The nearly 6% drop in the S&P 500 on Thursday obviously surprised a lot of people. Over the last two weeks we saw some very big name firms allocate a large amount of money to stocks – specifically small cap stocks. This large influx of cash and the broadening of the rally away from large cap tech stocks was a positive sign for the markets. Until the last two weeks, the rally had been on low volume (not much enthusiasm or support from large investors) and very narrow. To say few were expecting this would be an understatement.

The huge drop on Thursday shows how fragile the "bull market" is. Emotions remain high. Many 'experts' tried to attribute the sell-off to the Fed's negative outlook for the economy. On Wednesday they hinted the economy would remain weak until at least 2022. The problem with that theory is we knew that with 2 hours to go in the day and the market reaction was muted.

What is more likely the culprit is the fear the economic re-opening may be delayed or much slower as the number of Coronavirus infections has been going up rapidly in states that re-opened earlier than the rest of the country. I will caution anybody from using the number of cases as a metric. The number of cases SHOULD go up as testing supplies are becoming more available.

We live in a 100 square mile county of 22,000 people halfway between Williamsburg and Richmond. Until a few weeks ago if we wanted a same-day Coronavirus test we had to go to an ER in downtown Richmond. A couple of weeks ago CVS opened testing sites that allowed same-day appointments. The sites are still 20-30 minutes away from most of our residents, but it's better than we had before. Last week our county also set-up a 1-day testing site at the courthouse. We should see cases go up.

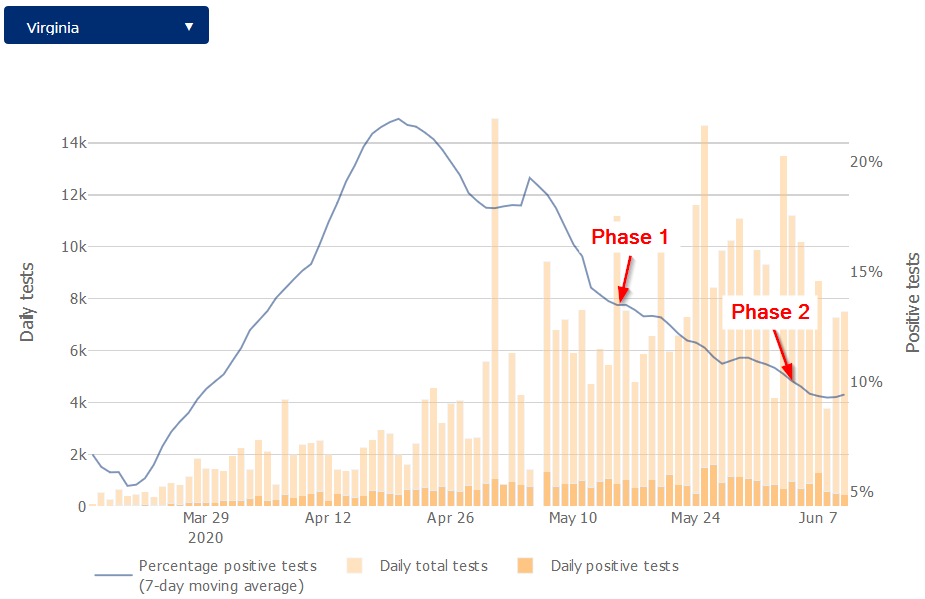

What I'm watching is the percent positive tests as this normalizes the increasing number of tests. If the spread of Coronavirus is truly waning we should expect to see the percent of positive tests going down. For instance, look at Virgina's trend in percent positives (SOURCE).

We just started phase 2 here in Virginia which allows inside dining (at 50% capacity), gyms to be opened at 30% capacity, and even sports programs to start-up again (our twins start club soccer practice next week — woohoo!). Phase 1 opened beaches and churches, allowed outdoor dining, outdoor fitness classes, and dentists and salons to open. You can already see the percent positives ticking up in Virginia.

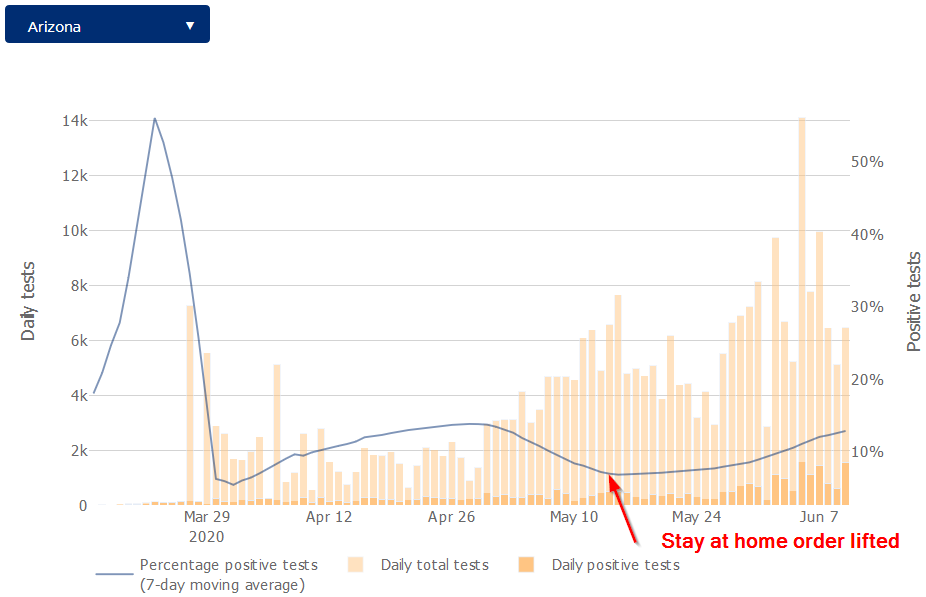

What grabbed headlines was the big spike in cases in Arizona. The theory was the hot weather would limit the spread of the virus. Arizona has generally been a virus denier throughout the crisis based on my Facebook feed. They've had nearly complete freedom for a month now and the cases are rising rapidly as well as the percent of positive tests.

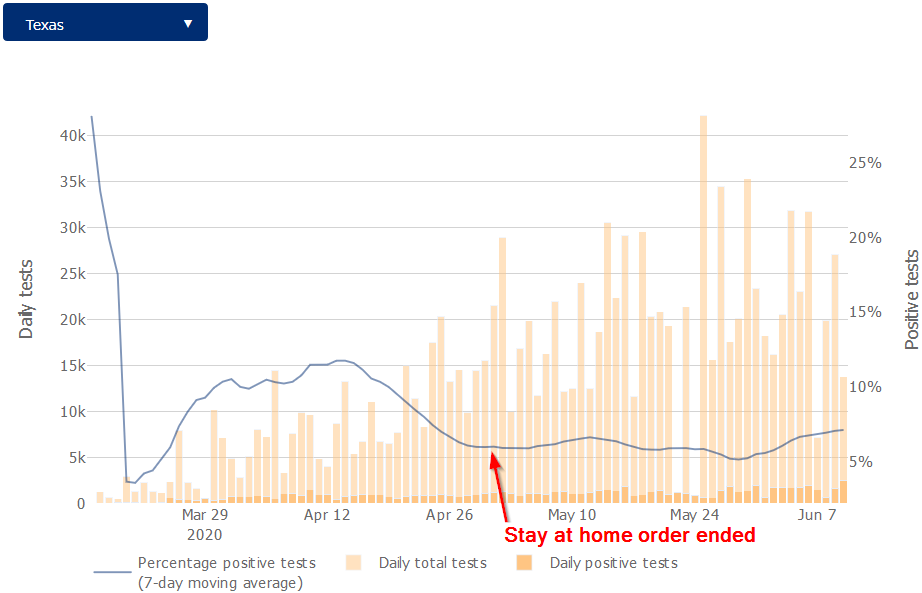

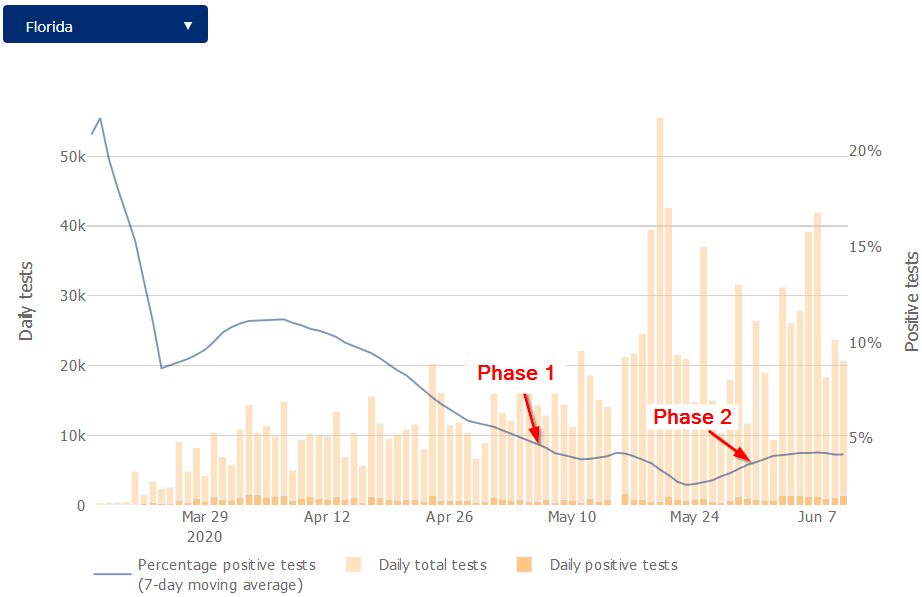

While not as steep, the same is true in Texas and Florida.

Now, what I think is being missed a bit is the fact in these states you aren't outside in the heat very often. Instead you go from your air conditioned house, to your air conditioned car, to the air conditioned office, restaurant, mall, movie theater (yes those are now open in Arizona). You only get outside in the early mornings and maybe in the evenings. It's been in the 100s since early May. This makes the spread of the virus much more rapid than the northern states because they are inside most of the time – without masks and without social distancing.

None of this is meant to be a political statement. We are dealing with limited data and a lot of unknowns. I'm just pointing out the fact the "rocket ship" recovery most seemed to think we would see is not going to happen. Add the Fed's pessimism to the spike in cases in the south and you can see how everyone can be disappointed.

We've talked about this A LOT. It's all about expectations. If you haven't seen them yet, check out these resources to help properly set your expectations for your investments.

- Just Guessing (SEM's Economic Outlook)

- The Value of SEM's Behavioral Approach in Times of Uncertainty

As a reminder, we have a plan for whatever happens in this on-going crisis. Our data-driven process is designed to take all the guesswork out of the investment process.