AI Stocks: Boom, Bubble……or Both?

Artificial Intelligence (AI) is most certainly transforming industries and grabbing headlines. From chipmakers like Nvidia to tech giants like Microsoft and Google to “forgotten” companies like Oracle, AI-related stocks have soared, helping push the S&P 500 to new highs. The excitement is real: companies are reporting record earnings, and AI is already reshaping how businesses operate.

But even real revolutions can create bubbles.

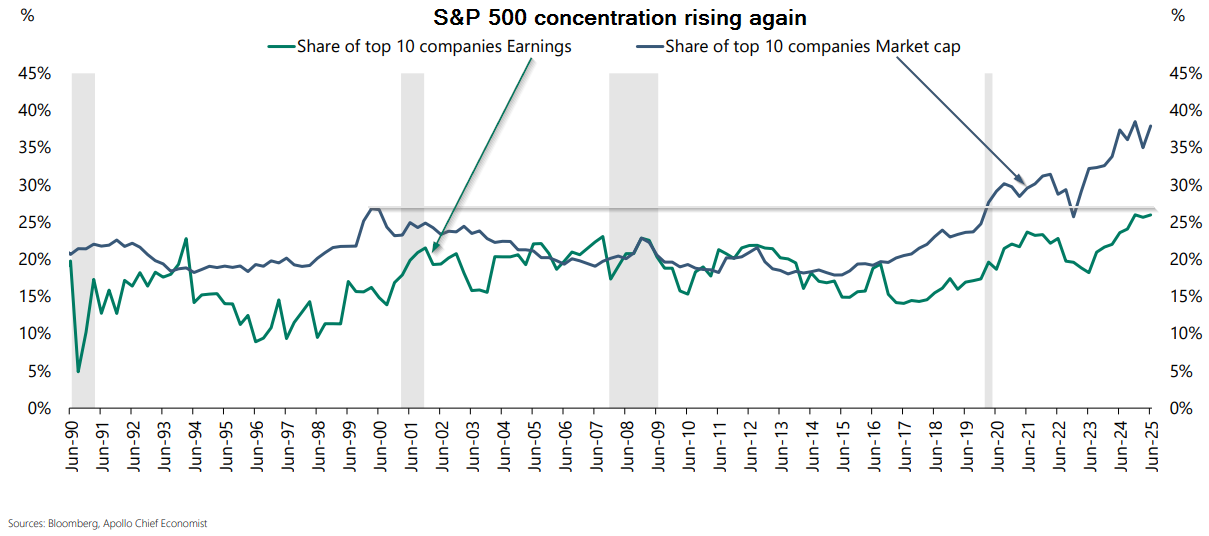

Stocks are trading at record high valuations, eclipsing the dot-com peak. This has created another concern—concentration risk. As of mid-2025, the top 10 stocks in the S&P 500 (mostly AI-driven) make up nearly 40% of the index’s value. That’s more than during the peak of the dot-com era. If just a few of these names stumble, the whole market could feel it.

So what should investors do? Stick to your plan. If your financial goals haven’t changed, your portfolio likely doesn’t need drastic adjustments. Your investment mix already includes exposure to AI. There’s no need to chase what’s already run so far by adding more AI exposure. As always, we’ll let the data, not the headlines guide our decisions.

For a deeper dive into the AI boom and what it means for your portfolio, check out the bonus content below.

FOMO: Sticking to your plan in a noisy market

Markets are hitting new highs. As noted above, AI is dominating the headlines. Everyone from Uber drivers to TV pundits seems to have a hot stock tip. We are constantly being asked to help find the “next Nvidia”. It’s easy to feel like you’re missing out.

But here’s the thing: chasing what’s hot rarely ends well.

We’ve seen it too often before (remember the meme stocks of 2021?) or worse, the dot-com era. Investors who jumped in late often bought high and sold low. Meanwhile, those who stuck to their plan, rebalanced regularly, and ignored the noise? They’re the ones who came out ahead.

At SEM, we always come back to this question: Has your financial situation changed? As Jeff often says, “If your plan hasn’t changed, neither should your allocation.”

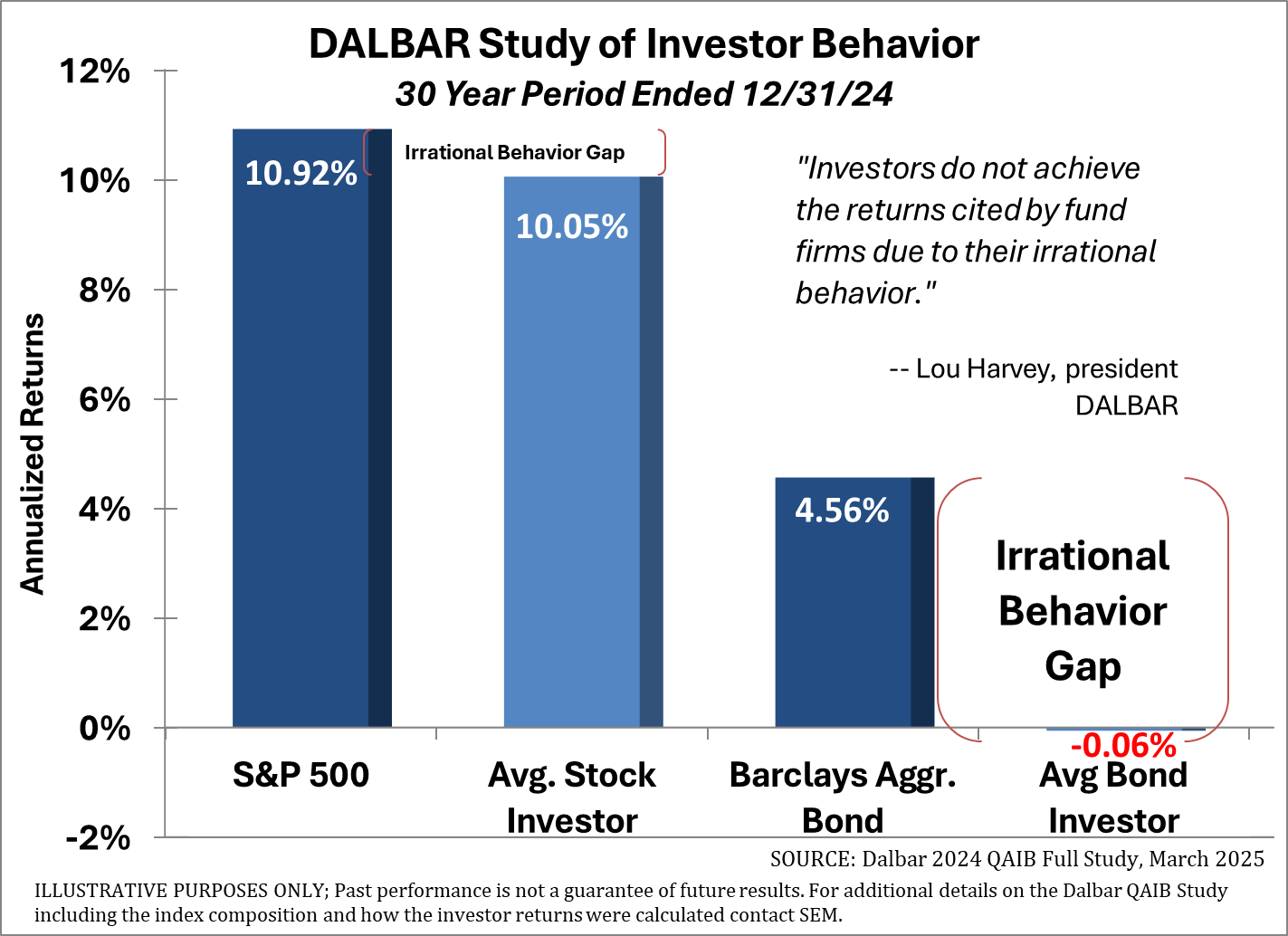

Behavioral finance tells us we’re wired to buy when everyone’s excited and sell when we’re scared. But flipping that instinct (or at least staying the course) leads to better outcomes. Studies from Vanguard and Dalbar show that investors are their own worst enemy.

Instead of reacting, do a portfolio check-up. Make sure your mix still fits your goals and risk tolerance. And if you haven’t updated your risk questionnaire lately, now’s a good time. A solid plan and a little patience go a long way.

If you would like a personalized review of your portfolio, go to Risk.SEMWealth.com

Retiring at Market Highs: your starting point matters

After a strong market run, many retirees (or soon-to-be retirees) are feeling pretty good about their portfolios. And they should. But market highs can also lead to overconfidence… and that’s when mistakes happen.

One of the most important things to remember is that your starting point matters. While stocks have historically averaged about 10% per year over the long run, that’s just an average. To get there, we’ve seen long stretches of above-average returns followed by years of below-average ones. And when you retire at a time of high valuations—like now—the next 10 years often bring lower-than-average returns.

For long-term investors, that’s an annoyance. For retirees, it could be the difference between a comfortable retirement and a stressful one. If you’re withdrawing from your portfolio during a period of weak returns, the impact compounds quickly.

That’s why now is a great time to check your allocation. If your 60/40 portfolio has drifted to 70/30 after recent gains, it might be time to trim back stocks and lock in some of those profits. Rebalancing doesn’t mean going ultra-conservative—it just means getting back to the mix that fits your plan.

One strategy we often recommend is the “bucket approach” where you divide your assets based on the short, intermediate, and long-term needs. This structure helps you ride out market dips without disrupting your income.

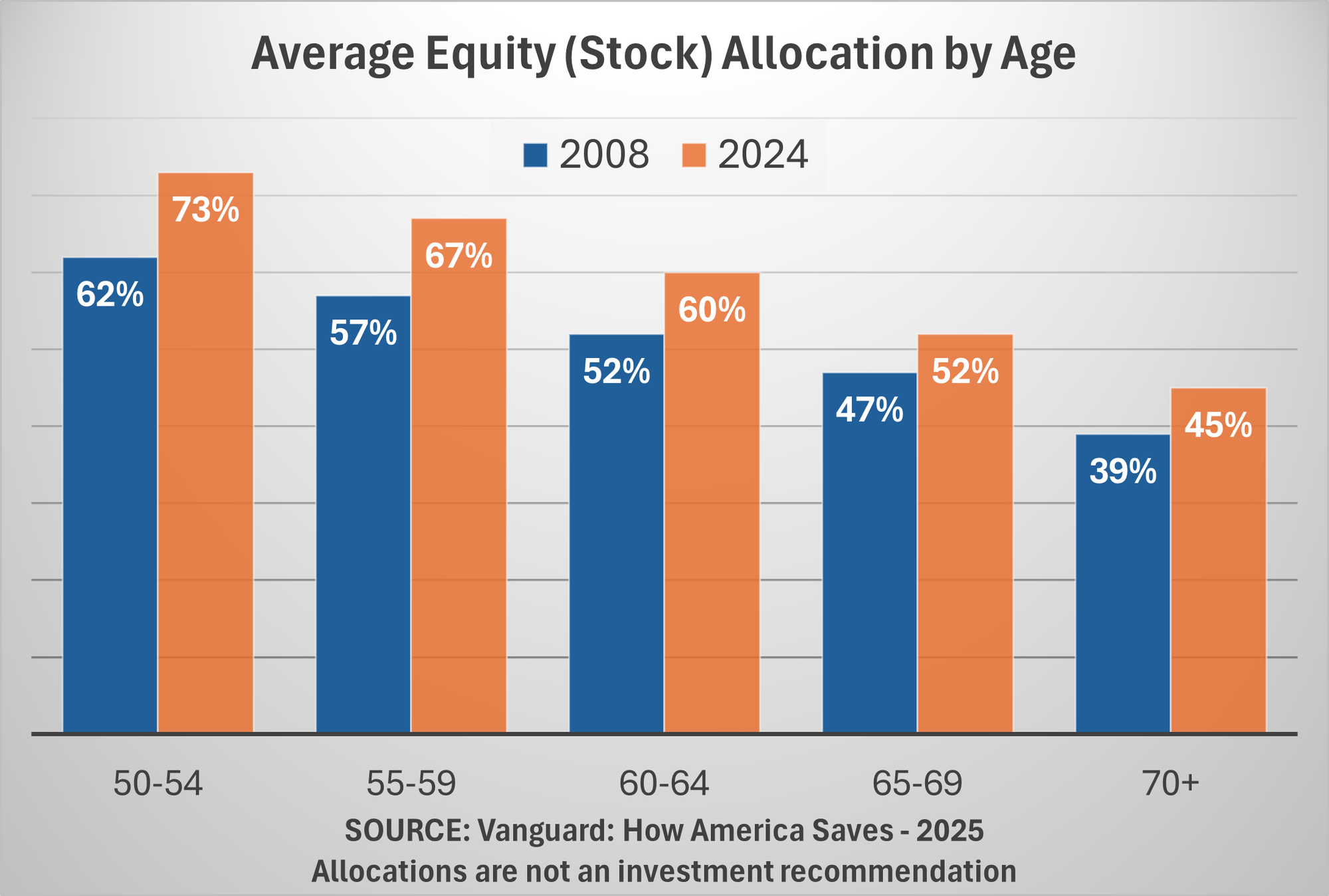

That said, don’t abandon stocks entirely. With people living longer and inflation still a factor, most retirees still need some equity exposure, but do they have too much? A recent study by Vanguard shows those approaching retirement or already retired have a record high level of stock exposure. This presents additional risks should the market go through another 10-year period of below average (or negative) returns. All of this of course, depends on your personal financial plan, cash flow strategy, and overall investment personality. There is no one-size fits all approach. “Rules of thumb” can be dangerous because they are not tailored to YOUR situation.

As always, the key is suitability. If your financial situation hasn’t changed, your allocation probably shouldn’t either. But if it has, now’s the time to adjust. Markets may be high, but that doesn’t mean your risk should be.

For more, check out our bonus content below.

Bonus Content:

Our (brief) take on the Government shutdown

The government shutdown at midnight on October 1. We posted this short (2 minute) video on our Money Talks with Dad TikTok page the afternoon of September 30 discussing the shutdown.

@moneytalkswithdad0 DC gridlock is back. What happens if the Capitol can’t agree on funding? Here’s how I’d explain to my adult kids how this hits your wallet. #DCShutdown #BudgetBattle #EconomyExplained #MoneyTalks #FYP ♬ original sound - MoneyTalksWithDad

We followed that up with a 52 second response about what is really being debated.

@moneytalkswithdad0 Replying to @ECHOmain Red Team wants a short-term fix. Blue Team says it’ll be too late. Here’s what’s really going on in DC 💸 #BudgetBattle #DCShutdown #MoneyTalks #shutdown #economics ♬ original sound - MoneyTalksWithDad

As always, we will be following this closely so you don't have to (unless you enjoy this sort of thing). Historically a government shutdown has been a time of angst for those working for the government and could delay some spending, but past shutdowns have had little impact on the market (the past few saw net GAINS for stocks). Our models and trading systems ignore the REASON the market is anxious and instead focuses on the trends. Should this become a problem, we should expect them to react accordingly.

If you are interested in following this in more detail, you can subscribe to the TradersBlog here to get our weekly updates (or if you have TikTok, follow our Money Talks with Dad page where we hopefully will get back to talking about financial literacy and not what is happening in DC.)

AI Revolution or Bubble?

Why Caution May Be the Smartest Play in an Exciting Market

It’s hard to avoid the hype around artificial intelligence (AI) right now. From Wall Street to Silicon Valley, the AI boom has propelled tech stocks to dizzying heights. The Nasdaq 100 surged more than 30% in the first half of 2023 (its best start in 40 years), largely on AI enthusiasm. Mega-cap companies like Nvidia, Microsoft, and Google have added hundreds of billions in market value as investors bet big on AI’s future.

And to be fair, the excitement isn’t just hype. Companies are reporting real earnings growth. Nvidia, for example, recently posted sales 56% higher than a year ago, driven by demand for its AI chips. Their CEO even projected $3 to $4 trillion in AI infrastructure spending by 2030. In short, this AI boom is being built on real innovation and real dollars.

But this doesn't mean we aren't in a bubble.

Many of the top-performing AI stocks are now trading at 30 to 50 times earnings—well above historical norms. The last time we saw valuations like this was during the dot-com boom of the late 1990s. Back then, the internet did change the world... but not before tech stocks crashed nearly 80%.

Another concern is market concentration. As of mid-2025, the top 10 stocks in the S&P 500 (mostly AI-driven) make up nearly 40% of the index’s total value. That’s more than during the peak of the dot-com era. When a few companies dominate the index, the entire market becomes more vulnerable to their performance. If just one or two stumble, the ripple effects can be significant.

History doesn’t repeat exactly, but it often rhymes. The AI frenzy has some eerie parallels to the dot-com mania. Back then, any company with a “.com” in its name soared. Today, we’re seeing startups rebrand with “AI” and watch their stock prices jump. Investment firms are racing to launch AI-themed funds. Companies are reorganizing their strategies to emphasize AI. Venture capital is flooding into AI startups. These are all signs of a powerful trend... but also potential froth.

And here’s the thing: companies can’t dominate forever. As firms grow larger, they often face diminishing returns. They saturate their markets, attract more scrutiny, and eventually compete with their own customers. Nvidia is a perfect example. It’s supplying the chips that power the AI boom, but in doing so, it’s also enabling its customers to build their own AI infrastructure. That could eventually reduce Nvidia’s pricing power or margins.

So what should investors do?

First, resist the urge to chase what’s hot. If your financial goals haven’t changed, your portfolio probably doesn’t need drastic adjustments. A diversified mix already includes exposure to AI. There’s no need to pile on more risk just because something is trending.

Bond investors tend to be conservative. According to Dalbar, bond investors have lost money over the past 30 years because they tend to give up on bonds and shift into stocks after long periods where bonds have underperformed a hot stock market.

Second, consider rebalancing. If your stock allocation has grown beyond your target due to AI-driven gains, it might be time to trim back and lock in some profits. Those proceeds can strengthen the bond or cash side of your portfolio, which offers better yields today and can cushion future volatility.

(Side note: SEM monitors and rebalances portfolios frequently when they exceed our 'tolerance ranges'. This occurs anytime there is a cash flow in or out of an account as well as an annual rebalance check for all portfolios back to their targets. In June our annual rebalance saw a very large number of accounts rebalance out of the 'overweight' position they held in our "stock" models to return the portfolios to their original "stock/bond" balance.)

Finally, remember that market leadership rotates. The top stocks today may not be the top stocks tomorrow. In the early 2000s, Cisco, GE, and Intel were market darlings. They’re still around, but their stock prices took years (or decades) to recover after the tech bubble burst.

At SEM, we’re excited about AI’s long-term potential. But we also know that hype can outpace reality. Our models are built to participate in innovation while managing risk. We’ll continue to follow the data... not the headlines.

For anybody wanting to think deeper on this, here's an interesting WSJ article.

The Rise (and Risk) of Market Concentration

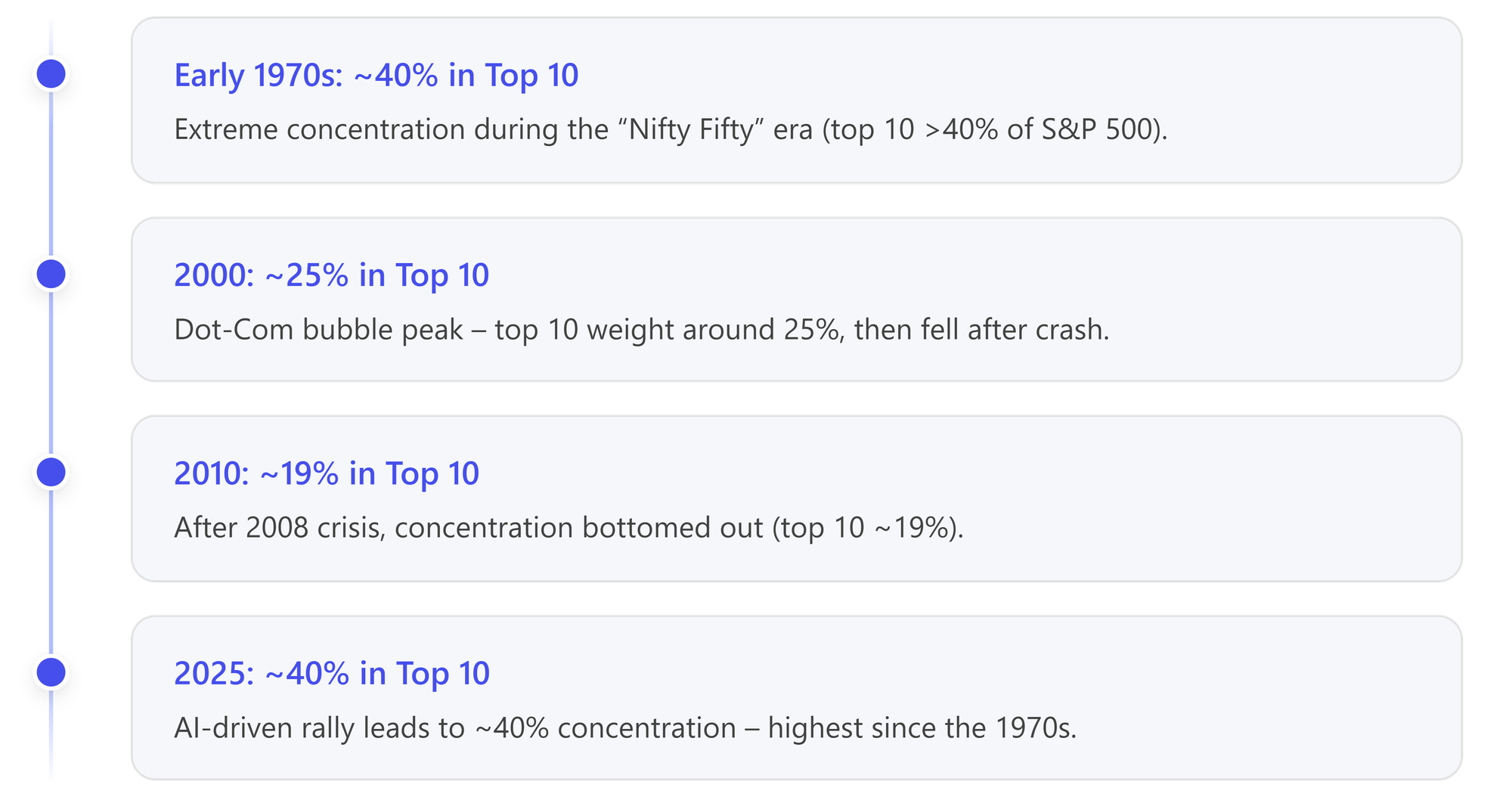

Over the past few years, a handful of mega-cap tech companies have come to dominate the S&P 500. As of mid-2025, the top 10 stocks—mostly AI-driven giants like Apple, Microsoft, Nvidia, Amazon, and Alphabet—make up nearly 40% of the index’s total market capitalization. That’s the highest level of concentration in over 50 years, rivaling even the “Nifty Fifty” era of the early 1970s.

A Historical Perspective

Here’s how the top 10’s share of the S&P 500 has evolved:

In the 1990s, the top 10 stocks hovered around 20% of the index. Even after the 2008 financial crisis, concentration remained low.....until the rise of the “FAANG” stocks in the late 2010s. Since then, the combination of strong earnings, investor enthusiasm, and the AI boom has pushed a few companies to dominate the index.

Why It Matters

When a small group of stocks drives most of the market’s returns, investors may be less diversified than they think. If one or two of those companies stumble, the entire index can suffer. This was evident in 2022, when several mega-cap tech stocks dropped 30–50%, dragging the S&P 500 down with them. High concentration also tends to correlate with lower forward returns. Historically, when the top 10 stocks exceed ~23% of the index, the next 5–10 years have delivered below-average performance. That doesn’t mean a crash is imminent, but it does suggest caution is warranted.

Why the Top Can’t Stay on Top Forever

There’s another reason to be cautious: companies cannot dominate forever. As firms grow larger, they often face diminishing returns. They saturate their markets, attract more regulatory scrutiny, and eventually compete with their own customers.

Take Nvidia, for example. It’s been the poster child of the AI boom, supplying the chips that power everything from ChatGPT to autonomous vehicles. But in doing so, it’s also enabling its customers—cloud providers, startups, and competitors—to build their own AI infrastructure. Oracle just announced jaw-dropping earnings, but part of the earnings included $60 billion in annual sales to OpenAI (the creator of ChatGPT). The problem is OpenAI only had $13 billion of revenue last year. A few days later, Nvidia announced an investment of up to $100 billion in OpenAI (based on the quantity of Nvidia chips OpenAI purchases). In a sense, Nvidia is funding the very ecosystem that could one day reduce its pricing power or margins.

This pattern isn’t new. Microsoft, Cisco, and Intel were once the dominant forces of the dot-com era. They’re still around, but their stock prices took years (or decades) to recover after the 2000 crash. Market leadership rotates. What’s hot today may cool tomorrow.

What Investors Should Do

If your portfolio is heavily tilted toward the S&P 500, you already have significant exposure to these top 10 names. That’s not necessarily bad, but it’s important to be aware of the risk. Consider:

- Rebalancing your portfolio to reduce overexposure.

- Adding diversification through equal-weighted indexes, value stocks, or international holdings.

- Reviewing your financial plan to ensure your allocation still matches your goals and risk tolerance.

At SEM, we monitor these trends closely. Our models are designed to adapt to changing market conditions and reduce risk when concentration becomes extreme. We believe in participating in innovation—but doing so with discipline.

✅ Portfolio Check-Up: Stay Grounded When Markets Get Loud

Before you make any big portfolio changes based on what’s trending, take a breath. The market may be loud right now but your financial plan should be the voice that cuts through the noise. Use this quick checklist to make sure your portfolio still fits your goals, not the headlines.

🟩 Has anything changed in your financial life?

- New job?

- Retirement?

- Inheritance or major expense?

🟩 Have your goals or time horizon shifted?

- Are you still investing for the same purpose?

- Has your timeline changed?

🟩 Is your current allocation still aligned with your risk tolerance?

- Too aggressive?

- Too conservative?

- Just right?

🟩 Have you rebalanced recently?

- Trimmed gains?

- Added to underweighted areas?

- NOTE: SEM monitors and completes this for you automatically!

🟩 Have you updated your SEM Risk Questionnaire this year?

- If not, take a few minutes to do it now:

👉Risk.SEMWealth.com

🟩 Are you automating your investments or withdrawals?

- Automation helps reduce emotional decisions during market swings.

🟩 Are you ignoring the noise?

- AI, crypto, meme stocks… exciting, but not a strategy.

📌 If your plan hasn’t changed, your portfolio probably shouldn’t either.

Crypto Craze Reloaded: Digital Assets in 2025 (and How to Tread Carefully)

Bitcoin dominated the headlines this past quarter in a big way. Last quarter, Bitcoin surged past the $125,000 mark for the first time, rekindling the kind of crypto enthusiasm we haven’t seen since 2021. A lot has changed since the last boom-and-bust cycle. The 2024 U.S. elections ushered in a more crypto-friendly administration, sparking optimism that clearer regulations are on the horizon. In fact, the new SEC leadership greenlit the first-ever spot Bitcoin ETFs, which attracted over $60 billion in investments within nine months – a sign of huge pent-up demand from both institutions and everyday investors. Even Federal Reserve Chair Jerome Powell has noted Bitcoin’s growing legitimacy, likening it to “digital gold” in terms of how it’s seen as a store of value.

All of this has added up to real momentum for crypto as we head through 2025. But (and there’s always a “but” in investing), uncertainties remain. The crypto market is nothing if not volatile. Bitcoin’s price history reads like a roller coaster: a 1,000% gain here, a 50% plunge there. It’s highly speculative, and many smaller cryptocurrencies have a track record of skyrocketing one month only to fizzle out the next. A lot of folks are jumping in now because they don’t want to miss out – you might even say “FOMO” is back in full force. As one market watcher quipped, “People are chasing gains like it’s 2021 all over again… speculation works until it doesn’t.” In other words, while it’s fun (and potentially profitable) to ride the wave, it’s crucial to remember that hype can outpace reality.

Let’s unpack a few of the risks in simple terms. First, extreme volatility: unlike blue-chip stocks or bonds, crypto assets can swing wildly in short periods. (If you’re checking prices every day, be prepared for a wild ride.) Second, regulatory uncertainty: yes, we have a more supportive tone from Washington now, but governments worldwide are still figuring out how to oversee crypto. New rules or crackdowns – whether on crypto trading, taxes, or security standards – could pop up and surprise markets. Third, the speculative excess: the fact that any coin with “AI” or “Dog” in its name can skyrocket overnight is a reminder that not all these projects will have staying power. In the last boom, thousands of crypto projects launched; most have since fallen by the wayside. That’s a classic sign of a nascent industry: lots of experimentation, plenty of failures, with a few winners emerging over time.

So, how can an everyday investor approach this new crypto surge pragmatically? We at SEM Wealth Management recommend keeping crypto in perspective. It can be a small slice of a well-diversified portfolio, but it shouldn’t be anywhere near the main course. Think of it like a hot sauce – a little can spice things up, but you wouldn’t want to eat a bowlful of it. Only invest what you are fully prepared to lose without derailing your goals. If Bitcoin or another coin doubles, great. If it gets cut in half (which has happened before, more than once), your financial plan should still stay on track.

Another smart approach: consider safer ways to get exposure. For instance, those new Bitcoin ETFs allow you to invest in Bitcoin through a regulated stock-market vehicle, without having to manage digital wallets or private keys. There are also blockchain-focused stocks and funds – companies investing in the crypto infrastructure – that might offer a more measured ride than pure cryptocurrencies. These options can reduce some of the technical and security risks of holding crypto directly. Just remember, “less risky” doesn’t mean “risk-free.” A Bitcoin ETF will still rise and fall with Bitcoin’s price; a blockchain stock’s fortunes are still tied to the crypto industry’s health.

Lastly, stay focused on fundamentals and your own financial plan. The core question to ask is: Why are you investing in this? If it’s because you believe in the long-term potential of blockchain technology or view Bitcoin as a hedge (like gold), that’s fine – just size your investment accordingly. If the honest answer is “because everyone else is and it’s going up,” that’s a sign to pump the brakes and revisit your strategy. Our advice, as always, is don’t let short-term excitement derail long-term discipline. Keep your emergency fund, stick to your retirement savings plan, and make sure any crypto investment is something you’ve done homework on. Crypto can play a role in the future of finance, but it’s not a ticket to guaranteed riches.

📊 Asset Comparison: Bitcoin vs. Gold vs. Stocks

Understanding how these assets behave can help investors decide where (and how much) to allocate.

| Feature / Metric | 🪙 Bitcoin | 🟡 Gold | 📈 Stocks (S&P 500) |

|---|---|---|---|

| Typical Role in Portfolio | Speculative diversifier | Inflation hedge / store of value | Growth engine / core equity |

| Historical Annual Return | ~50% (highly variable) | ~6–7% | ~10% (long-term average) |

| Annual Volatility (Std Dev) | ~70–80% | ~15% | ~18% |

| Income Yield | 0% | 0% | ~1.5% (dividends) |

| Correlation to Stocks | Low to moderate | Low | N/A |

| Regulatory Risk | High | Low | Low |

| Market Maturity | Emerging | Established | Mature |

| Liquidity / Accessibility | High (24/7 trading) | High | High |

| Storage / Custody Complexity | Moderate to high | Moderate | Low |

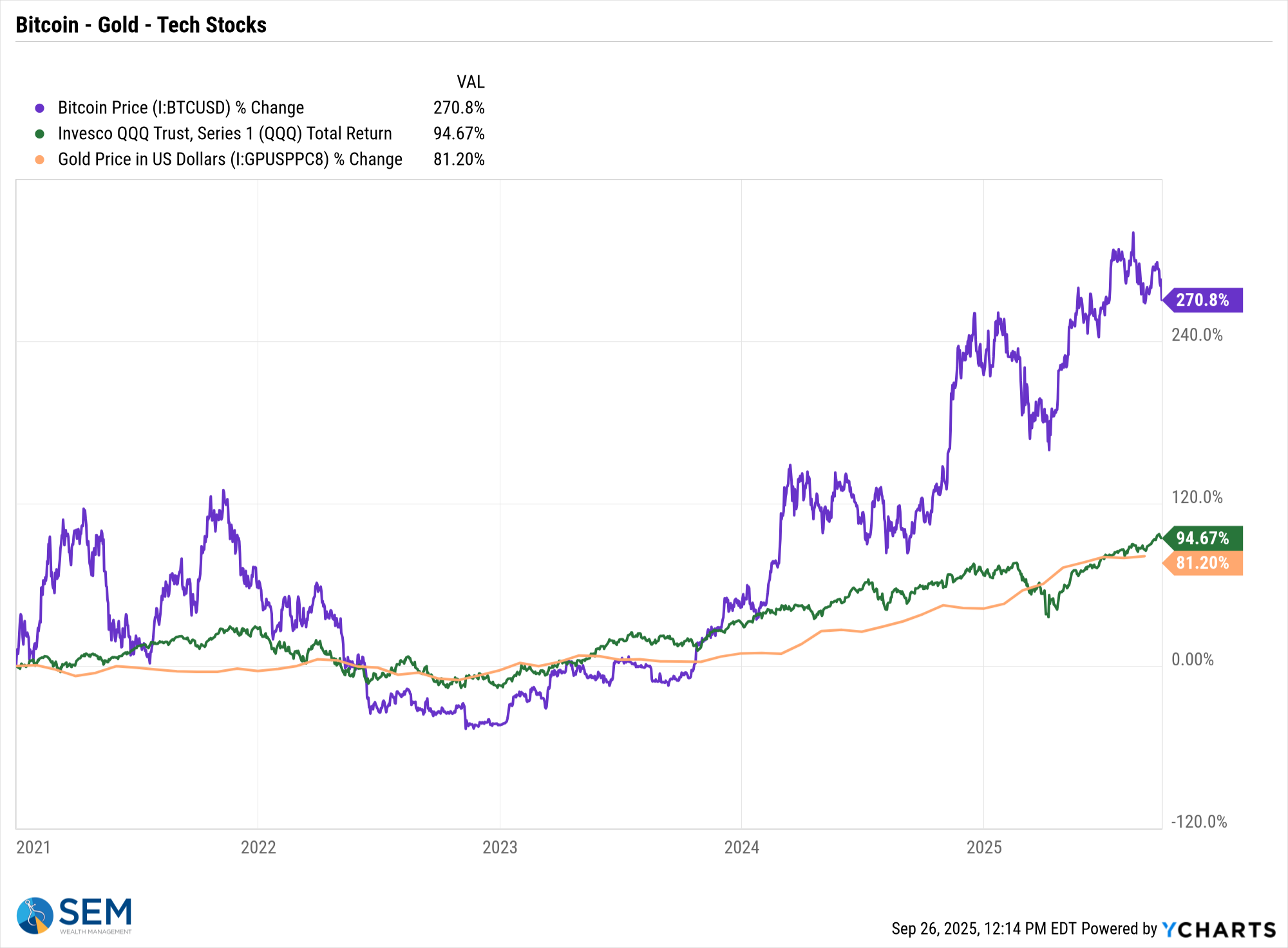

Since the end of 2020, Bitcoin has risen 270%, well above Gold and the NASDAQ 100.

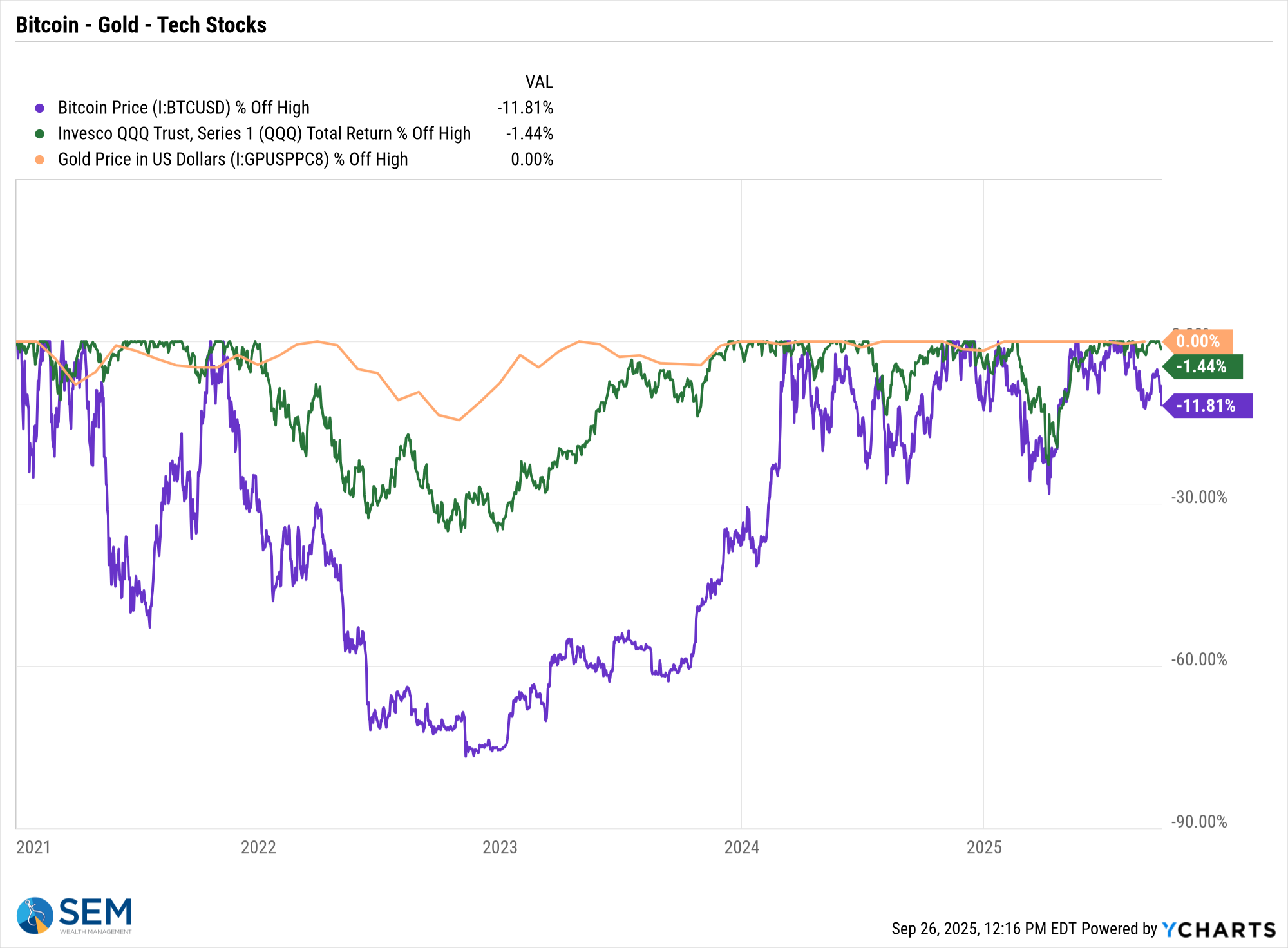

Of course, investing at the wrong time could lead to very large losses.

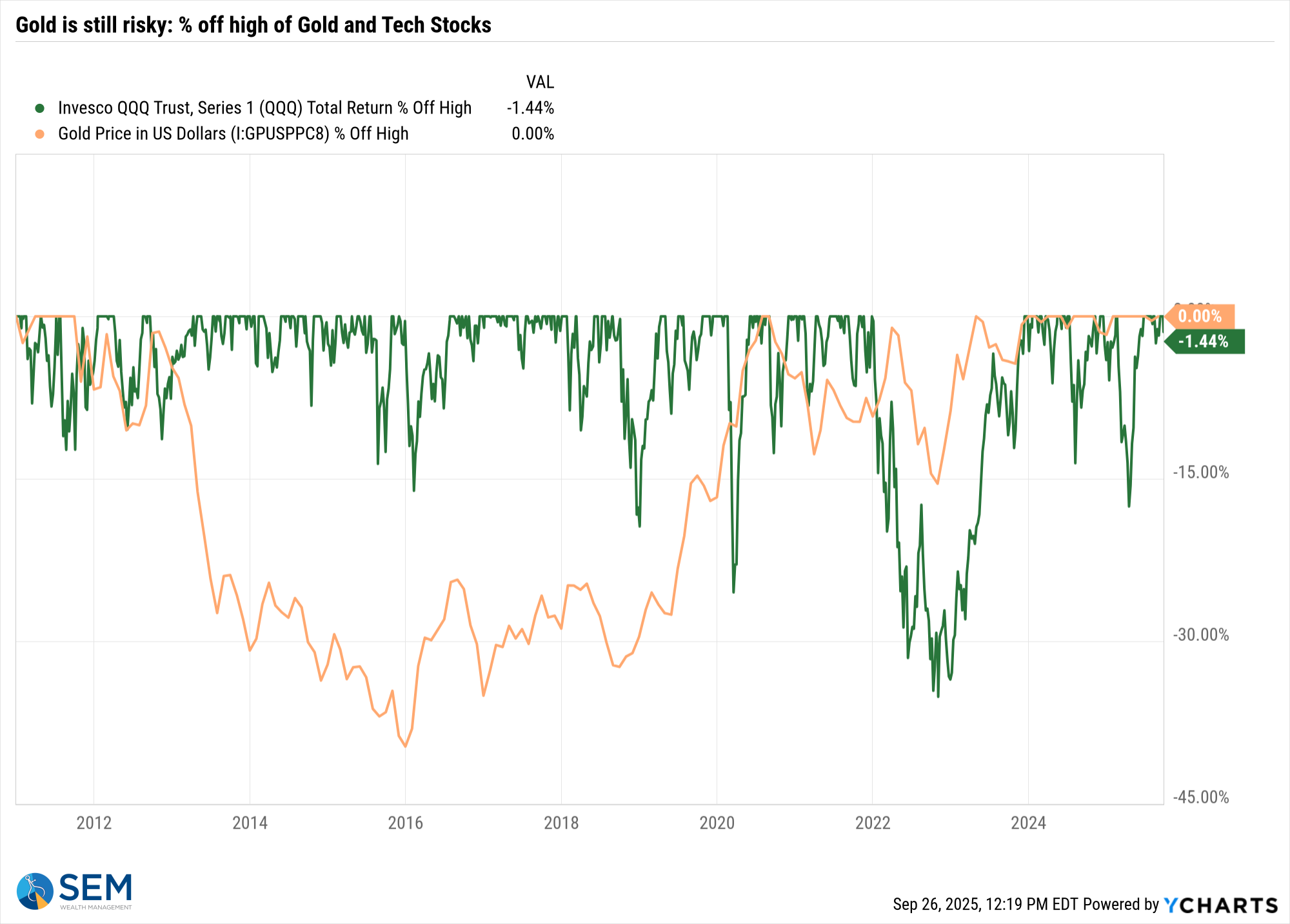

Gold is not without risks – going back to 2010, we can see the price of gold fell by nearly 40% over 6 years. Still less than Bitcoin, but a reminder that gold can be extremely risky.

Introducing SEM's Digital Asset Portfolio

Despite our warnings and hesitation in this newsletter about the extremely high valuation for stocks and excessive risk taking we are seeing from investors and advisors, our goal at SEM is to provide investment options to meet the needs of as many investors as possible, which allows us to keep their portfolios inside of our "Behavioral Portfolio" framework.

For both financial planners and individual investors, digital assets represent a new frontier in portfolio diversification. They offer the potential for high growth but also come with volatility and complexity. We've talked since 2018 about the potential (and risks) of this new investment category.

While individual cryptocurrencies may seem like compelling investments, SEM Wealth believes the most promising opportunities lie in the companies adopting blockchain technology and those building the tools that support it. These firms are laying the foundation for long-term innovation and stability in the digital asset space.

In August of this year, SEM launched a Digital Asset Portfolio (DAP) that includes:

- Bitcoin and Ethereum exposure for growth potential,

- Blockchain-focused ETFs for stability and innovation,

- Digital infrastructure ETFs that support the broader tech ecosystem.

This balanced approach aims to capture the upside of digital assets while managing risk through diversification and disciplined rebalancing.

The Overlap of AI and Digital Assets

As noted in the articles above, AI is another trendy, but likely long-lasting buzzword in the investment markets. This had caught the attention of investors and led for many to ask for MORE AI exposure. As we mentioned in the prior articles, index investments such as the S&P 500 are already heavily exposed to AI, so we chose not to create an "AI" portfolio. However, many of the same companies, technologies, and ideas show up in both the AI and crypto worlds. That’s not a coincidence.

Shared Technology and Infrastructure

Both AI and digital assets rely heavily on powerful computing, cloud services, and data centers. Whether it’s training a machine learning model or verifying a blockchain transaction, the backbone is the same: fast processors, secure networks, and lots of data.

Companies like NVIDIA, Microsoft, and Amazon are key players in both spaces. They provide the chips, cloud platforms, and tools that power AI applications and blockchain networks. So when you invest in infrastructure ETFs tied to digital assets, you’re often getting exposure to AI as well.

Common Themes: Automation, Decentralization, and Innovation

AI is about teaching machines to make decisions. Crypto is about removing middlemen and letting systems run on their own. Both are pushing toward automation and decentralization, just in different ways.

- AI helps analyze data, predict trends, and personalize services.

- Blockchain helps record data, verify transactions, and secure ownership.

Together, they’re changing how businesses operate, how people interact online, and how value is exchanged.

Investment Crossover

Some of the ETFs and companies in SEM’s Digital Asset Portfolio also happen to benefit from the AI boom. So, when clients ask for “AI exposure,” they might already be getting it, just not in the way they expect. The goal of this portfolio isn’t to also attempt to chase AI trends. The S&P 500 already gives plenty of exposure to the big AI players like Nvidia, Microsoft, Google, and Amazon.

It’s more of a happy accident that many companies in the digital asset space also have ties to AI. That overlap is a good reminder: tech sectors don’t operate in silos. Innovation tends to happen where different ideas collide. And that’s exactly where SEM’s Digital Asset Portfolio is focused – on the edge of disruption, where digital infrastructure, blockchain, and crypto intersect with emerging tech like AI.

We are currently working on a report detailing all of the innerworkings of this still new industry. Here is an excerpt from the introduction:

📌 Summary: Why Digital Assets Matter

What are digital assets?

Cryptocurrencies like Bitcoin and Ethereum, plus companies and technologies built around blockchain.

Why now?

Institutional support, regulatory progress, and real-world adoption are turning crypto from a fad into a legitimate investment space.

What’s the opportunity?

Potential for high growth, innovation, and diversification—especially in blockchain infrastructure and services.

What’s the risk?

Volatility, complexity, and evolving regulations make it essential to approach with caution and strategy. Due to so many unknowns, this portfolio could lose 50-80% (or more) if the opportunities do not develop as we predict.

How much exposure should I have?

This depends on the overall financial plan, cash flow strategy, and investment personality, but this belongs in the "alternative" or "speculative" portion of any investment portfolio. Our general advice is to have NO MORE than 10% of the total investment portfolio allocated to any alternative investments. Whether it is 0 or closer to 10% should be discussed with your financial advisor.

What is the minimum investment?

In order to allocate to the various ETFs, we would need a minimum of $5,000.

Where can I learn more?

Here is a link to the Morningstar Portfolio X-Ray. Please keep in mind that these returns are hypothetical based on the allocation of the SEM models. Many people will focus on the returns, but it is critical to note the drawdowns (risk) of the portfolio – 60%. It is important to critically ask yourself whether you could withstand that type of a loss inside of your portfolio. Keep in mind, when that loss occurred historically many people started to proclaim the "end" of the crypto-mania. When you combine those news articles with the portfolio losses, it is easy to no longer believe in this new industry. Investors should fully expect cycles such as this and should only invest if a.) they believe in the LONG-TERM prospects and b.) the money allocated is not part of the financial plan needs for the next 15-20 years.

This is NOT a get-rich-quick investment, but rather something that could have strong LONG-TERM rewards with tremendous risks.

Download/Print version of the Newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.