Working according to plan

In 2023, stocks enjoyed strong gains, but all that did was make-up for the 2022 losses. In 2024, stocks posted another impressive year of gains, while bonds again struggled. This has left many people believing they should increase their stock allocation and reduce their bond exposures. Some have even followed some extreme advice of ditching bonds altogether. This is a very natural urge.

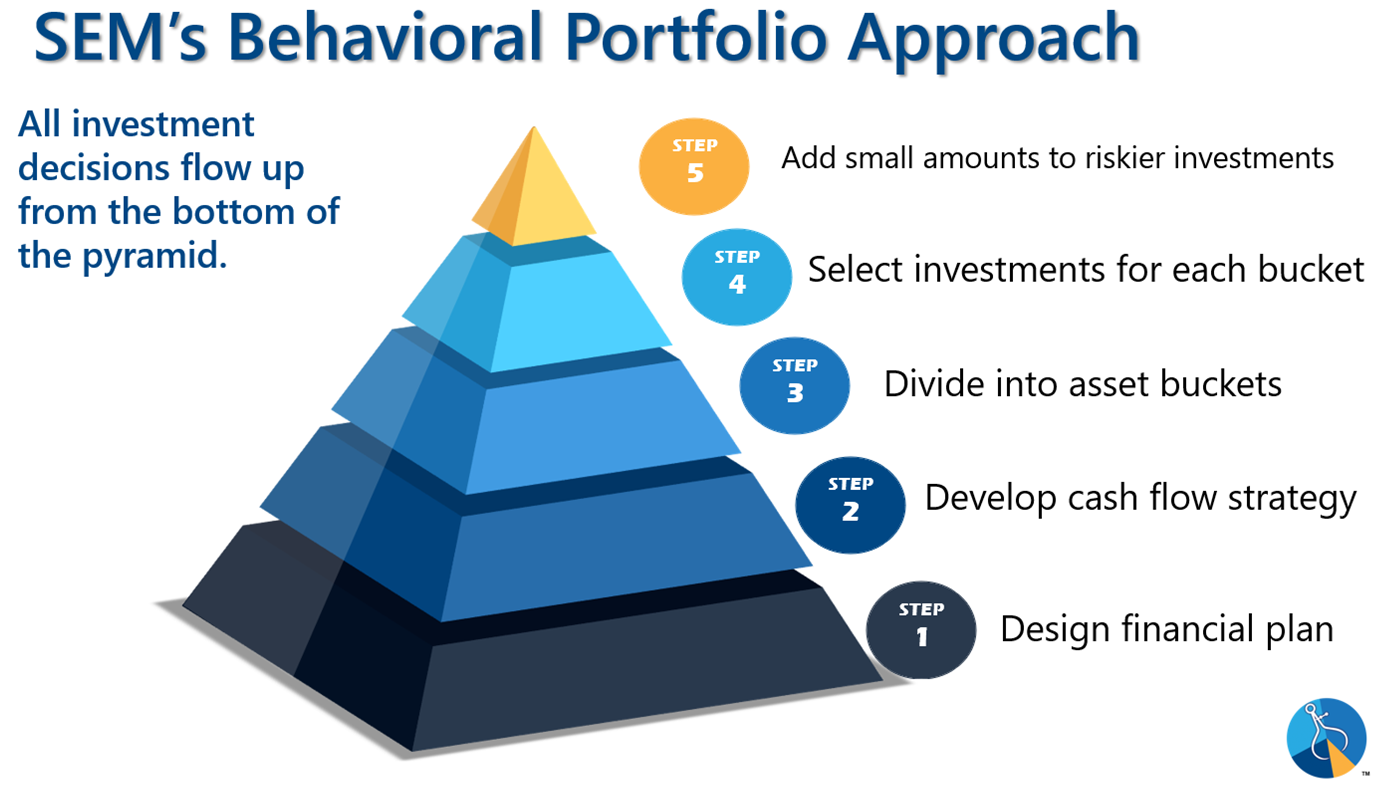

SEM has structured every part of our investment process around predictable, human behavior. Our investment models completely remove the human element from the decision making process because our models use data and mathematical formulas to measure the current trends and their likelihood to continue. We also have trademarked our “behavioral portfolio pyramid” illustrated above to take out the natural human desire to chase the best performing asset classes.

The base of every decision is the financial plan. Even with “below average” performance in the bond market, the well above average performance of the stock market (and thus SEM’s stock-based models), unless there were outside changes to the demands on the financial plan, every plan should be looking a bit BETTER than it did a year ago.

Should you change your investment allocation? Only if your financial plan, or cash flow needs have changed. Stronger than average growth in your investment portfolio could allow more risk, but it also could mean you could REDUCE your exposure to riskier assets. How do you decide? The first step is to contact your financial advisor or take SEM’s Risk Questionnaire on our website.

SEM's Prediction for 2025

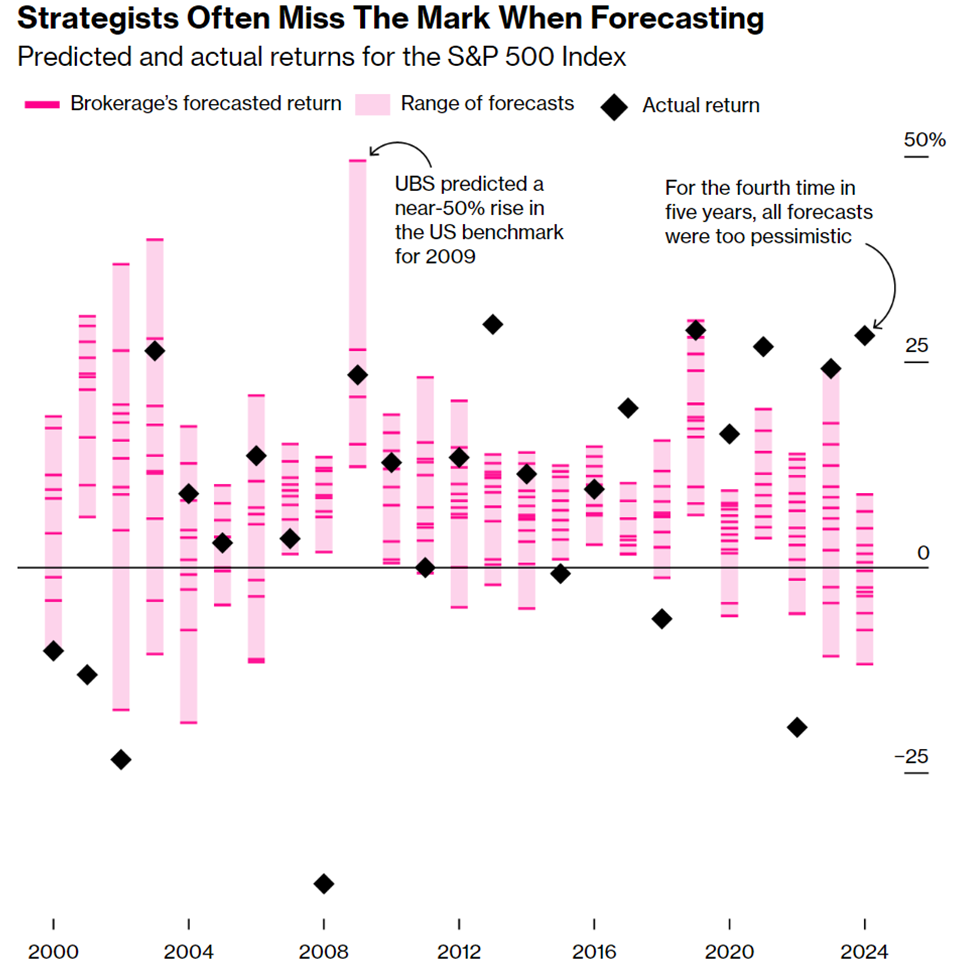

At SEM, we do not make predictions on what the markets will do in the year ahead. This year we have decided to switch it up and make one prediction — most (or all) of Wall Street’s predictions for 2025 will be wrong. We know why Wall Street feels the need to publish and then relentlessly publicize their forecasts (people EXPECT them to be the “experts” and it also generates new business for them.) This is also the reason very few firms will ever predict a NEGATIVE return for stocks. How can SEM be so bold in predicting the forecasts for 2025 will be wrong? That’s what the DATA says we should expect.

Right now, Wall Street’s forecasts call for a 5-15% gain for stocks in 2025. At SEM, we’ll let the data call the shots, with the expectation that once again, Wall Street will be wrong.

For the latest updates and analysis, subscribe to the blog.

Everything is not as it seems

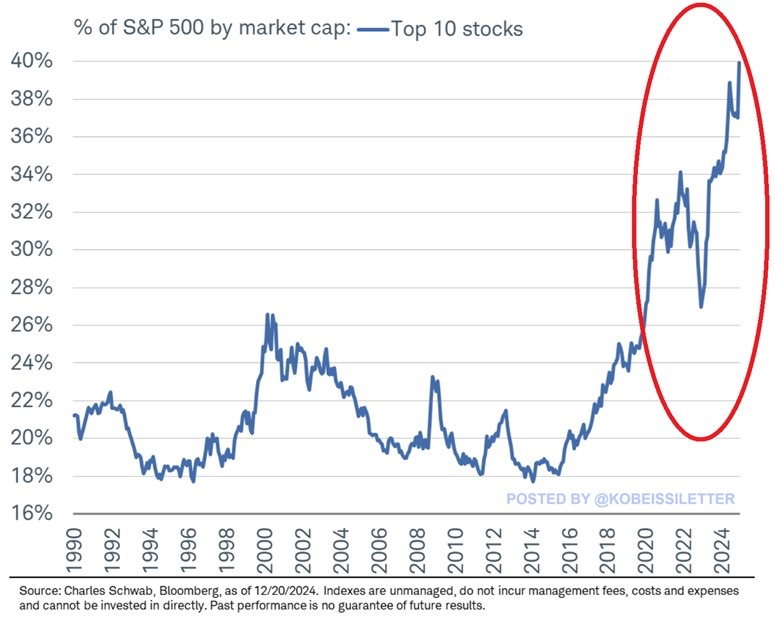

Having a properly diversified portfolio is one of the most often recommended investment “rules” around. Diversification is supposed to lower risk and increase returns over the long-term. However, the past several years we’ve witnessed just a small subset of stocks driving nearly all of the performance. Not having those stocks as a large portion of your portfolio makes it seem like you are missing out.

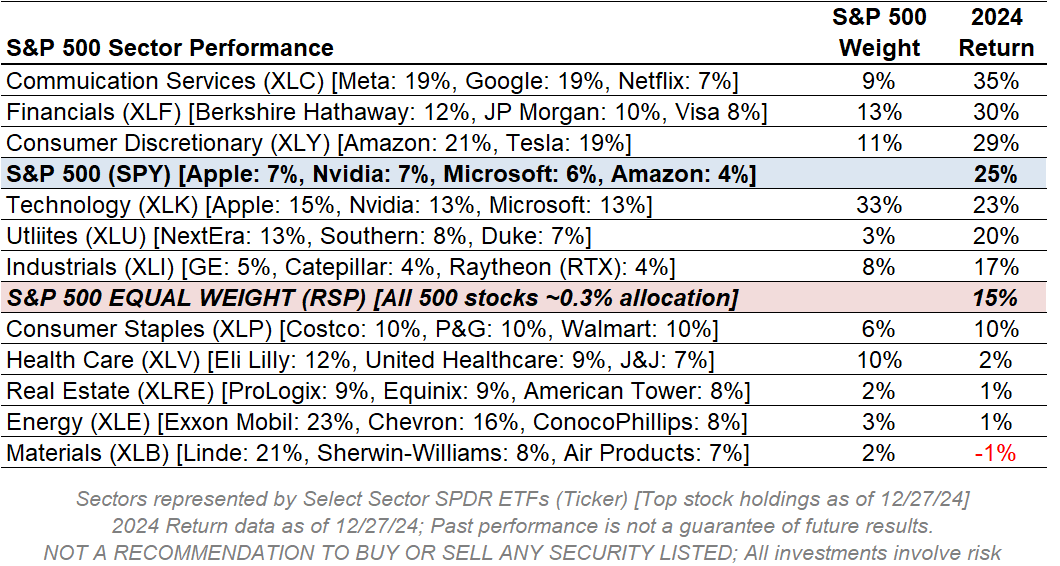

As of December 2024, if you are invested in the S&P 500 index, you have 40% of your money in just 10 stocks. It’s not just the S&P 500 which shows a stark imbalance. Industry sectors are often dominated by just a few companies. The table below shows the 2024 returns for the sectors inside the S&P 500. You may think you are diversifying away from “technology” by investing in Communication Services or Consumer Discretionary sectors, but those funds are also heavily invested in technology companies.

A better measure of the overall health of the stock market is better represented by the “equal weight” S&P 500 index, which as the name implies invests the same amount into all 500 stocks. The 15% return in 2024 for the equal weight index is well above average, but it is obviously not as impressive as the 25% return for the S&P 500, which is weighted based on the market capitalization of each stock.

Simply because the S&P 500 is being driven by just 10 stocks does not mean we recommend selling it — SEM’s longer-term models own S&P 500 ETFs. The difference is, the S&P 500 is not our only investment. We know from studying history when 10 stocks drive the entire index the risk of a large decline is magnified.

When evaluating your investments it is important to understand that over shorter periods of time diversification could hamper returns when compared to the S&P 500, but over longer periods of time diversification should reduce the risk in the portfolio overall, providing a smoother ride.

Bonus Content:

Tech Tip: SEM & Axos will NOT Text You

Money Talks with Dad: New Video Series

Election Results: Expectations vs Reality

Return of the K-Shaped Economy

Where we stand as we enter 2025

Tech Tip: SEM and Axos WILL NOT text you

Criminals have been taking advantage of added security measures which require "two-factor" authentication since websites began using them. We've also seen plenty of "lost" or "delayed" shipment or "payment did not process" texts leading individuals to click a link in a text message and turn over their personal information to the scammers. As always, when in doubt, go directly to the website of your financial institution or online shopping site and log in this way rather than clicking a link in a text or email.

Given the high instance of text scams floating around, we wanted to remind our clients (and advisors) that neither SEM or Axos will text you with a link to log in or verify any information on your account. We have not heard of any instances of scammers hitting our clients, but wanted everyone to be especially aware as the new year begins. The ONLY time you will receive any sort of text related to your account is if you are using Docusign and they need to send you a verification code.

Speaking of Docusign, scammers continue to attempt to get personal information with fake emails, including those which look like a Docusign email. Our tech tip from March included ways to tell whether or not the Docusign email is legit (the easiest being your advisor or SEM told you they were sending you a Docusign packet. Check out the full post here:

We also sent out a special alert in October after the FBI warned about several new scams, including one called "pig butchering". Here is the link to that post:

For all of our Cyber Security Tech Tips, we created a post discussing tips and best practices here:

Money Talks with Dad: New Video Series

One of our missions at SEM is to promote financial literacy as this is critical for everyone to take control of their finances. With that in mind, SEM Portfolio Manager Jeff Hybiak and his oldest daughter Corryn launched a monthly video series to help others. Through Jeff's own experience raising 6 kids on a middle class income to Corryn's own take on growing up with a "non-math" brain the two share stories and tips on ways anybody can have a better relationship with money.

We are 5 episodes in. We've created a playlist on our YouTube page to make it easier to catch-up. You can also subscribe on the page to get updates when each new video posts. Feel free to share it with any family or friends who may benefit.

Episode 1 is linked here:

Election Results: Relief vs Reality

No matter who you voted for, the stock market certainly made it clear they were relieved at the results of the election, which has led many clients and advisors alike to believe the next four years will be 'spectacular'. Following the election we posted a few reminders about the reality of the situation. In the post, we broke down a few of the campaign promises President-elect Trump made and how they could end up hurting the stock market (short-term).

- Tariffs: could be inflationary, hurt earnings growth, and create retaliatory tariffs and other trade policies which hurt US companies.

- Ending regulations: easy to say, harder to do and come with unforeseen impacts across the economy;

- Immigration / Mass Deportations: Could cause a drop in growth for specific industries and hurt

- Drill, baby drill: this will not magically create new growth given the time and $$$$ it takes; Energy producers will only increase production if they are confident prices will remain high.

- Lower taxes: Given the slim majority in Congress for Republicans, getting all of the promises made on the campaign trail will not be easy (or likely); Many of the promises would likely increase the deficit which is a problem for both the President-elect and Congressional Republicans.

Another thing to keep in mind is during President Trump's first term, the first year (2017) was indeed spectacular, but the second year was met with very wild swings, including a nearly 20% drop in the 4th quarter of 2018. About the only thing we should count on is volatility as President-elect Trump's method of testing the waters on policies tends to be to throw the idea out on social media and see how everyone reacts. This isn't a knock on him, but it is DIFFERENT than what the markets are used to.

Read the full post here which includes charts and additional commentary/data:

We will be hosting a webinar the week before inauguration day to take a deeper look at what we should look for in the second Trump administration. More details are here:

The Return of the K-Shaped Economy?

During 2020, I began describing the K-shaped economy we were experiencing as a way for all of us to understand how the stock market and economy could be doing so well, but so many Americans felt like they were being left behind. We posted a series of videos describing this for those of you who missed it or need a refresher.

Because of this K-Shaped economy President-elect Trump shocked Democrats by pulling a significant amount of 'struggling' Americans away from the Democrats. Going forward, though it will be important to see whether the President's policies help the "lower half" of the K more than the "upper half".

In the Traders Blog we posted the areas where the President's policies could hurt the lower-half of the K. This is important first and foremost because of the slim majority in the House of Representatives and the 2-year election cycle. Here are some of the areas where the lower half of the K were hurt during the first Trump presidency:

- Deregulations and Tax Cuts: focused on larger corporations and wealthy Americans with the data showing little benefit to the middle class.

- Trade Policies & Tariffs: Price increases to cover tariffs and retaliatory actions from other countries hurt Americans living paycheck to paycheck far more than anybody else.

- Health Care Policies: We know health care is a mess, but the Affordable Care Act does (mostly) benefit the middle and lower income Americans. Repealing this would hurt them the most (short-term).

- Minimum Wage Stagnation: Wages continue to lag behind inflation and did so throughout the first Trump presidency.

- Infrastructure Spending & Rural Investment: There was little actual investment in infrastructure, especially in rural areas during the first Trump presidency. While there are many areas where President Biden's "infrastructure" bills were wasteful, there are some tangible benefits being realized already. President Trump has threatened already to pull most of the unused federal funds away, potentially hurting the rural areas benefitting from the bills.

- Education and Workforce Development: Cutting the Department of Education sounds extreme and over the short-term could hurt the lower half of the K significantly unless there is an immediate plan to fund trade schools, high school vocational courses and other critical training programs currently funded by the Department of Education.

Finding the Next Big AI Stock

SEM was founded in 1992. We lived through the tech-bubble and survived the inevitable burst. We again lived through the housing bubble and again survived the inevitable burst. Lately AI has been all the buzz and given our experience (and understanding of economic fundamentals it's hard to believe this isn't yet another bubble which will inevitably burst.

For anyone interested in understanding better why we think this is a bubble, some of the lessons we learned during the tech bubble, and how SEM is still participating in AI, check out this post from December. It even includes Jeff using AI to help him write it and create graphics.

Should you invest in Bitcoin?

Speaking of bubble-like moves........we also received quite a few requests from clients and advisors asking about investing in Bitcoin. This is not the first time we've had a flow of inquires regarding a Bitcoin investment. For the past 5 years every time there has been a big enough run in the most widely known crypto-currency we've seen this happen. Those inquiries dropped after Bitcoin lost a significant amount of its value.

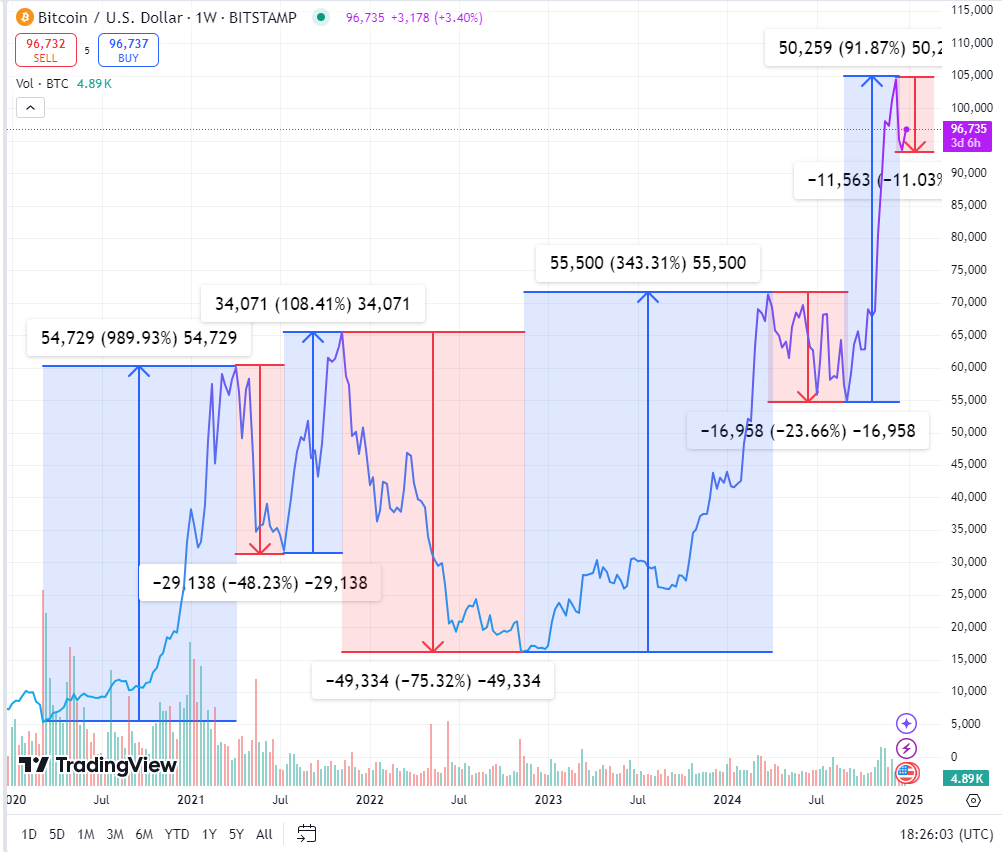

This chart of the daily price of Bitcoin should be studied closely. Most of us pay attention to the blue areas – we all want a piece of that. Few of us have the stomach to stick out the red periods, especially when you consider most people did not get in at the START of the blue period, but after it finally started making the news.

Yes, plenty of people who stuck it out have gotten rich, but a much higher number of people have lost 50-75% of their investment following the run-up from 5,000 to 65,000. This should be expected to happen again.

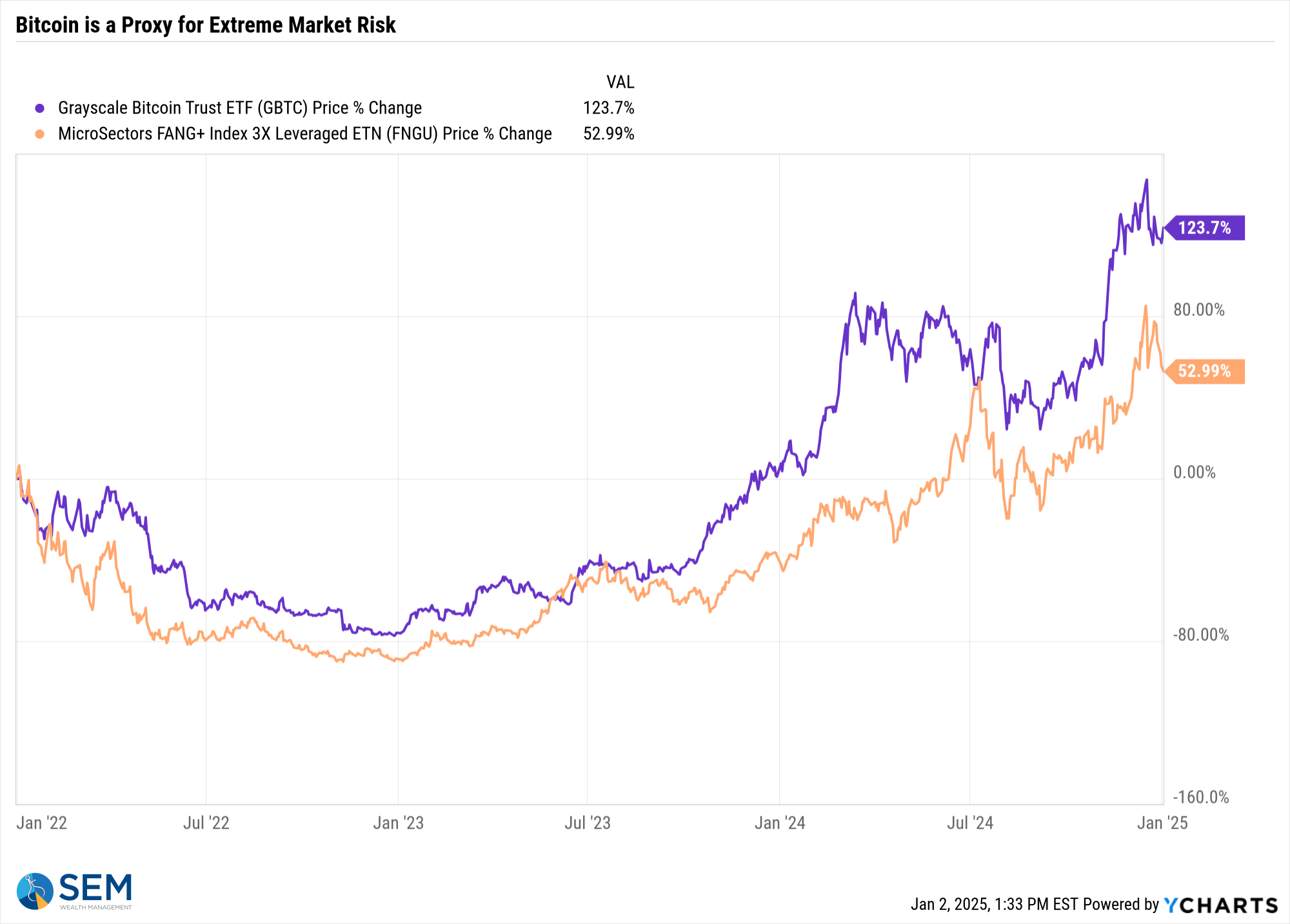

Many Bitcoin supporters describe it as a "hedge" against the US dollar, inflation, and the stock market. That makes no sense when you consider Bitcoin lost 75% in 2022 when inflation was raging causing bonds and stocks to each lose 20% while gold rallied strongly. Looking at the price history of the longest running Bitcoin ETF (Greyscale Bitcoin Trust), Bitcoin is merely a vehicle to add a significant amount of leverage to your riskiest stock market bets. Take a look at how closely the direction of Bitcoin has tracked the 3X "FAANG" ETF (Facebook, Apple, Netflix, and Google).

Over the past 5 years, when investors have a high appetite for risk, Bitcoin rockets higher. When that appetite reverses, Bitcoin investors get an upset stomach.

Back to the question, 'should you invest in Bitcoin?' Obviously we cannot give individual investment advice on here, but here are some general guidelines.

1.) You should be able to explain what Bitcoin actually is in layman's terms: Why? It is simple — if you truly believe and understand what Bitcoin is, you are more likely to hold onto it when it loses 10, 25, 50, or 75% of its value again. Do you get rid of your dollars when the US dollar loses value? No – most people probably don't even realize when the dollar goes up or down.

2.) This is a LONG-TERM investment: Just as you do not compare the value of the US Dollar to other currencies, you SHOULD NOT LOOK at the value of Bitcoin in your account. For most people the fluctuations will mean you eventually give up on it when it loses too much value. (This is true of most long-term investments.)

3.) Only invest money you can afford to lose: Bitcoin belongs in the "collectibles" category because there is simply no way to fundamentally value it. Bitcoin is worth whatever other people say it is worth. In general, this category of investment (the top of the pyramid mentioned in our Investment Pyramid at the top of the page) should be limited to no more than 5-10% of the portfolio.

4.) You should be able to explain what Bitcoin actually is in layman's terms: Yes I listed this twice because I do believe there is something behind Bitcoin that could lead it to still be around and worth much more money 5-10 years from now. I don't invest in Bitcoin because I still cannot understand it, which means if I see it go from 100,000 to 75,000 my brain would say, "well that's because it's not really a currency" and I could end up getting out at the wrong time.

Does SEM invest in Bitcoin? No – there is not enough history, liquidity, and fundamental proof of concept to include it in any models.

Could SEM invest in Bitcoin in the future? Yes – if Bitcoin becomes financially viable as an actual currency, then there is a chance it could end up in some of our investment models in the future. For now, it's just too risky.

Most importantly: Talk to your financial advisor about how ANY investment, including SEM's models impact your overall financial plan. The easiest and most likely way to get "rich" is to do it slowly and methodically. You've worked too hard for your money to place your future on the outcome of a speculative "asset".

While we're on the topic, we last discussed Bitcoin when we were being asked by our clients about investing in Precious Metals. You can find that article here:

Where we stand as we enter 2025

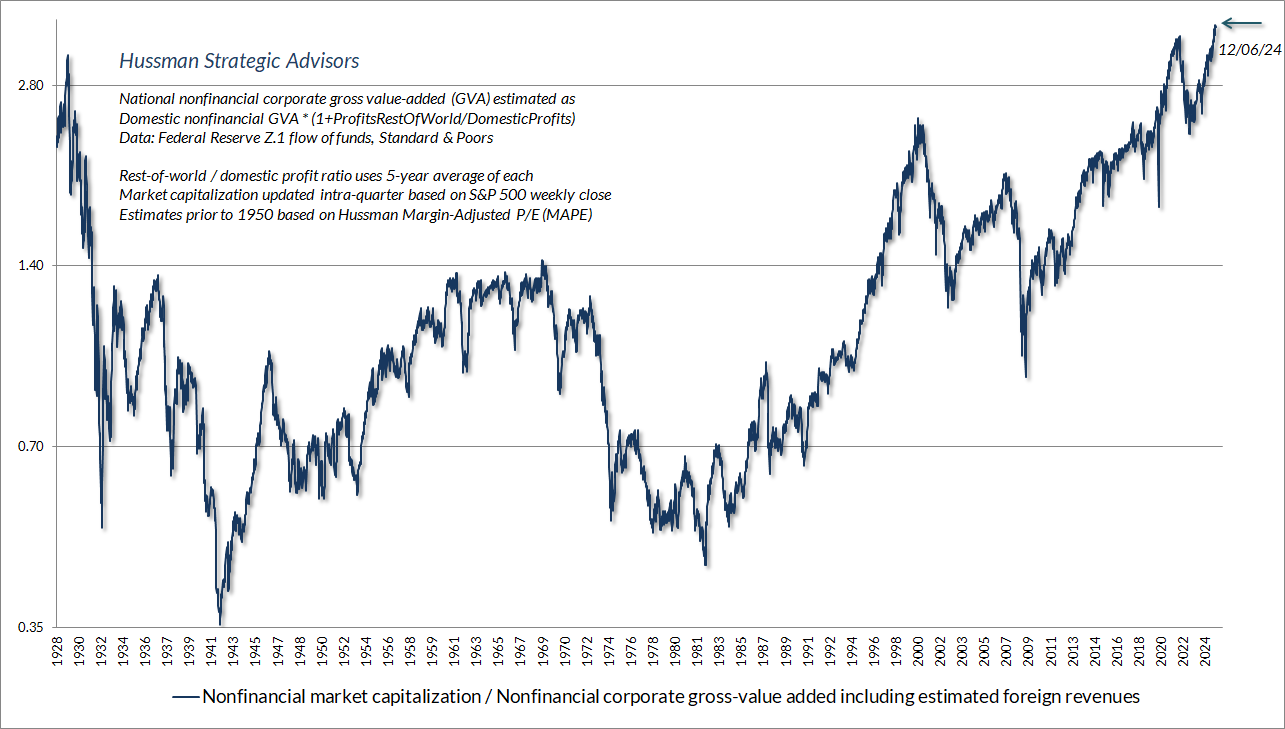

To end the year SEM Portfolio manager shared a series of charts highlighting the current levels of the stock market to help everyone put in perspective where we are compared to past market cycles. (Hint: we are at or above all-time record highs for most valuation and sentiment measures.)

Just because we are at or above record valuation levels does not mean the market will immediately go down. For more check out the full post here:

Download/Print version of the Newsletter

News & Notes:

2024 Year-End Tax Statements—what to watch for early 2025:

For taxable accounts, Axos Advisor Services will send your tax documents by February 15, 2025.

SEM strongly recommends you do not make your tax appointment until after February 15. Please wait until you receive Axos’s 2024 Consolidated 1099 prior to completing your taxes. SEM will be posting additional information on the tax reports page of our website.

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.