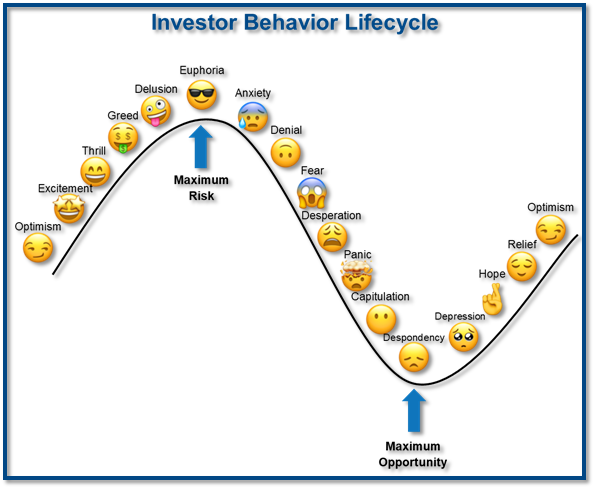

I've been managing money for over 25 years. With advisors and clients across the country and now the ability to hold client meetings online I can usually get a pretty good feeling for investor sentiment. I used the word "animal spirits" to describe investor sentiment two weeks ago. Euphoric and delusional are also words I would use. It doesn't mean the market is going to crash in the near future, it just means the risk of a crash has gone up significantly. When you think there aren't any risks in the market, the slightest scare can cause a panic.

I usually know when investor feelings are getting to extremes when I see financial advisors questioning what in my opinion is one of the best risk/return investment models around – our Tactical Bond model. Three times already this week I've had an advisor say we "missed" the big rally by being too defensive. They all expressed disappointment in our inability to adapt to the "new" market environment.

It's not as easy as it looks with the benefit of hindsight. I've managed money for nearly 25 years. The key to success in investment management is humility. My response to the "you missed it" comment is simple:

- During times of uncertainty for whatever reason most of us feel more confident in our ability to forecast the future.

- The best weapon to fight uncertainty and to overcome our behavioral biases is a data driven process that has been battle tested.

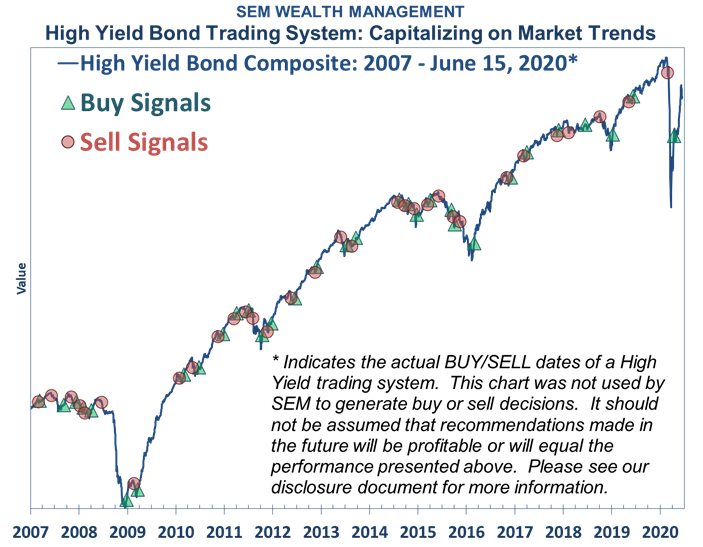

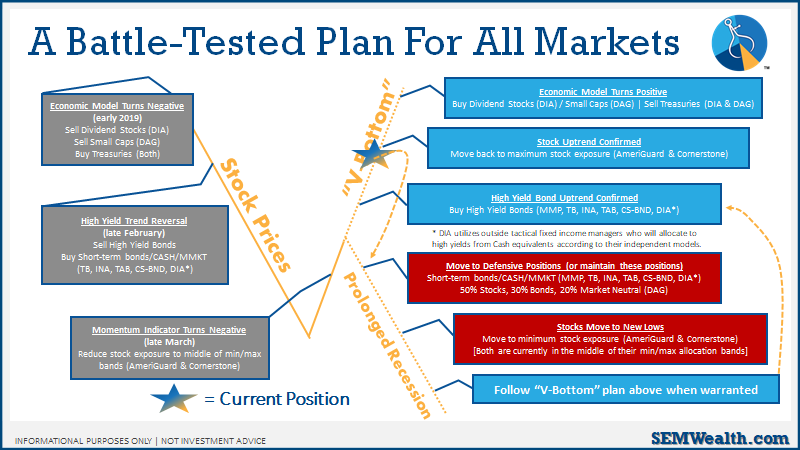

- To show this week's Chart of the Week, which maps our real-time buy/sell signals. The chart goes back to 2007, but this system has been used in real-time since 1992.

I use this chart quite frequently to illustrate two points:

1.) We will never get in or out at the exact bottom or top

2.) There are many times with hindsight we'll ask "why did you take that signal" (or not get in sooner)?

What is missed is the experience investors felt the last six months. Our income models started the year fully invested in high yield bonds. They had some nice steady returns, although not the huge jump we saw in stock prices the first 7 weeks of the year. As the attention of the market turned from impeachment to COVID19 near the end of February, our models started selling high yields. We weren't forecasting what would come next. The models simply saw risk developing and moved to lower risk investments.

I don't like talking about performance. If a fund provider sends me an email touting their recent performance I delete it immediately. That said, sometimes you need to see performance as proof of concept (with a key understanding of the much bigger picture of where the model fits and how it has performed through ALL types of markets.) Past performance of course is not a guarantee of future results. For details on any performance numbers discussed here, please see this disclaimer. With all that in mind, let's look at the performance this year for some of our key models.

From high to low our income models (Tactical Bond, Income Allocator, Dynamic Income, Cornerstone Bond, and Cornerstone Income) lost around 2-4% from late February until mid-April. Interestingly enough, about 1/3 of those losses came from the "low risk" investments we had in mid-March. As you'll recall the entire bond market siezed up and we saw even short-term Treasury bills losing significant amounts of money. We proactively sold those investments and spent the rest of March in money market or cash accounts. The Fed stepped in about 4 days after we exited those investments, but by that time rates were close to 0% in all short-term instruments anyway.

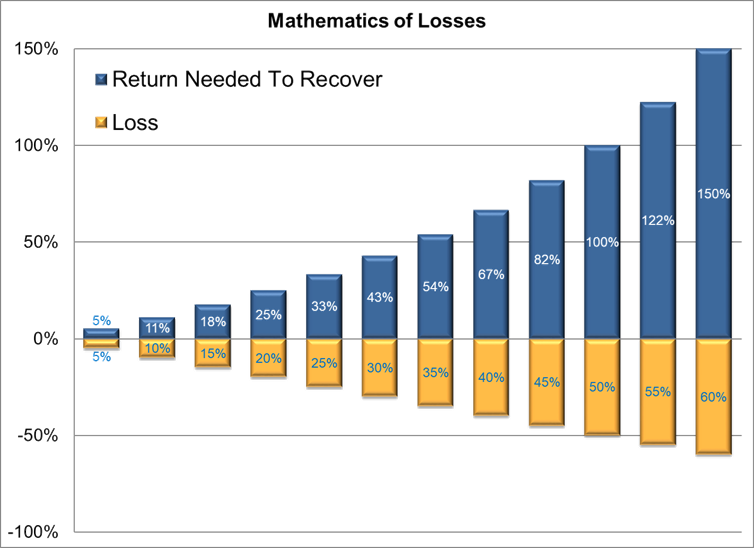

Managing losses is key. The less you lose the less you have to make on the way back up. Or another way, the more you lose the more you have to make. The more you need to make the more risk you have to take. This means you risk losing even more the next time around.

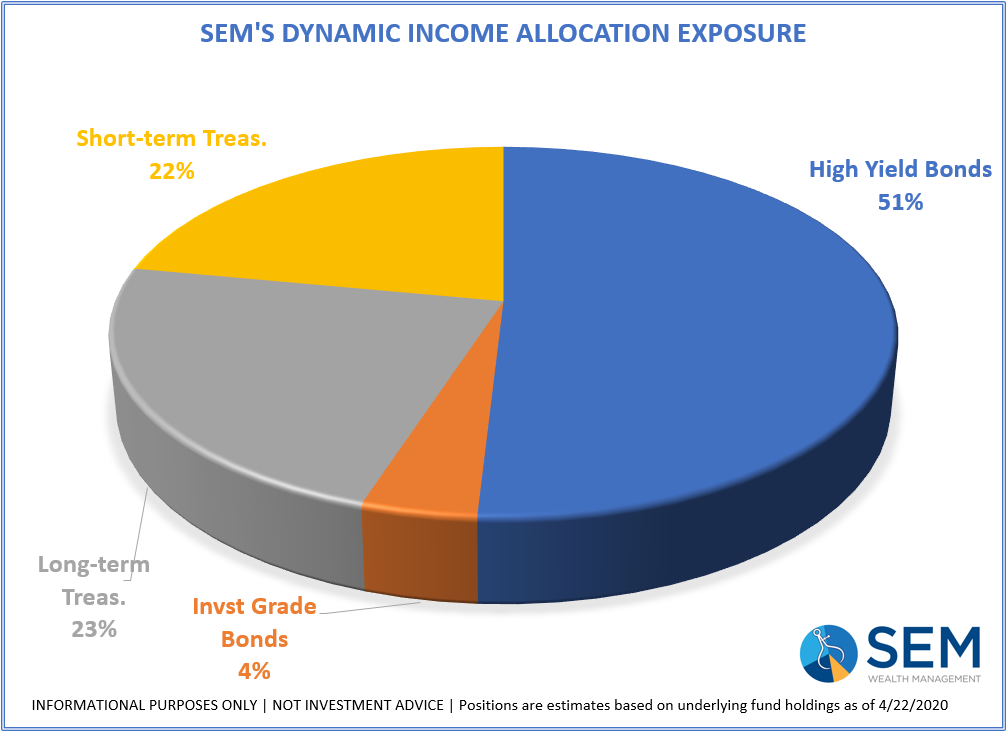

Our model started buying in mid-April, which was around the same time the Federal Reserve announced they could buy bonds down to a BB rating (if they were BBB or higher before COVID) as well as high yield ETFs (with restrictions on how much of the outstanding shares they can own). Yes we could have subjectively jumped all in, but that's not how we work. Once you override a model you are in a terrible position of deciding when you go back to the model for guidance. We won't do that.

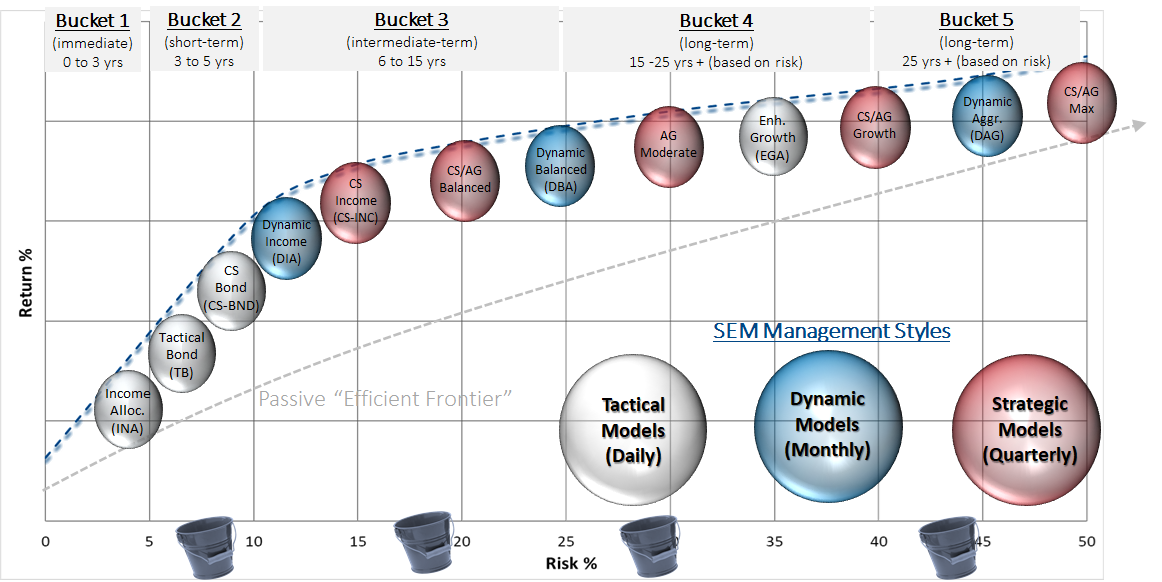

Over the past two months, our income models are up between 4-6% (after fees). Since they barely lost anything, this puts them up 2-5% year-to-date (after fees). The stock market is still down 2% (with no fees) for the year. At one point it was down over 20% for the year. If that's the type of volatility you as an advisor or investor is comfortable with, I'd encourage you to check out our AmeriGuard or Cornerstone Max models. Both of which are up 3% (after fees) for the year. Better yet, apply our behavioral approach and segment out the investments into different buckets based on the time horizon and individual risk tolerance of that "bucket".

Going back to the income models, at the end of April I detailed the opportunities we have in the coming months and possibly years in high yield bonds. The Fed's actions do not cancel those opportunities. We haven't missed them. They've just been delayed.

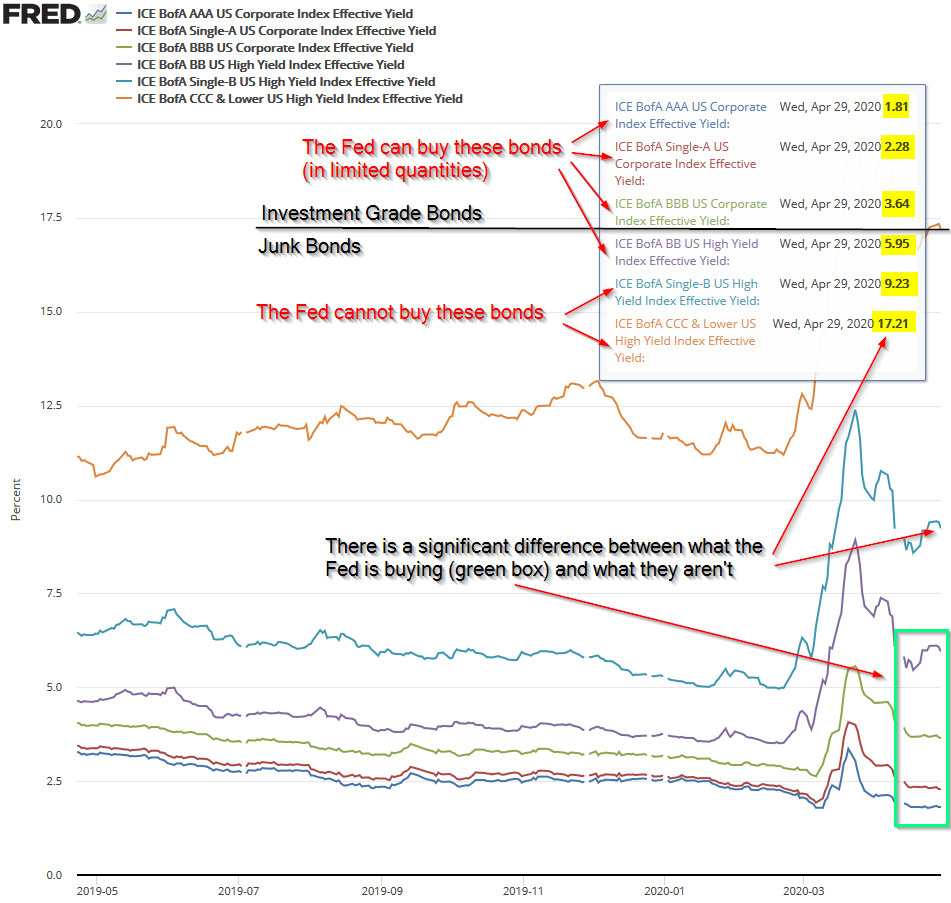

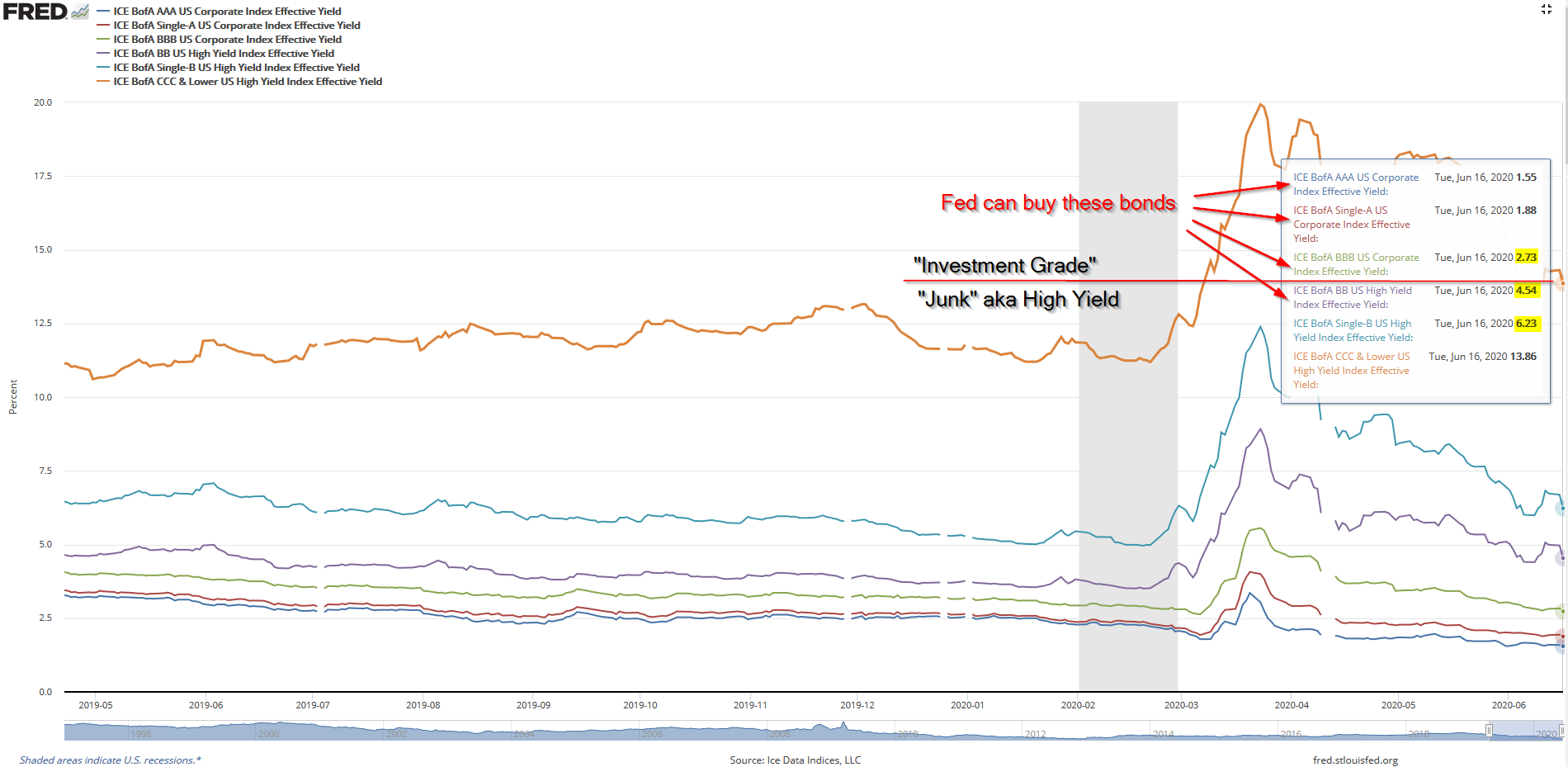

Stability breeds instability. The more investors think the Fed can prevent defaults, the more confident investors become. What they are missing is the fact the Fed cannot buy insolvent bonds (when the issuer does not have enough cash flow to cover their debt payments). They also can't buy bonds rated below BB, which is a huge portion of the high yield bond market (and represents the majority of holdings in most high yield bond funds). Here's a chart of yields for the different levels of corporate bonds. As you can see there is a huge gap.

This week the Fed announced they were starting to buy individual bonds. They announced the program in March, but just those words were enough to calm the markets. Then last Thursday (June 11) the market panicked. Stocks fell 6% and liquidity in the bond markets completely disappeared. You couldn't get quotes on a lot of bonds because nobody was willing to step in. While I don't like this type of market manipulation by the Fed and know it will cause long-term issues with the functioning of markets, the Fed's actions are helping our income models tremendously. We'll gladly take the 4-6% annual yields as long as they are there.

Last week the Fed warned interest rates could be near zero through at least 2022 as the economic recovery will take several years. This means if you're an income investor you're going to need to be more active. In addition to Tactical Bond, Cornerstone Bond, and Cornerstone Income models, our Dynamic Income Allocation model is designed to adapt to whatever the market brings us.

We didn't miss anything. You didn't miss anything. Our economy has a long way to go. The more stock and bond prices go up in anticipation of the recovery, the more likely we'll see a sharp correction in proces. Our battle tested process is designed to adapt. No guessing. No opinions. Just data.

If you'd like to hop on a quick call to discuss our models, our outlook, and our process, click here to schedule a meeting.