For those of you who have been following along, I've been using this space each Monday to list all the things I thought about over the weekend. It's something I did during the financial crisis and the 2011 "debt ceiling circus/EU debt panic". There's just too much happening to write a detailed blog post on each topic. The last two weeks have been good ones for stocks. The swift action by the Fed and then Congress has created hope the economic damage will be small and the economy will come back like a "rocket ship".

-Have we found a cure? Last week we saw stocks post a huge rally to end the week on reports Gilead's drug used to treat Ebola has been effective in curing some critical patients. This is welcome news, but of course true clinical trials need to occur. Then we have the issue of production, which as we've seen has been a problem in the medical field.

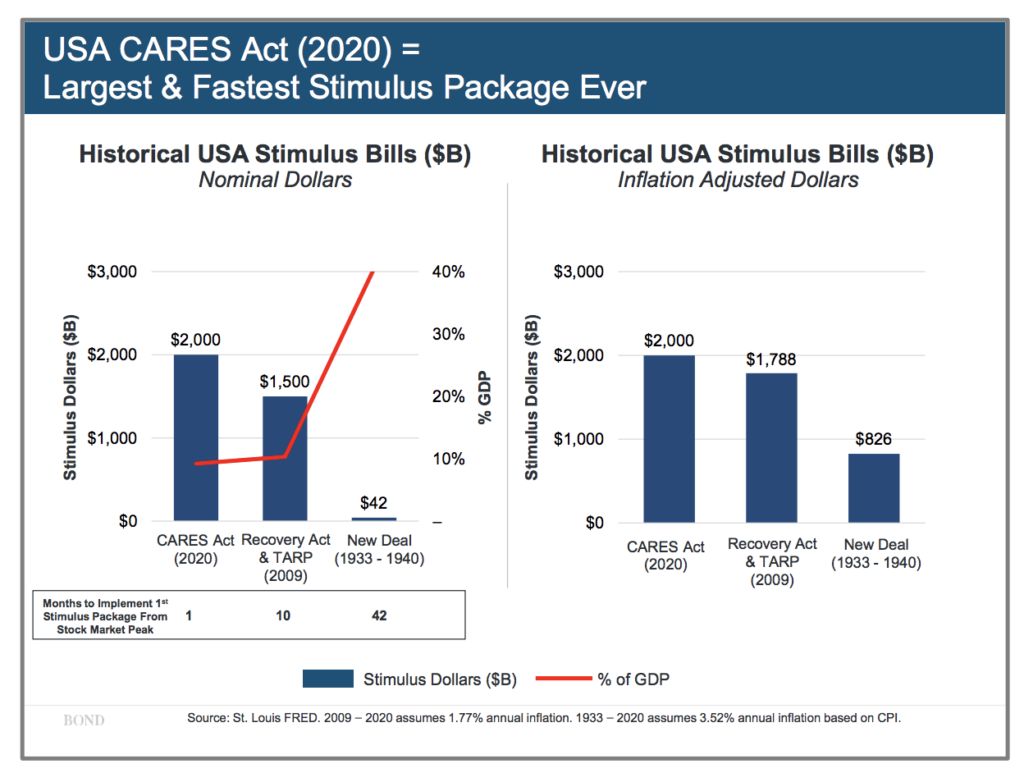

-Stimulus is certainly having an impact.

I saw this chart on the Reformed Broker blog. It shows both the size and the speed of the stimulus.

One thing is for sure – with direct deposit arriving for many people last week, the money was being spent. My friend shared this on Facebook on Saturday showing one of the Tucson Home Depots. Our friends in Virginia reported the same thing at Lowes and Home Depots here.

Our pastor is also the Fire Chief at one of the towns near Williamsburg. He said based on the call-outs they had on Friday, Saturday, and Sunday for car accidents, people have definitely been going out in full force. It had been pleasantly quiet on that front up until this point. You have to wonder if the stimulus money will cause the "curve" to be prolonged.

-Be careful with your quarantine portfolio. Friday gave us a glimpse of what could happen if the quarantine were ended quickly and the economy did what the bulls (and the President) expects – a rapid recovery back to where we were in January. Consumer staples stocks were hit hard – small cap stocks had a huge day. Basically the Gilead news was used to sell everything that held up well the last 6 weeks and to buy everything that has been hurt the most. As somebody put it over the weekend, "do you ever think Costco will have a month better than the month it just had?" Costco is trading at 35 times earnings right now, more than double the long-term average.

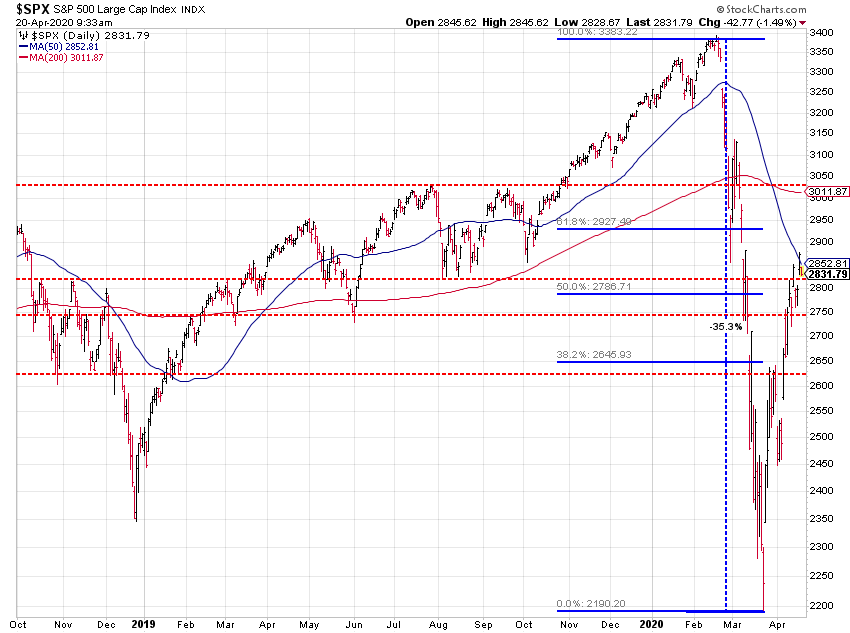

-Be careful with stocks. With NOBODY knowing for sure the true longer-term economic impact, we have technical analysis to fallback on. Stocks have exceeded the typical 50% retracement, but on Friday hit the 50-day moving average. Typically this is a sell point as it means people who bought over the past 50 days are (on average) back to "break-even". The 200-day is right above, which shows the average price for the past year. Combine this with stocks that are very overvalued using last year's earnings and I'd be looking to reduce risk at this point.

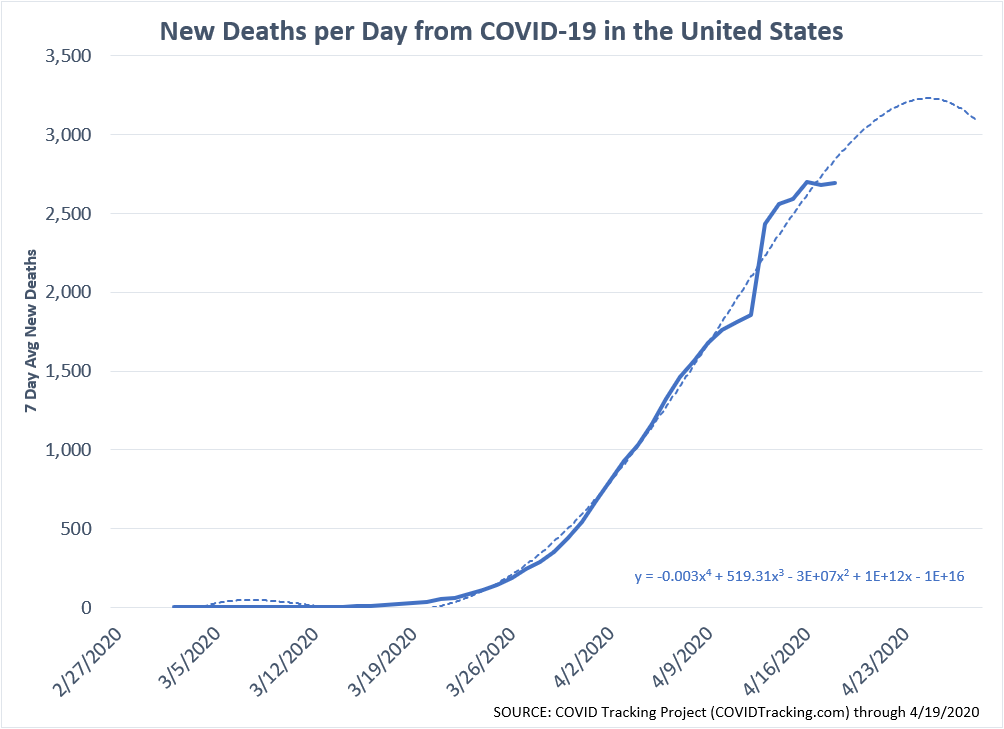

-Hindsight Bias will be prevalent. The frustrating part for any leader is all the second-guessing that is already occurring. We've heard people asking how much saving lives is really worth. A rapidly increasing movement is demanding states reopen their economies. The dire predictions from the President at the end of March of 100-200 thousand deaths most likely will not come to fruition. But nobody will know how many deaths would have occurred had the country done nothing. I've updated the data in our "Worse Before it Gets Better" post. It appears we are close to "rolling over" as a country, but many states including Virginia and Arizona where we have offices continue to see an increasing number of cases.

-What actually worked? Virginia was about 10 days ahead of Arizona in locking down the state. California did it even sooner. Obviously Arizona and California have much nicer weather than Virginia, especially when you factor in the D.C. area, which holds a large chunk of Virginia's population. The rate of deaths in Virginia is increasing by 12%, California by 8%, and Arizona by 7%. 20% of the deaths in Virginia have been from one assisted living facility in Virginia. Each county has different rules/procedures on reporting. Last week the CDC changed their reporting criteria, which is going to again skew the data. Nobody will ever know what actually worked. Our leaders were elected to do their best to protect their states. There is no manual for this. Don't like the results? We have an election this year.

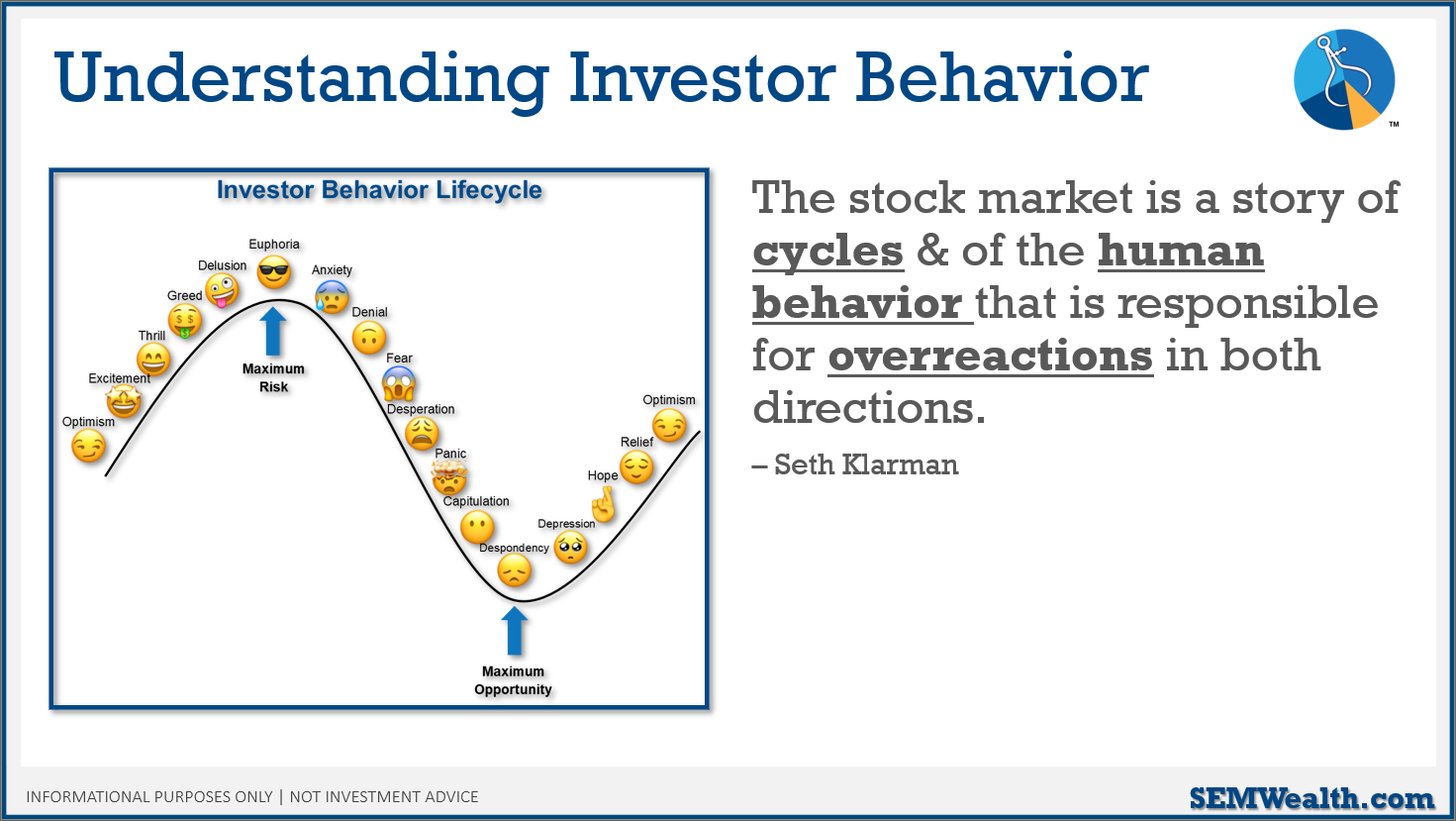

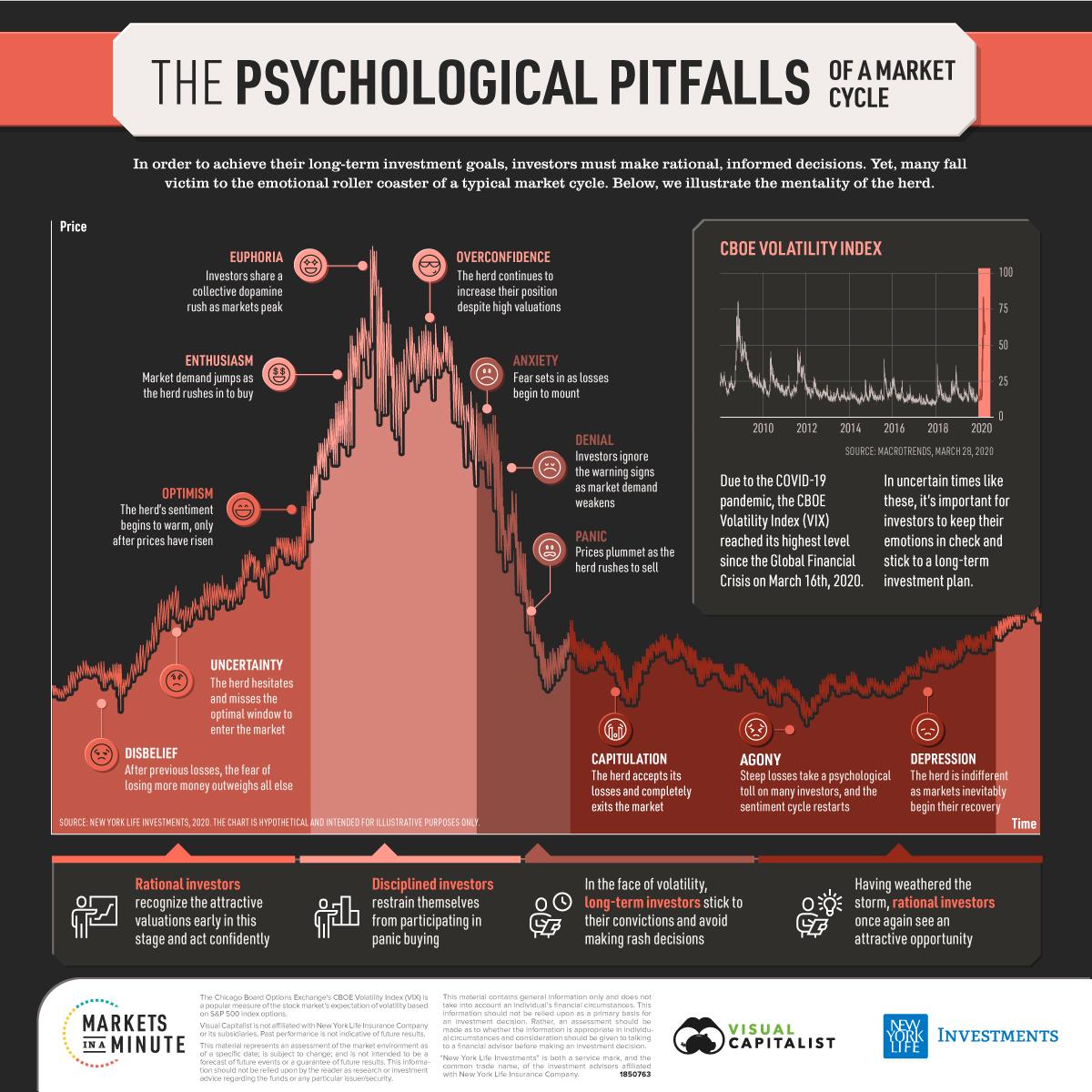

-Where are we in the emotional cycle? We've used this graphic for years. Courtney added some fun to it with some emojis. The question is where are we?

Dr. Daniel Crosby from Brinker shared a different version on LinkedIn last week. I still believe we are in the "denial" stage of the cycle.

There are just too many people who WANT to buy stocks. A real bear market with true panic and capitulation leads to people HATING stocks and looking at you like you're crazy when you suggest owning stocks. I still spend most of my calls having to explain why I don't think this is a buying opportunity. Yes there was about a 10 day period where I was doing the opposite – trying to talk people into STAYING in stocks, but that switch quickly flipped.

-Where are we in your opinion and why? One of the many improvements to the new blog is the comments section. I'd love to hear from you.

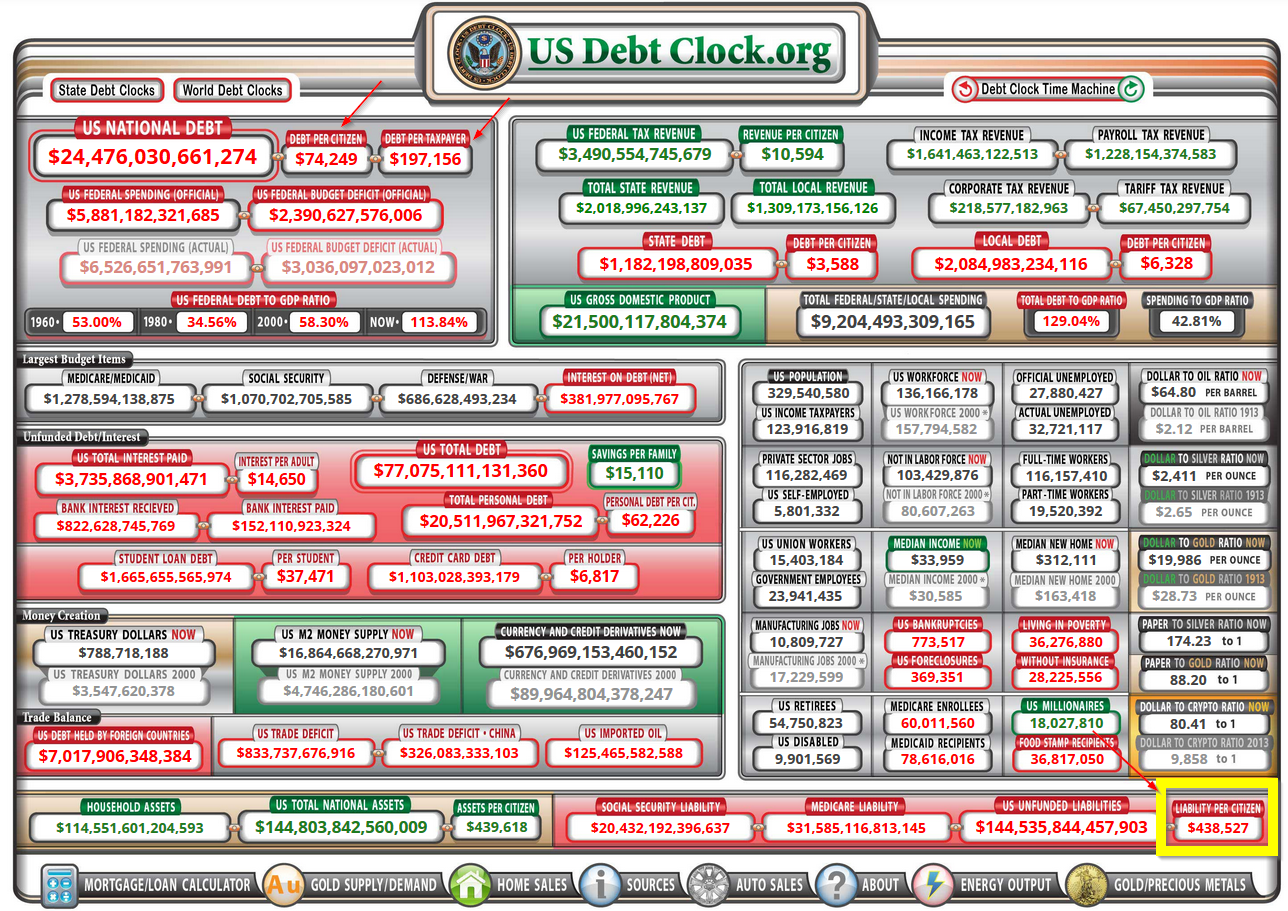

-Debt will crush Millennials (and probably their children and grand-children). My whole career I've warned about the debt-time bomb we are facing. The Babyboom generation was born at a time of great prosperity. Their parents remembered the Great Depression and lived very frugally. In true generational cycle fashion, the Boomers showed the opposite characteristics. From a big picture perspective, everything was always better in the future, which encouraged massive use of debt to generate current satisfaction. From the time they took over government and businesses in the 1980s we've seen an explosion of debt. 53% of Congress is still represented by members who are 60 or older. We shouldn't have been surprised for them to use massive amounts of debt to fight the current crisis.

Here's a freeze frame from USDebtClock.org. Note the amount of debt per citizen (including children) and taxpayers. The "unfunded liabilities" of Social Security and Medicare at the bottom right is downright scary. BOTH parties are responsible for this. They both love to use debt, they just use it for different things.

-Taxes will be higher; Services reduced; Growth will be lower. Those are simple economic facts. This is no time to celebrate. If you're younger than 50, this is your reality. Plan accordingly.

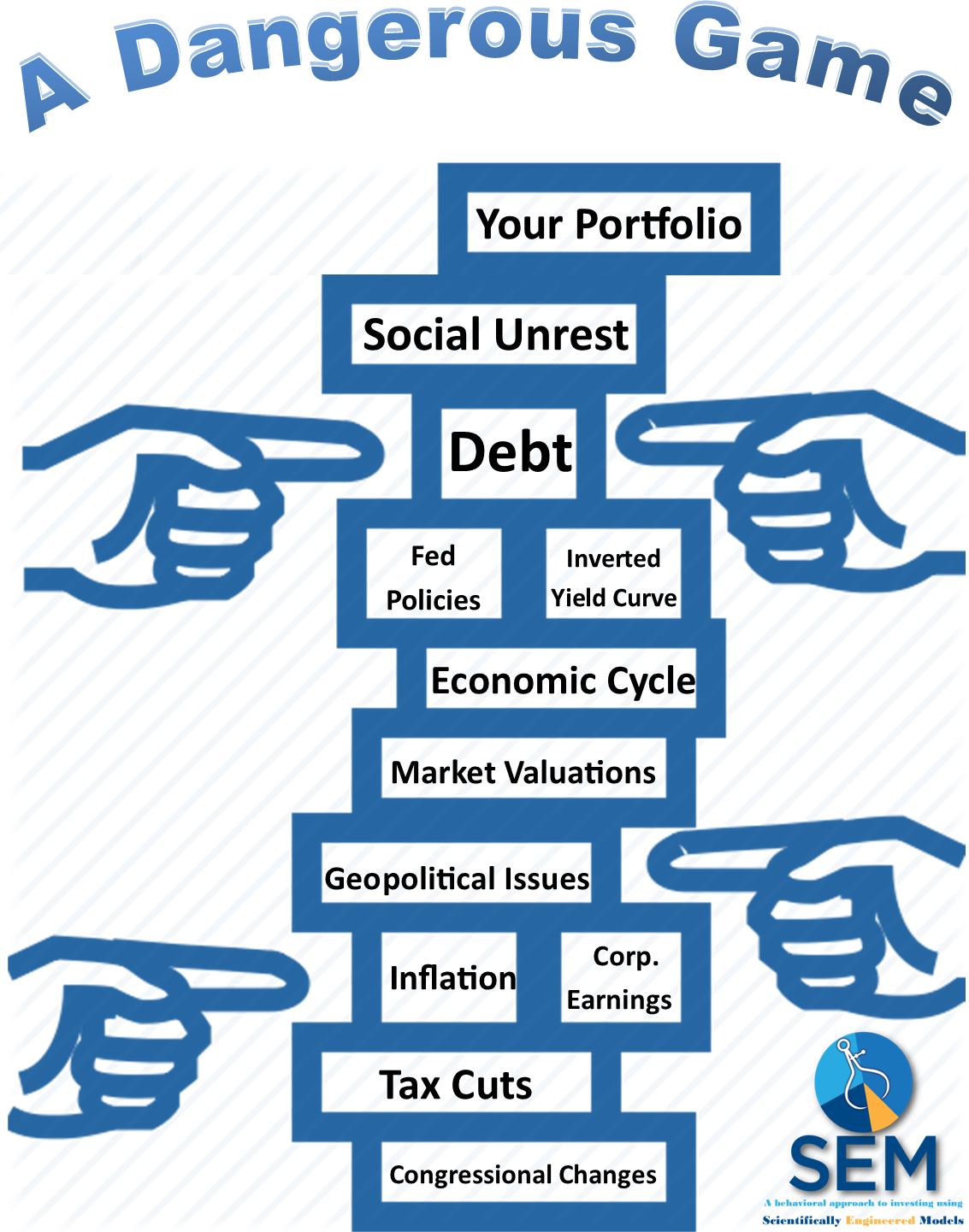

-A Dangerous Game. Back in the spring of 2018 I included this graphic. My point was to list all the possible things that could topple the market/economy. What I said was, "nobody knows what move will actually cause the tower to topple, but when it does it will go fast." While our leaders are furiously trying to save the tower and changing the rules of the game, the tower is wobbly and they are creating problems in other parts of the structure. Any of them can topple your portfolio and ruin your financial plan.

-Oil continues to fall. Despite a "historic" deal made last week to cut production, oil continues to fall. The US became a net exporter of oil the past 10 years. This will be a continued drag on any recovery and will have a spiralling impact on credit markets as the US oil industry was heavily leveraged. This morning oil is down in the $10-12 range. Here's the chart through Friday. Staggering. Why would the US not order as much oil as possible at these prices and store it? Seems like a better use of our children's (and grand-children's) tax dollars than giving money to people who don't need it (more on that later).

-Fed has done a great job. I've been a constant critic of the Fed the past 12 years. They did an absolutely terrible job during the economic expansion. They failed to unwind their "emergency" stimulus measures used to fight the financial crisis. They kept rates too low for too long. They overreacted every time the stock market dropped by 7%. That said, they've acted very quickly to keep money markets afloat, corporations in business, municipalities funded, and even foreign banks liquid.

-Fed can't save everyone. The Fed is good at fighting a crisis. The hard part will be getting back to capitalism. Before the crisis 16% of US companies were "zombie" companies. These are companies who had more INTEREST EXPENSE than cash flow from earnings. Worse, 1/3 of the Russell 2000 index were classified as zombies (source) We're already hearing rumors some of those zombies are already preparing bankruptcy filings.

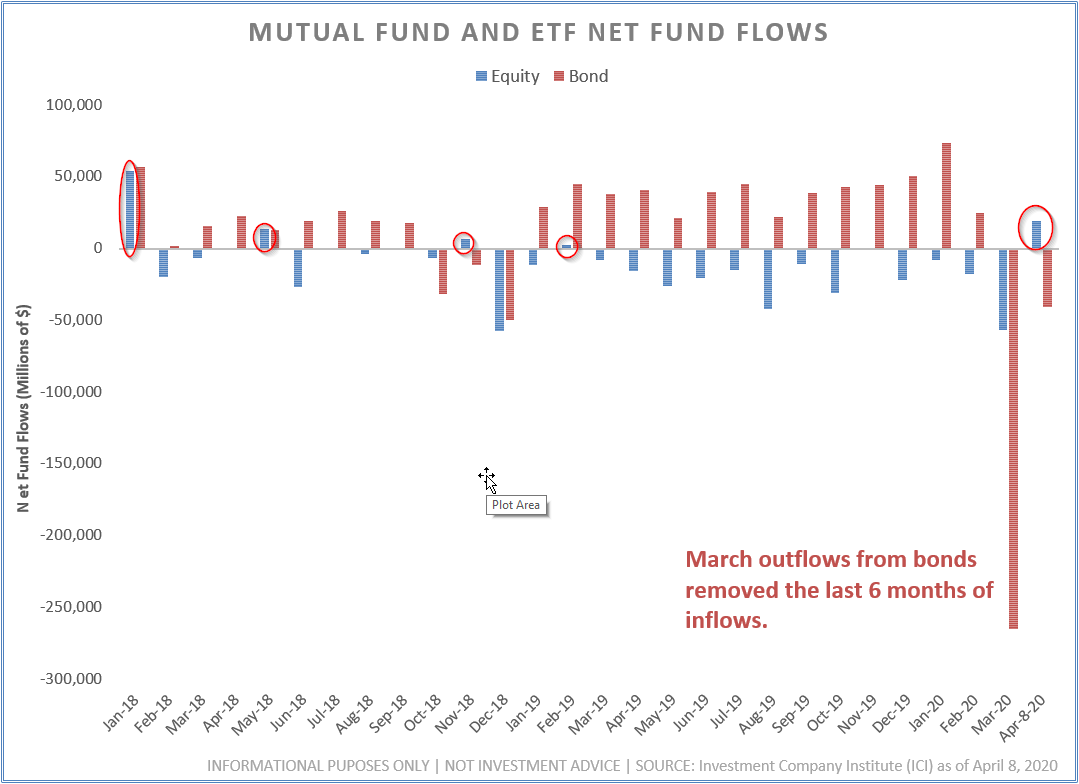

-Who is buying? I was asked on a call about fund flows. I'll admit I'm perplexed by these numbers. Keep in mind over 65% of retirement assets are controlled by investors 60 and over. They were all buying bonds the last two years and barely any stocks. Too many people follow a "target date" portfolio where you are constantly selling stocks and buying bonds as you get older. The first two weeks of April we saw a bit of nibbling in stocks. Why did investors panic and sell bonds? Could it be because so many people were chasing yield and investing in bonds with very high risks?

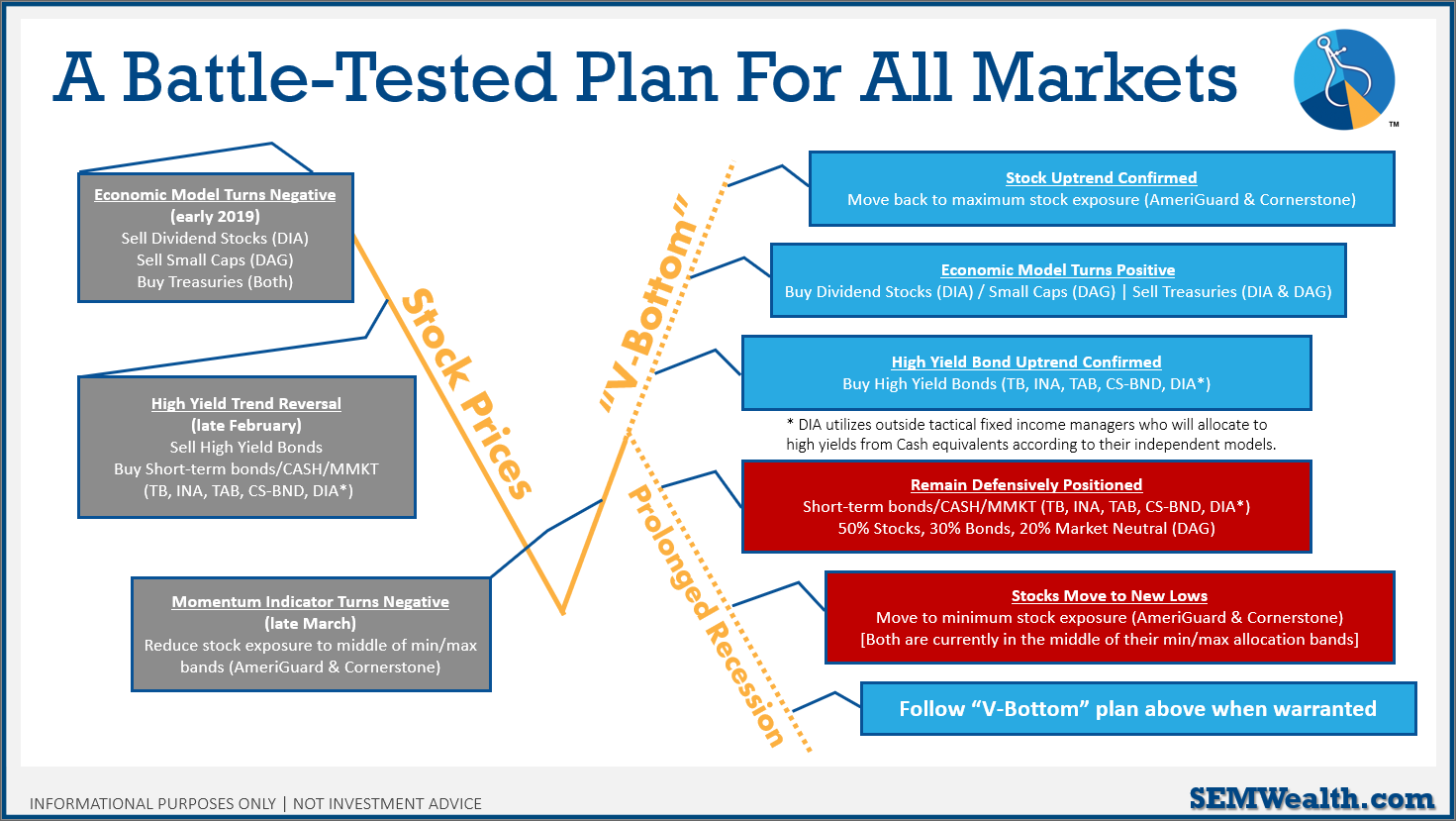

-What's your next move? While we utilize high yield bonds heavily in our strategies, we NEVER recommend a buy & hold approach (or an arm-chair investor use) with these very risky securities. Last week in our economic, market, and model update I discussed our next move. While my opinion is we are not in a "V-bottom" scenario, we've seen a move into high yield bonds from our models.

-A video for clients, advisors, and prospects. I don't like recording or watching videos. I do however love presenting to groups. When I "retire" I've always said I want to be a professor. Last week's video was my attempt to 'teach' our audience what is truly happening right now. We've received very positive feedback on it. I'd encourage you to share it with your clients, colleagues, and prospective clients. I do look forward to getting to share our data-driven analysis and approach with a live audience.

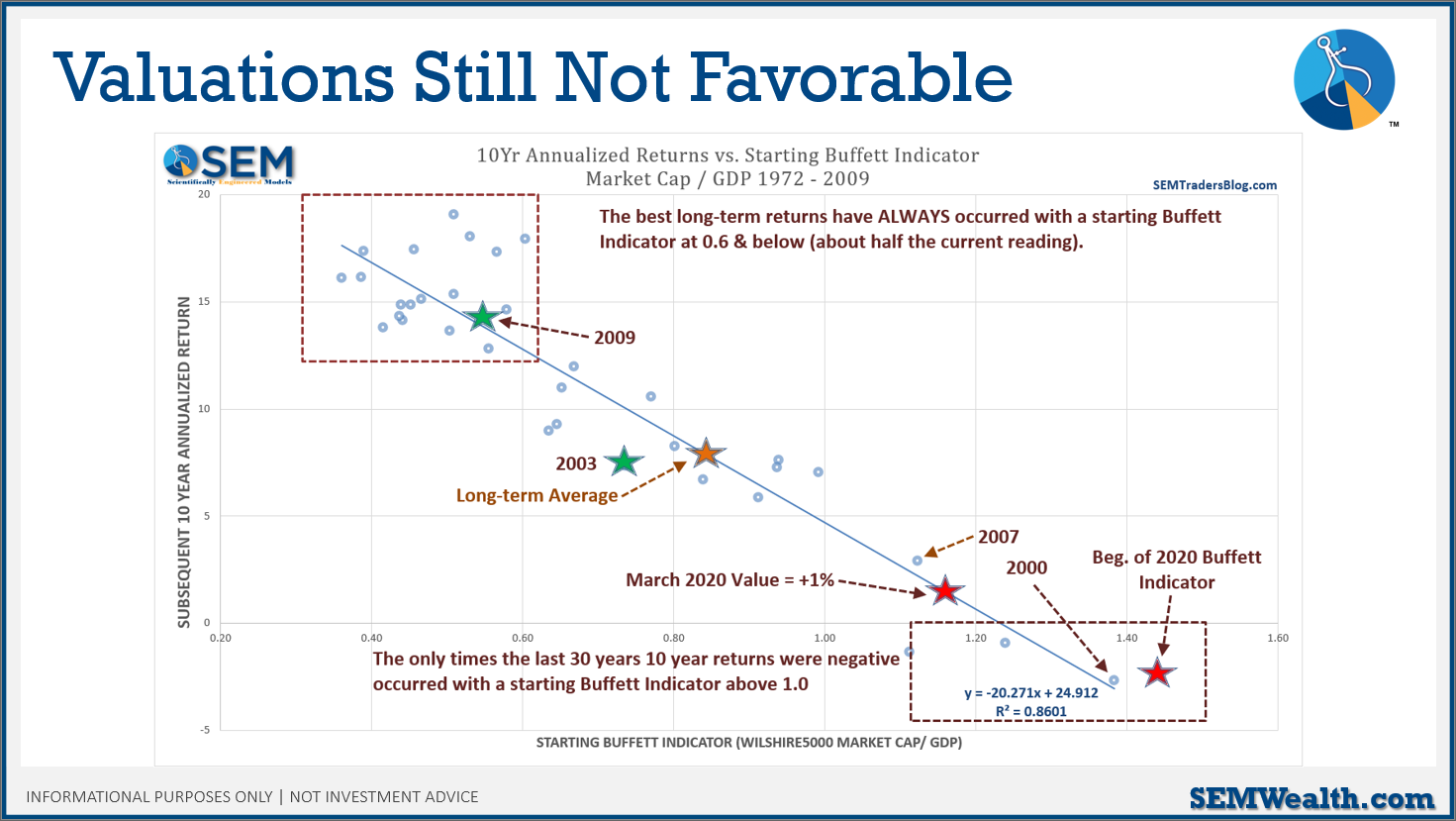

-Why is Buffett so Quiet? Apparently Barron's is asking the same question I did in our video last week. To me the reason is simple – stocks are still VERY EXPENSIVE according to the valuation indicator named after the "Oracle of Omaha".

Who should you listen to?

I was asked by an advisor on a call last week who I would recommend advisors listen to (besides me). In a LinkedIn post several weeks ago I shared exactly who I would listen to – those managers who have a history of successfully navigating difficult markets. This list is quite small. Besides SEM, I listed Steve Blumenthal, Phil Toews, Isaac Braley, Sean Clark, and Terri Spath.

-Our advisors will likely recognize those names. They all have a place in our Dynamic Income Allocation portfolio. This is what makes SEM so unique – we do not believe we have the single best algorithm to manage money. All of the other portfolio managers listed above have managed money since at least the 1980s using a quantitative process. Their models adapted to the bursting of the tech bubble, the post-9/11 shift in the fixed income markets, the housing bubble and subsequent collapse, the crazy summer of 2011, the recession panic of 2015/16, the December 2018 collapse when the Fed dared hint they were going to pull back stimulus, and of course the coronavirus panic. SEM monitors them everyday, is on frequent phone calls with the managers, and has a deep understanding of how, why, and when their models will adapt. This gives Dynamic Income Allocation (DIA) one of the most unique fixed income portfolios available in our industry. (We also have some "Platinum" portfolios for select advisors which include allocations to those managers.)

-DIA stepping into high yields. Thanks to those managers and their QUANTITATIVE models we have seen a big increase in our high yield bond exposure. We also have some "protection" by still owning Treasury bonds. As of this morning, DIA is allocated 55% to high yields, 23% to Long-term Treasuries, and 22% to Short-term Treasury Bills. The allocations are adjusted by our mix of managers in the current economic state. As SEM's economic model moves from "bearish" towards "bullish" we'll see Treasury exposure reduced/eliminated and some tactical fixed income managers reduced as we add dividend growth stocks. Given the HUGE uncertainty in fixed income, my opinion is DIA should be a core to any fixed income portfolio.

-Tactical Bond also stepping into high yields. We have our own high yield trend following system which has been used in real-time since 1992. It is currently 37% exposed to high yields, with another 20% invested in BBB bonds (one notch above junk). Tactical Bond is a nice compliment to DIA in most fixed income portfolios. [Cornerstone Bond, which applies Tactical Bond's signals to Biblically Responsible Investment funds is currently 39% high yields, and 31% investment grade bonds. Another 20% is invested in longer-term Treasury Bonds.]

-Lots of ways to access Dynamic Income & Tactical Bond. While we believe a full direct relationship where you get access to our portfolio managers, operations team, technology support, and all SEM models, we understand many of our readers cannot logistically make the move to a direct relationship. DIA & TB (along with our Dynamic Aggressive Growth model) is available via Adhesion, FlexUMA, Axiom, E*Trade's Money Manager Exchange, and Orion Portfolio Solutions (formerly FTJ). If you'd like information on how to use us on these platforms (or to get the full-service experience) let us know.

-Fed has (temporarily) reduced opportunities. The best measure of potential returns in high yields is the spread between high yield bonds and Treasuries. When the Fed announced they were buying up to $750 billion of bonds, including high yield bonds (down to a BB rating), the spreads contracted rapidly. They are still attractive, but not as attractive as they were a few weeks back. Keep in mind the high yield bond market (also known as junk bonds) is $1 Trillion. There is another $2 Trillion in BBB bonds (one notch above junk). This means the Fed can't buy everything. They may stop short-term defaults, but long-term defaults are on the way. We still have a chance to make some decent returns here, but the big opportunities will be further down the road.

-Back to who to listen to. We work with mostly independent Broker-Dealers who do not necessarily have access to huge research arms. We also know those representatives are bombarded by wholesalers sending them research and "ideas". Part of the purpose of the Trader's Blog is to be your filter. I block out the first hour of every day to read. I have a filter on my email to compile all the research notes and articles I receive into one folder (to not distract me during the day). On average this folder has 75 items added each day. This is after unsubscribing or flagging as junk hundreds of other senders over the past few months. On Saturdays I block out 2-3 hours to read. There are three which I read first thing on Saturday - John Maudin's "Thoughts from the Frontline" (been reading since 1999), Steve Blumenthal's "On My Radar", and Michael Kitces' "Weekend Reading for Financial Planners". I then use Saturday's to read deeper thought pieces from the CFA Institute and the Financial Planners Association. Everything you see in the blog is a mosaic approach of the hundreds of things I read everyday. I do the reading because I love it, but it's also my job. I've been managing money in the market for over 25 years and believe I have a good filter to help me determine what matters and what doesn't. If you want to see the other sites I visit, check out the "Nerd Links" found in the menu above.

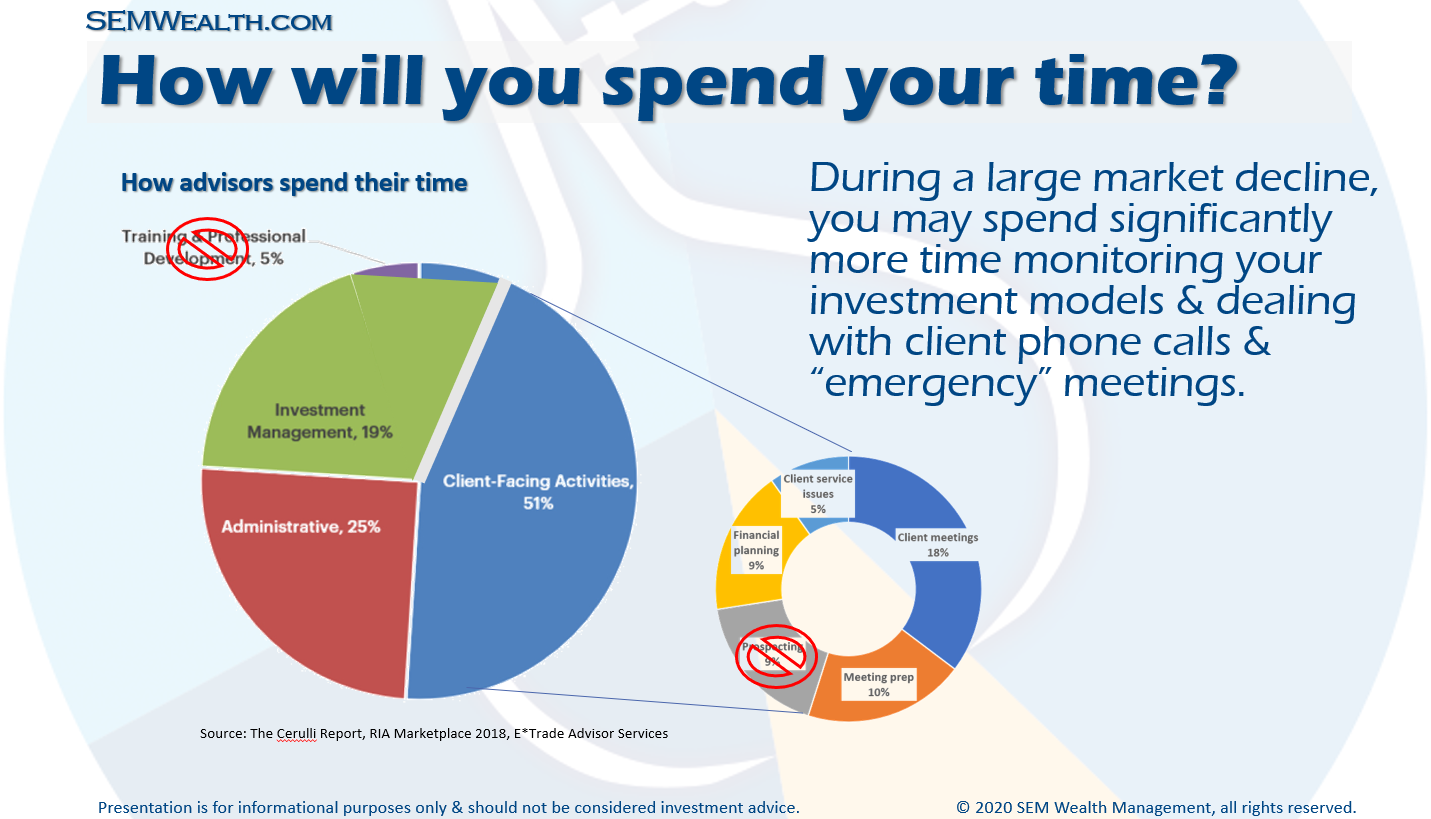

-How are you spending your time? During the fall conference season (which seems like years ago), I hosted some standing-room only breakout sessions on "A Behavioral Approach to Practice Management". My main point was challenging the audience to focus on what brings the most value to their practice. I included a chart highlighting a Cerulli Report on how advisors spend their time. I pointed out that during a large market decline we see too many advisors having to focus on investment management, which then wipes out any time for "professional development" and "prospecting". Hiring SEM as your Outsourced Chief Investment Office (OCIO) allows you to take advantage of drops in the market. As you've seen, our process allows us to not only navigate deeply uncertain and volatile markets, but gives us confidence in communicating what is happening and what is likely to happen with our portfolios. You should be growing your business right now, not focusing on investments or holding the hands of your clients.

-An invaluable resource. One of the things SEM offers our Platinum Advisors is access to our Technology. This includes our Director of Technology Dustin Briles. He's been heavily used by our advisors who have suddenly had to figure out how to work remotely, use DocuSign, join/host web meetings, and most importantly make sure they are securing their electronic data. He has his own blog as well, which is a mixture of technical and non-technical articles.

-An inside look. Probably my favorite part of the quarantine has been the opportunity to see everybody's home offices. Whether it is tv personalities, the numerous "experts", or just those advisors we are on video calls with, I love seeing how everybody works from home. I've always had a nice home office set-up since I've always worked from home, especially on nights and weekends. When we set-up our Virginia office we wanted it to feel like home. Minus showers and bedrooms, we have everything we need here. Brandi, Dustin, Corryn, and I have all found it much more efficient to be in our office. Since we're family and we're the only one in the office it has been our own home away from home. I'll have to get some shots of my own home office at some point, but here is a small look at our office last Friday.

Our two-year old grand-daughter has taken over our "living room" conference room. Our 13-year old twins have enjoyed using the empty desks for their post-school X-Box time. And then we have our cat Rose and dog Harley apparently ready to head home.

-Speaking of heading home. In our own "return to normal", we were excited last week when one night we were home by 5:30. I've been getting to the office by 6 and Brandi by 7:30. Most nights we're here until 6:30 or 7. I'm not complaining. We're blessed and absolutely love our jobs and the way we are helping people in these uncertain times.

-I actually slept in this weekend. I used to wake up at 6 to get a workout in and start my reading. I shifted it to 5 when the crisis started and the workout was quickly nixed. It's rare for me to sleep late even on weekends. I was surprised when I slept until 9 on Saturday and 7:30 on Sunday. Apparently my body needed it. It also led to a VERY long list for my Monday Morning Musings. I didn't get to hit them all. I'll save them until next week.

-Time to get back on track. Nixing my workout and working late definitely led to the "Covid 15", one advisors comparison to the "freshman 15" for your first year of college. I've vowed this week to end the snacks at my desk and to find a way to add back a workout to my routine. I'm up 15 pounds since February 20. If the lock-down ended today I'd have to stimulate the economy by buying more suits. Time to get back on track.

I hope you have a fantastic week. Please let me know your thoughts on any of these topics or things you'd like to see in the blog using the new comments section below. In addition, if you found this useful, hit the "share" buttons below.