The virtual ink had barely dried on my "time to get excited about valuations" post when the Federal Reserve did what, up until that point, most of us thought would never happen. They announced they would not only be buying junk bonds, but also junk bond ETFs. The spread between high yield (junk) bonds and Treasury bonds had hit levels we hadn't seen since 2009 (1087.) The junk bond market immediately rallied.

Large increases in the spread have always led to large gains for SEM's Tactical Bond (TB) model as well as many of the tactical fixed income managers which are utilized inside our Dynamic Income Allocation (DIA) model. The Fed's actions have temporarily eased the panic in high yield bonds, with spreads down to 750 basis points. These are obviously more attractive than the 325 basis point spread we saw in January, which was the lowest we'd seen since 2007. The problem is the Fed's actions have skewed reality where the risk you are taking to buy high yields does not justify the potential reward.

Now that we've had time to hear from the Federal Reserve Chairman, Jerome Powell as well as having sat on over a dozen conference calls with large fixed income managers, it is clear our opportunities are still there. They've just been delayed. Let's look at a few details:

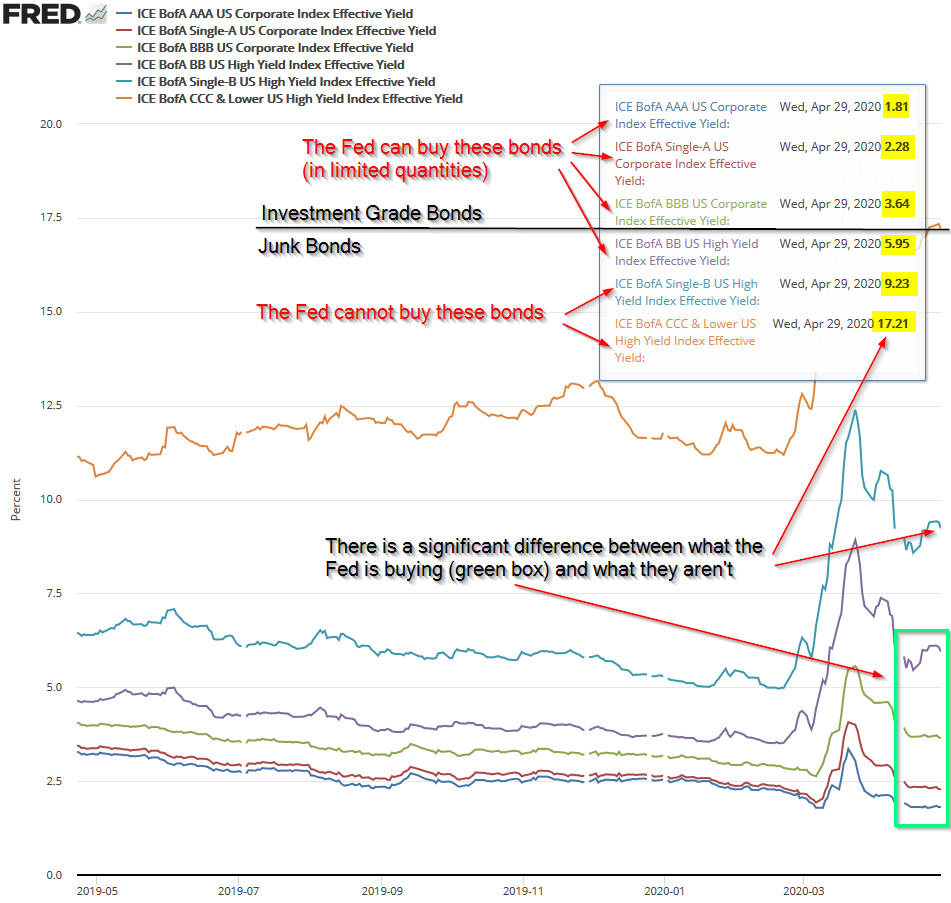

- The Fed's purchases are limited to "fallen angels", those bonds who were rated at least BBB (investment grade) prior to the crisis and were no lower than BB (highest level of "junk") as of March 20. This excludes a large portion of the junk bond market, which has an average rating of B.

- While the Fed also is buying junk bond ETFs, namely tickers HYG and JNK, they cannot own more than 10% of the shares outstanding and cannot pay a "premium" (value above the underlying funds) more than 5%. This limits how much of a backstop they can provide.

- The Fed's actions were approved by Congress via the CARES Act, the 800 page legislation that was rushed to a vote without both sides fully understanding how it would work. The Treasury Department would have to go back to Congress to be authorized to purchase more junk bonds once the money allocated to these purchases is utilized. This creates severe political risk.

- The "fallen angels" risk saturating the junk bond market. Going into the year, the junk bond market was $1 Trillion. BBB bonds (the lowest level of investment grade) were $2 Trillion. Even seeing half of those bonds downgraded would double the size of the junk bond market. Pension funds and insurance companies are limited in how many junk bonds they can own. This creates risk of a major sell-off.

- Chairman Powell was clear in his press conference – The Fed can only provide liquidity, not solvency. There is a key difference – companies who were cash flow positive prior to the shutdown just need some temporary help to pay their bills. Companies who were "zombies", or didn't have enough cash flow or assets to cover their debt service are insolvent. Those companies are probably going to default and have no protection from the Fed.

The current estimated default rate for junk bonds is around 8%. It was 3% at the end of February. Moody's (one of the 3 credit ratings agencies) outlined three possible scenarios.

- Scenario 1: Sharp contraction/ fast recovery (the notorious "V-bottom"): Estimated default rate of 8% with spreads of 1060 basis points.

- Scenario 2: Recessionary conditions similar to 2008 (about a 12 month recession): Estimated default rate of 16% with spreads of 1800 basis points.

- Scenario 3: Extremely severe recession worse than 2008 (18+ month recession): Estimated default rate of 18% with spreads of 2500 basis points.

Essentially the bond market (along with the stock market) is pricing in a "V-bottom". I hope that is the case, but hope is not a strategy. In 2016 we saw defaults go to 12% with just a small economic slowdown. I wouldn't want to base my strategy on everything coming back like a "rocket ship."

What is key is my opinion doesn't matter (nor do the opinions of the other tactical fixed income managers we utilize in DIA). If our quantitative systems, which guided all of us since the 1990s or earlier say to buy, they buy. While our huge opportunities have been delayed and while all of us are disappointed with the Treasury/Fed's purchases of junk bonds since all they are doing is delaying the inevitable and causing a mis-pricing of risks, we are seeing some short-term opportunities emerging.

Last week's Chart of the Week highlighted our DIA model. The portfolio via both our economic model and the outside fixed income managers has about 50% exposure to high yields. All of that exposure is a TRADE, not an investment. The managers' systems are designed to exit when the trends reverse. In a similar fashion our Tactical Bond model has taken positions as the trends have stabilized. What is interesting with Tactical Bond's selections is what segments of the corporate bond market it is buying – essentially it is buying what the Fed is buying (bonds rated BB or higher).

This week's Chart of the Week takes a look at the difference in yields between the various segments of the corporate bond market. It shows a clear line of distinction between what the Fed is buying and what they aren't. The problem with most high yield bonds is they have an average rating of B, meaning there is no parachute for that market.

Being tactical and watching it closely is the only way to play in this market at this point in time. Some of the managers inside of DIA have exposure to the large yields in the Single-B market, but with a very tight limit on losses. Other managers have more limited high yield exposure with some "hedges" via Treasury Bonds. Another's systems still haven't triggered and are sitting in short-term Treasuries or Money Market.

Tactical Bond is essentially splitting the difference – allocated to the BBB to BB category. Nobody has a crystal ball. I'm irritated at how confident the "experts" on TV are with their outlooks. Nobody knows how this will play out. What I do know is our unemotional, data driven process has been critical to our success the last 28 years. Based on the data (and my 25 years of managing money), we are much more likely to see a deeper, more prolonged recession than we are the "V-bottom". With both stock and bond markets pricing in the V-bottom, common sense tells me it's a great opportunity to right-size the risk in your portfolios.

For those people who may have panicked and went to cash in March or April, these two models are a good "re-entry" portfolio as they have some nice potential upside with limited downside (compared to a stock portfolio). Logic tells us the huge opportunities will come. When they do it will be scary and experience tells me I'll have a hard time convincing people to get their money out of cash and into these models. Based on past recessions, we won't see this that night:

We have plenty of tools to help and a wide-range of investment models. Dynamic Income and Tactical Bond are certainly deserving as core holdings in most people's portfolios. They can take advantage of short-term opportunities and wait patiently for the more significant opportunities that will come if the recession runs much deeper than most are currently forecasting.

For a look at our full line-up and how each of the different models and how they plan to adjust to changes in the economy/market, check out "What's Next?"