Do you ever wonder what the history books will say about 2020? How much space will really be dedicated to the last few months? I often think about that as I study history. Think of how relatively little space was dedicated to the Civil War or World War I back when we were in school. Before this year, how much time did you spend thinking about the Spanish Flu Pandemic of 1918-1919? Will they talk about the election of 2016 as a critical change that led to a decade of upheaval or will it be a non-event? Will the 2020's be looked at like the 1960s in terms of the spark that led to significant improvements in the treatment of all Americans? Or will we have another high profile death lead to a few weeks of outrage five years from now?

Those are just some of the thoughts on my mind following a mentally exhausting weekend. As you know I love studying history and have spent a great deal of time looking at how the demographic, economic, and social cycles all play a role in our history. I've been reading a lot of books lately and need to spend some time consolidating all my notes in a more shareable format. The content in the blog is a mosaic of all the things I've read or studied. I'll do my best to get that out there as much as I can, keeping in mind I'm paid to manage money so everything I do is through that lens.

With so much on my mind and so much happening in the markets and our country, here is a short list to start your week:

Welcome Payroll News, but......

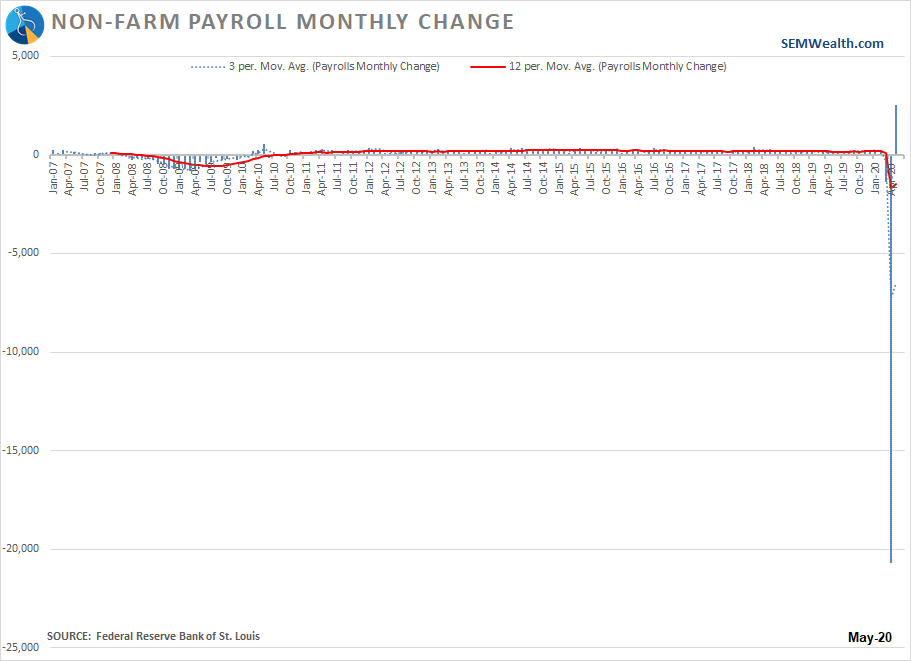

The headlines on Friday were about the 2 million "new" jobs. It should have said, "based on a small survey, we estimate 2 million people RETURNED to work in May." During extremes the process of measuring jobs from the prior month the first Friday of the next month is full of guesstimates. The good news, is people returned to work based on surveys conducted during the third week of May. Since then we've seen quite a few more states enter their second phase of re-opening. The bad news is the initial and continuing employment gains do not line-up. People are still filing for unemployment and staying on unemployment at a very high rate. We'll see how the numbers are adjusted in the months ahead.

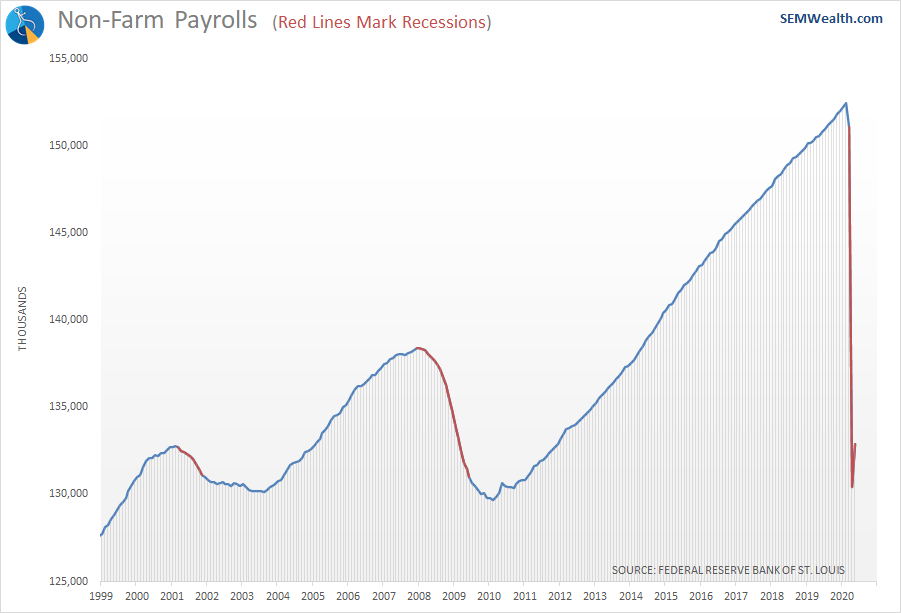

Let's look at the payroll numbers through a series of charts. April we had record job losses. May we had record job gains.

I think this chart tells a better story. Based on the May number we have 87% of the jobs we had in February.

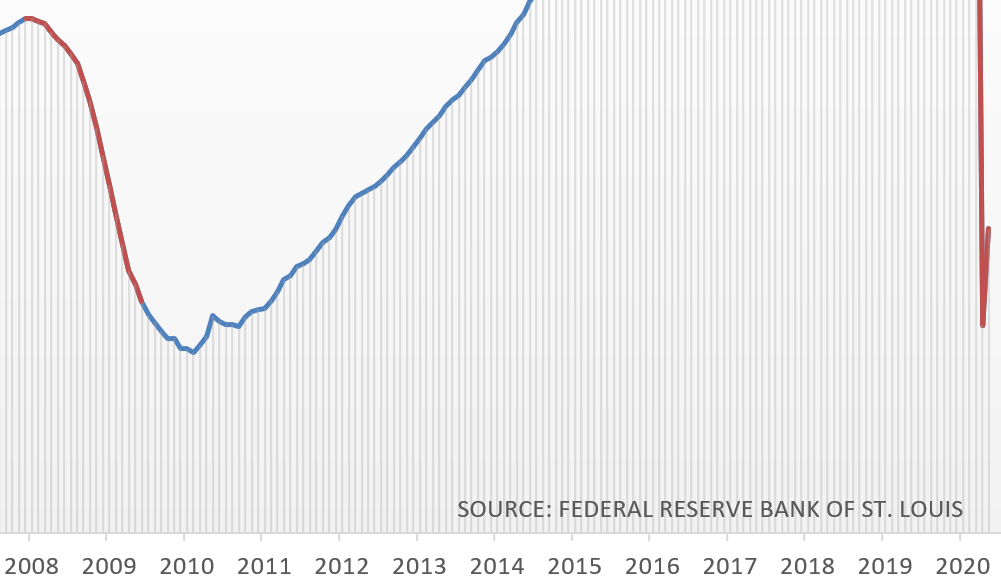

You need to zoom in to see the improvement. Note where we are at in terms of the number of jobs compared to 2008/2009.

Obviously it's good news to see growth, but we are nowhere near out of the woods. What is more important is what type of jobs were brought back and how many of the remaining jobs will come back.

Economy: Significant Damage, but some Improvement

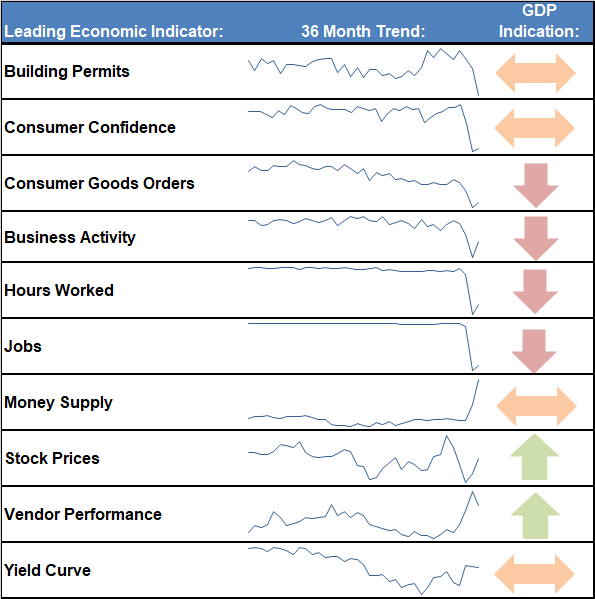

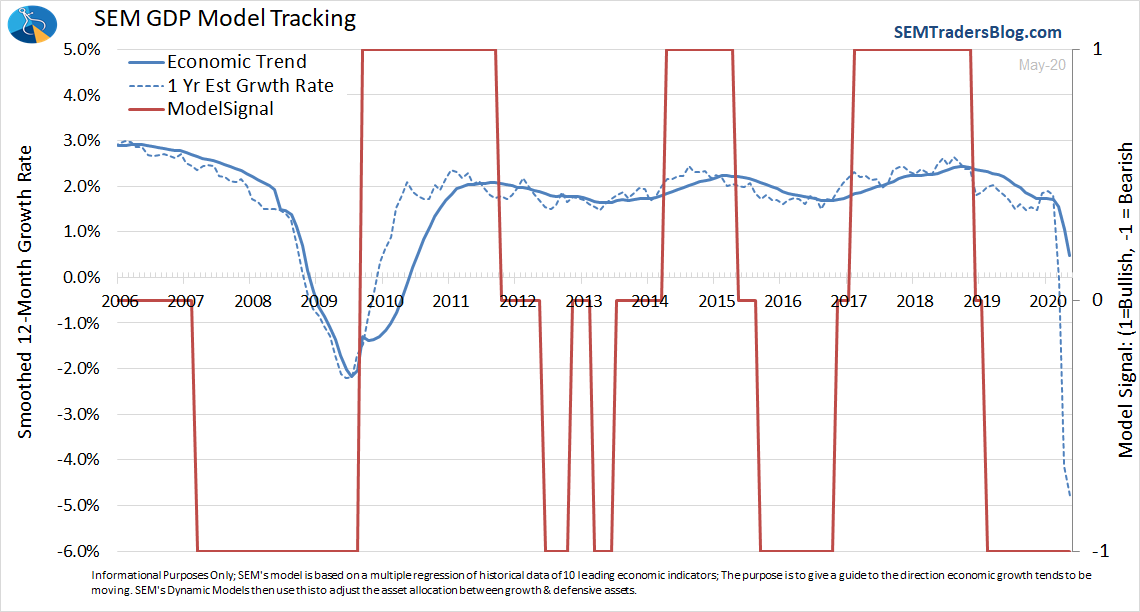

I mentioned last week our economic model picking-up on some improvement in the indicators, namely in the Money Supply (obviously thanks to the Fed & Congress), Yield Curve, Manufacturing New Orders, Service Business Activity, and Stock Prices (which is a leading economic indicator). This movement was enough for our Dynamic Income Allocation model to cut its Treasury Bond duration in half at the end of May. The timing was pretty good. We saw the 10-year Treasury bond go from 0.6% to 0.9% last week. Despite that, there is a long way to go. Here's our updated indicator dashboard from our economic model.

Overall, even with the improved jobs numbers our model is not flinching in terms of adding more risk to our Dynamic portfolios.

Don't Stand in the Way of Animal Spirits

Completely shutting down the economy was scary and unprecedented. We saw people overreact and sell stocks with ferocity. Seeing Congress and the Fed act so quickly helped stem the selling and offer some stabilization to the markets. As the virus waned in New York & New Jersey (where half the cases and deaths occurred), the virus numbers looked better. As states began to re-open our brains flipped from "the economy is doomed" to "there is no stopping our economy". The data, history, and economic logic says that is wrong (see the prior two sections), but that does not play a role in our investment allocations.

The re-opening is a positive sign and given our emotions plays a big role in the bidding-up of stock prices. As I said from my first post on the virus in February – science said the virus would wane in the heat and humidity of summer. We will also see more cases as more people get tested. Our small county in Virginia just had its first testing site last week (only for one day). Now we are back to still needing to drive 30 minutes to Williamsburg or Richmond if we want to get tested. That is actually an improvement. Until a few weeks ago, our best bet for a test was to drive 45 minutes to an ER. How many people had the virus and never got a test the last three months?

What will be a concern is if we see the percentage of positive tests go up throughout the summer. This would mean the virus is spreading despite the heat and humidity. If that doesn't happen we should see the emotionally driven buying continue to drive prices higher.

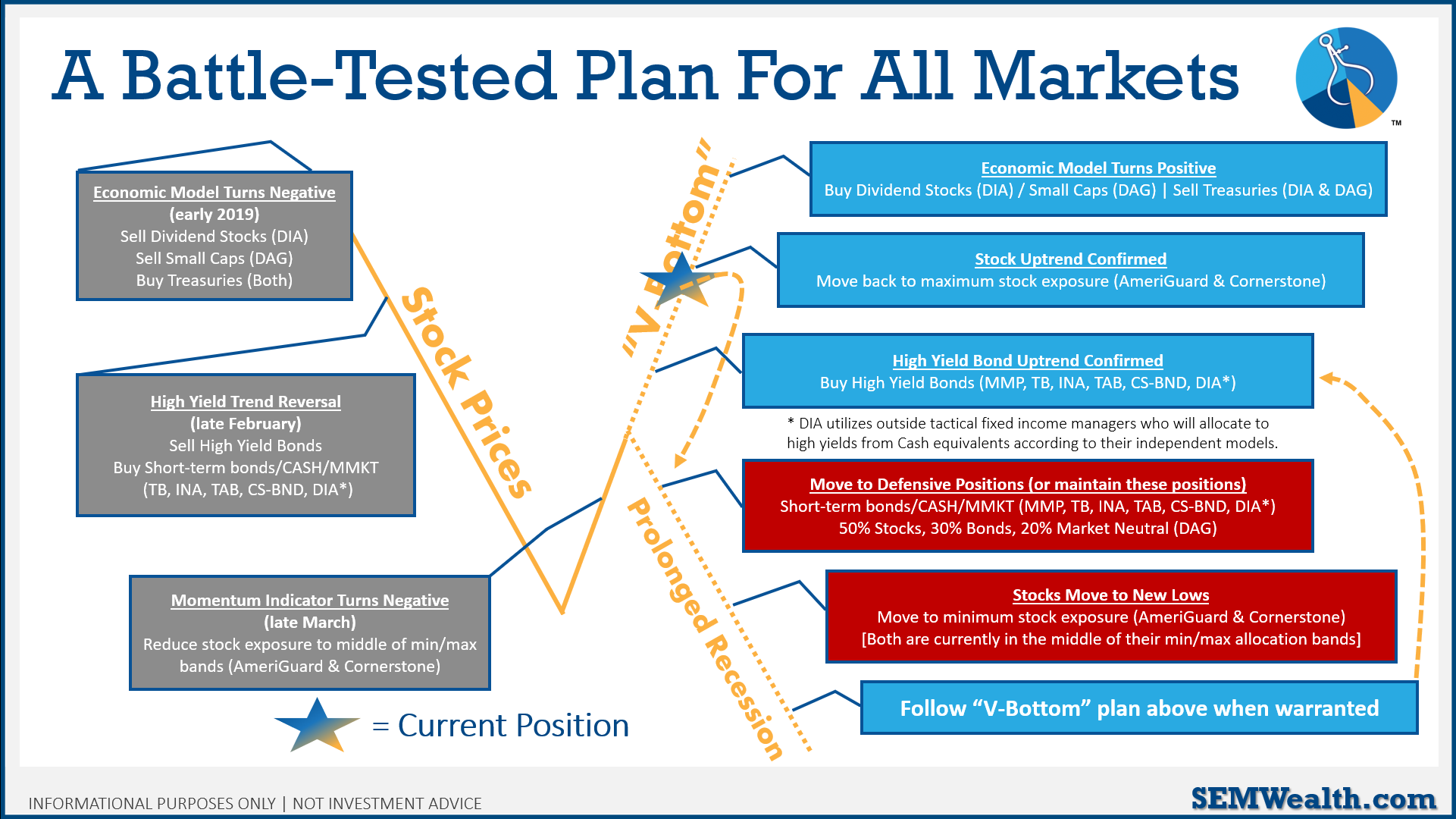

Throughout the crisis, we outlined the value of our data-driven process.

Note the "Current Position". Our plan has played out perfectly. Sure with hindsight, you could say, "selling was a mistake". We don't invest with the benefit of hindsight. Our data-driven process allowed us to walk our clients and advisors through all the steps of what would happen before they happened. We had already taken action before most people even noticed there was a problem. We continued throughout March to calmly work our plan in the midst of unprecedented volatility and uncertainty. As the market has rallied, we've seen money put back to work and take advantage of the rising prices. Minus our economic model, we are "all in".

Whether you think the rally is justified or not, we're making money because the data says we should be invested.

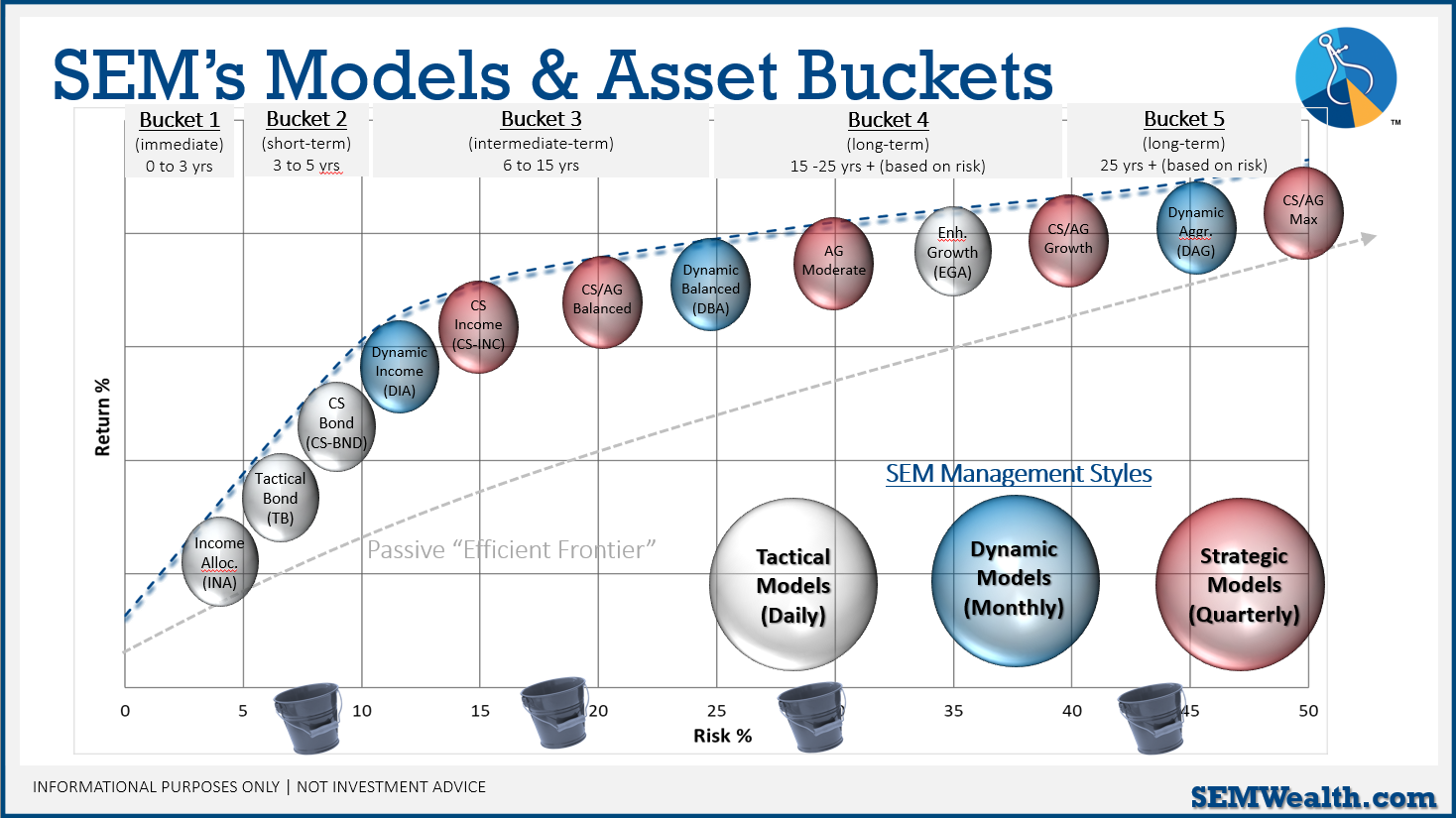

Let's go back to the "selling was a mistake" logic and look at the two ends of the SEM risk spectrum.

SEM is known for our active fixed income management. Along with a handful of other firms, I don't know of anybody else with a track record like ours that goes back into the 1990s. (The other managers are actually a part of our Dynamic Income and Platinum models.) For a couple of decades we've provided higher returns with lower risk than most buy & hold fixed income portfolios. These models, from Income Allocator (INA), through Cornerstone Income on the chart above at worst were down 3% for the year. Some, like Cornerstone Bond and Dynamic Income were never negative in 2020.

This means during the panic, investors in those models saw very stable account values. They are all now up 2-4% after fees in 2020. The S&P 500 is on the verge of finally being positive once again for the year.

Now let's shift all the way out to AmeriGuard & Cornerstone "Max" models. The max in their names means they are always invested in stocks. Unlike a traditional buy & hold portfolio these models will rotate around a core portfolio and overweight different stock market segments. This means these models rode the stock market all the way down. While they were down less than the S&P 500 at the lows, they still lost a lot of money. This is by design. Those models are designed for the long-term "bucket". During the depths of the sell-off we saw advisors rapidly doing Roth conversions into the "Max" models and using other strategies to put more money into "max" at the lows. We saw little panic because investors in those models were expecting losses at some point and knew it was a long-term investment. Most also had some allocations to our "income" models which stabilized their portfolios.

Through Friday, both AmeriGuard & Cornerstone Max models were UP 3%.

In other words, you had two different paths to get to the +3% range with SEM portfolios. What happens next is anyone's guess. What is important is where the models fit into the overall financial plan, cash flow strategy, and personality spectrum. As we've again proven, our data-driven process allows us to react and adjust in a consistent and reliable fashion.

Valuations are Still Extreme

Despite the above, if you're just now looking to get into stocks, the odds for strong long-term returns are much smaller because you're buying at levels that do not reflect the underlying economic environment.

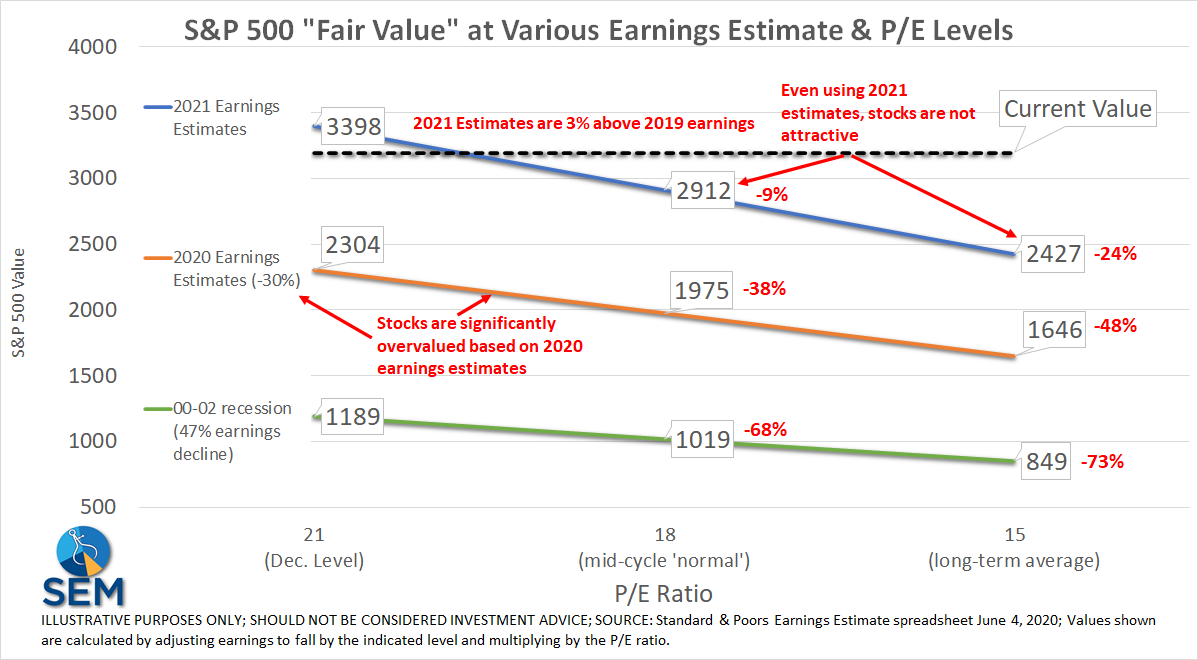

We've shown this chart throughout the panic and recovery. "Fair value" is subjective and is defined differently by most. It illustrates to me what the market is currently expecting.

The market expects in less than 18 months corporations will have recovered 103% of where they were at the end of 2019. Crisis over, more growth ahead. I hope that is the case, but what are you paying for that type of growth? You're paying an unprecedented multiple of those earnings. Today you're paying nearly the same amount for earnings that are 18 months out as you were paying at the start of the year for earnings that were already reported. Despite all the uncertainty in the strength of the recovery, stocks are pricing in no risks.

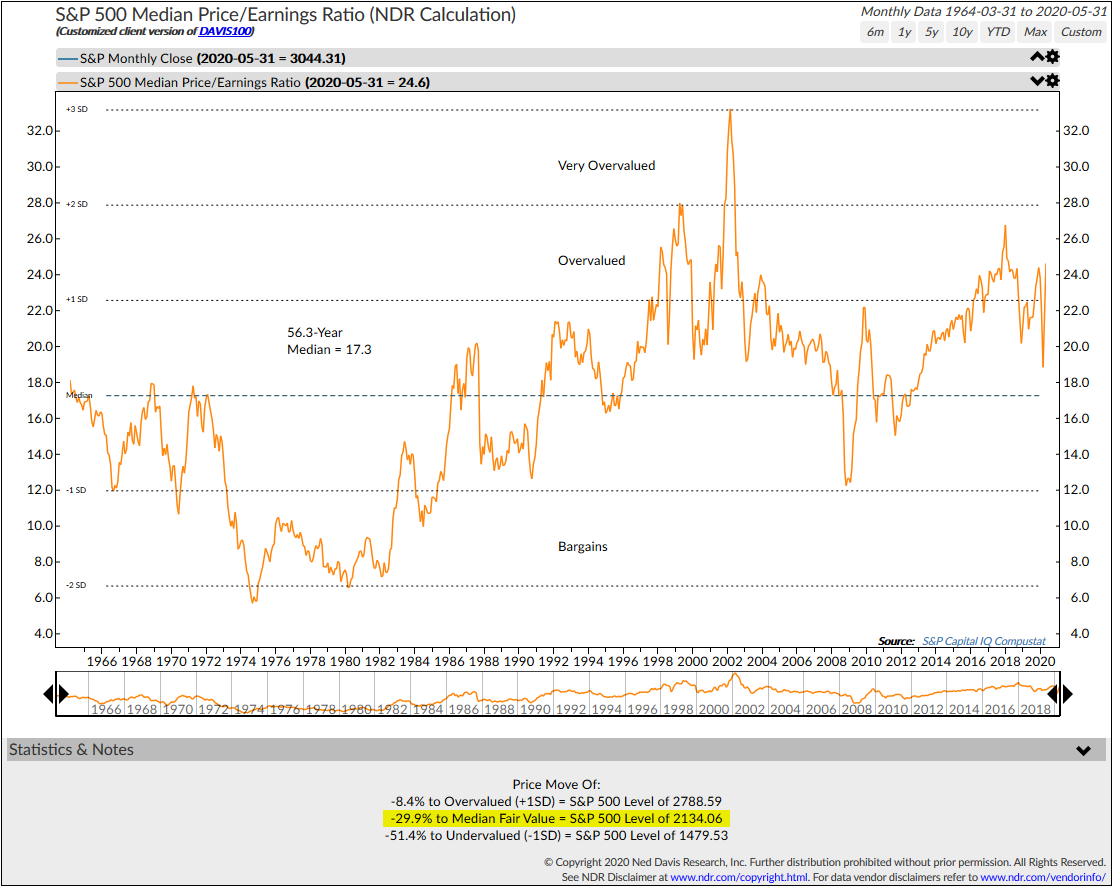

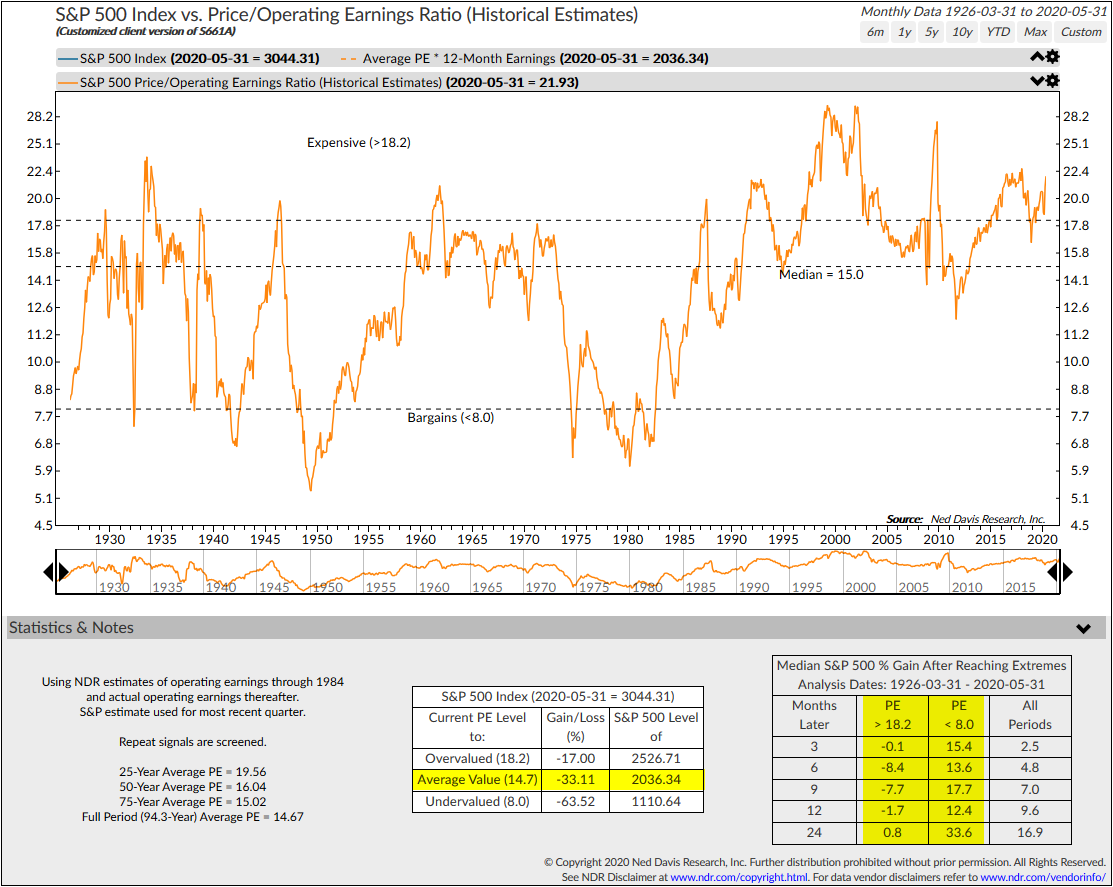

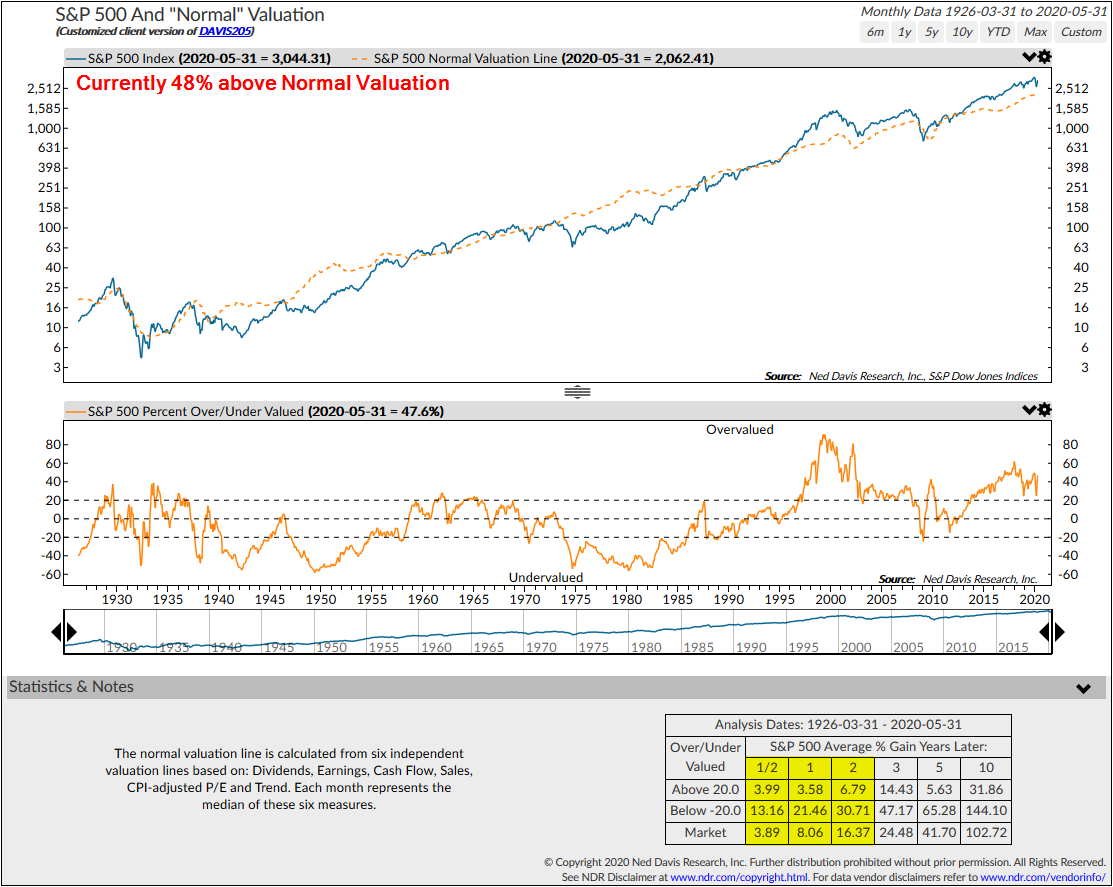

Stocks can remain overvalued for quite some time. That's the nature of the market. We do not use valuations in any of our allocations, but they are important to set expectations. Ned Davis took a look at a few different valuation models to illustrate where stock prices might be attractive.

The first looks at the Median P/E, which provides a more balanced look at the overall market by removing the outliers from the average. As of the end of May stocks were 30% overvalued and 51% from being "undervalued".

The next chart looks at the S&P 500's Price/Operating Earnings. Operating Earnings are the "on-going" earnings numbers that management puts out to exclude and "extraordinary" items. This number is almost always higher than the actual earnings. Using this metric, stocks are 34% overvalued. The table at the bottom shows the performance for various holding periods when this ratio is in "overvalued" territory.

The final chart is really interesting. NDR looked at six different valuation indicators to plot a "normal" valuation. This gives a much smoother trend and removes the fluctuations we see from different cycles. It also provides an upward bias to valuations, which I've heard analysts argues is necessary due to the 40-year downtrend in interest rates and the impact technology has had in increasing profit margins. Even using this more favorable metric, stocks are still significantly overvalued.

Based on the DATA, thanks to the animal spirits arround the re-opening, stocks are anywhere from 30 to 48% overvalued. With valuations this high you should both expect much lower than average returns if you hold for the long-term and a signficant pullback in stock prices.

When would I get excited about stocks? Based on the DATA I'd say somewhere around 2000-2100 on the S&P 500.

What this means is I couldn't think of a better time to shift money over to SEM. We are essentially "all-in", just like the buy & hold investments inside most portfolios. The key difference is we have a plan to take money off the table when reality begins to set in again AND to put it back to work at significantly lower prices. We proved the validity of this strategy so far in 2020.

Nothing has changed from a big picture perspective.

Social Activism Important

The demographic, economic, and social cycles absolutely will play an impact on our investment returns and is something we all need to understand as we work on financial and investment plans. Properly setting expectations is one of the primary keys behind a true Behavioral Approach. This includes looking into politically hot-button issues. I'm a registered independent and try to be as non-political as possible and have been doing so for over 20 years. From an economic and social perspective I have issues with both sides and believe at some point this decade we will see a third and probably fourth party play a role in our country's politics if the leadership from both sides do not acknowledge and begin to listen to the large swath of people who no longer are represented by the far left and far right. I saw a t-shirt during the protests that said, "not left, not right, forward." We're all Americans and need to remember that. There are groups who are hurting and we need to listen.

Last week was tough. I shared my heart and showed more emotions than I am typically accustomed to showing. If you haven't seen last week's posts, I'd encourage you to take some time this week and digest them.

While written about COVID, I'd also encourage you to take some time to read and understand our own personal biases as this plays a role in our view of the on-going racial tensions. The way our brains are programmed will lead us to digest new information differently. There's nothing wrong with that, it's what makes us humans.

In last week's blogs and in our social media posts I noted how SEM is taking a stand to address ways we can help with the racial imbalances that have again been pushed to the forefront. We don't want these to be empty words. The outpouring of support has been encouraging. I don't have the answers or the solutions, but am willing to admit there is a problem and it is important for the long-term success of our economy to address it. It's great to see the protests turn peaceful and so many people like me finally acknowledge we have a problem. I'll be the first to admit I didn't think we still had a problem in our country. Like many, I didn't see it so thought there was no issue or that it has already been solved.

One book that opened my eyes was "The Master Plan" by Chris Wilson. It's both frustrating and encouraging. It most certainly addresses many of the things today's peacful protestors are trying to highlight.

I was added to a LinkedIn group of Financial Advisors wanting to increase diversity in our industry. We also want to look at ways we can start addressing the economic issues that are impacting the black community far more than any other race. If you'd like to be a part of this group as we go from discussion, to planning, to implementation, let me know in the comments below or by sending me an email.