Which sounds worse?

Dow plummets 800 points

-or-

Stocks decline 3%, still above June levels

Both describe what happened on Wednesday, but I’m guessing nobody’s smart phone was popping with the latter alert. Why would you click on that headline?

Yes, it is frustrating and a little bit alarming that stocks can fall 5% in 5 days. Unfortunately, it can happen. You may see a wide variety of reasons from the experts as to why stocks fell so fast:

-

Rising interest rates

-

Impact of tariffs hurting earnings

-

A series of hacking scandals at several big-name tech firms

-

Brexit negotiations breaking down

-

Italian bond concerns

All are legitimate reasons for the market to sell off. The problem is, all of the above bullet points were well known 5 days ago. In fact, they were well known for most of this year as well as the better part of 2017. Anybody that wants to argue the market is efficient (pricing in all known data immediately) clearly does not watch the market everyday. The fact is, more people were selling than buying the last 5 days. As prices fell, more people decided to sell. If they are suddenly concerned about all the above reasons all that tells us is they are human. These same people are likely to start buying when prices start going back up and will then stumble all over themselves telling us why the above reasons do not matter.

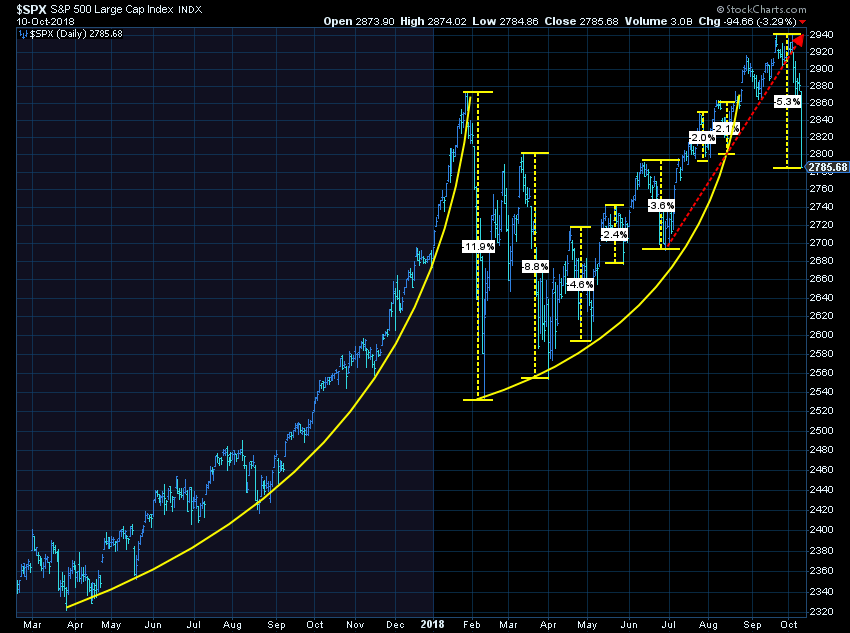

To keep things in perspective, I updated the chart I used to document the early February sell-off and recovery (most people have forgotten this sharp correction). Notice both the parabolic move up (which drew record amounts of money into the market) as well as the rallies and large drops that followed. The market eventually overtook those highs, more money came into the market and now it has given back a few months’ worth of gains.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

A “V” type bottom is not likely here (they are rare). If it is like a normal correction we will see a similar pattern. That said, we cannot ignore the fact that all bear markets begin with some very volatile moves — a push to record highs, a quick decline, a convincing recovery (remember when everyone was talking about the “resiliency” of the market in the face of all this bad news?), and then some more declines. The market is long overdue for a bear market.

Remember, at SEM we have a broad range of strategies to mitigate making emotional decisions. Our Tactical models are monitored daily. Yesterday we saw multiple sell signals in our Tactical Bond program, taking us all the way to cash (or low duration bonds). Enhanced Growth Allocator (EGA) entered the day only 55% exposed to stocks. It actually BOUGHT stocks on the close yesterday (via our Volatility system), looking for a short recovery.

Our Dynamic models (monitored monthly using our economic models) remain “bullish” as the economic data continues to show no signs of rising interest rates or the growing trade war hitting economic growth. That said, our Dynamic Income Allocation program did take a position in a Treasury “Bear” fund which makes money as long-term interest rates go up.

Our AmeriGuard models, monitored quarterly, also remains bullish. Even with the 5% drop in stocks the longer-term trend is still higher. Keep in mind, our Balanced & Moderate AmeriGuard models can reduce some exposure intra-quarter. As of this morning that indicator is not showing a sell signal yet.

A side note on interest rates, the Fed, and President Trump blaming the Fed for the stock sell-off. Last week’s Chart of the Week dove into this topic (click here to read it). I’m hoping the President’s staff is successful in reminding him the Fed only controls short-term rates. The free market controls long-term rates and they have gone up because they fear the Fed is moving TOO SLOWLY.

Finally, I want to be clear about the risks I see in the market. While I can make a strong case for this to be a buying opportunity, I can make an even stronger case for this being an opportunity to get out of stocks, even after a 5% drop. Each person is different and each person’s financial situation is different.

If you have felt even slightly uneasy with the recent drop in stocks or are not sure if your portfolios is structured to meet your needs, click here for a short risk tolerance survey. I will send you your report with a brief explanation of what the survey indicates you should be doing right now.