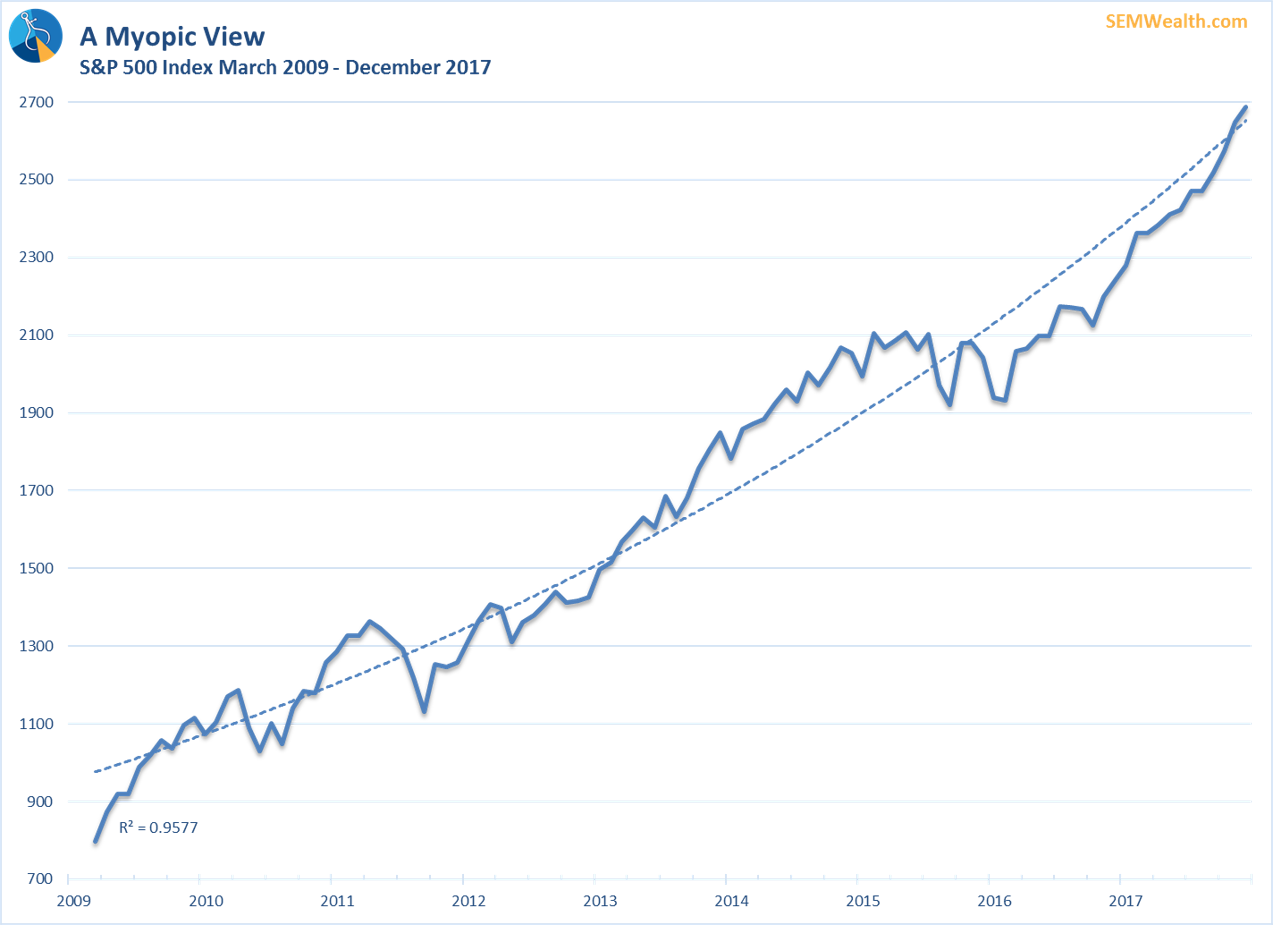

The stock market has rallied since the election of Donald Trump in an unprecedented fashion. It has broken records for most consecutive positive months, the first calendar year on record to not have a losing month, the longest streak without a 3% or 5% correction, the lowest daily standard deviation,

The S&P 500 is up nearly 5% the first 3 weeks of the year. Following the euphoria of 2017’s 20% rally in the US stock market, market participants are buzzing with the prospects of another 20%+ gain. Few people see any possibility for the market to

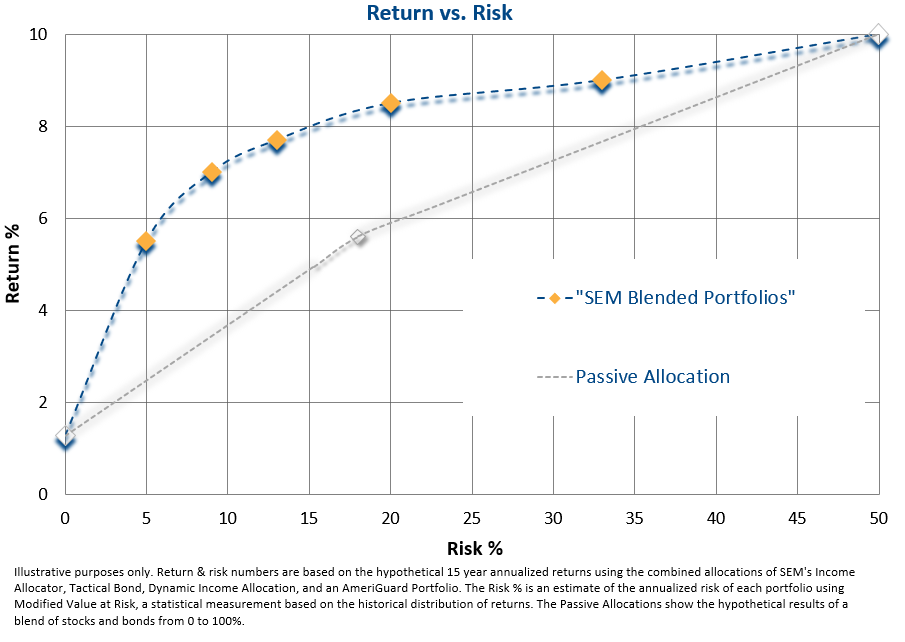

One of the fundamental laws of investing is the more return you seek, the more risk you must take on. While short periods of time may make it appear this law is no longer in place, over the long-run it always ends up being true. The longer the bull market

85% of Wall Street Banks expect the S&P 500 to end higher in 2018. The S&P 500 was up every month in 2017 (first time ever). It has been up 14 consecutive months (also the first time ever). It has not had a 3% correction in

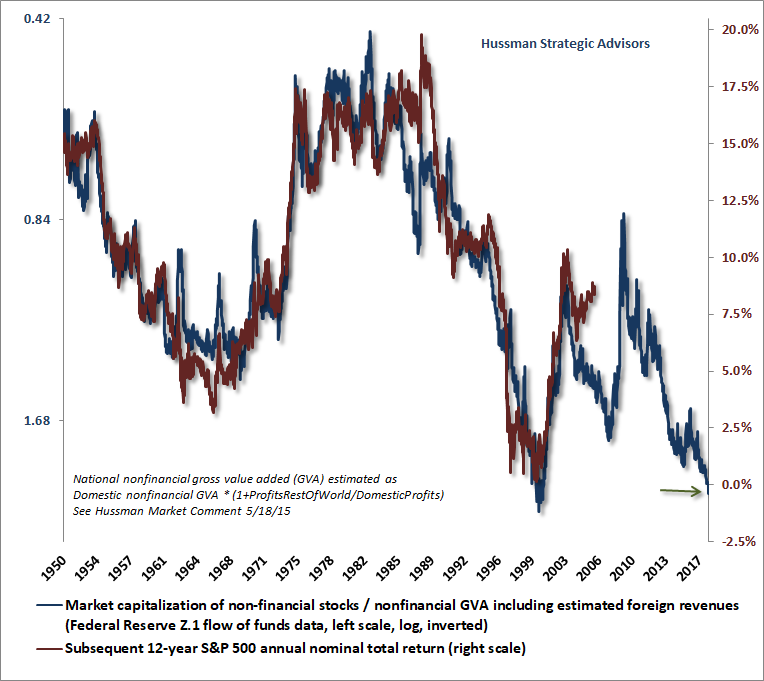

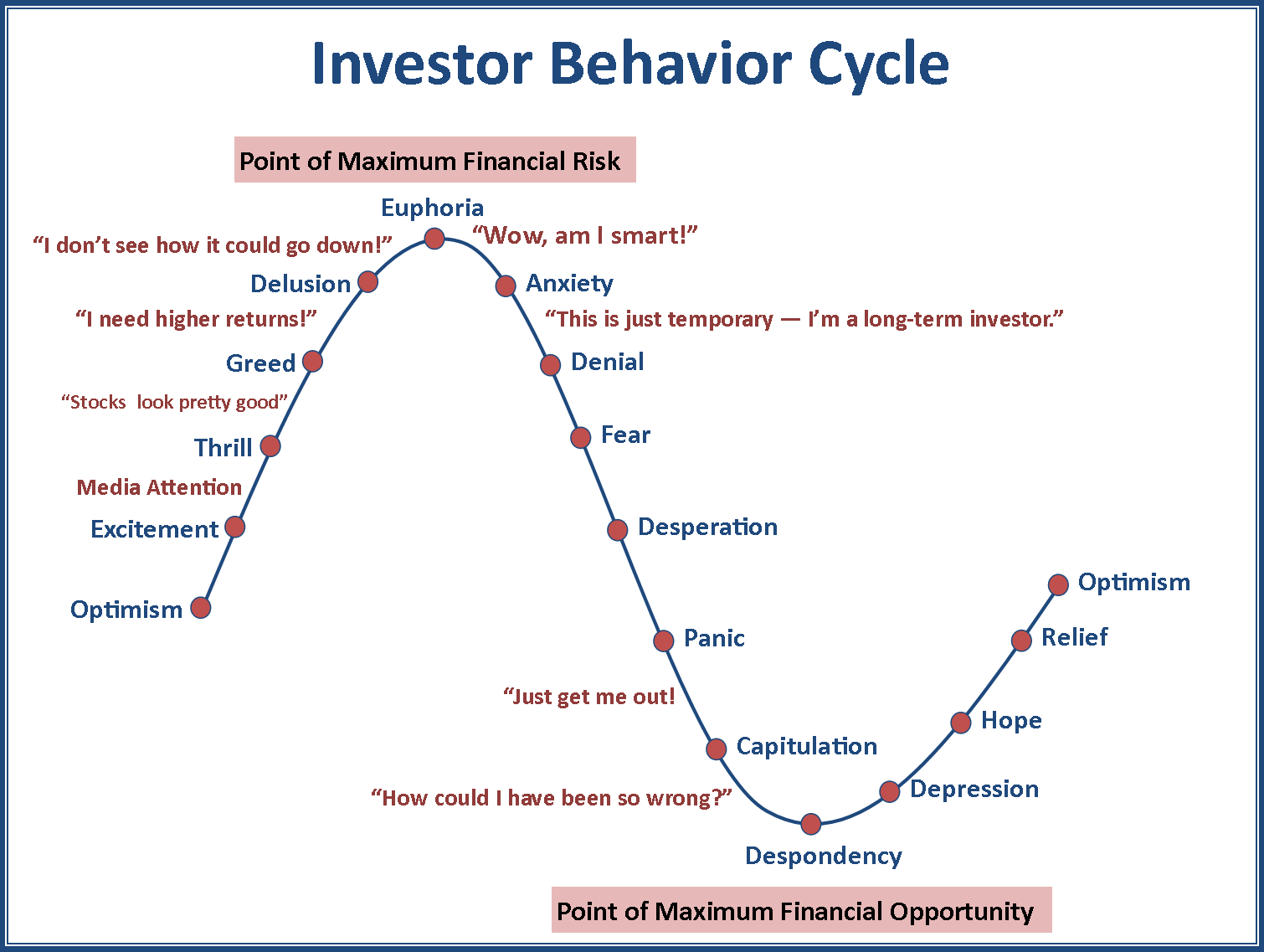

Point of Maximum Risk

It is human nature to take the current environment and project it into the foreseeable future. Whether it is a situation on the job, something with your kids, a sports team’s performance, or the stock market, this “recency” bias shapes the way we view