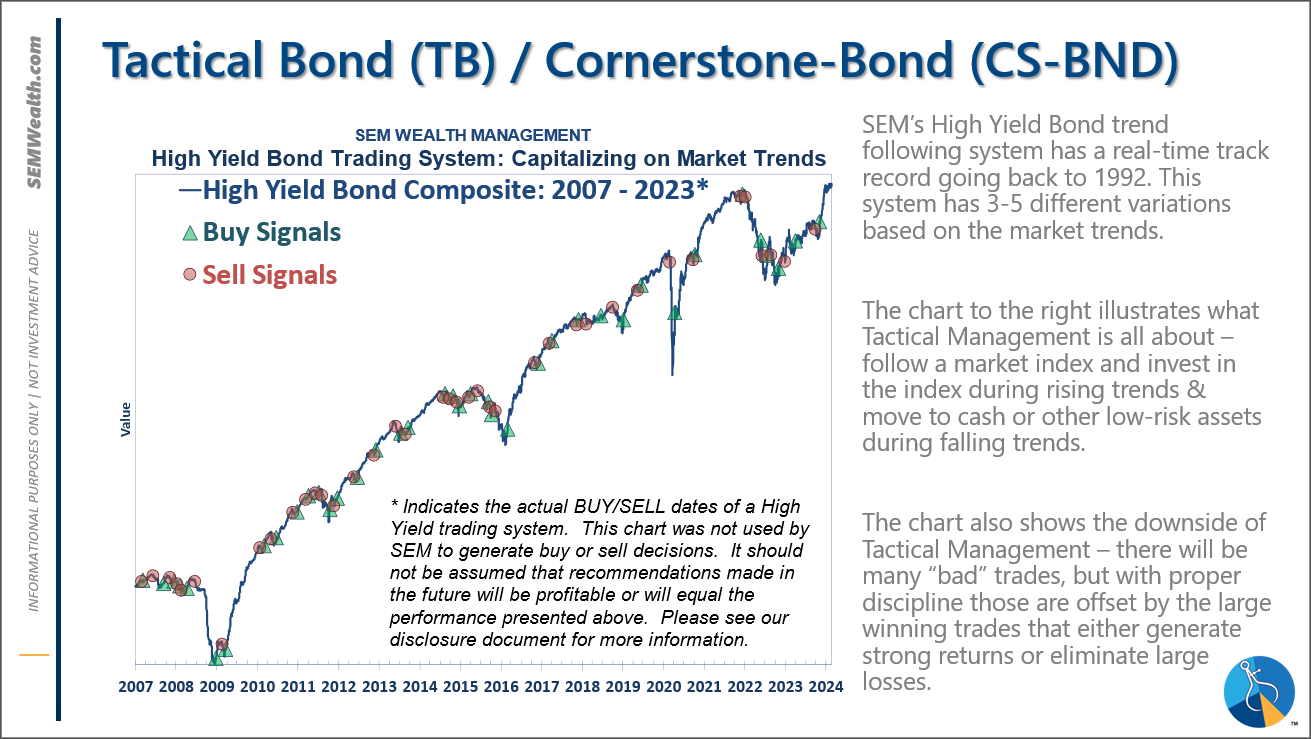

-Tactical High Yield went on a buy 11/3/2023

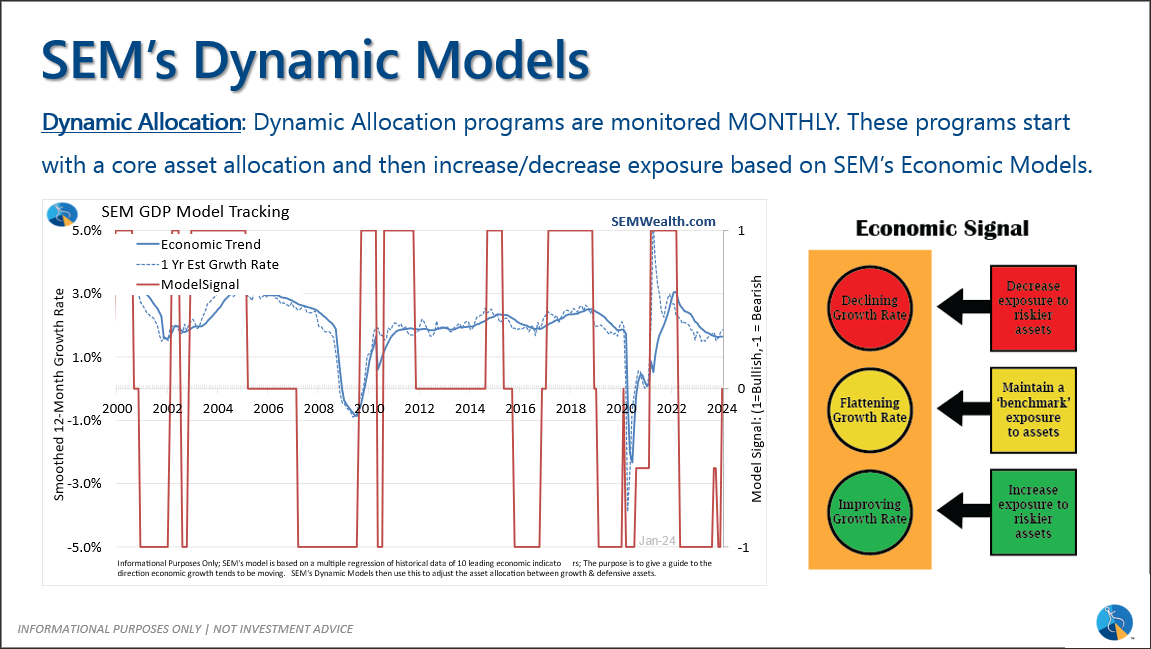

-Dynamic Models went to 'neutral' 2/5/2024

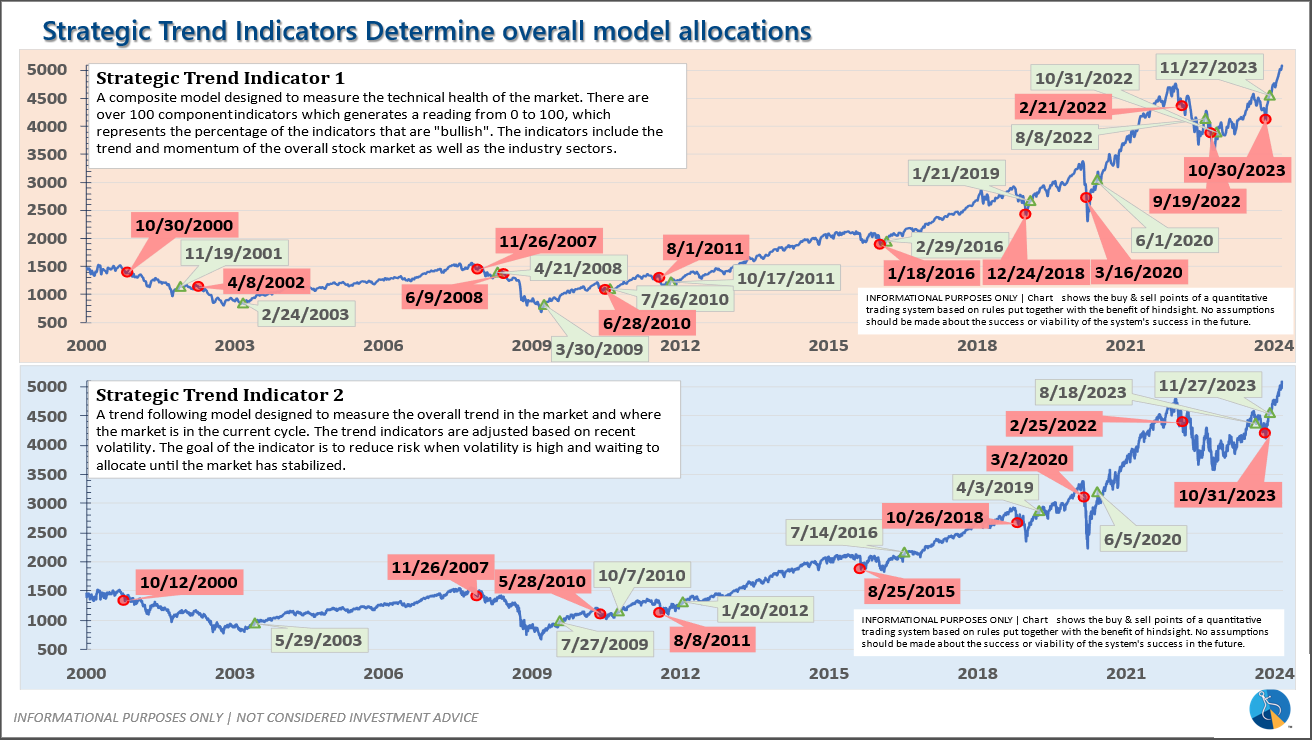

-Strategic Trend Models went on a buy 11/27/2023

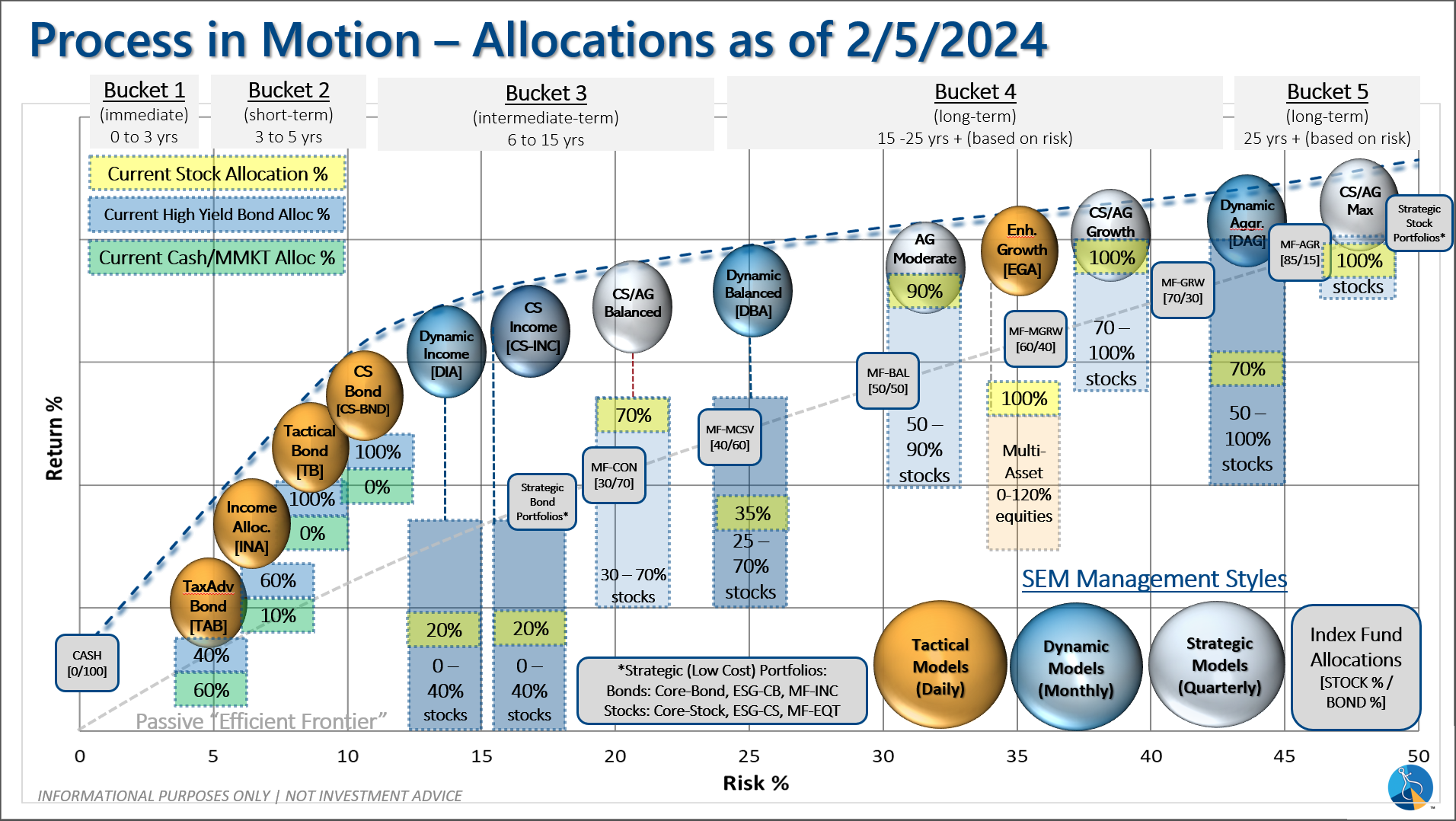

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The High Yield Bond system bought the beginning of April and issued all 3 sell signals 9/28/2023. All 3 systems were back on buy signals by the close on 11/3/2023. The bond funds we are invested in are a bit more 'conservative' than the overall index, but still yielding between 7.5 -8.5% annually.

Dynamic (monthly): At the beginning of December the economic model reverted back to "bearish". This was reversed at the beginning of February. This means benchmark positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth.

Strategic (quarterly)*:

BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change: