One of the hardest lessons for finance graduates is understanding the moves in the market often go completely against the tens of thousands of dollars their education taught them. One reason I enjoy being a guest lecturer at Liberty University is I get the opportunity to teach a small subset of future finance professionals this lesson. No matter the topic, I try to work this into the conversation.

This week was yet another example of the markets not doing what the academics would tell us it should do. Going into the jobs report this was the general consensus:

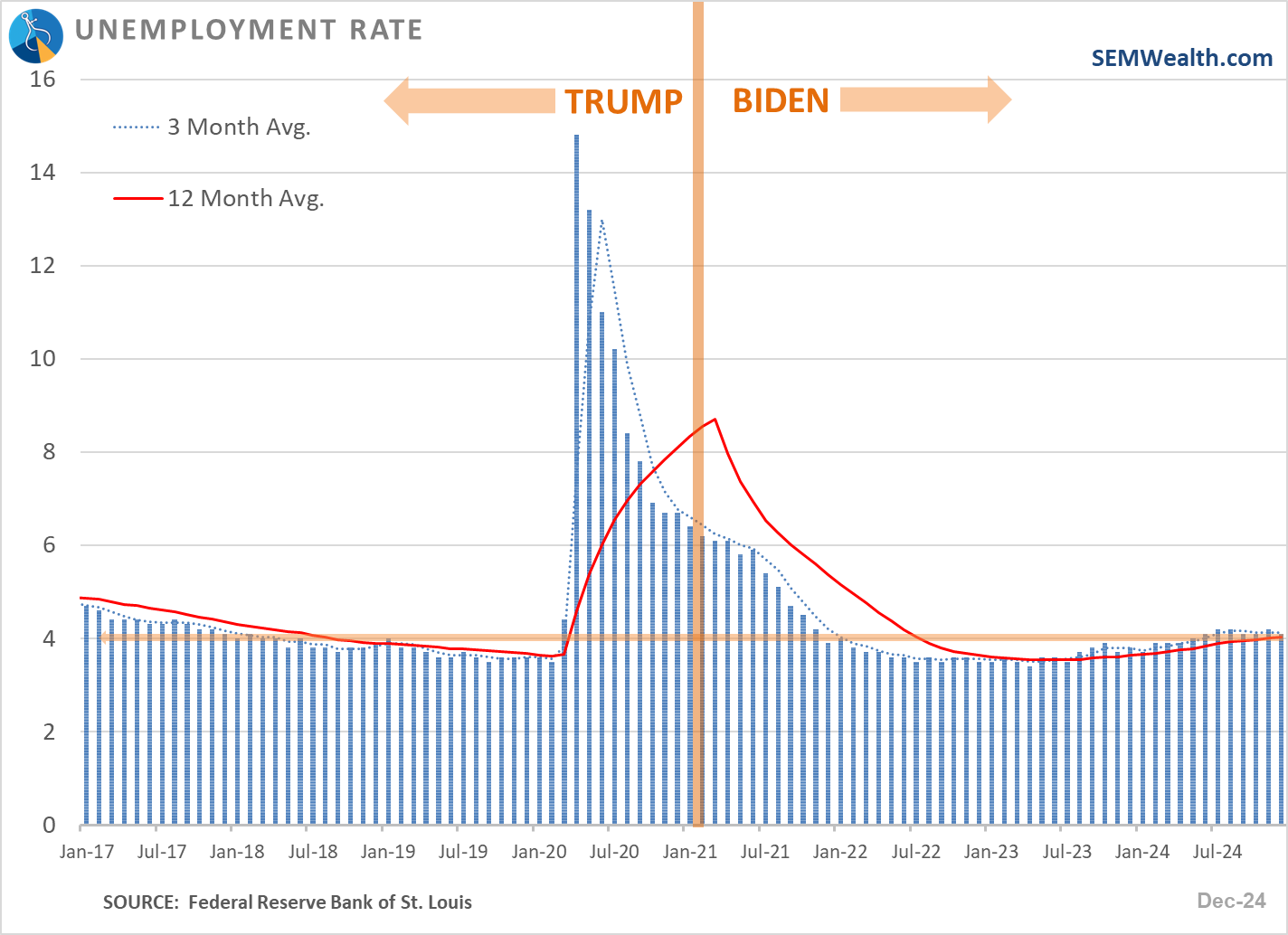

- The labor market was tightening with the unemployment rate drifting higher the last few months.

- The estimated number of new jobs was around 186,000 for December.

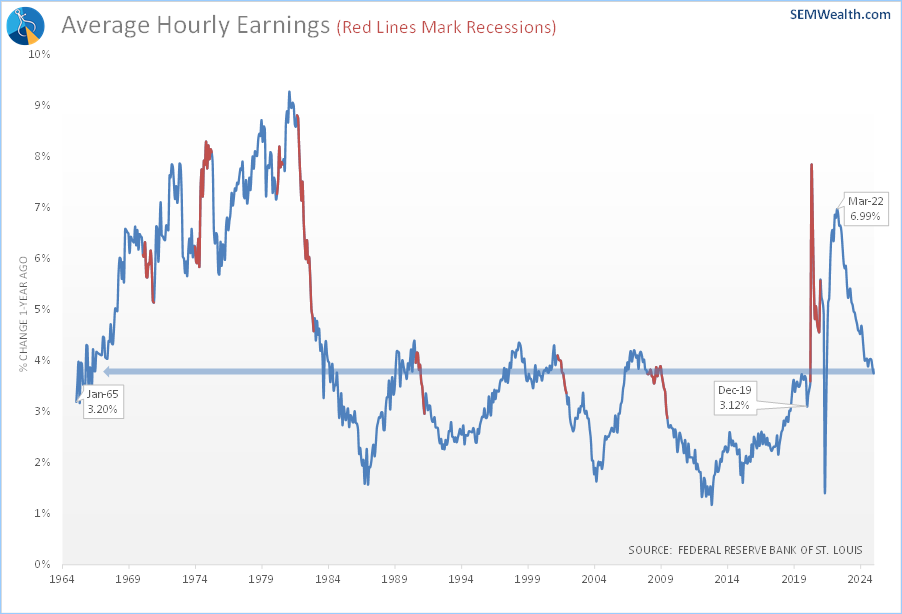

- Wage inflation was creeping higher and was likely to continue to do so.

On Friday we learned:

- The unemployment rate DECLINED in December

- The US added an impressive 256,000 jobs in December

- The rate of wage inflation SLOWED in December

With the market already down for the week, you would think all of these positive economic developments would lead to a stock market rally. Instead, large cap stocks lost 1.5% and the small cap Russell 2000 fell by 2.2%. What happened? Check out the musings below, including our latest Economic Model Update.

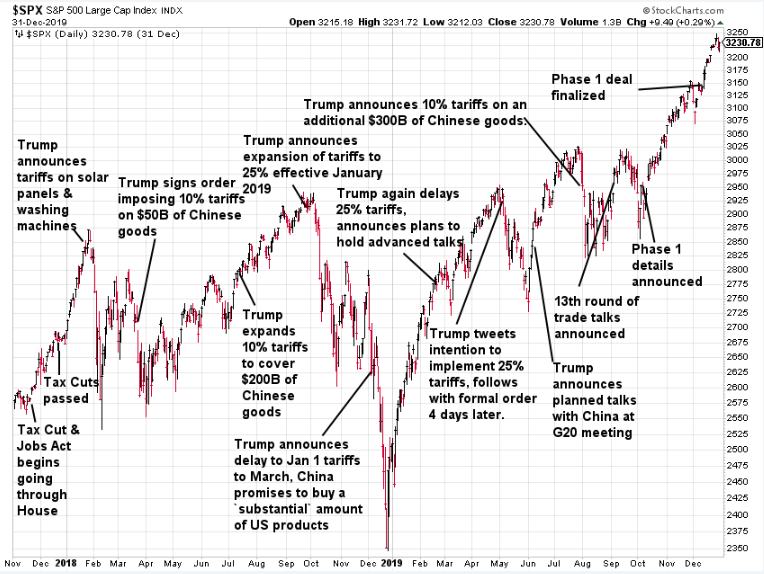

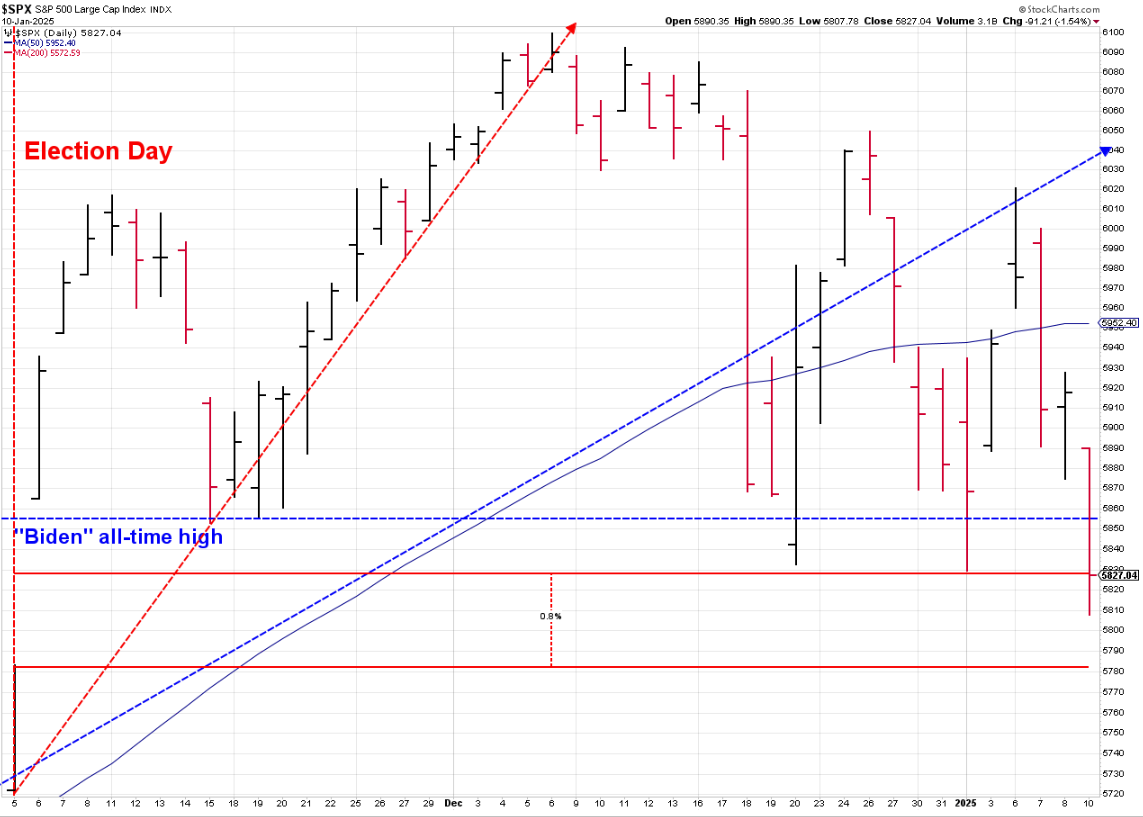

Trump tariff whipsaw has begun

Since the President-elect started taking credit for the market rally after his impressive election victory (and then started claiming credit for the entire rally since August), we've been posting charts of the S&P 500 since the election. (Check out the Market Charts below for the updated chart). The reason I'm doing this is because I fear instead of focusing on the BIG PICTURE policies which won him the election that are NECESSARY for the US's LONG-TERM success and will thus take LONG-TERM thinking to implement, the President-elect could once again fall into the trap of using the stock market as his measuring stick for every single idea.

In other words, I fear we will see more of what we saw during Trump 1.0, which was a lot of market volatility surrounding nearly daily whipsaws in ideas on tariffs with the ultimate tariffs being not enough to move the needle on our massive trade deficit.

After falling below the post-election opening price last week, the messaging out of the Trump camp over the weekend was the tariffs would only be implemented on products which oppose a direct threat to "national security". This sparked a nice rally, but 2 days later the president back-tracked on that messaging claiming he never said that. Shortly thereafter, it was reported that President Trump could use a "national emergency" declaration to implement new tariffs, circumventing Congress and allowing him to ignore any trade agreements already in place. Stocks were selling off already that day before the next piece of tariff related news hit the wires.................

Fed worried about impact of tariffs

Wednesday afternoon, the minutes from the Fed's December meeting were released. This was the meeting where the Fed did cut rates by 1/4% but made clear they were going to 'pause' and watch the data. According to the minutes, the 'data' they ware worried about is how, what, and when tariffs will be implemented and more importantly what type of impact that will have on inflation. Stocks, which were already down, moved even lower, closing down 2% from the highs of the day.

With this as the framework, let's look at what we learned about the economy on Friday.

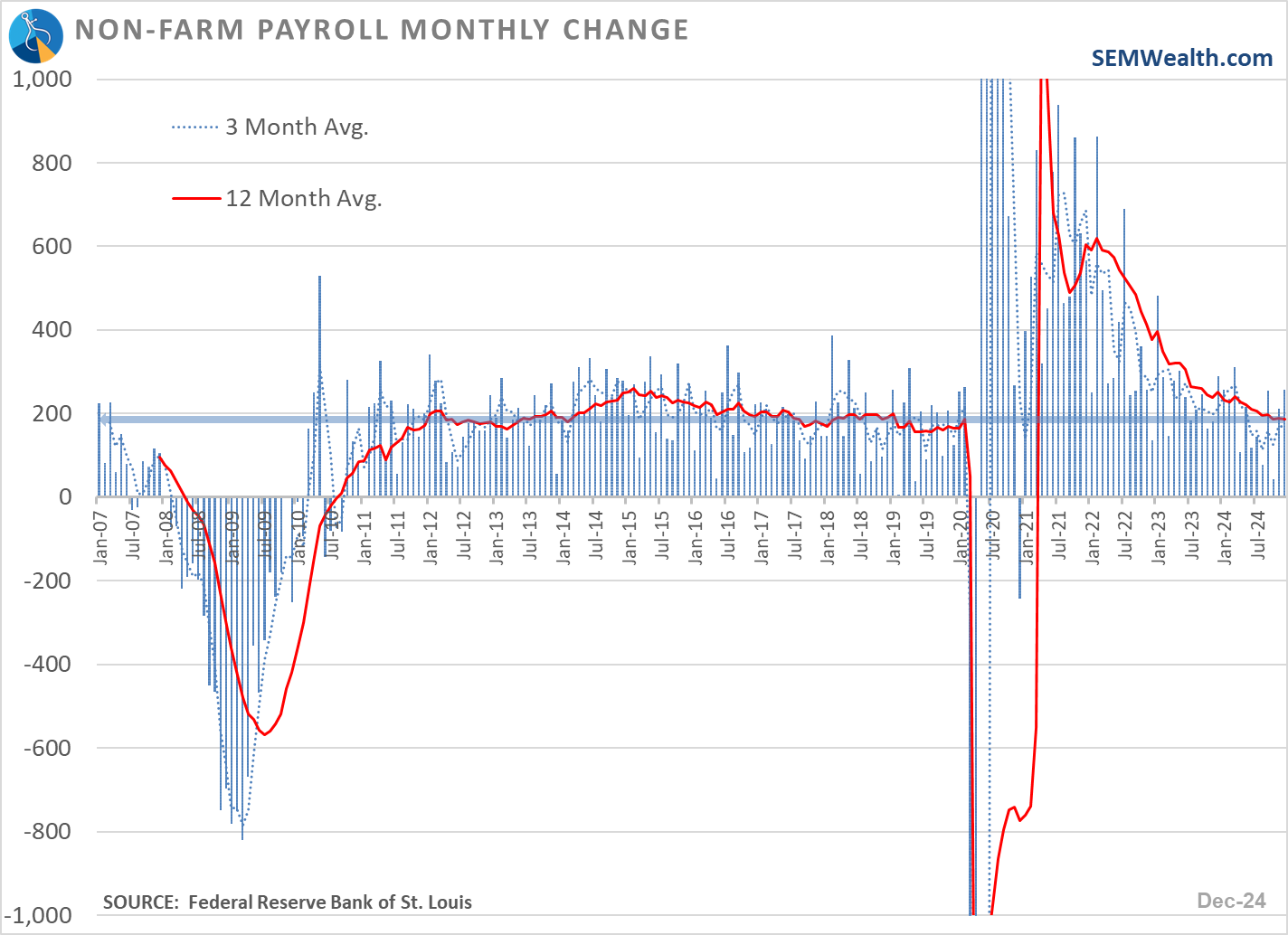

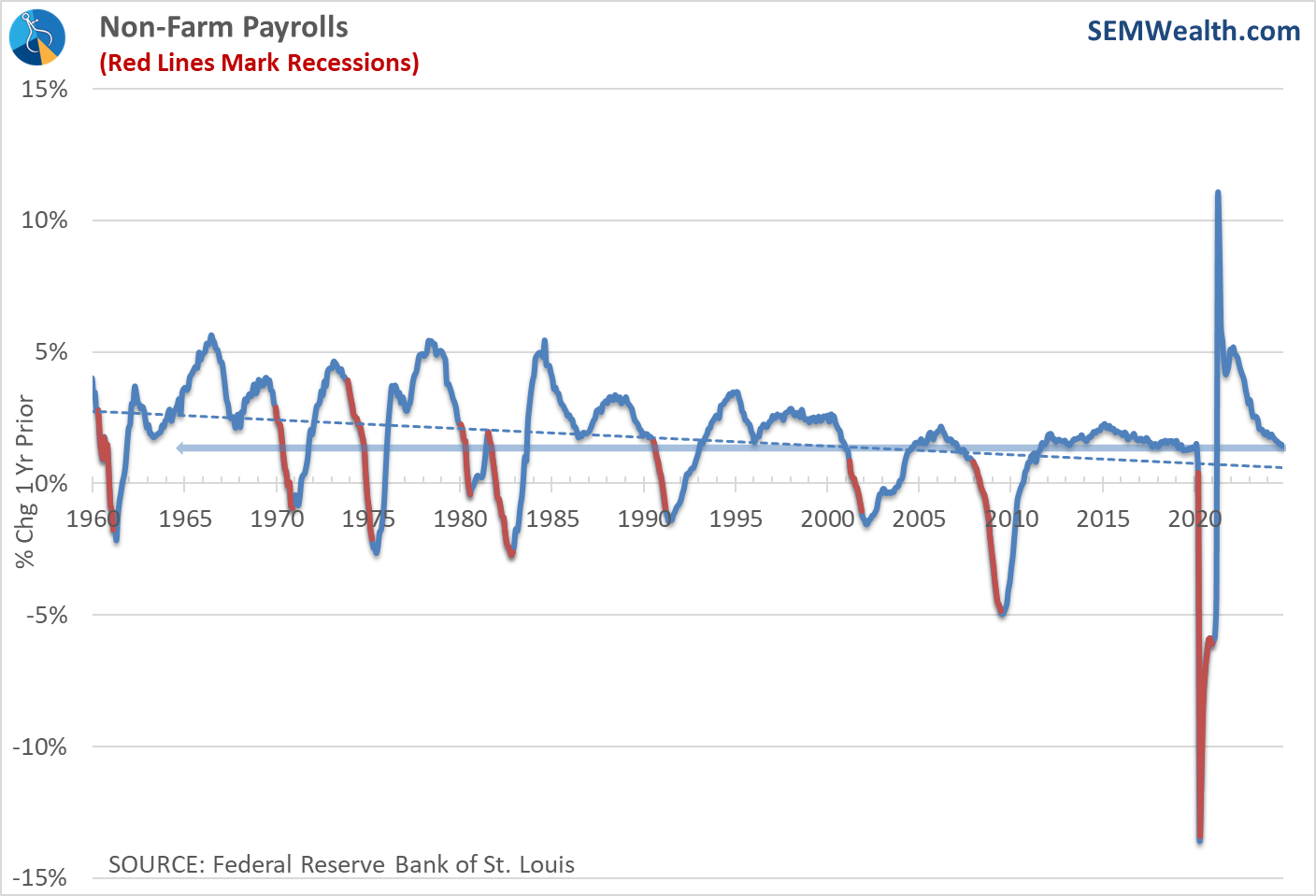

Job growth strong, unemployment falls, earnings growth tame

Pretty much everything came in better than expected with the December payrolls report.

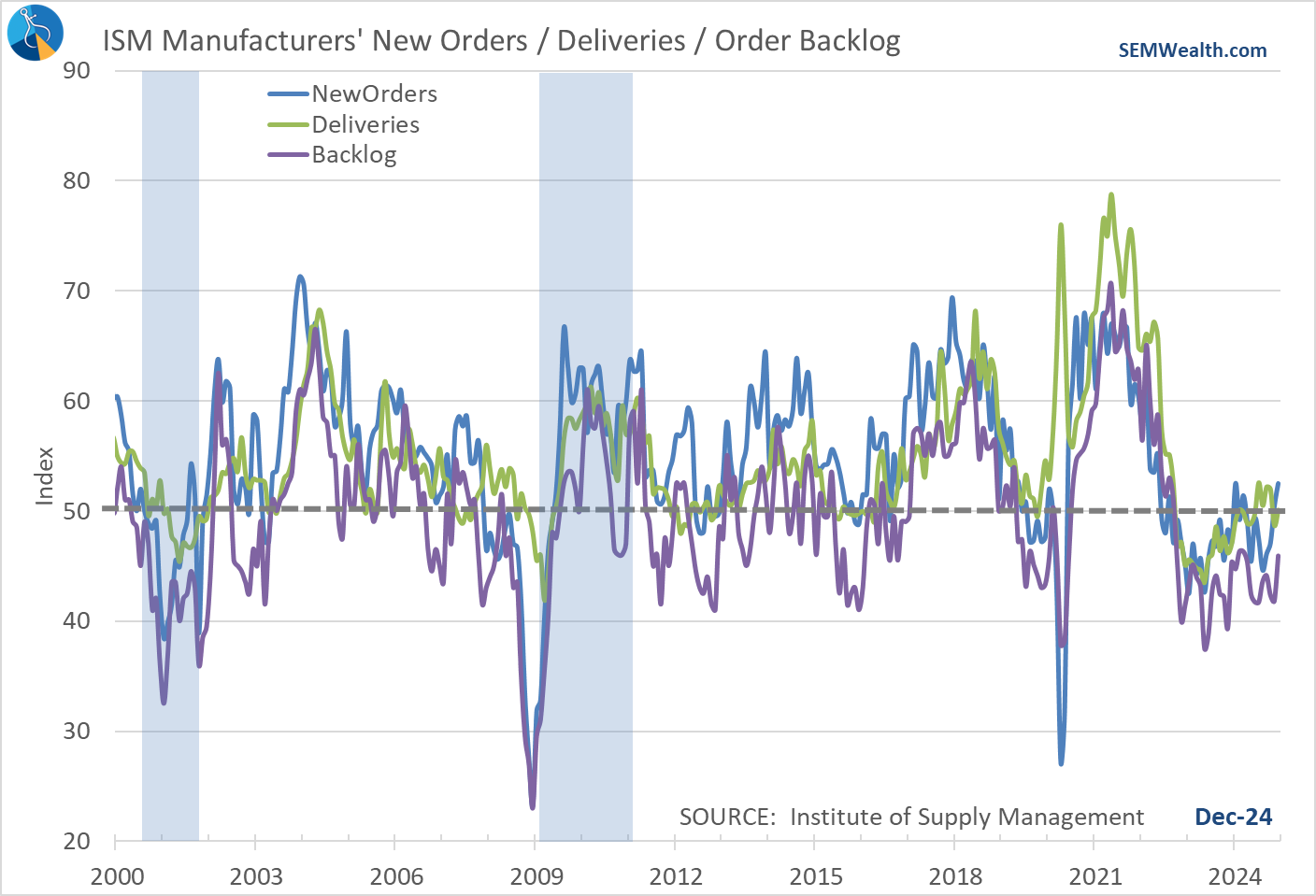

Manufacturing improving

One of the weak points since 2022 has been manufacturing, that however has turned with the leading 'new orders' indicator now back in 'expansion' territory.

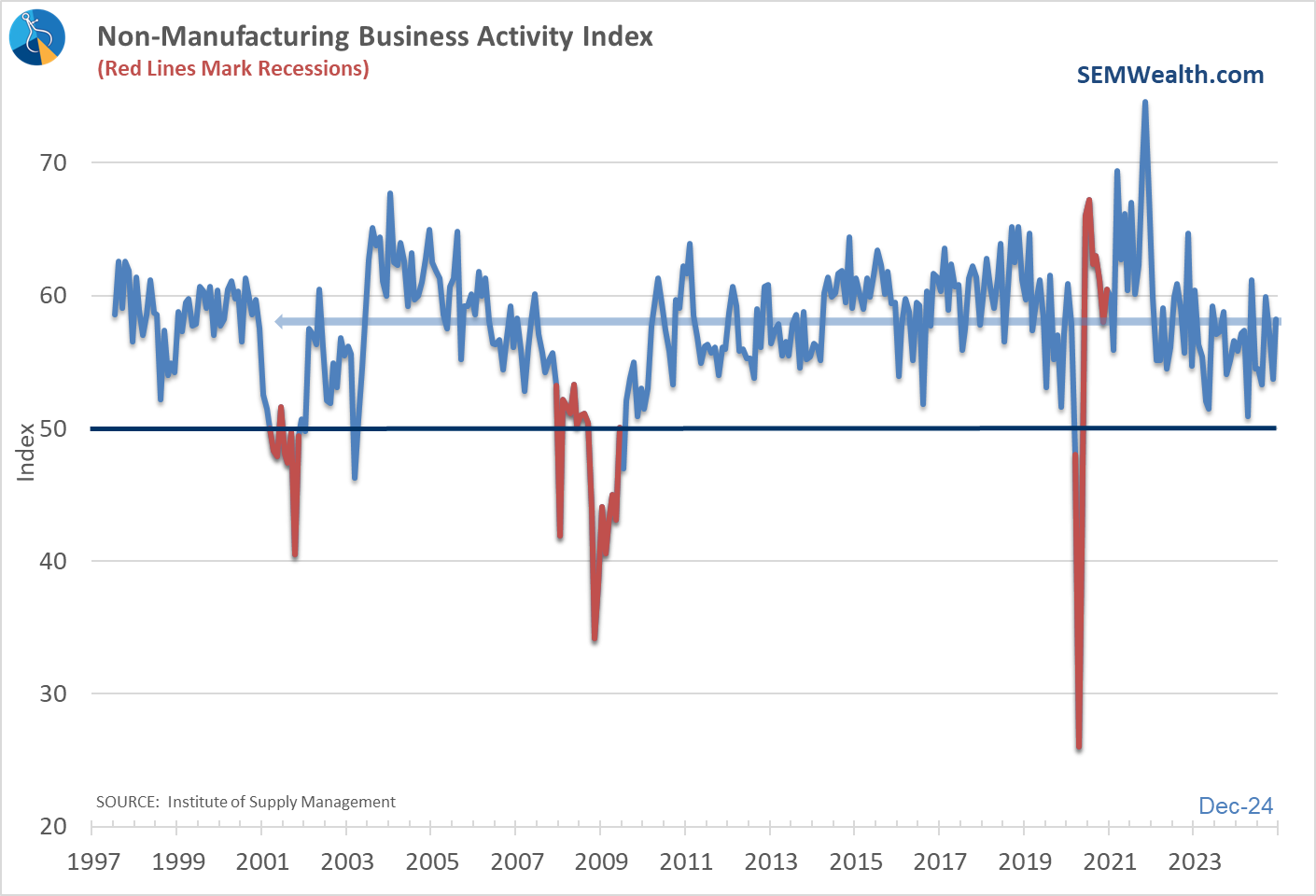

Service activity still strong

Another recent weak spot as the service sector, but that too has reversed to the upside.

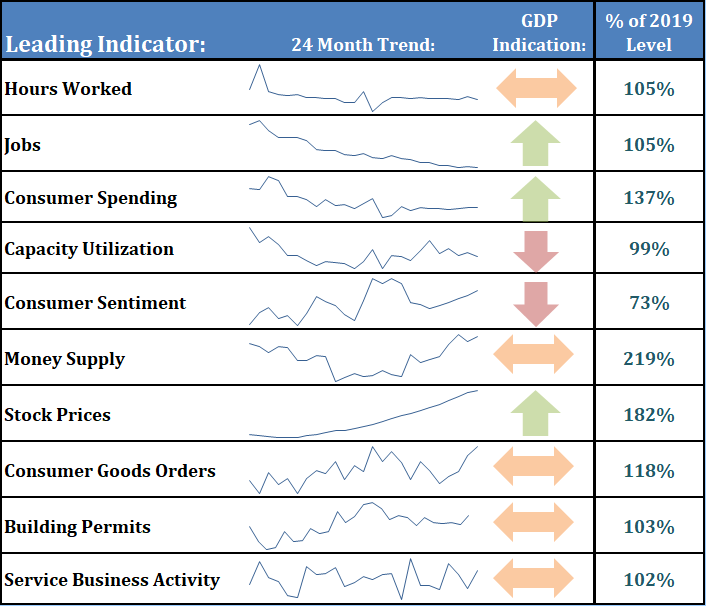

Not Weak, Not Strong

All in our dashboard shows some improvement in the GDP Indication, but overall we have 3 indicators showing above average growth, 2 showing below average growth and the rest just meandering around a 2.25 - 2.5% growth rate economy. That's not 'bad', but it's also not anything to get excited about.

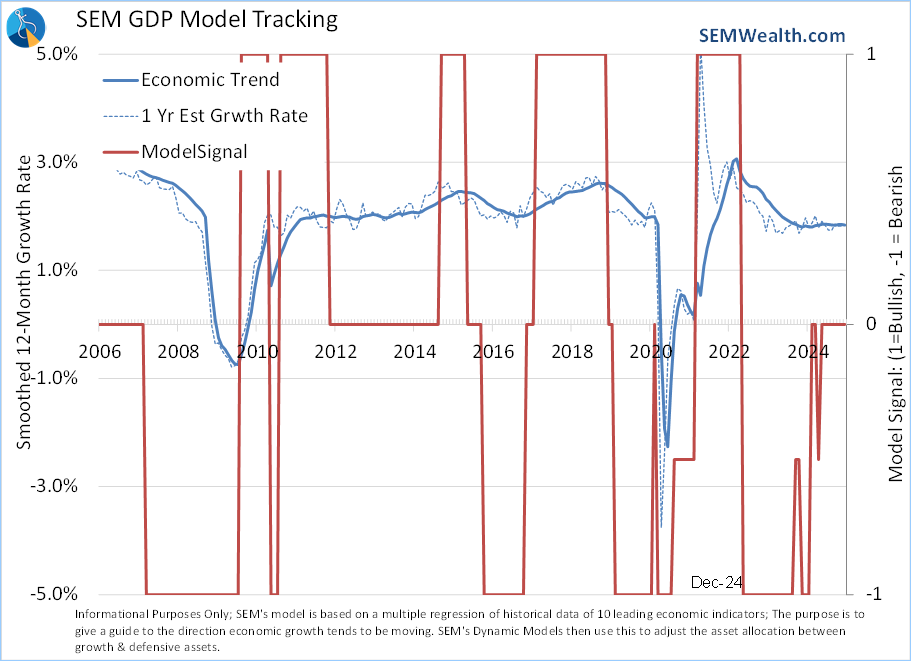

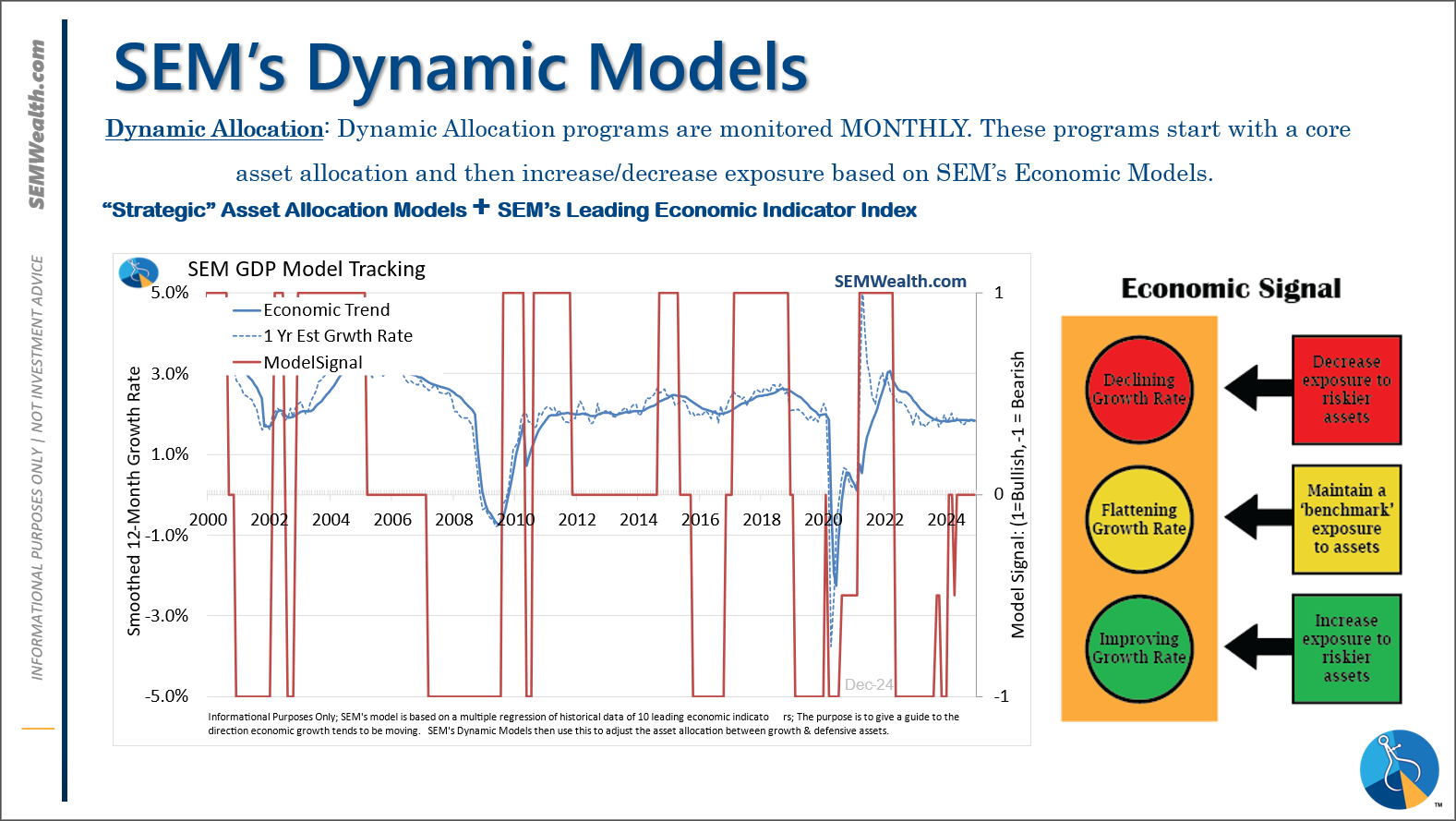

The flattening of the economy really shows up in our Economic Model Chart, which remains 'neutral'.

Why are stocks falling on good news?

All of this positive data should be good news, but both the stock market and the bond market sold off heavily on Friday. Stocks went into the year expecting 10-15% earnings growth (the average growth rate is around 7-9% for the S&P 500).

A robust labor market should mean the ability for the economy to grow at an ABOVE AVERAGE Rate (even though our model says that isn't happening just yet.) Did the earnings assumption also include a Fed that was going to continue to slash rates?

Based on the market reaction this week, that is exactly what they believed (which as I've said for a year now is completely illogical.) An economy strong enough to generate above average corporate earnings growth should mean a Fed that at best leaves rates along or at worst start hiking rates.

Fed is again running an experiment

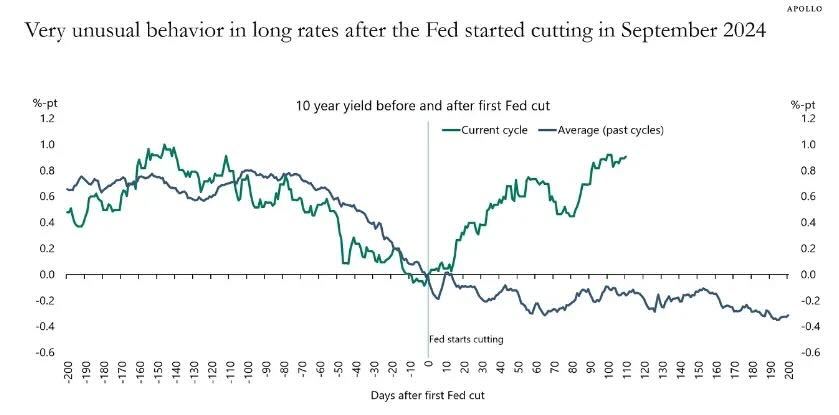

I've attempted for decades to educate everyone on the inner workings of interest rate movements. The Fed always makes headlines with their interest rate policies which leads most people to believe ALL interest rates will move in that direction. What is always lost in those reports is the fact the Federal Reserve only sets SHORT-TERM interest rates. The free market sets longer-term interest rates.

Now normally, when the Fed cuts rates, long-term rates also come down. This is because the Fed is reacting to current economic data, so they are in lock-step with the market and there is relief the Fed is watching the same data.

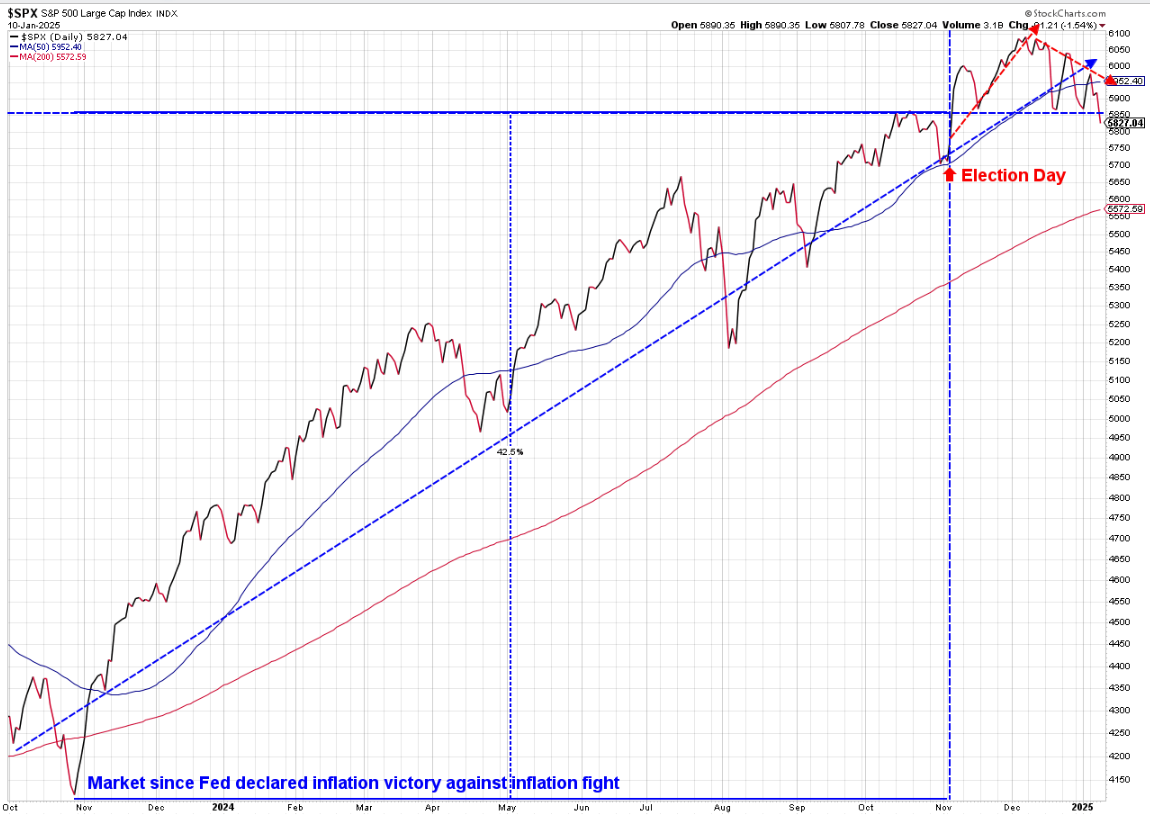

However, this time around Jerome Powell is running an experiment. Rather than being data dependent and waiting for the economy to show signs it NEEDS a little boost, the Fed is anticipating both inflation coming down to their 2% target AND the economy slowing down. Neither has happened, yet the Fed has cut rates aggressively. The stock market LOVED this – who doesn't love the idea of a Fed that never lets the economy go into a recession (and no consequences for trying to prevent it)?

The stock market doesn't seem to care that the Fed has a horrific track record at predicting the economy, including somehow forgiving Jerome Powell's Fed for completely missing the fact inflation was raging and create far reaching damage. They instead kept simulating the economy until they were forced to begin hiking rates.

The bond market however, immediately took the Fed's rate cut as a huge risk that inflation would return. Inflation is the enemy of bonds and bonds have thus reacted aggressively.

This chart from Bloomberg shows how the 10-year bond normally reacts (the blue line) to the Fed's rate cuts. The green line shows what has happened this time.

All of this is exactly why we do not use fundamental analysis. It's pointless. Stocks go up because more people buy than sell. They go down when more people sell than buy. They buy when events EXCEED expectations and sell when they do not. Human nature causes us to be overly optimistic making expectations eventually impossible to meet and then shift to overly pessimistic expectations eventually making it easy to "exceed" once again.

For more on the current markets and how SEM is positioned, check out the sections below.

Market Charts

This will continue to be the chart of the year. We will see what emerges this week, the final week before President Trump takes office. Stocks are now below the opening price the day after the election and up less than 1% since election day.

A better chart, though is the chart since the bottom in 2023. This shows the real driver of the rally – the Fed announcing they were done with their inflation fight and ready to help simulating stocks again. The uptrend has been broken and the market did violate some levels that had been "support". Now the question is – if the 40% 14 month rally was led by the thought the Fed would aggressively cut rates, does the news the past few weeks mean stocks need to reset to a more reasonable level?

I continue to believe the answer will come from the bond market. Since the Fed's first rate cut the bond market has been screaming their displeasure. Bond yields are now threatening the 5% level on the 10-year Treasury, a number that psychologically could be quite attractive to many people.

One important thing to keep in mind – while short-term rates and Fed policy may juice stock prices and other risky assets – only the Wall Street banks actually pay the short-term rates set by the Fed. Everyone else pays the market set rates and most of those are driven off of the 10-year Treasury. So yes, the Fed cut rates which has juiced Wall Street, but the hikes from the bond market could be a big issue for the Fed and Wall Street.

SEM Model Positioning

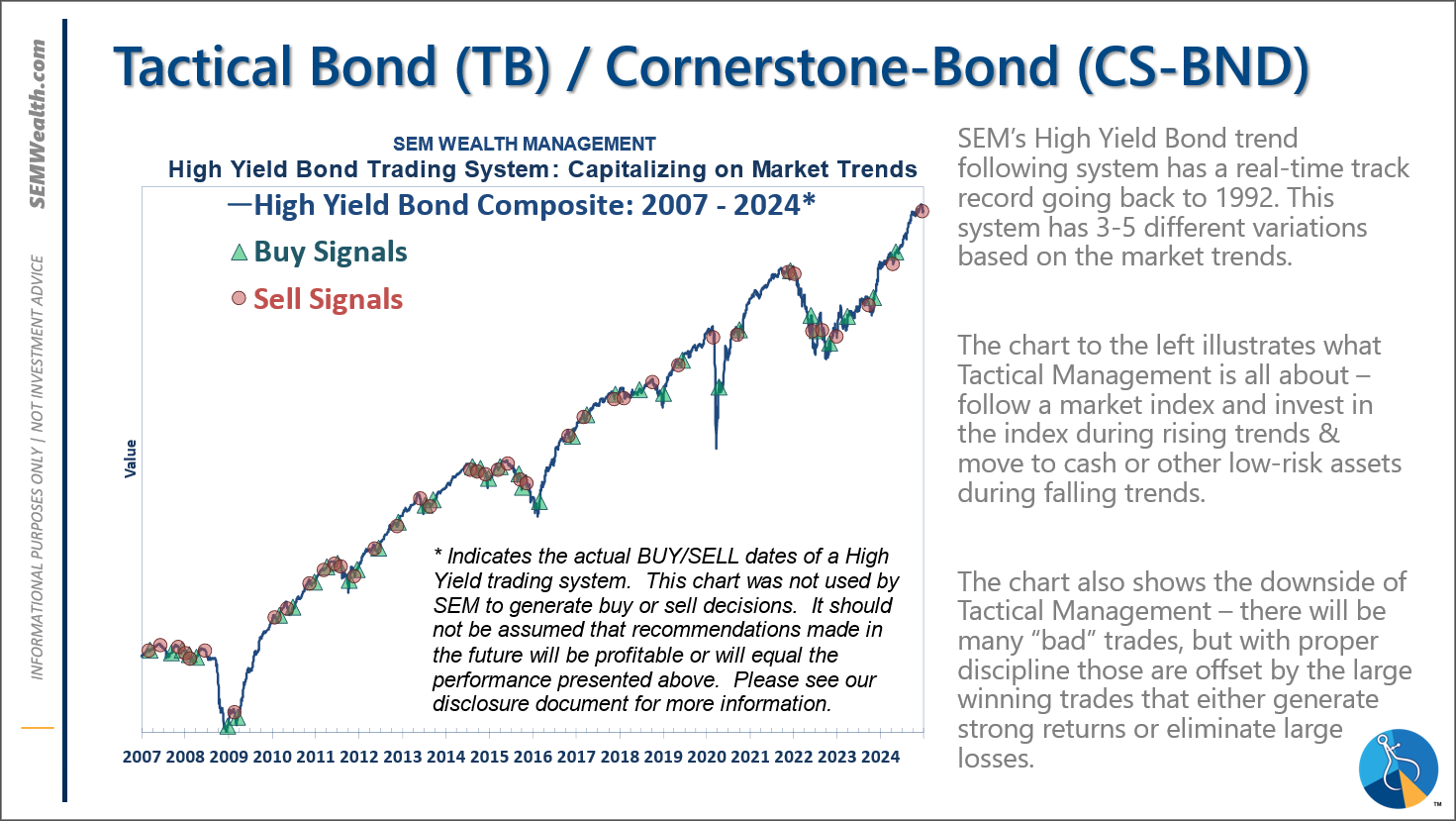

-Tactical High Yield sold our high yield bond positions purchased last spring on 12/20/24. We had added a 30% position in floating rate bonds on 12/6/24, which currently have a 9% yield compared to a 6% yield in high yields and 4.6% in money markets. This follows the partial (about 67%) buy signal on 5/6/24.

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

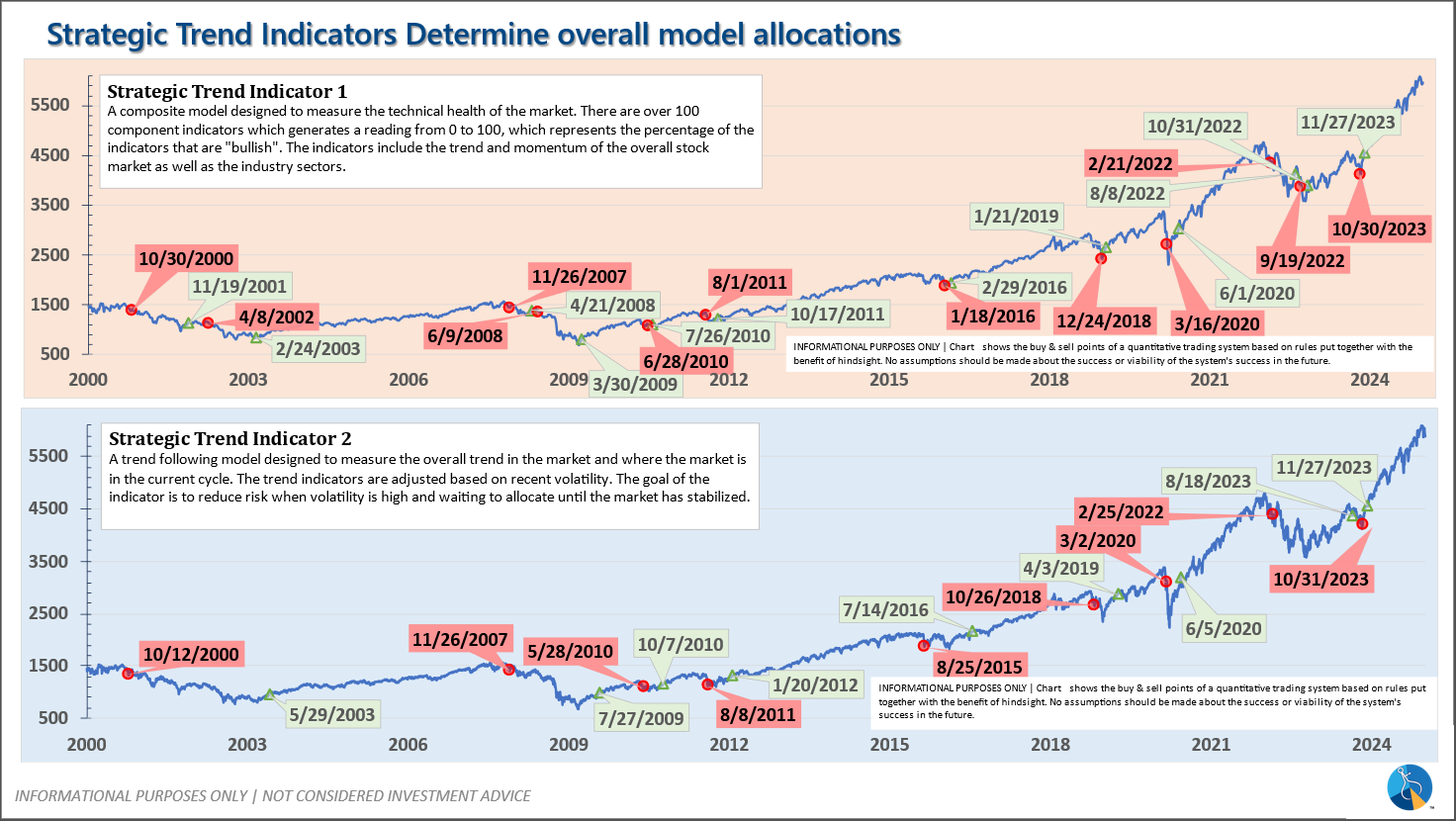

-Strategic Trend Models went on a buy 11/27/2023; 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

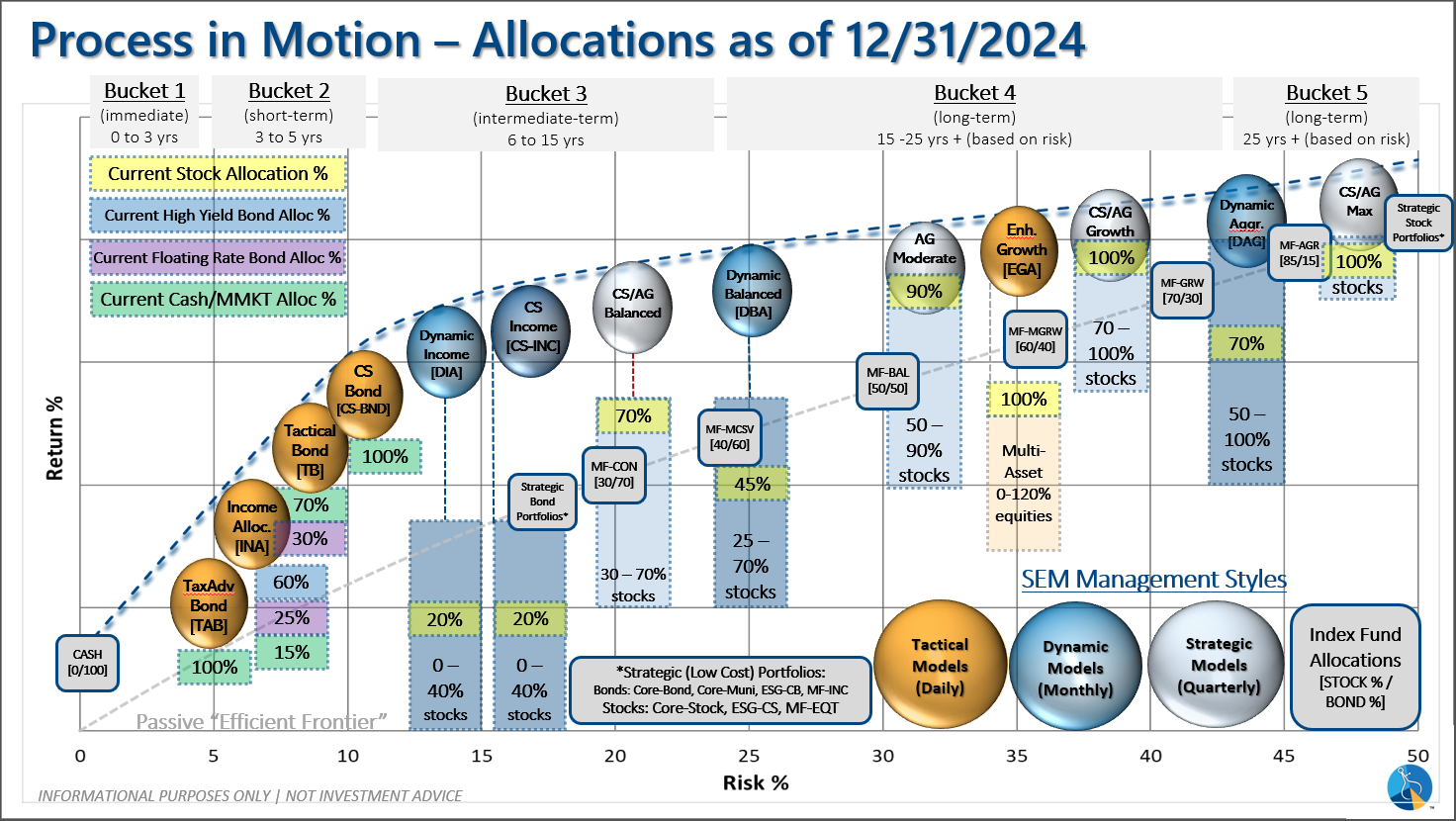

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 12/20/2024 our tactical high yield model sold out of high yield bond (about 70% of our holdings) into money market. The other 30% is invested in shorter duration, higher yielding floating rate bonds. These instruments are not as sensitive to credit risk and are typically allocated to in the early and late stages of a high yield bond move in our model.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire