Oftentimes taking a step back and looking at the big picture leads to a crystallization of what is actually happening.

-

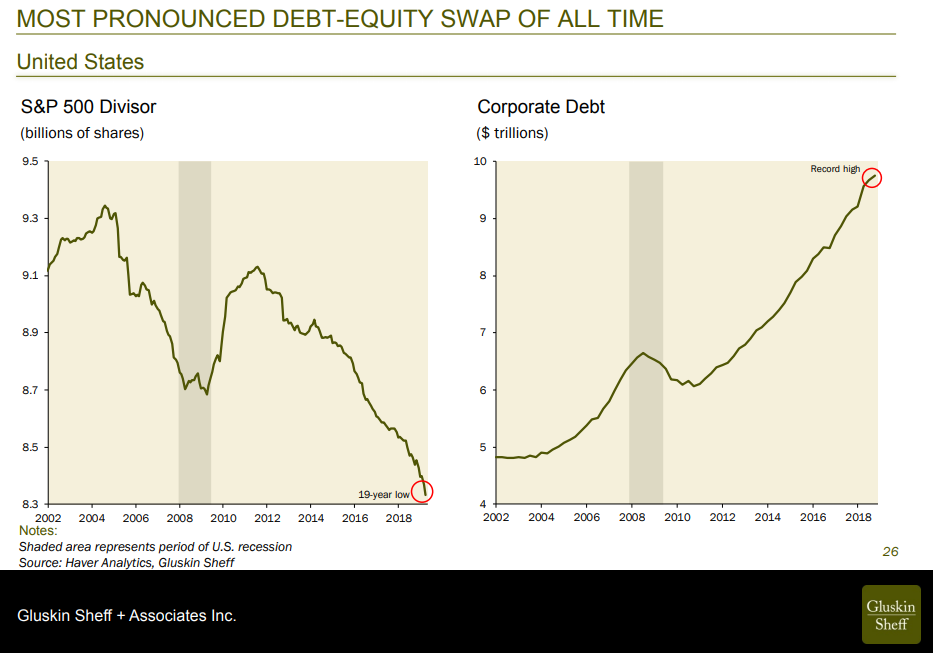

The Federal Reserve’s Quantitative Easing (QE) program created an additional $4 Trillion of money.

-

The Fed used QE to pull $4 trillion of debt out of the system by purchasing bonds from the Wall Street bank.

-

The corporate sector issued $4 trillion of new debt.

-

Corporations bought back $4 trillion of stock.

QE was supposed to encourage economic activity. Instead it created yet another asset bubble. Corporations could have used the new debt to invest in long-term projects, but instead used it to boost their share prices (fewer shares outstanding boosts earnings per share and thus stock valuations, all things being equal). This is nice while it lasts, but the money shuffling cannot go on forever.

One of SEM’s Platinum Portfolio Managers, CMG Wealth posted a summary of David Rosenberg’s presentation at the Mauldin Strategic Investment Conference a few weeks back. The bullet points above were paraphrased from his rapid-fire presentation. I’d encourage you to read the entire summary here, but for now take a look at what I think is a key summary of what got us here.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

Now consider:

-

QE is not only over, but the Fed is letting their balance sheet decrease.

-

In the next 3 years at least $3.5 trillion of corporate bonds will mature.

-

In the next 3 years the US government will need to borrow at least $3 trillion.

-

Economic growth is slowing rapidly, which will hurt sales and thus corporate earnings.

The writing is on the wall. The corporate bond bubble is on the verge of bursting. When that happens is anyone’s guess. Why it will be ugly is documented in great detail in our article “Investment Grade Junk”. After numerous requests from advisors, we also made a client approved version of the article. You can download it on the White Paper section of our website. We also are having a bunch of these printed in booklet fashion to use with your clients and potential clients. Let me know if you’d like copies. We have quite a few new White Papers available, so if you see any others you want printed we can send those as well.

David included in his presentation a study of where to be invested during past recessions – Volatility, Dividend Aristocrats, Government Bonds, Investment Grade Bonds, & Cash. Since you have to use ultra-high risk derivative based instruments to invest in volatility, we won’t consider that one, but the next 4 categories are all assets which will be heavily used by SEM in our income investment models. The beauty of SEM’s investment models is our ability to rotate to areas of strength regardless of the market.

Just as we proved in the 4th quarter of 2018, the month of May is highlighting the value of our disciplined approach. From our Tactical Bond to our Dynamic Income, to our Platinum Preservation Portfolios we captured some decent gains early in the year and have since put on a highly defensive position. Based on my experience and study of market history, the stock market action during both periods are a sneak peak of what we should expect in a full-fledged bear market.

We’re ready. Are you?