There are plenty of Wall Street sayings that become cemented in investors’ brains. Often times those phrases are not necessarily based on sound logic or representative of the current market. One of those that has (mostly) held up through time is “Sell in May & Go Away.” Long time readers know this phrase has been misunderstood. Most believe they should sell in the beginning of May, but May is actually one of the stronger months historically, rising 74% of the time for an average of 1.2%. Putting it in perspective, the S&P 500 is up 65% of the months for an average of 0.8% per month.

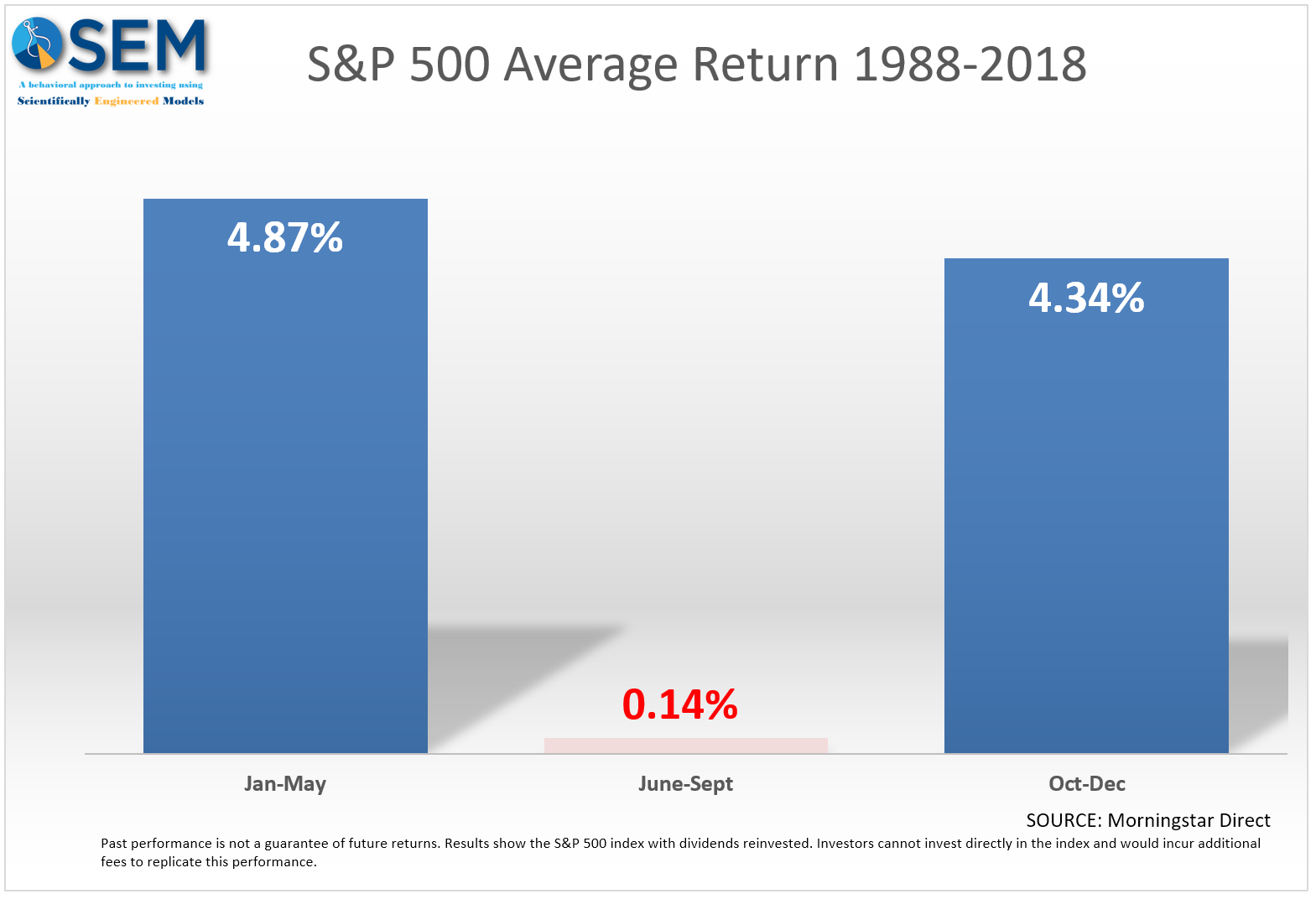

The same cannot be said about the period of June through September, which is where the phrase probably came from. This week’s Chart of the Week shows the difference in performance during the summer compared to the spring and fall months.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

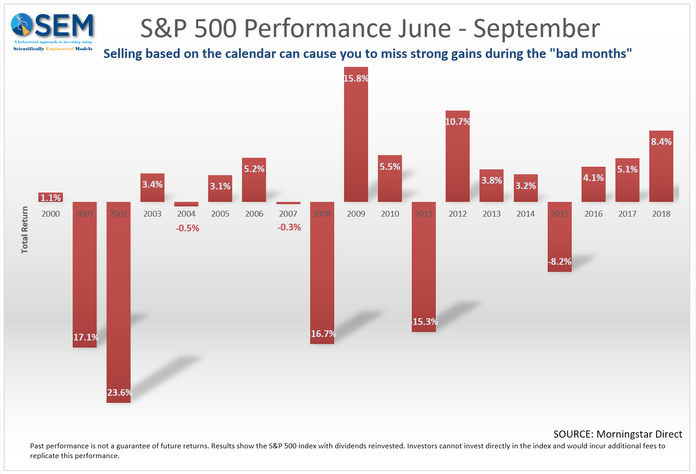

As I do each year, I caution anyone from making wholesale changes based on the calendar. There have been times the “bad” months have had significant gains (just as the “good months” can have significant losses. 2018 was one example. Stocks rallied 8.4% in May-September and then fell 13% in the October-December period. SEM does not specifically use the calendar to make allocation adjustments. However, our Price Divergence System, which is a key part of our EGA model does have rules that make it easier to sell in the June – September period (and harder to sell in the October – December months).

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

This is one tiny example of why SEM follows a Behavioral Approach to investing. Our brains like simple things we can remember that are more often based on experience rather than data. Besides, “Sell in May and go away” we hear “don’t fight the Fed”, “the trend is your friend”, and “buy the rumor, sell the news” are all examples that generally work. If you happened to follow that advice and made a lot of money you are likely to believe it’s true regardless of what the data tells us.

The same is true in all walks of life. You’ve probably heard “chocolate causes acne”, “feed a cold, starve a fever”, and “you’re going to catch cold by going outside with wet hair.” Those are all sayings that started with doctors that have little evidence backing them. People saw two things and put them together without looking at all the other evidence.

Heuristics or “rules of thumb” are mechanisms our brains use to simplify complex decisions. It is important to first realize we all use heuristics at certain times and then challenge ourselves to look at the DATA with an open mind to make a better decision. While I can’t help you treat your cold, SEM is here to do all of the hard decision making for you with our Behavioral Approach to Investing.