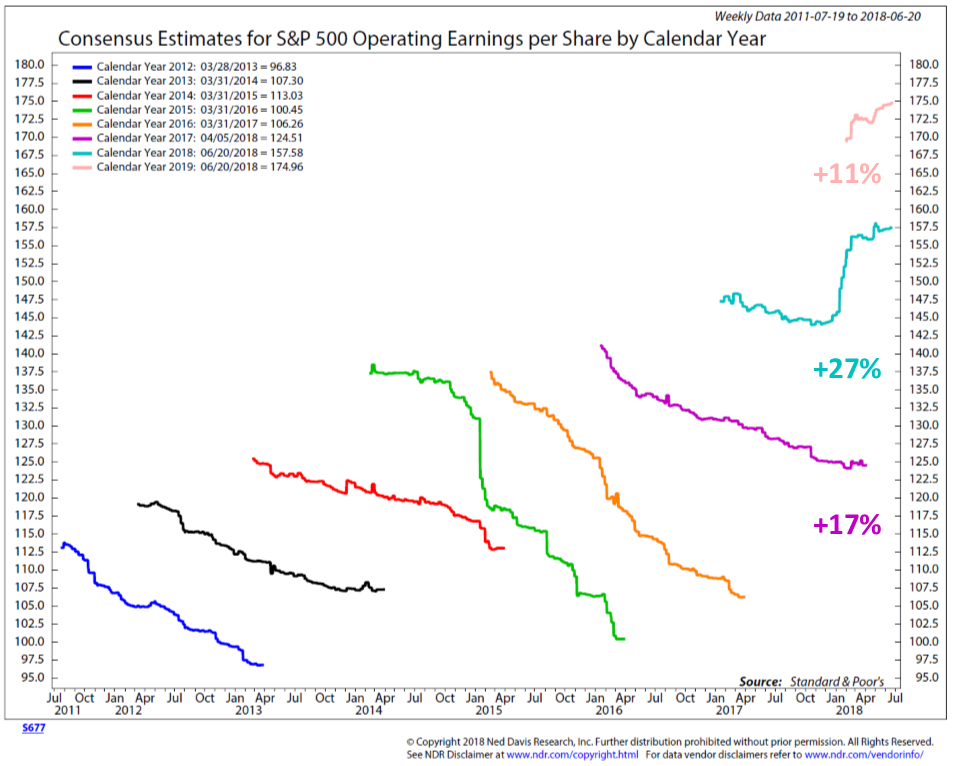

At a time when there is so much angst on the damage the escalating trade war may have on corporate profits, we seem to be losing focus on the fact corporations are expected to post some impressive earnings growth over the next few years. The biggest boost in profit expectations

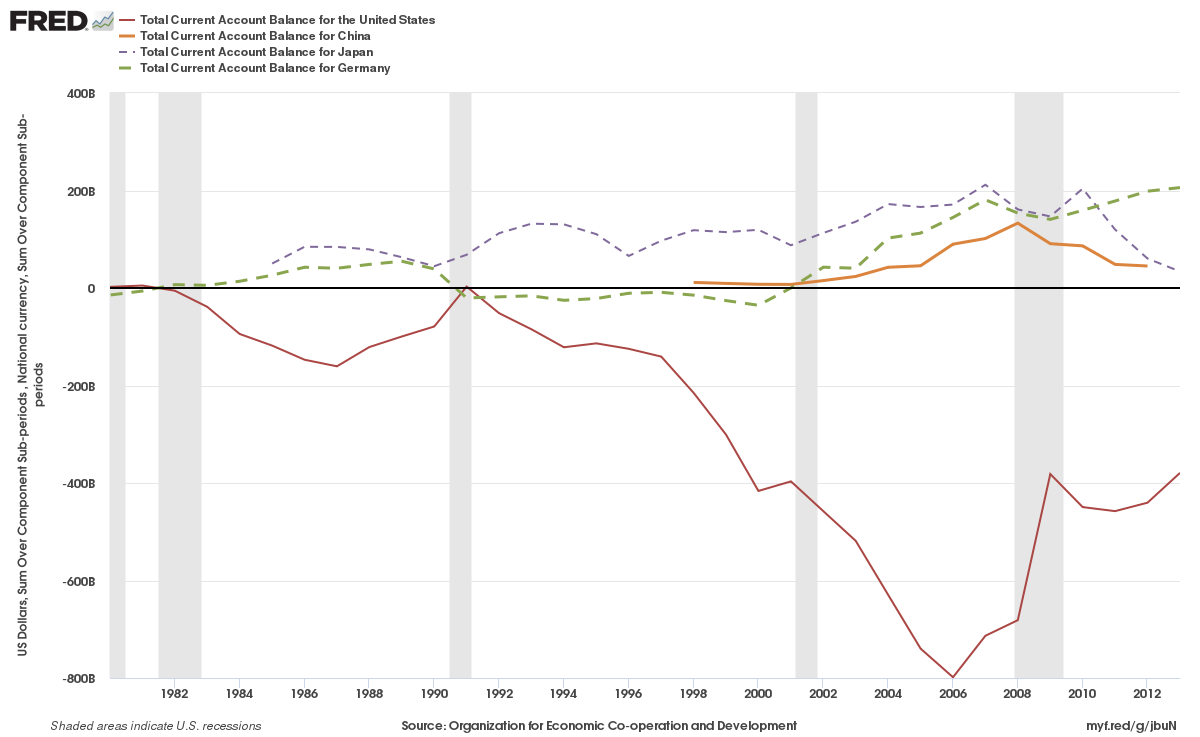

Uncertainty is not a friend of the market. Or most things really. Outside of the episode of your weekly TV drama at 8:55 PM you watch on Tuesday’s you probably would want to know what the future holds. Uncertainty is risk and people typically don’t want

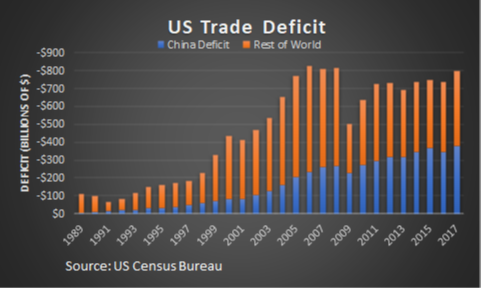

Tariffs and Trade Wars are dominating the headlines. Stock market participants are worried and the market indices have been falling every time one of the sides announces a new tariff or other restrictions on trade. Whenever markets start falling emotions begin to take over. The logic is “stocks dropped

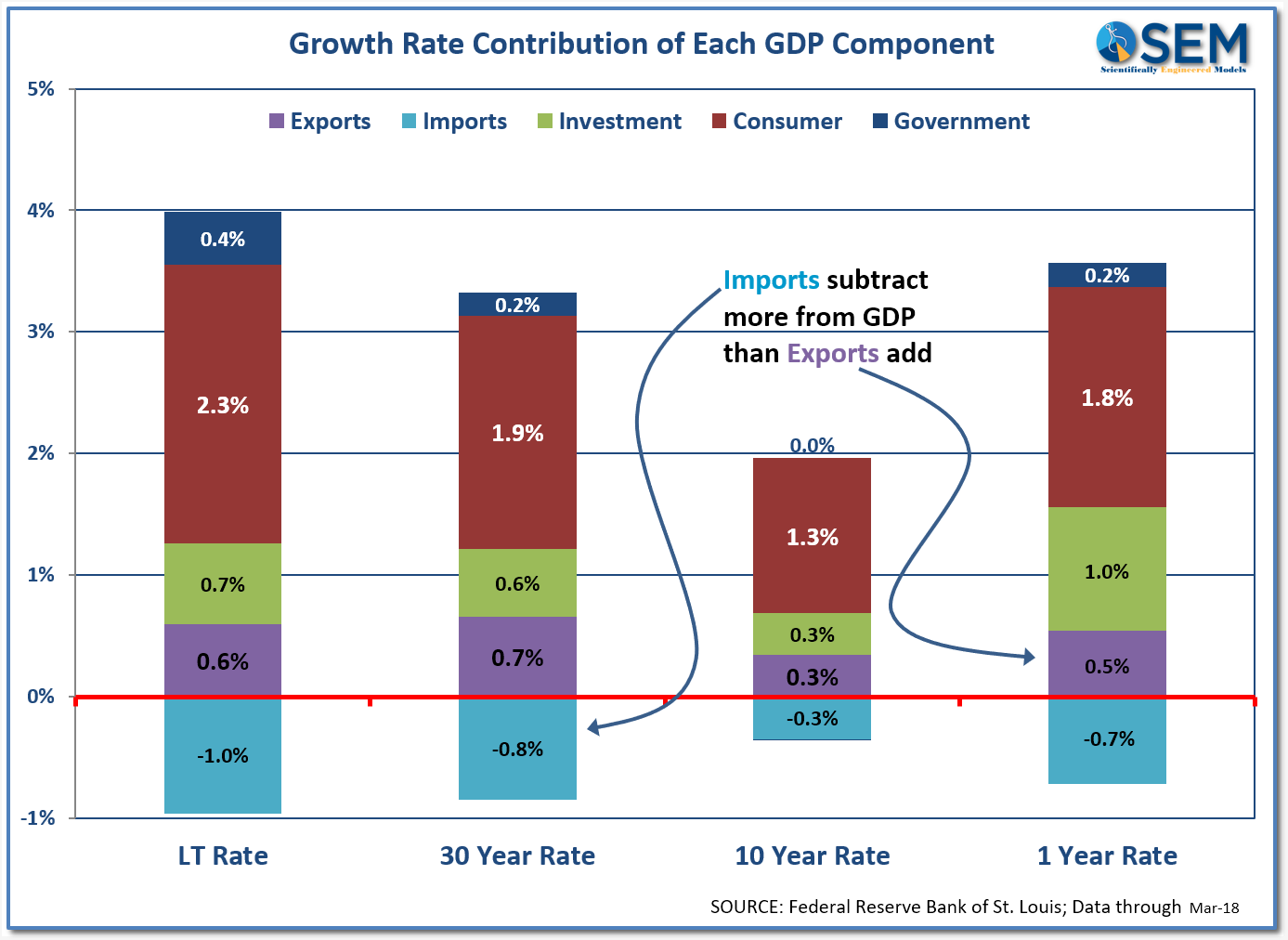

SEM Portfolio Manager Jeff Hybiak talks about the data behind the trade war talk we’ve been seeing in the market.

For more information, read ‘How trade impacts the economy.’

The stock market is again on shaky ground as the Trump Administration is escalating the potential for a heated trade war with China. They announced the initial shots in March, which was matched by China with their own tariffs (even though China already charges heavy tariffs on US goods). Wall