What has been will be again,

what has been done will be done again;

there is nothing new under the sun. - Ecclesiastes 1:9 (NIV)

"The market can remain irrational longer than you can remain solvent." - John Maynard Keynes

Tulip bulbs, South Sea Company, railroads, Japan, tech stocks, US Housing, and Reddit??

It's hard to say what history will say about the action the last few weeks in stocks mentioned on a Reddit message board. I'm already tired of talking about it and trying to educate people about the dangerous game being played. I spent some time on Reddit on Saturday and there were so many things that are 100% incorrect on those boards it would be pointless to comment on.

The market is not efficient

I first argued with my professors back in college about the problems with the "efficient market" hypothesis. Over the very long-run the price of a stock will eventually reflect all the known information, including whether or not the business model is viable enough to remain solvent enough to pay back the investors. Over long periods of time, however, stocks are nowhere close to reflecting the real value of a company.

When asked why the market (or a stock) went up, I've always replied, "more people bought than sold." The inverse is true when it goes down. Right now we have a whole bunch of people with a bunch of disposable income on platforms with no visible trading costs colluding together to buy a bunch of shares of assets with the sole purpose of driving the price up to hurt those betting against it.

This will work until it doesn't. When the money runs out after people begin to lose money the game will stop. The last ones in will lose the most. In my opinion, the companies being bid to the moon (specifically Game Stop, Blackberry, AMC, and Bed, Bath, and Beyond) have no viable long-term business model. There is no possible way these companies will be able to remain in business long enough to return value to the shareholders. I will say the management of the companies are savvy – they are using the ridiculous spike higher to raise capital.

Remember I've been here before. Adding dot-com to your name back in the late-1990s was a way to double, triple, quintuple, or more your stock. Back then CD Now, the company who sold compilation CDs via television commercials had their stock triple in one day when they changed their name to CDNow.com. AltaVista, IVillage, AskJeeves, Lycos, Netscape, Excite, Palm, and the infamous Pets.com are just a handful of examples of companies who enjoyed spectacular stock rallies before eventually seeing their stocks become worthless.

At least back then the CONCEPT of the dot-com business model was long-term viable. Many of those ideas were put to use by other companies who have made significant money since then.

Again, the companies being bid up now are not going up because they have a solid business idea; they are going up because more people are buying than selling. There is no end game.

Contagion an issue

While the goal on the Reddit boards is to punish the hedge funds who have bet against the companies who have no viable long-term business model there is a significant risk this can have severe collateral damage.

One of the pieces of "advice" on Reddit is to use options rather than the underlying stock to drive the price higher. The speculator doesn't have to put up much money and can make huge gains, while it still forces somebody else to buy the stock and thus driving the stock higher. The firm selling the options has to buy stock in the company to help hedge it. The way options pricing formulas work, it is not a 1:1 relationship (or 1:100 since 1 option entitles you to 100 shares of stock). Instead, the more the stock goes up, the more the underwriter of the options has to buy to keep the hedge in place. The firms selling options are likely being hurt. This includes many of the Wall Street banks.

In addition, firms like Robinhood allowing the stocks (and options) to be bought on their platforms do not hold the stock in their "inventory". They have 2 days to find the stock and move it to their clients' accounts. This has proven to be costly. Their clearinghouse upped the collateral requirement for Robinhood last week, which caused them to have to raise emergency capital from their investors to remain solvent. Other firms such as TD Ameritrade, E*Trade, and Schwab all began restricting purchases of the Reddit stocks last week due to the same concerns. (Note E*Trade Securities, the online brokerage is a completely separate entity from E*Trade Advisor Services where we custody our assets.)

Finally, in the past this type of speculation has almost always led to severe losses in the stock market. Investors eventually lose confidence in the rally and choose to move to the sidelines (more people sell than buy). All those people who came into the rally the last few months simply because stocks were going up will be the ones hurt the most.

While the goal of the Reddit community is to hurt hedge funds, they could hurt most American's retirement funds. In addition to the trillions of dollars invested in passive index strategies in their employer plans, most pension funds over the past 10 years have turned to hedge funds as they attempt to overcome two decades of returns well below what they had priced into their benefit payouts. There is no telling which funds the plans are invested in, but it is likely some of them will be taking a large hit.

Closing the barn door after the horses are out

We should expect legislators and regulators to spend the next few months trying to fix whatever happened. This is always the case. Warren Buffet described derivatives as "weapons of mass financial destruction". Since the late 1990s I've long criticized the repeal of Depression-era legislation designed to protect the financial system. After the financial system nearly imploded in 2008, Dodd-Frank was designed to put protections in place once again. As humans typically do, because there wasn't a crisis in the 10 years following the implementation of Dodd-Frank, it was essentially watered down to nothing, allowing banks to make money any way possible.

Hopefully it won't come to this. Newly appointed Treasury Secretary Janet Yellen has long warned about banks taking on too much risk. She fought any push for banks to have their capital requirements relaxed as Fed Chair. Her successor, Jerome Powell recently relented and has allowed banks to carry less capital on their books.

Better than the lottery

The main piece of advice I give to anybody wanting to join the Reddit stock game is this – if you are prone to play the lottery or go to casinos, take the money you would normally use for those activities and open a brokerage account. Your probability of winning and your payout is higher gambling in stocks than other gambling endeavors. (This is not a recommendation to gamble, but simple a different way to do something you're already doing.)

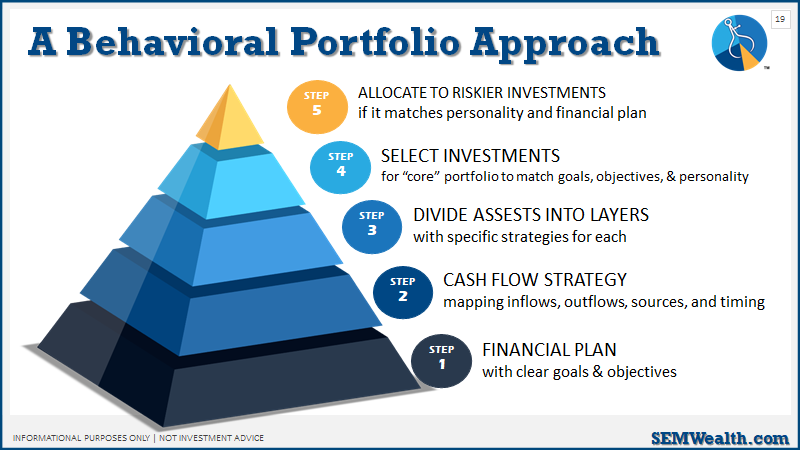

From our perspective, this is money that is at the "top of the pyramid". We designed the Behavioral Portfolio approach to manage around our natural human tendencies.

The top of the pyramid is the "fun" money – the money that if taken completely out of the financial plan does not impact your future. You SHOULD NOT be gambling with top of the pyramid money if you haven't already taken care of the rest of the pyramid.

While maybe not as "sexy" as the Reddit stock game, we did launch a Breakaway Stock Model last spring to allow clients who have money at the top of the pyramid who want to own individual stocks. Click here for the details.

From a portfolio perspective, our models are still fully invested although the speculation last week is beginning to shake some of our trend following models closer to some sell points. Just as we've done all along, our models will be ready to adapt to whatever environment comes along next. We're ready. Are you?

Going back to the Ecclesiastes quote at the top – there is nothing new under the sun (or in the markets). Bubbles emerge, bubbles pop. Investors get sucked in, investors get burned. Lather, rinse, repeat.

Our goal is to help you develop a financial plan, cash flow strategy, and then match the investments to fit the plan and your overall investment personality. Slow and steady.

In case you missed it, check out last week's blog on "Foolishness". While I didn't discuss GameStop or the other Reddit names then, the bigger picture lesson still applies:

Also, while hedge funds making big bets on companies are the target of Reddit users currently, our "liquid, transparent, low cost" hedge fund proxy, Dynamic Asset Allocator is a solid solution for those seeking alternative investments. For the details, check out this post:

I'll end with this – while greed is running rampant, it is important to keep our personal motives in check. Here's a great article by Courtney discussing our motives: