For over a decade I've been listening to "experts" recommend investors dump bonds and use dividend paying stocks for the fixed income needs of clients. I've again heard this advice in the past month. This is what I thought of:

For over a decade I've pointed out two things with this "Turrible" advice.

1.) Bonds are not created equal; It is impossible and irresponsible to give advice for all bonds.

2.) Dividend stocks are too risky to represent a large portion of most fixed income investors portfolios.

Not all bonds are equal. Yes Treasury Bond yields are low. Treasury Bond yields are priced based on the economic outlook. If the economy is likely to be strong, we'll see Treasury Bond yields increase. If economic growth is expected to be weak (or negative), we'll see Treasury Bond yields decrease.

High yield bonds are much higher. High yields are priced based on the ability of the issuer to repay their debts. This means as economic growth prospects worsen, the yields on these bonds go up. As prospects improve for the economy, the risks of default are reduced, so high yield bond yields decrease. In other words, high yield bond yields generally move in the OPPOSITE direction of Treasury Bonds.

This means an actively managed fixed income portfolio can add significant value if it can rotate between Treasury Bonds and High Yield Bonds. We'll revisit this key point in a minute.

Dividend stocks are too risky. I'm so tired of hearing how "attractive" stocks are because their dividend is higher than Treasury yields. Stocks SHOULD have a higher yield because they are SIGNIFICANTLY MORE RISKY. The 2020 market has once again illustrated this. High dividend stocks, like they did in the financial crisis have once again lost more money than the S&P 500 overall. Your dividends didn't "protect" you. Worse, we are seeing many companies again cutting their dividends. Not only can you lose significant capital with dividend stocks, your income can also be cut at the same time.

This doesn't mean we don't believe this asset class is valuable. Instead we want to utilize this key asset class when the economy is strong and avoid it when the economy is weak. We'll revisit this key point in a minute.

Your Common-Sense Income Portfolio

We know Treasury yields are low. We know we've been in a 40 year bull market in Treasury bonds. We know dividend stocks can generate strong returns. This doesn't mean you should nix bonds and use dividend stocks. Instead, let's look at how SEM's Dynamic Income Allocation (DIA) model is designed.

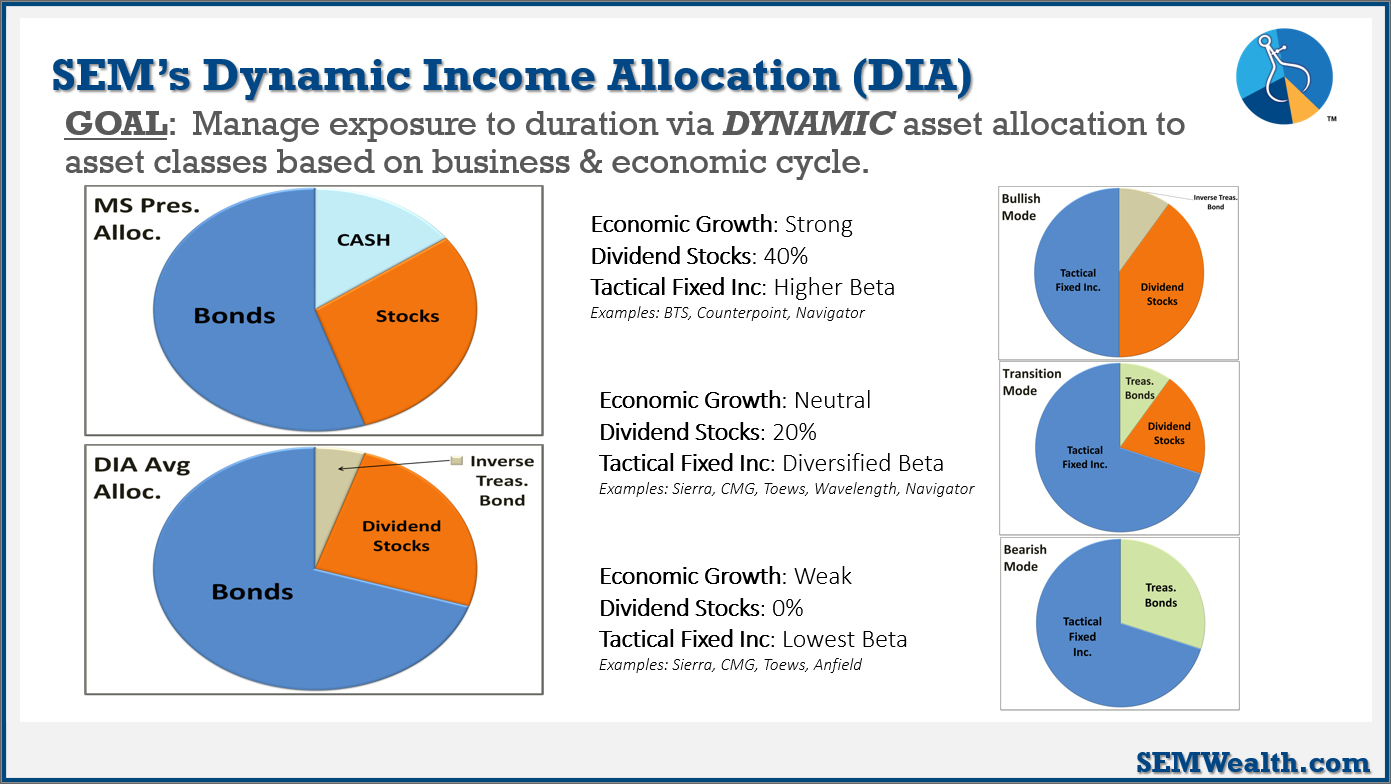

DIA is a common-sense approach to income. We want to invest more heavily in Treasury Bonds when economic growth is slowing and more heavily in dividend stocks and remove Treasury Bonds when economic growth is rising.

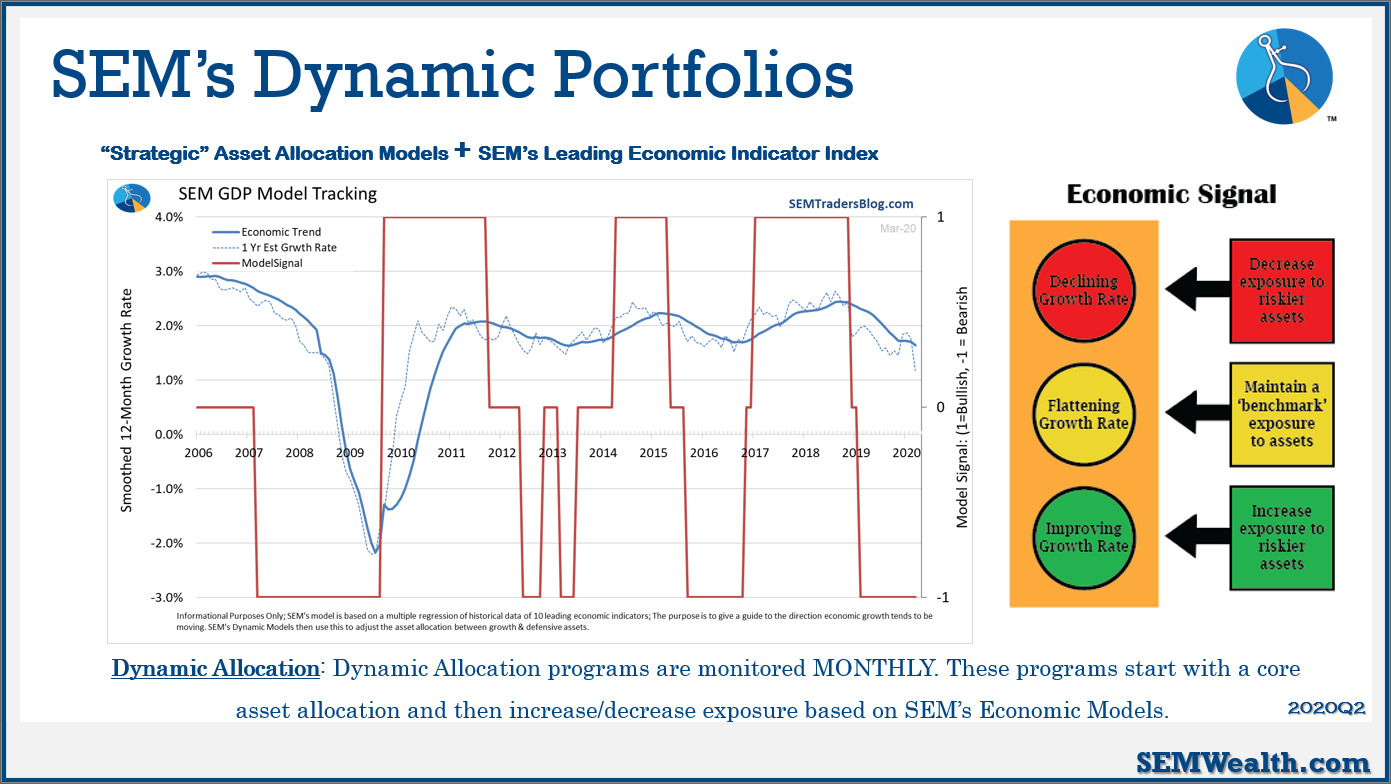

Rather than having an investment committee determine the economic growth trend, the base of DIA (and all of our Dynamic models) is a quantitative economic model I began developing in 1995 and mechanized in 2001. The model uses trends in some of the leading economic indicators to determine the trend in the growth rate. It's not designed to call recessions, but rather when we will see trends change since this typically leads to changes in stock earnings estimates and the prices of Treasury bonds.

Think of the economic signals as you would a stoplight. You'll see a dramatically different income allocation between "green" and "red". Here is how DIA is designed.

The economic model went from green to red at the beginning of 2019. This means we went from 40% Dividend Growth stocks and 10% Inverse Treasury Bonds (which make money as interest rates go up) to complete elimination of Dividend Growth stocks, a 20% position in long-term Treasury Bonds, and an 80% allocation to Tactical Fixed Income managers.

This is what makes DIA truly unique. We do not believe we have the absolute best tactical fixed income strategy in the country. The data says it's certainly one of the best, which is why you'll see Tactical Bond (TB) show up in most of our recommended portfolio allocations (as a compliment to DIA). That said, we know there is a small set of managers out there who have been managing fixed income as long (or longer) than SEM using their own quantiative approach. They all have the same goal, just a different way to reach it.

During the "red" or "bearish" economic cycles it is the most dangerous for income investors. Treasury bonds tend to move as much as stocks. Defaults may cause wide losses in the fixed income markets and create a panic. Liquidity may dry up. Essentially all of the things we saw happening in March. However, you'll also see bonds eventually bottom (or at least stabilize and partially recover) before the economic model moves off the red signal.

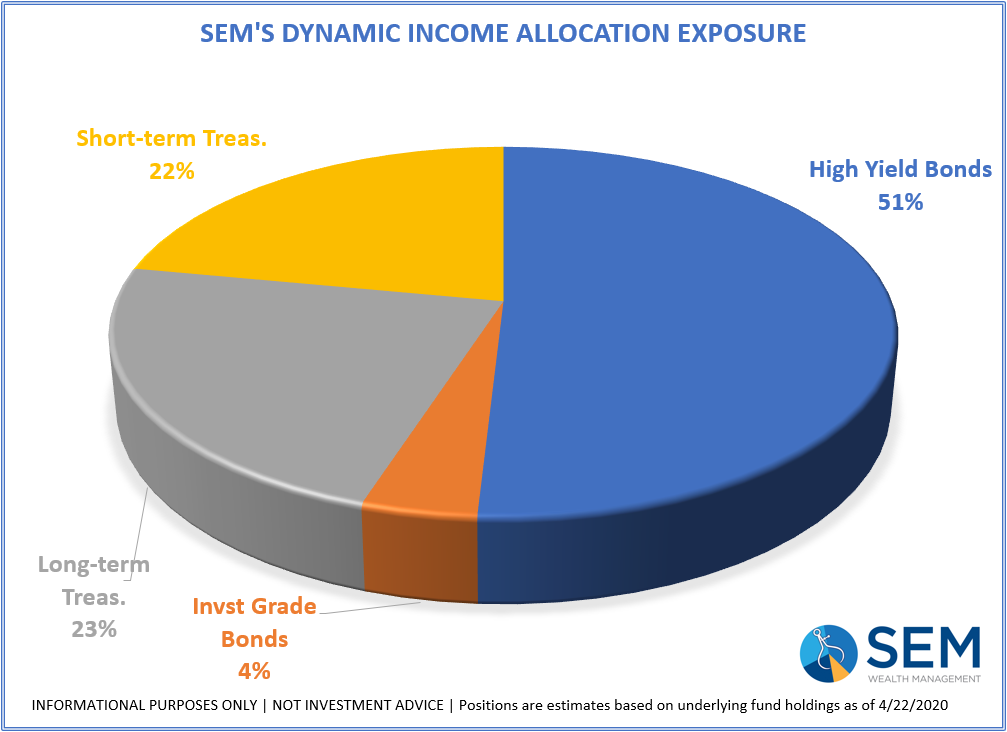

Having the outside tactical fixed income managers inside our portfolio allows these experienced fixed income experts to adjust our allocations much earlier based on the current market environment. We currently have 5 tactical fixed income managers in our DIA portfolio. We've seen a couple start buying high yields close to the lows a few weeks back. Others did not start buying until last week, and another's system is designed to wait for volatility to settle down. This has given DIA a very unique, diversified mixture of assets.

With DIA you don't have to make a call for the economic or market direction. These experts who have managed fixed income since the 1990s are earlier instead will do that for us. If this is simply a false-hope rally in high yield bonds (and stocks), the managers have systems in place to adjust. Several weeks ago, DIA was nearly all short and long-term Treasury bonds. Where else can you find this type of income portfolio without trying to do it all yourself?

[I discussed these managers, how SEM selects them, and our due diligence procedures in this portion of Monday's blog.]

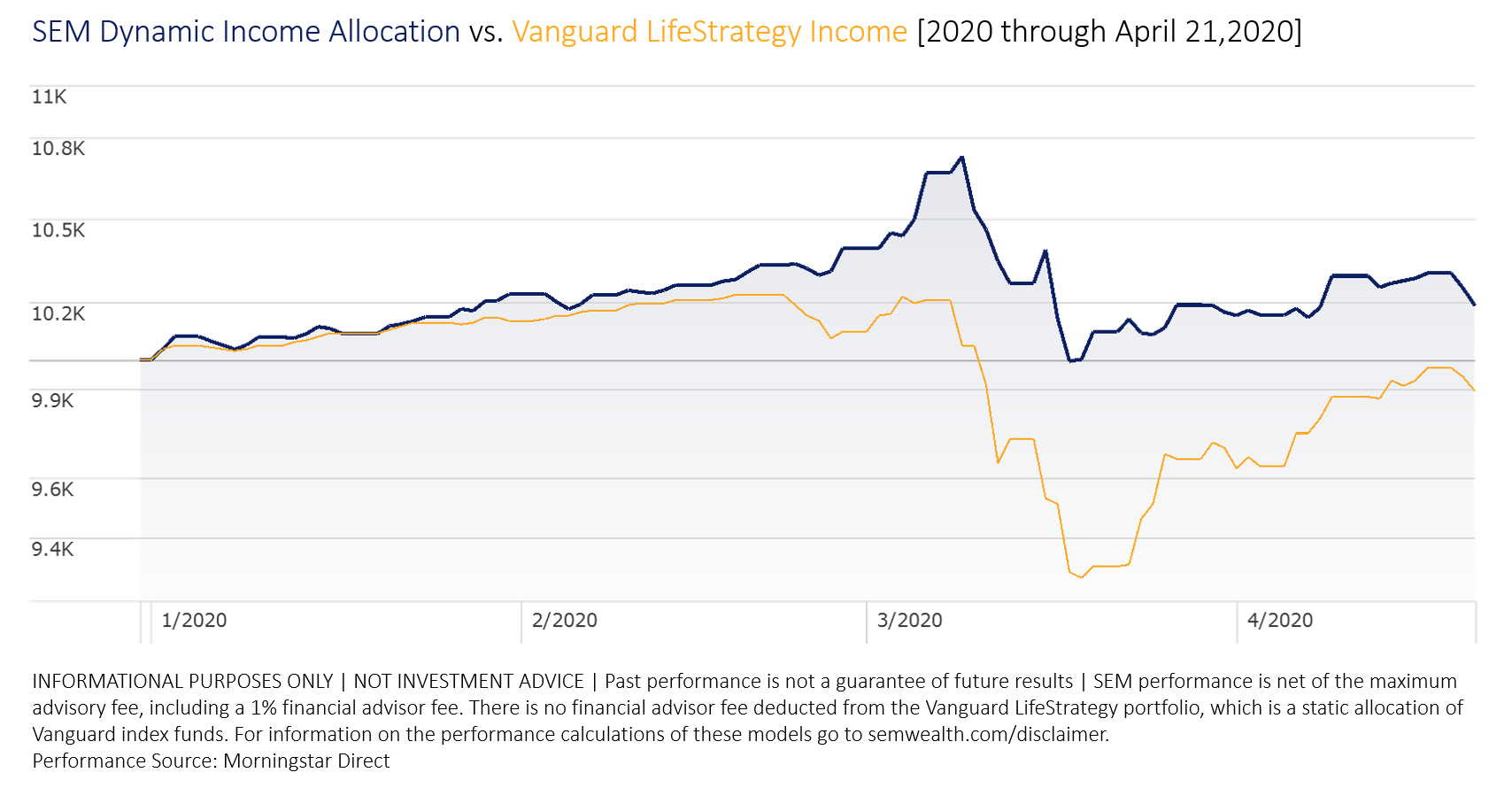

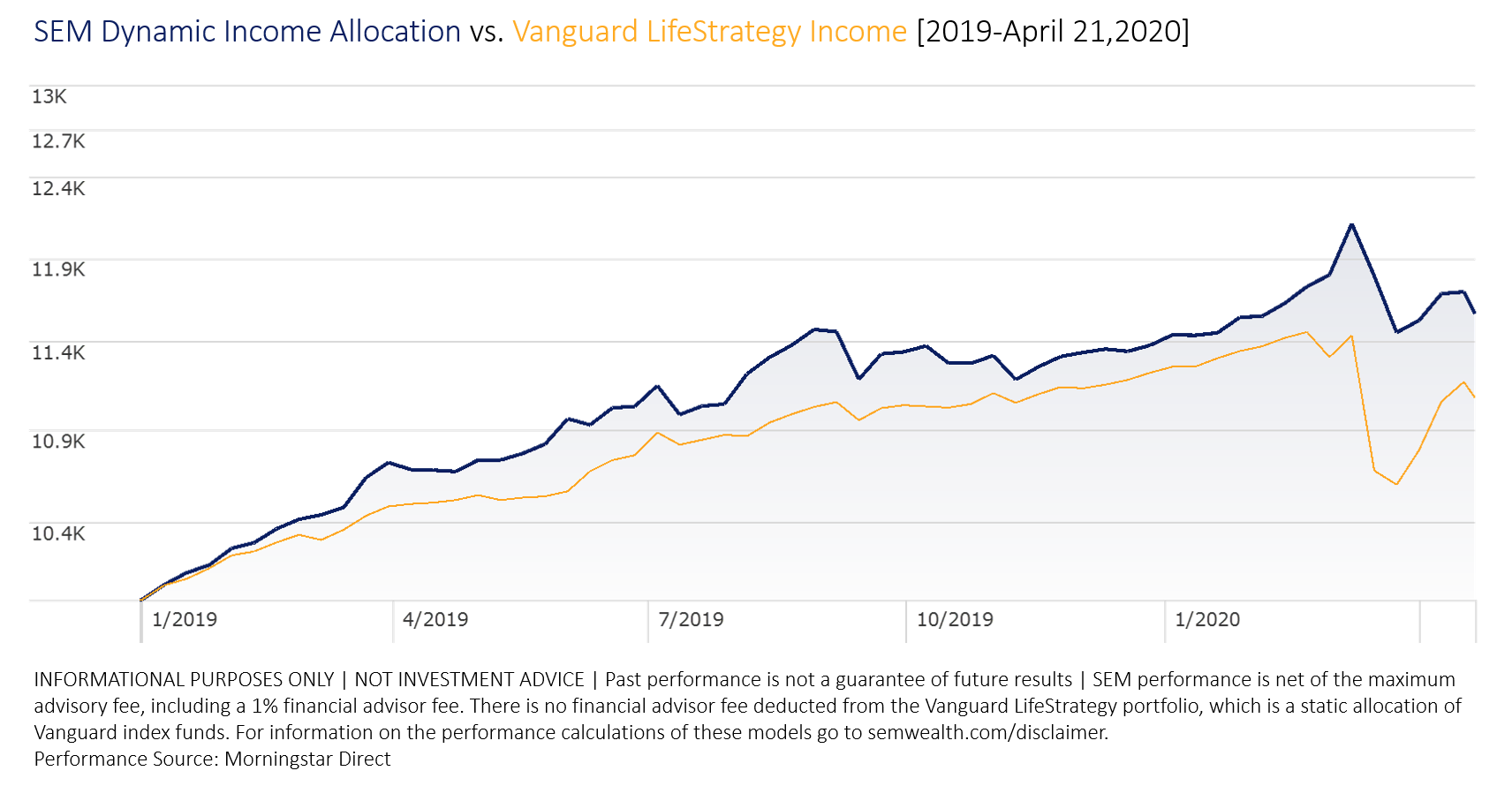

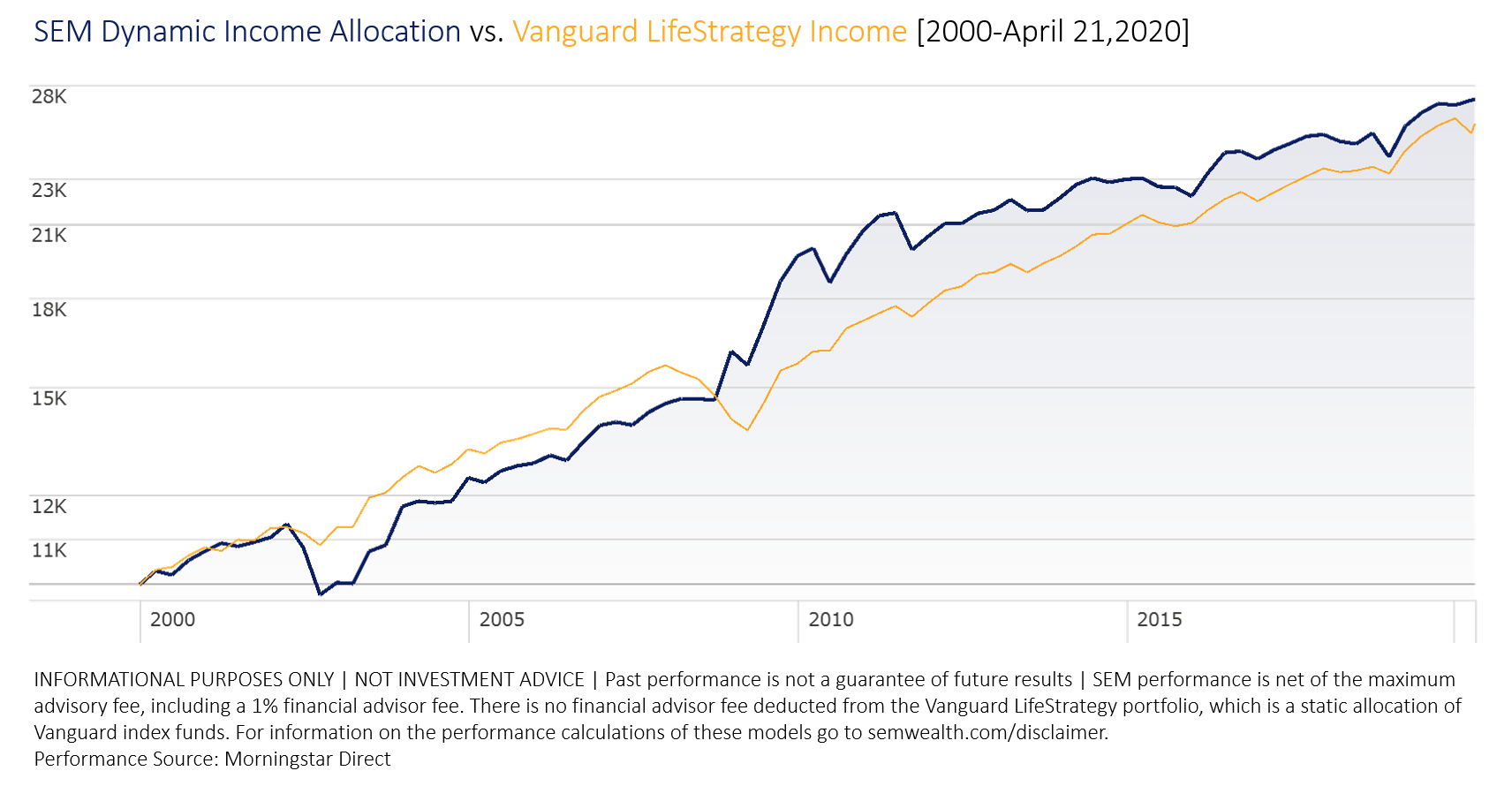

The value of this approach has been proven the past two years. More importantly, with more uncertainty in the year (and decade) ahead I can't think of a better core fixed income portfolio than DIA. Here are some comparisons of DIA to a more "strategic" income portfolio, Vanguard's LifeStrategy Income. This is a good benchmark for DIA because it includes a 20% allocation to stocks. Looking at DIA's history, 42% of the time we were in a "bullish" signal with 34% of the time in a "bearish" signal. The other 24% is a "transition" signal. All told, DIA has averaged a 21% allocation to stocks.

When looking at these keep in mind the DIA results include all SEM fees plus a 1% Financial Advisor Fee. The Vanguard results include NO MANAGEMENT FEE. In other words, if you were to use this portfolio or a similar approach, you'd either have to do it for free, or subtract 1% from the portfolio results.

2020

2019-2020

2000-2020

One other thing to keep in mind – 57% of the Vanguard portfolio is in the "Total Bond Market" index. This is a copy of the popular Aggregate Bond benchmark. This benchmark is 'issuance weighted'. Currently about 50% of the Aggregate Bond index is US Government bonds. With $4-6 Trillion or more of new issuance of US Government bonds expected over the next year and a likely $2-3 Trillion or more each of the following years, the Aggregate Bond index will essentially turn into the US Treasury Bond index.

This means if you are in a "strategic" or passively managed income portfolio, you're going to own more and more US Government bonds. Long-term, the heavy exposure to Treasury bonds has helped boost performance, but this is likely going to be a major drag on any Aggregate Bond indexed portfolio. It also is likely going to make those indexed portfolios significantly more risky.

All of the things I worried about going into the crisis (state/local budget deficits/pension issues, lack of funding for social security and medicare, double the leverage ratio in the 'investment grade bond' market, and a huge demographic imbalance) are all made worse by this crisis and the reaction to throw trillions of dollars at it. I would not want to be in a 'passive' or 'strategic' fixed income allocation.

With Dynamic Income Allocation, you don't have to be over-exposed to US Government Bonds, stretch for yield in higher risk bonds, take on more risk with dividend stocks, or try to find your own income solution. Instead, it will adjust to the economic and market environment and own all of those assets at various times.

In addition to being available direct with SEM/E*Trade, DIA is available on E*Trade's MMX Platform, Adhesion, FlexUMA, Axiom, and Orion Portfolio Solutions (formerly FTJ Fundchoice.) Tactical Bond, a nice compliment to DIA is also available on all of those platforms.

You can view performance and risk information as well as the current position of all of our models on the MODELS page of our website.