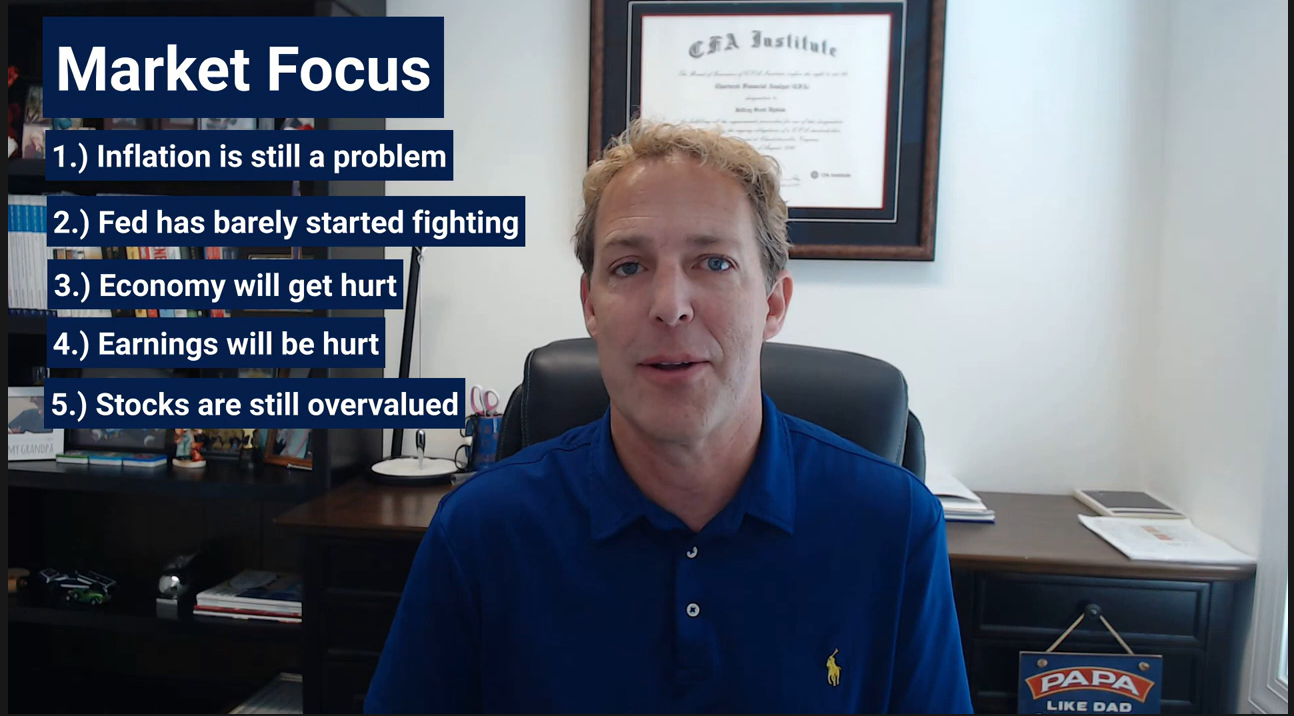

Stocks are set to retest the lows from June. We'll hear a lot this week about a "breakdown" or if stocks hit new lows and then rally. I'm confident there will be plenty of "experts" calling it the "bottom". Stocks are down 16% since August 16 and 13% since Fed

When we initially launched the Cornerstone Portfolios, we wanted to help those who serve God reflect that in their finances – starting with their investment decisions. Each month with these blogs, we want to help people continue learning and applying Biblical principles to investing and finances. Now that we've covered all

With the market falling, we wanted to get a quick video out to our clients and advisors with an update on how SEM is currently positioned. You can watch the six minute video below or scroll down for the highlights.

Click the YouTube logo for full screen viewing and other

We're used to things being resolved in short order. I'd like to say that's a function of today's always-connected world where we can find pretty much anything we want on demand. A study of history and human behavior tells us its not the technology that makes us impatient, but instead

9/13/22 - Check out the short video update at the bottom of the page.

The biggest rallies almost always occur inside a bear market. It's human nature. After large drops our brains instantly begin to think things will only get worse. Losses generate twice the emotional response as