If it seems we've been in election season since 2022, you're right – that's when former President Trump and President Biden both declared their intention to run for president in 2024. With the Iowa Caucus now in the books, we are finally 'officially' in election season. I'm not going to comment on the results or what they mean. If we've learned anything the early results are not always an indicator of who ends up on the ballot, although this time around it seems the people who run the two parties and those who vote in the primaries are dead set on giving us a rematch of the 2020 election. All this with both candidates having an approval rating of below 40%.

What I do want to talk about is mixing politics and investing. Back in 2008 when I saw clients and advisors on both sides of the political spectrum declaring with certainty how good things would be if their side won and how bad they would be if the other side was victorious, I saw them aligning their investments with their politics. I coined a phrase you've probably heard me use many times:

"Don't let your political opinions influence your investment decisions."

I'm sure I'll have much more on that throughout the year including an update to the data behind which party is better for stocks (hint: it's basically 50/50).

Before I go much further, I do need to remind everyone two things:

1.) I'm a registered Independent so I usually offend both sides. That's not my intention. I respect the views of both sides and their right to have them. That's why I love America.

2.) I care more about DATA and do my best to not let opinions influence my money decisions.

That said, I didn't want to have to post a blog on this topic, but I've received so many emails and calls on this topic that it would be easier for me to put it on the blog so I can forward a link instead ofcopying/pasting the same response over and over again.

What did Blackrock do?

What I'm talking about is Blackrock and the on-going perception from the far right that they represent the extreme liberal agenda. Based on my emails the furor against Blackrock comes in waves. The biggest wave was in 2022 when the media on the right began highlighting comments from Blackrock CEO Larry Fink.

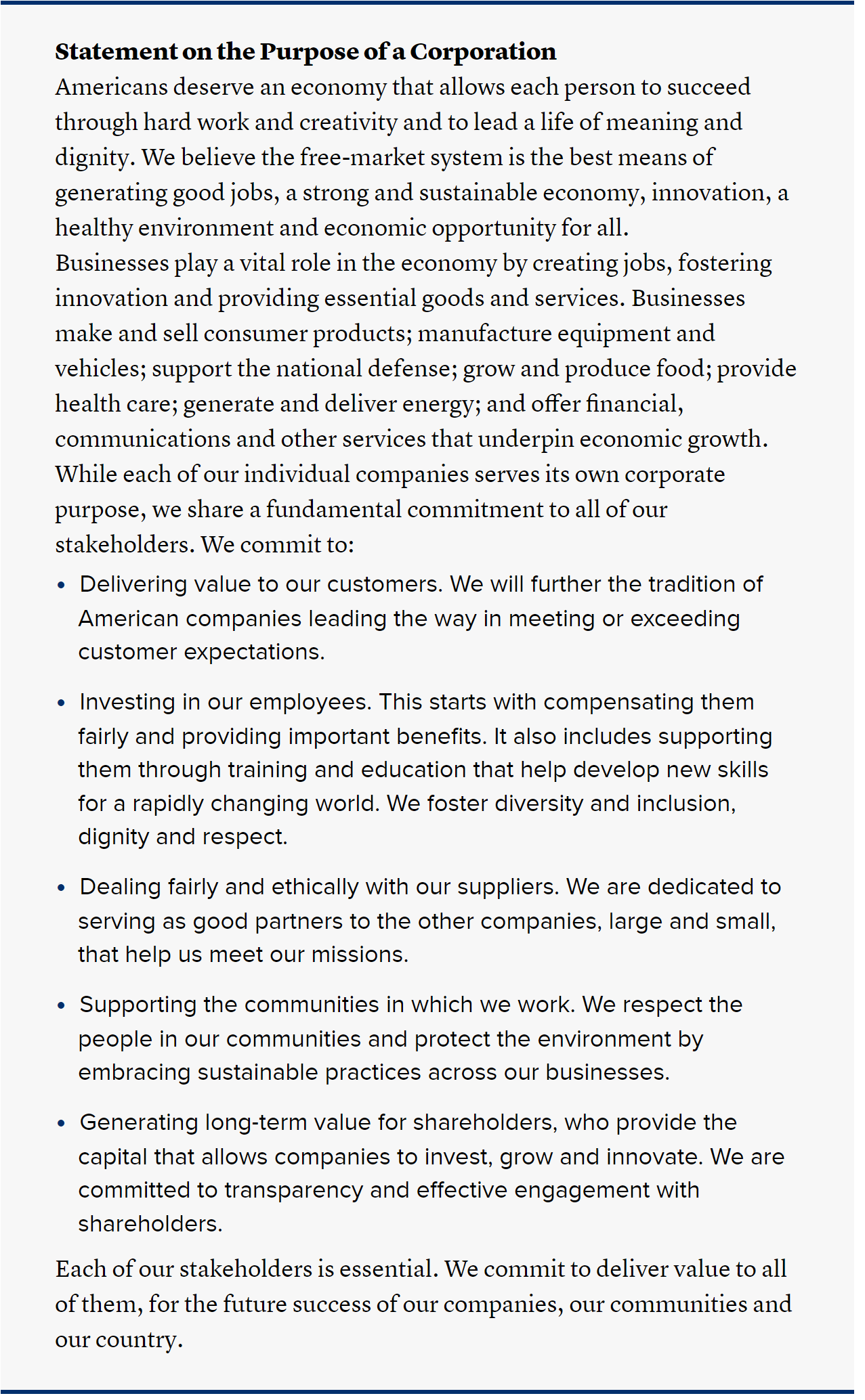

The story actually begins back in 2019 with Mr. Fink's annual letter to shareholders. Essentially he said, for capitalism to survive and generate sustainable long-term returns, companies need to move beyond a shareholder focus to a stakeholder focus. The Business Roundtable, which represents 180 of the largest companies in the world followed suit the same year and released a statement of the Purpose of a Corporation.

The CEOs who signed the above statement included the heads of Apple, Microsoft, Alphabet (Google), Meta (Facebook), Amazon, & JP Morgan. All of those firms are top 10 holdings in the S&P 500 index, meaning if you own an S&P 500 index fund you are invested in companies who believe the same thing Blackrock's CEO said in his 2019 letter.

Before I go further let me be clear — there are MANY things wrong with the ESG movement some of which will do far more harm than good. I am by no means endorsing the current interpretation of ESG investing. However, if you re-read the statement from the Business Roundtable it is essentially what I've been saying for over 20 years.

Returning to the pre-1995 Corporate Role

For those who haven't heard my story, I took a 2 year break in my pursuit of a degree in the 1990s. When I took my first economics class in 1993, the 'role' of a corporation was to maximize stakeholder value. This included employees, customers, suppliers, the community, and shareholders. When I returned to college in 1995 my next economics class defined the 'role' of a corporation as maximizing shareholder value. In other words, in the mid-1990s there was a shift in the perceived role of the corporation that eliminated employees, customers, suppliers, and the community.

What Mr. Fink and the Business Roundtable said in 2019 was essentially, we need to get back to the pre-1995 definition of the role of a corporation. Going back to Mr. Fink's original comment:

In today’s globally interconnected world, a company must create value for and be valued by its full range of stakeholders in order to deliver long-term value for its shareholders. It is through effective stakeholder capitalism that capital is efficiently allocated, companies achieve durable profitability, and value is created and sustained over the long-term. Make no mistake, the fair pursuit of profit is still what animates markets; and long-term profitability is the measure by which markets will ultimately determine your company’s success.

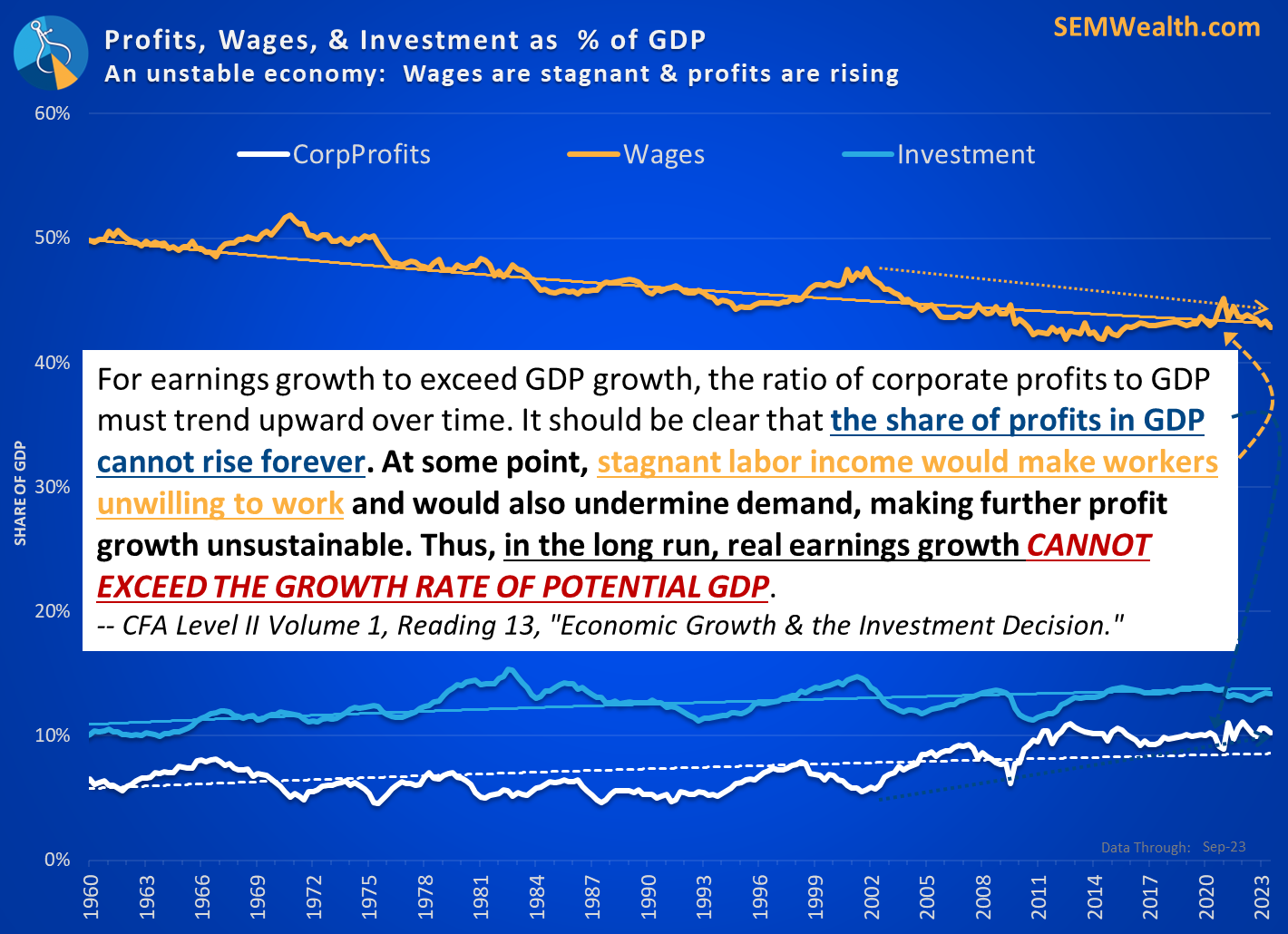

This is based on long-standing economic theory. In fact, I shared this chart back in 2015 which included a quote from the CFA Institute discussing the economic problem if labor (employee) share of profits is stagnant. Notice the trend in wages versus the trend in profits. In other posts I've talked about how our economy has been growing below potential.

Corporations are realizing they've squeezed about everything they can out of the other stakeholders. If they want to create LONG-TERM sustainable growth, they need to find a balance among all stakeholders. This is not the result of one investment firm's CEO saying it, but rather economic laws taking over. The fact that he dared say it out loud (and 180 CEOs of the largest corporations agreed) should be looked at as a GOOD thing in terms of LONG-TERM sustainable growth.

Again, I'm not endorsing the current interpretation of ESG investing, but rather a STAKEHOLDER focus. The free market will take care of it because shareholders want long-term growth and capital will be allocated accordingly.

Finally, at SEM we have our own version of values-based, or impact investing which at its core focuses on stakeholder value. It is designed for Christian investors wanting to align their investments with their values. There is some overlap between a Biblical Approach and "ESG" investing, but some critical differences.

You can learn more about our Biblically Responsible Investment options here.

Why does SEM own Blackrock funds?

For our non-Biblically Responsible models (most of our assets), we do not have ANY values-based or ESG screens on our holdings. We instead use our quantitative models to invest in areas which are trending higher. When we allocate to any fund/ETF it is based on DATA not anything else including the perception of what the company 'stands for'.

This means we own Blackrock funds including iShares. Here is what I wrote back in 2022 when a client expressed 'grave' concern about our Blackrock/iShares holdings:

Yes we use Blackrock and iShares in our models, but this has nothing to do with agreeing or disagreeing with what the CEO (who does not make investment management decisions) says in the media or how they are portrayed by others. Blackrock is the largest manager in the world and offers the advantages of major economies of scale which leads to lower prices and better performance.

I just had a meeting with one of our contacts at Blackrock and obviously they are hearing a lot about this. Ironically he said recently they are being attacked from the LEFT outside their offices because they own energy stocks (and other 'evil' corporations in the eyes of the far left). In other words, because they are the largest money manager in the world and face enormous pressure from both sides. This is not being covered in the media because it would highlight the fact Blackrock owns a tremendous amount of non-ESG friendly investments.

Blackrock’s number one priority is to track the benchmarks and they do an exceptional job of this. Yes they have ESG funds, but so does Vanguard (and most other large fund providers).

Like all investment managers, they have a specific fiduciary duty that is disclosed in their prospectus, and we believe they are doing this. They track their benchmarks as close as any other provider and that’s the most important thing, not what their CEO’s opinion is about ESG investing.

They shared with us a resource you can send to any client concerned about us using Blackrock:

Setting the Record Straight on Energy Investing | BlackRock

What does the DATA say?

I recently was forwarded this report and it was FASCINATING because it was an INDEPENDENT look at the voting records of fund managers in terms of how often they support ESG friendly policies. An A means they vote for very few ESG policies and an F means they support all of them.

We know a lot of advisors and clients use Charles Schwab. We also know that Schwab makes their funds and ETFs much more attractive on a cost basis than other funds, which means a lot of Schwab clients own Schwab funds. Based on this report, somebody who is anti-ESG should be much more concerned about Schwab's ESG voting record than Blackrock's because Blackrock is LESS ESG FRIENDLY THAN SCHWAB!

Overall, note what the DATA shows – Blackrock is the 5th LEAST-FRIENDLY ESG policy supporter. There are only four firms who rank better than Blackrock. Dimensional funds are expensive and they have dramatically underperformed over the past 15 years. We use Vanguard at times, but tend to use iShares in market segments where the execution costs of iShares are cheaper than Vanguard. T. Rowe funds are generally more expensive, but they will show up in our allocations when warranted. Fidelity funds are hard to use outside of Fidelity (because they charge significantly higher fees if you aren’t at Fidelity), but we do use them at times.

In other words, even though we use Blackrock/iShares our non-BRI portfolios are about as anti-ESG as possible. That isn't a statement for or against ESG investing, but instead a highlight of the value of using SEM – we let the DATA make the decisions, not our opinion.

The bottom line – the anti-Blackrock messaging is not supported by the data. The most important thing is Blackrock provides index funds and they have a fiduciary duty to TRACK THE INDEX. If the data shows they are not tracking the index we would use somebody else.

Final Thoughts

I understand the importance of not investing in things you do not agree with. That is literally why we were compelled to create our Biblically Responsible Cornerstone Models. That said, we also know the media is good at playing into our emotions. They find a narrative that keeps their audience engaged and they keep pushing it even if the DATA doesn't support it. Our approach at SEM allows us to ignore the media, keep our opinions out of our decisions, and instead focus on what matters most – consistent, disciplined, and sophisticated investment models which can be customized to meet the needs of our clients.

Again, I'll leave you with the most important advice for this election year (and any year):

Don't let your political opinions influence your investment decisions.

Market Charts

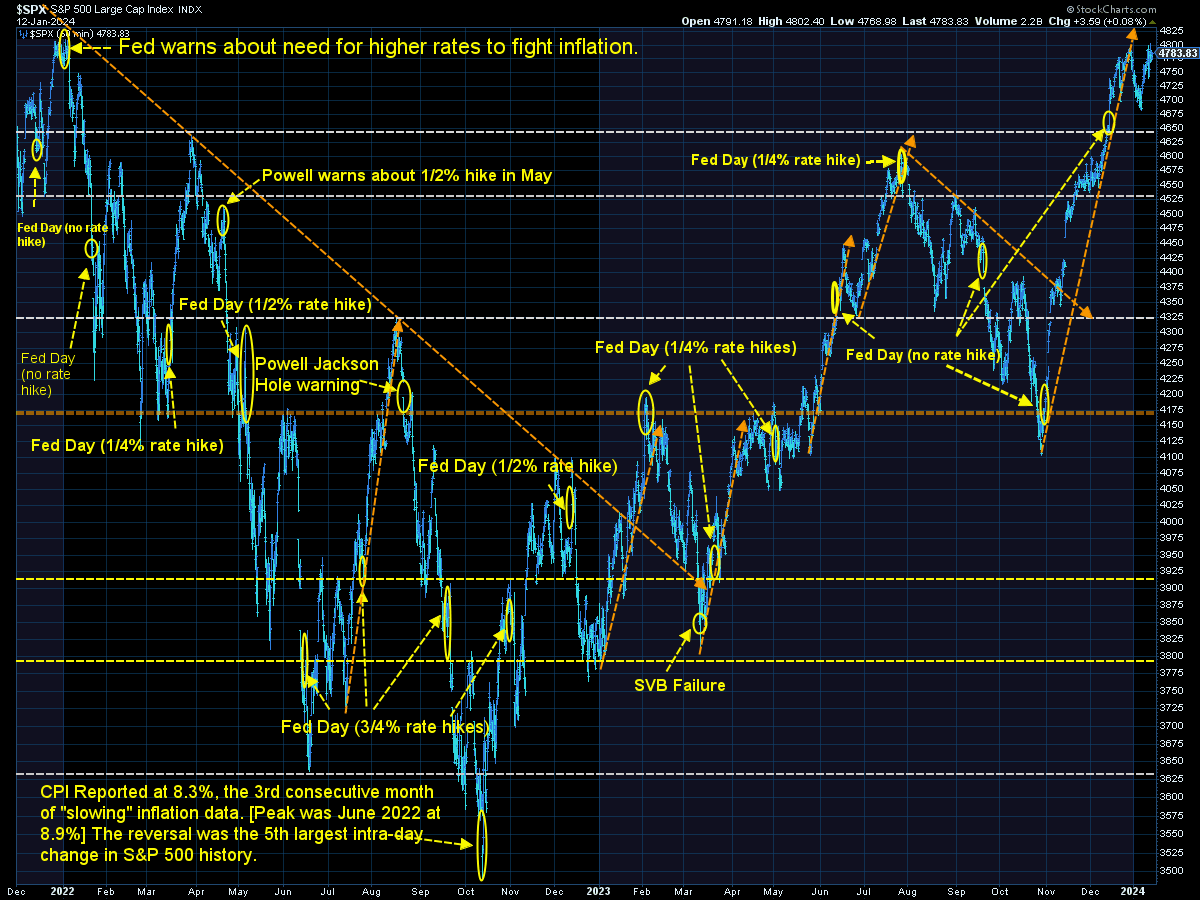

The S&P 500 is once again attempting to breakthrough the 2021 end of year peak. Earnings season kicked off last week with the large Wall Street banks reporting. The results were mixed, but were mostly ignored. Things will get heavy the next few weeks and the optimism of companies for their growth outlook will likely dictate whether or not we see a breakout to new highs or start another sell-off.

Turning to bonds, the 10-year Treasury yield had a volatile week, crossing back above 4% earlier in the week before settling just below that benchmark. Remember, the market is pricing in roughly 6 interest rate cuts in 2024 while the Fed is predicting just 3. While that disconnect is sorted out we could see continued volatility in the rates market.

SEM Model Positioning

MODEL CHANGES LAST WEEK – the 'Core Rotation' system of AmeriGuard ran its quarterly rebalance last week. We sold all of our Small Cap Value and Mid Cap Growth positions to purchase another American Funds position (our 3rd) and a Dividend Growth ETF. This is interesting in that the broadening of the market in the 4th quarter with small caps nearly doubling the returns of the S&P the last 8 weeks apparently has lost its momentum. That said, the move to American Funds and Dividend Growth is an indication that at least for the large cap market the signs are the strength of the market is moving beyond the top 10 stocks. Unlike the S&P index funds, American Funds cannot have more than 2-5% allocated to a single stock so when those funds are at the top of our rankings it is (hopefully) a positive sign.

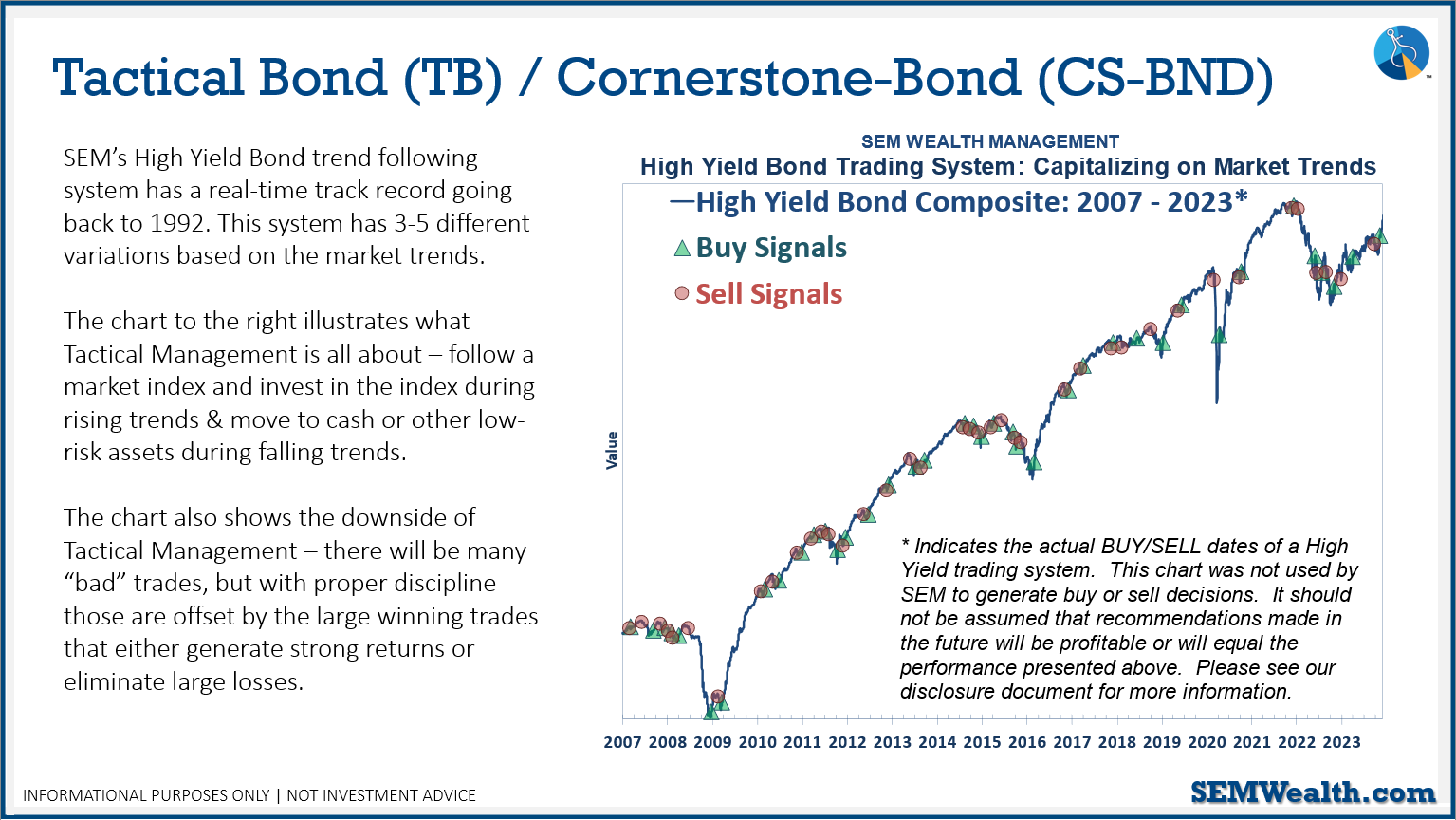

-Tactical High Yield went on a buy 11/3/2023

-Dynamic Models reverted back to 'bearish' 12/8/2023

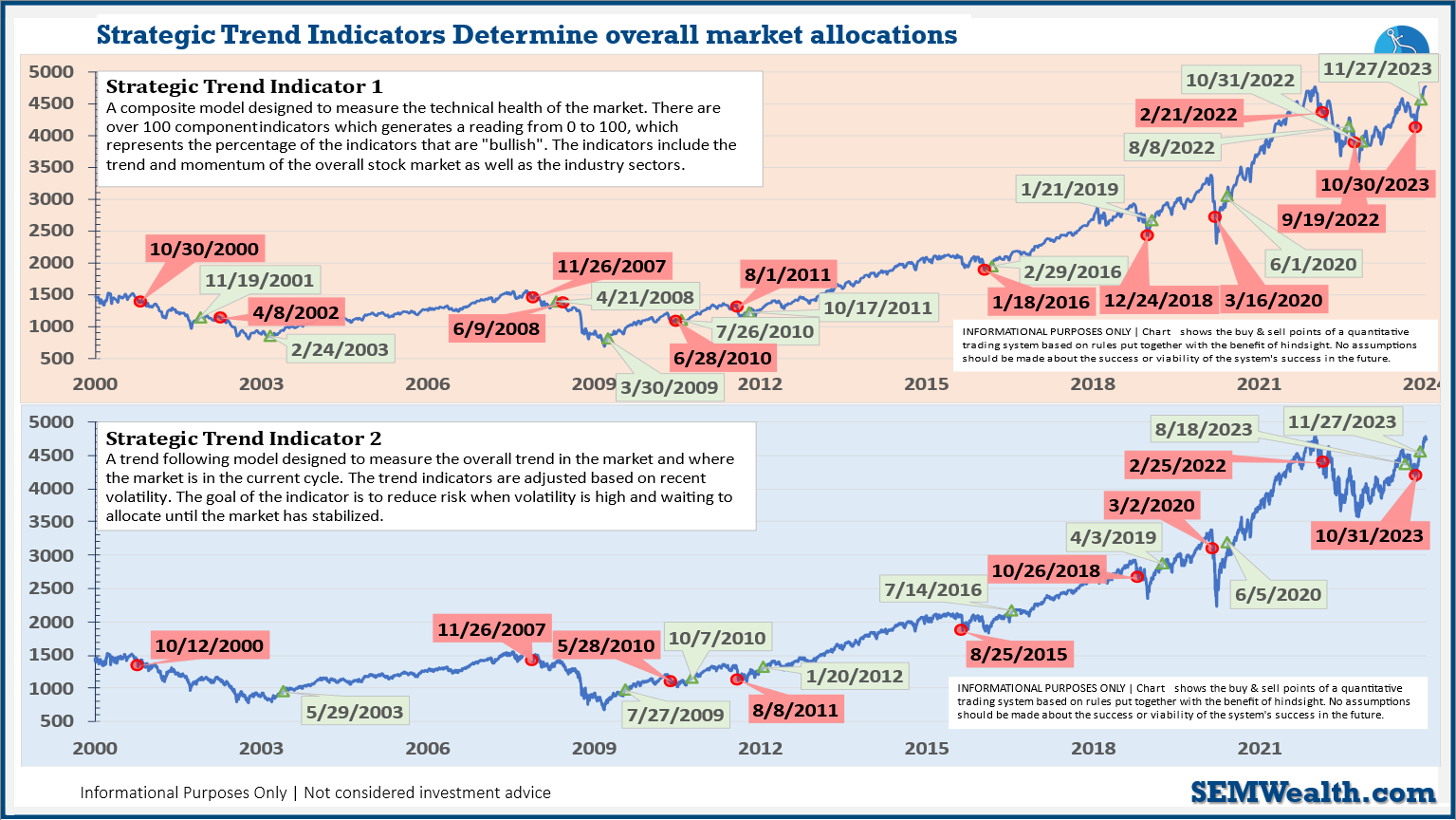

-Strategic Trend Models went on a buy 11/27/2023

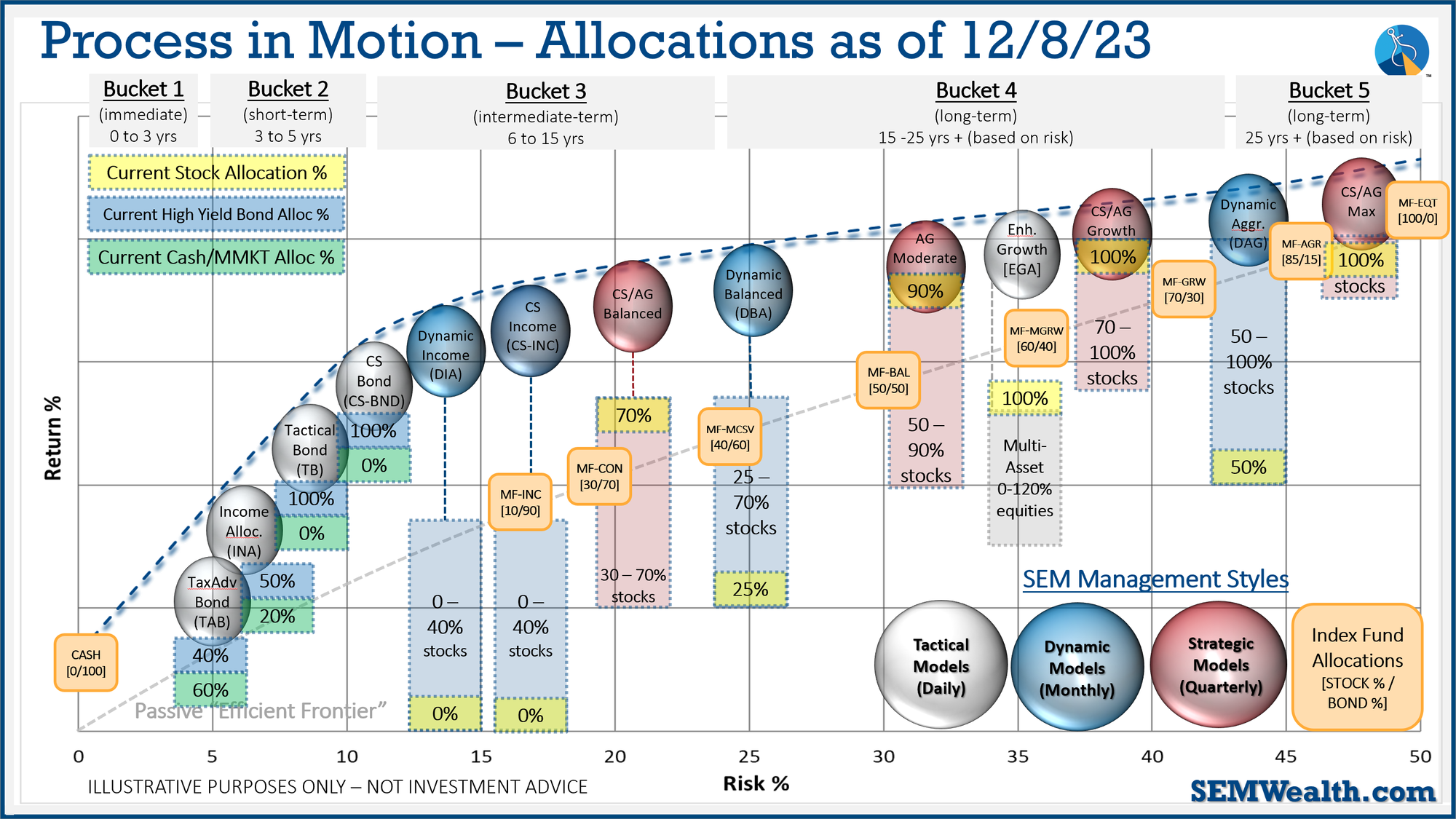

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The High Yield Bond system bought the beginning of April and issued all 3 sell signals 9/28/2023. All 3 systems were back on buy signals by the close on 11/3/2023. The bond funds we are invested in are a bit more 'conservative' than the overall index, but still yielding between 7.5 -8.5% annually.

Dynamic (monthly): At the beginning of October the model moved slightly off the "bearish" signal we've had since April 2022. At the beginning of December it reverted back to "bearish". This means no positions in dividend stocks (Dynamic Income) or small cap stocks (Dynamic Aggressive Growth).

Strategic (quarterly)*:

BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change: