The craziness of 2020 continues as we start the 14th week since our country completely changed. We now continue to work through the consequences of the decisions made not just 14 weeks ago, but 18-22 weeks ago when the Coronavirus first hit our shores. As part of our Behavioral Approach we've spent quite a bit of time researching and educating our advisors and clients how our brains make decisions. One thing we warn about – the more uncertain and the more impactful the decision, the more we will be prone to both emotional and cognitive biases.

Obviously we've never gone through anything like this in our country. There's no handbook. This leaves us with a wide range of opinions and interpretations of the data. Depending on our own personal outlook, we latch on to data that supports our own outlook and tend to ignore if not insult any data that questions our personal outlook. This often turns into personal attacks and has devolved into an us vs. them mindset. (When I say "us" or "we" I mean humans in general. We all have our own biases at various degrees and we all adapt to them differently. The best way to overcome biases is to have an open mind, use as much independent data as possible, and challenge yourself to take the opposite viewpoint to look for possible reasons your opinion could be wrong.)

Most importantly, we need to respect those who disagree with us and start a dialogue. We're all in this together.

That said, here's some random things on my mind as we start the week:

Two States, Two Different Trends

Panic returned to the markets late last week. Some blamed the nearly 6% drop in stock prices on the Fed's "pessimistic" outlook following their meeting. I don't buy that since the Fed has said from the outset it would be 2022 or later before the economy fully recovered. Stock analysts have had a different take – they are pricing in a full recovery (and even higher growth) by 2021. The real issue is the "V-recovery" has been threatened as we see the number of cases in states that re-opened first rapidly increasing. I wrote about that on Friday.

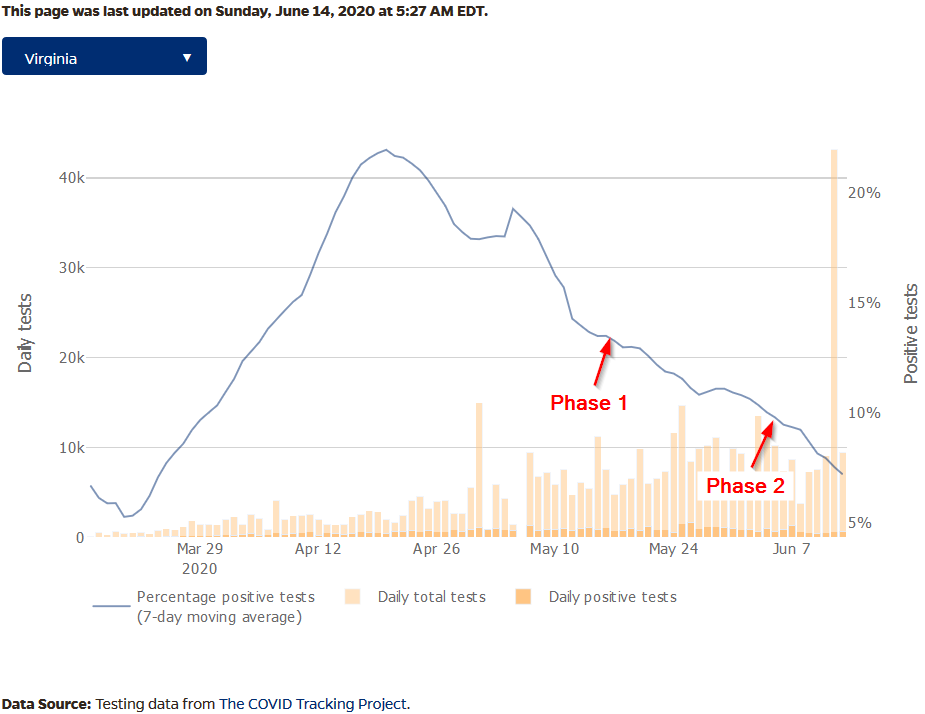

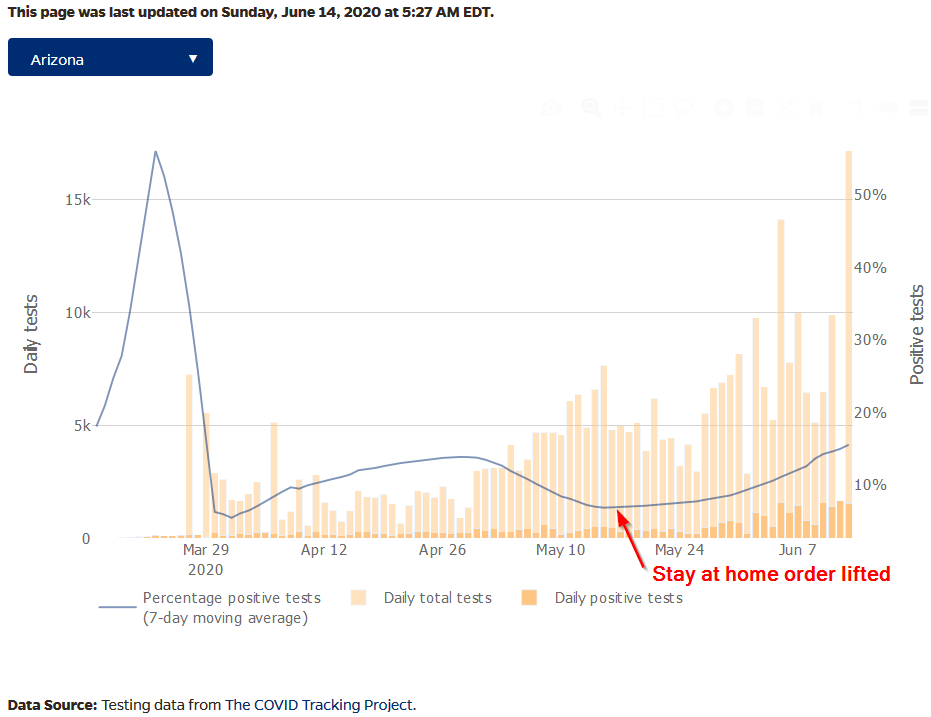

The reaction to COVID19 was about the polar opposite in Arizona and Virginia. I obviously followed those developments closely with offices, friends, and family in both states. One state essentially denied it was a problem, the other (who’s governor is a pediatric neurosurgeon) followed the recommendations of medical experts. It’s been frustrating at times, but we are thankful for the diligence and hopeful as we are in the second week of “phase 2” Virginians will continue to do better.

We are seeing more tests, so the absolute number of cases may go up, but we should still see the percentage of positive tests moving lower. As you look at the charts, note the difference in scale. Arizona is rapidly approaching the percentage of positive tests Virginia had at the peak of the crisis back in April.

This isn’t about politics. I truly hope and pray Arizona gets this under control and we don’t see loved ones dying unnecessarily and medical providers being overwhelmed as they treat their patients.

From the beginning I saw many people in Arizona in the COVID19-denier/conspiracy camp. I continue to see them finding reasons the big spike in cases is not an issue. I've heard the new cases are "not as lethal", that the "data is biased", or simply, "the result of everybody getting tested now." At the beginning of May I said we were about to get 50 different experiments in 50 different states. We simply will not know what worked, what didn't, what was bad data, and what was good data until possibly years down the road.

The real issue is what it does to the psyche of consumers. During my rounds of calls last week I had advisors and clients in Arizona asking me when I'd be back (I used to work one week per quarter in our Arizona office). They were baffled when I said, "I'm not willing to commit to any timeline." One accused me of being naive. Another said I was doing exactly what the liberal media wanted me to do.

To me it's about common sense. We have confidently eaten out 3 times in the past week since Phase 2 started allowing inside dining in Virginia. Our twins are starting soccer practice this week. We hosted a small group in our home to watch church on Sunday. We're going to the beach on Saturday. We're certainly not living in fear. Virginia isn't out of the woods by any means, but the state for the most part has done a good job of following the guidelines set forth by our MD governor. Data and science over opinions as much as possible. It's what we've lived by at SEM since our inception and what I've always tried to live by.

I’d encourage you to read this excellent article by Cody discussing some of the biases most of us are susceptible to.

What does this mean for the economy?

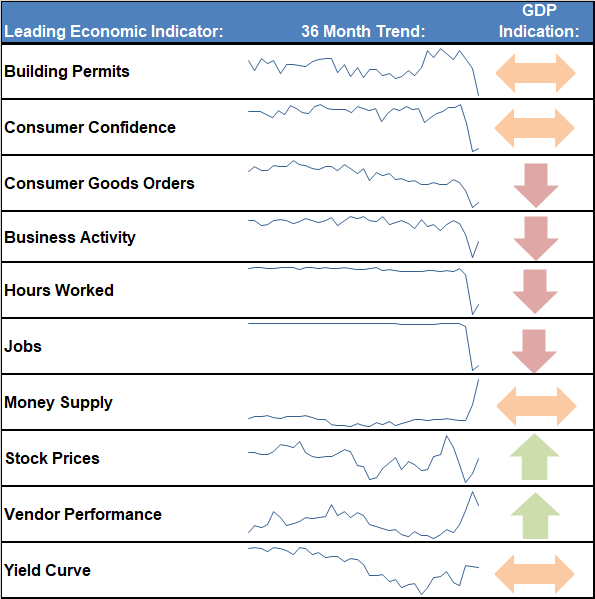

Last week I mentioned the positive signs we had seen in our economic model. While we have a long way to go, this table was useful in the past recession/recovery and will help us all see what is going strong and what is still holding us back as we move forward.

I also wrote late last week about the importance of seeing continued improvement in the jobs numbers. One reason the market may be growing concerned with the spike in cases is the lost momentum we could see in the number of people brought back to work. The shutdown was never about eliminating all COVID19 cases, but to "flatten the curve". Some states did that, others didn't. Now the potential economic damage of re-opening too soon could cause more damage than those states who have taken a more measured approach. People need to feel safer to get out and spend money.

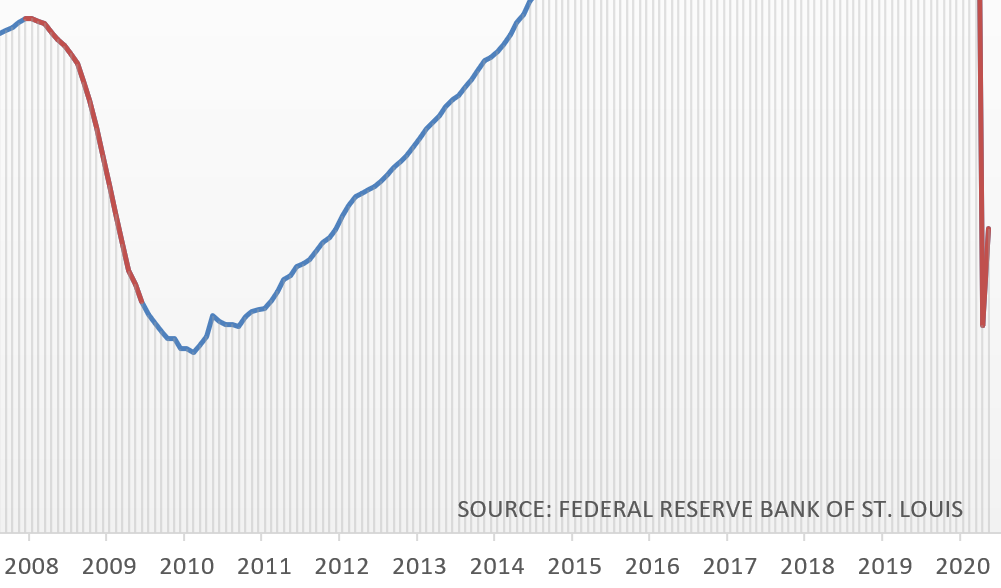

Remember, we are running about 87% of where we were at in February. This zoomed in look at Payrolls shows the very small relative improvement as well as where we sit versus the number of jobs in 2009. We have a long way to go and will only get a full recovery if Americans feel safe to resume normal activities.

Buy High, Sell Higher?

We don't use valuations in any of our models. We do use them to help set expectations. It's never "different this time" even though we have seen countless 'experts' tell us it is. Yes, the Fed poured unprecedented amounts of money into the market. Yes, we have every state opening back up. Yes, stocks (briefly) entered a bear market. It still doesn't change the VALUE of an investment – how much cash flow it will generate, priced in today's dollars. There are a lot of variables that go into determining today's value, most of which are subjective and based on how we feel today about the future. When it's all said and done, if the future cash flow doesn't compensate you for the risk you took, you look for better places to invest.

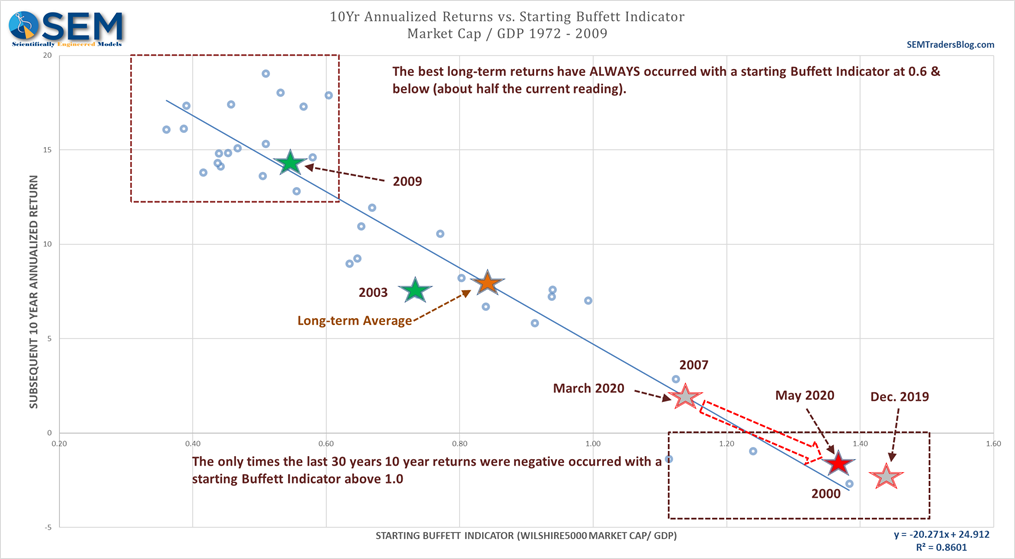

Over the long-run a stock market cannot be worth more than the economic output it is producing. It's simple math. Investors will go elsewhere with their money and stock prices will (over)correct. That's the premise behind the Buffett Indicator and why Mr. Buffett has not been buying stocks at these levels (just as he wasn't buying before COVID19.

For a closer look at other valuation metrics and what they mean for future returns, check out this portion of last week's Musings.

A Better Perspective on Social Issues

Social issues have again bubbled up to the forefront. I'm a registered Independent and always try to look at both sides of the political spectrum. In most cases, the "right" answers is probably somewhere in the middle. I've spent the better part of two decades studying the social cycle, demographics, and economic history. It is such a broad arena it's been difficult to consolidate the material into a 50-90 minute webinar/seminar. I still want to do that, but I keep coming across more research that I want added to the material. Instead, over the years I've weaved in some of the research into articles.

The most recent was when I discussed one primary reason we are seeing black people hit the point where they are speaking out. The killing of George Floyd was a symptom of a much broader problem. I'm pleased to see so many white Americans stand-up and acknowledge there is a problem. It goes way beyond police interactions with people of color. We won't solve it in a few weeks or by protests, but it is a start. At this point in the cycle we need to see all areas of strain addressed so we can move forward from a much stable balances. The "stability" our economy has had the past 30 years was the result of too much government intervention which favored some groups and left too many people behind. That can be solved without reverting to Socialism or some of the more extreme suggestions. The key will be finding common ground we can build on.

Something to think about - unlike pretty much every country in the world which evolved over thousands of years the US was created and developed out of necessity and survival. Each region served a key role - industrial centers of the northeast, plantations in the south, farms of the Midwest, border protectors of the southwest, and ports on the west coast. This led to a completely different culture that have shaped the region which still plays an influence today. This worked because each section of the country served its role for the greater good.

Expecting all of the regions to think and act the same goes against the core of our country’s culture. This doesn’t mean we don’t move forward, but it does mean empathy, grace, and an open mind.

Having lived in 3 different regions, two of them for 20+ years (Midwest and Southwest) I clearly see the difference in culture. We risk seeing our country being pulled apart if each region digs in their heels and refuses to identify the issues other regions are facing and asking what they can do to help move our country forward.

As Ice T said - left wing or right wing, we’re all the same bird. As my daughter said, "who would have thought you'd close a thoughtful post about our country's history with a quote from Ice T. #Thanks2020."

For the record. I am not a Democrat and I am not Republican so you can miss me with all your Left-Right talk.. Both Wings are on the same Bird.

— ICE T (@FINALLEVEL) June 1, 2020

I've shared research and interviews from Neil Howe many times over the last decade. Back in the 1980s he predicted the environment we are in today. Here's a recent interview he gave.

"Institutions are not in control, political leaders are not in control, and remember one essential dynamic that I talk about in The Fourth Turning was how senior generations of leaders having had no experience of crisis, no experience of building and maintaining authority and strong institutions, are going to be completely at sea......and eventually what you need is an end-run by an entirely new group, or new movement to take control and be energized by a young generation moving in... and I see that happening early in this decade."