This week the Federal Reserve voted to raise interest rates again despite phantom inflation and lackluster economic growth. This has again brought out the “rising rates are bad for bonds” crowd. As expected this has caused our clients in our Income Allocator (INA) and Tactical Bond (TB) programs to become concerned about the fact they own bonds in these portfolios.

Rising rates are certainly bad for the specific bonds that are impacted. In this case, the expectation when the Fed raises SHORT-TERM interest rates is the LONG-TERM (10 Year+) Treasury bond will also see its interest rates go up (and prices go down). If that was the case (and that’s a big if based on our economic models — see Losing Momentum), SEM’s INA & TB programs could be positioned to thrive. Barring a 1970’s style stagflation environment, long-term rates typically go up when we see stronger than expected economic growth. This causes the bonds INA & TB invest in to see their rates go DOWN and prices UP.

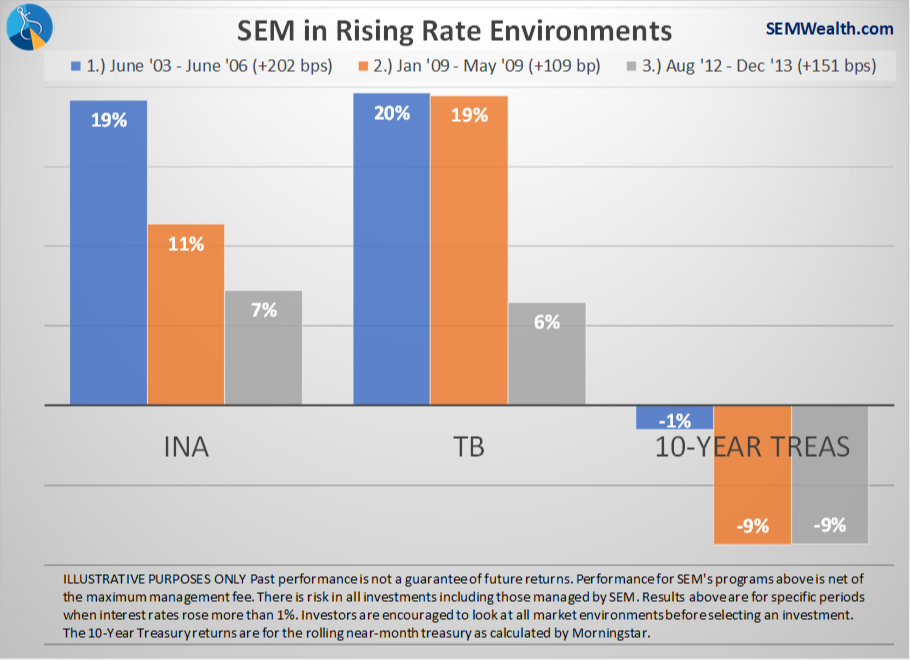

Over the past 15 years we’ve seen three times where LONG-TERM interest rates rose more than 100 basis points (1%). In each of those times, INA & TB made money.

The next time you hear a pundit say “rising rates are bad for bonds”, please add “unless you are SEM”.

NOTE: I do not want to take the fact the Fed raised rates lightly. If they raise rates in a slow growth environment they risk sending the economy back into a recession. As has been the case EVERY time, the Fed tends to be very slow in changing directions with their policies. If this is the case, LONG-TERM rates are likely to decline and SEM would be forced to sell our riskier bonds and ride out the pending recession in lower risk (and lower yielding) bonds. In 2 of the 3 “rising rates” periods illustrated above the Fed was actually reducing short-term interest rates, yet long-term rates increased significantly.